Executive Summary

One of the most interesting findings is the consistent way in which non-prime African Americans look a lot like the wider non-prime population, but that prime African Americans are more fragile compared to the wider prime population.

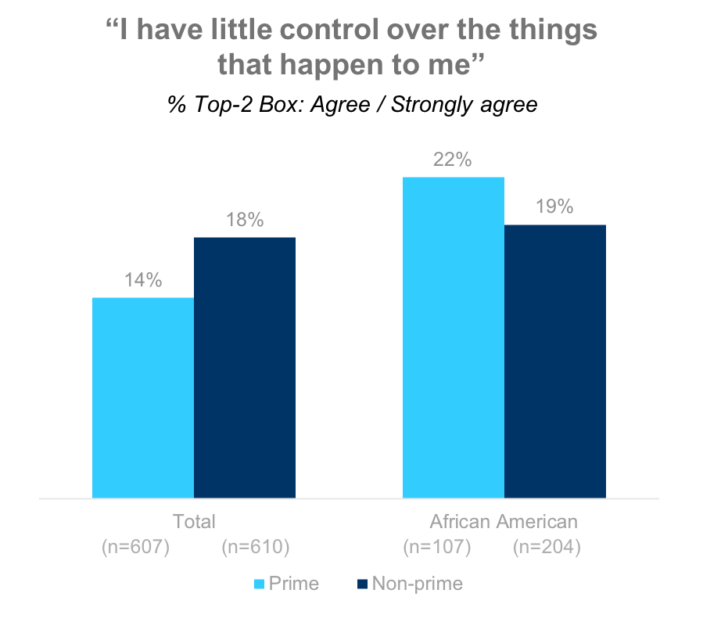

- Prime African Americans feel significantly less in-control than the wider prime population

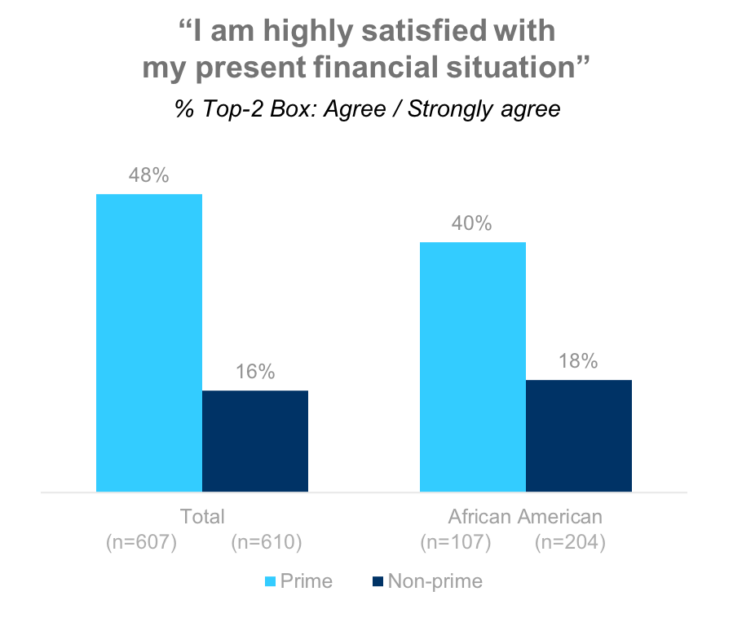

- Prime AA are 15% less “satisfied” with their present financial situation than wider prime

- 21% less likely to never run out of money in a year compared to prime

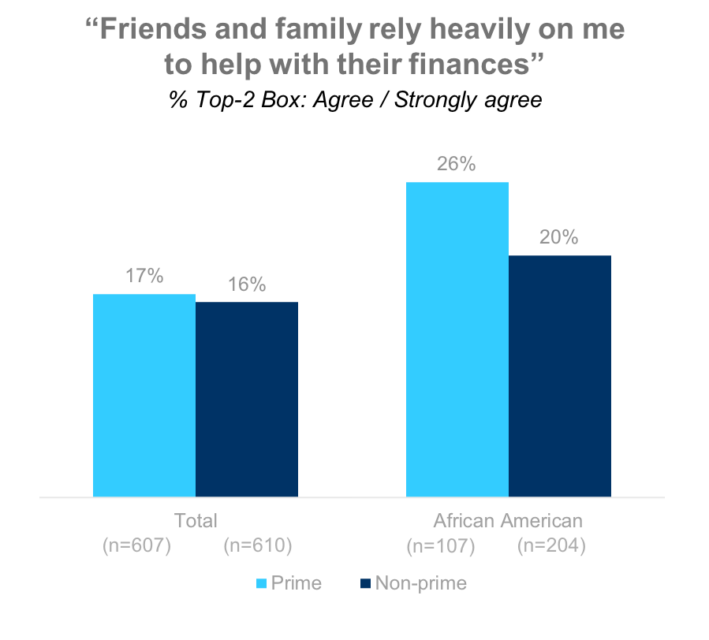

- They are 53% more likely to say family or friends rely on them

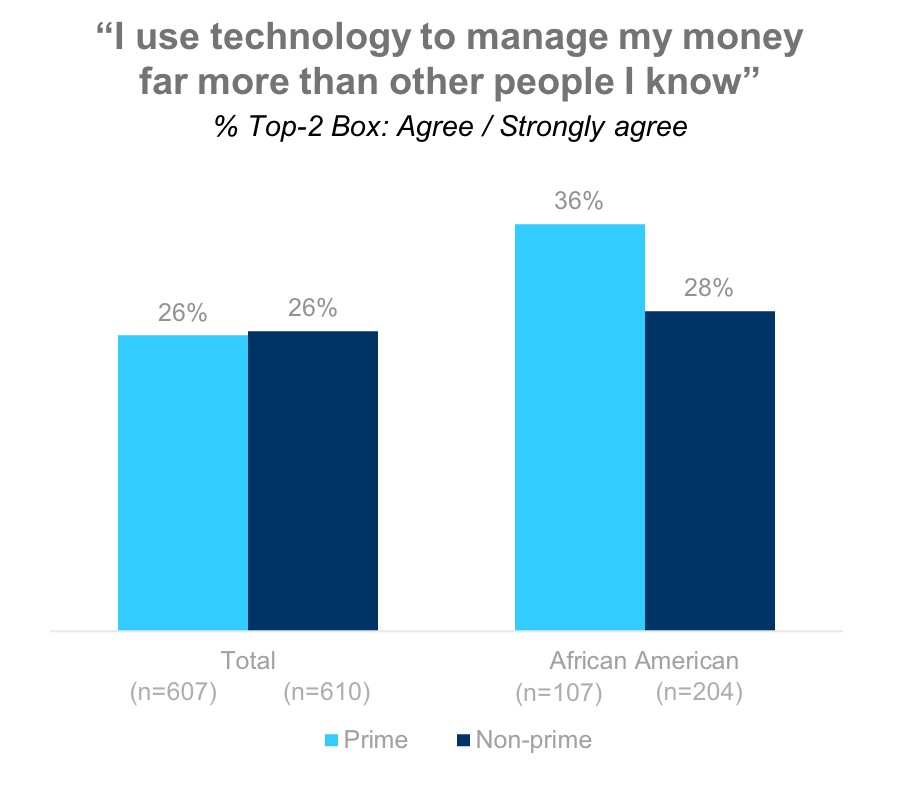

- 38% more likely to say they use technology to manage finances more than the people around them

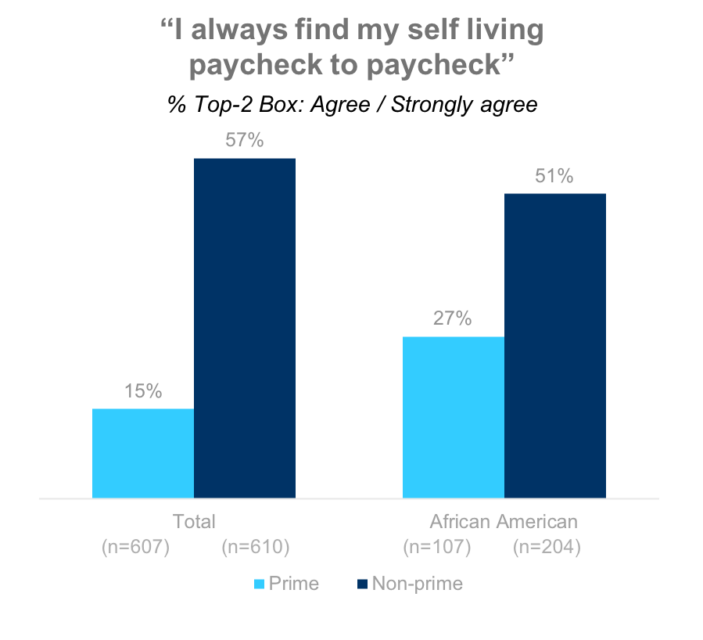

- 80% more likely to say that they live paycheck-to-paycheck

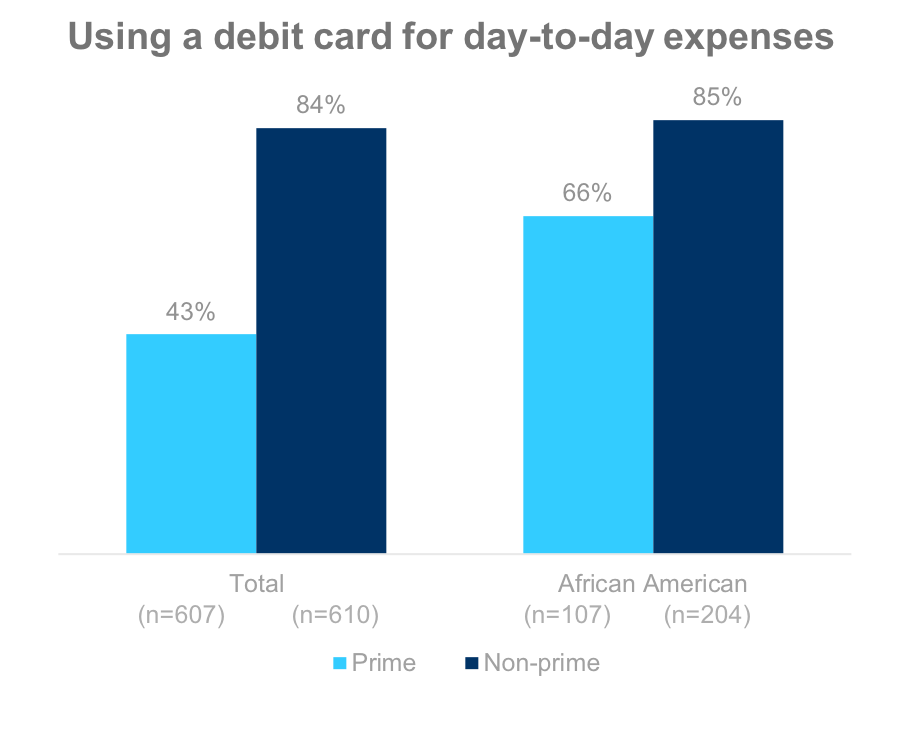

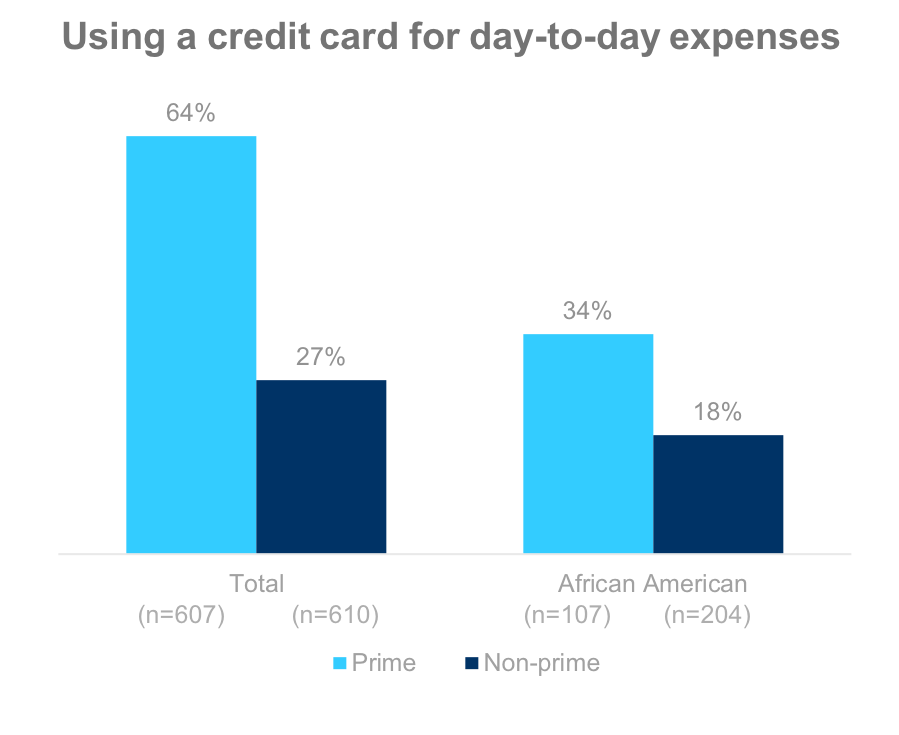

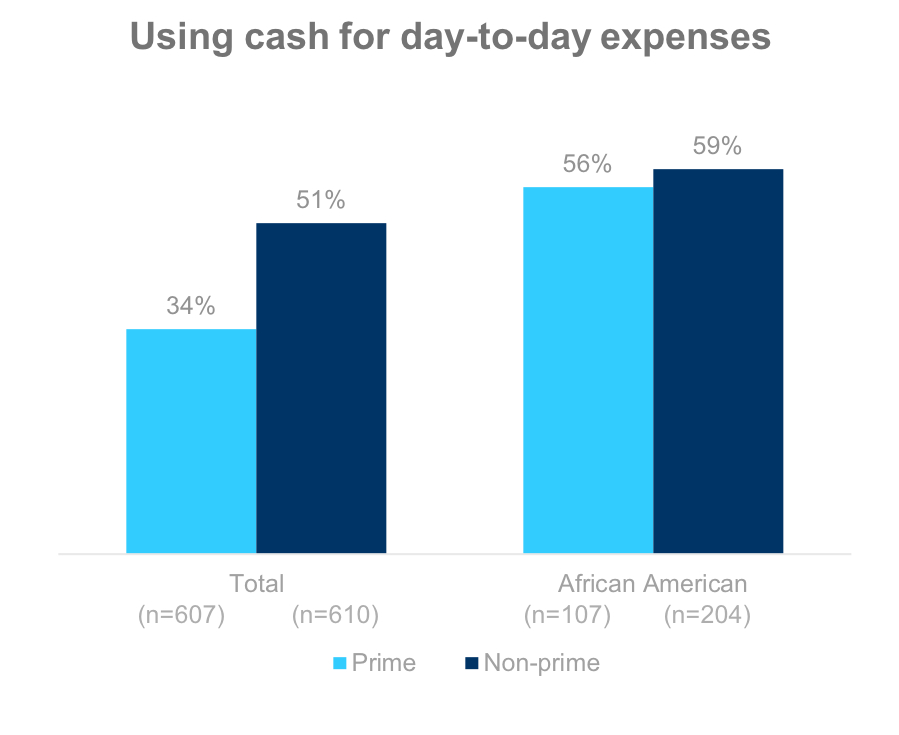

- 53% more likely to use a debit card for day-to-day purchases; 47% less likely to use a credit card; and, 65% more likely to use cash.

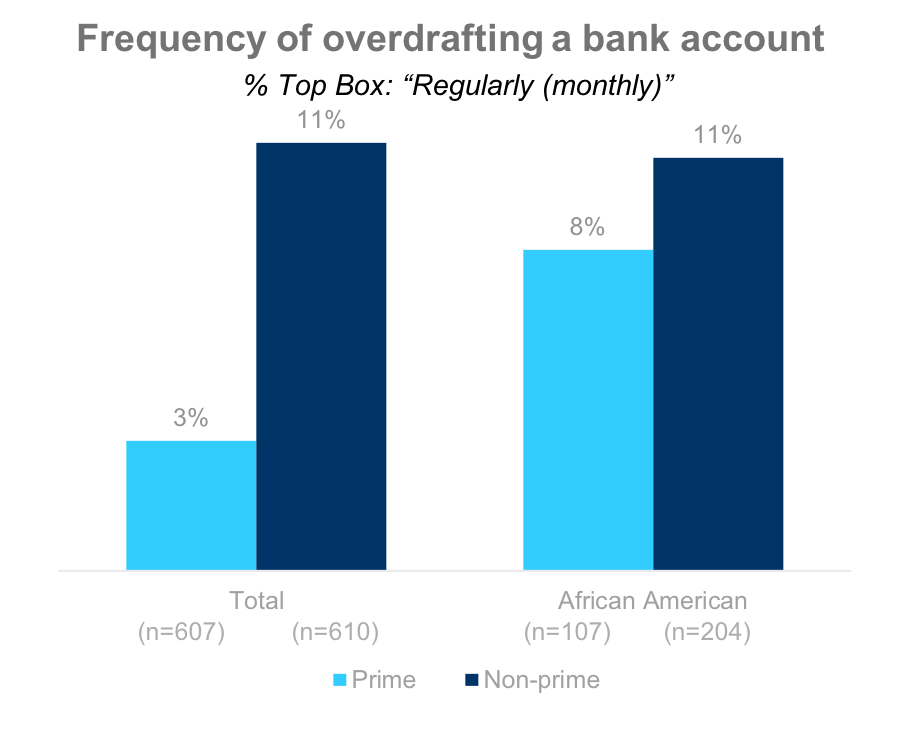

- They are 2.5x more likely to overdraft on a bank account

- 28% less likely to have $1,200 for a financial emergency

- Much less likely to turn to a credit card to cover a financial emergency

- 50% more likely to say they have “too much debt right now”

- 3x as likely to have ever used a payday loan and 4x as likely to be using one now

- Carry credit card balances like the non-prime population

- Less confident they can meet long term financial goals

Financial sentiment

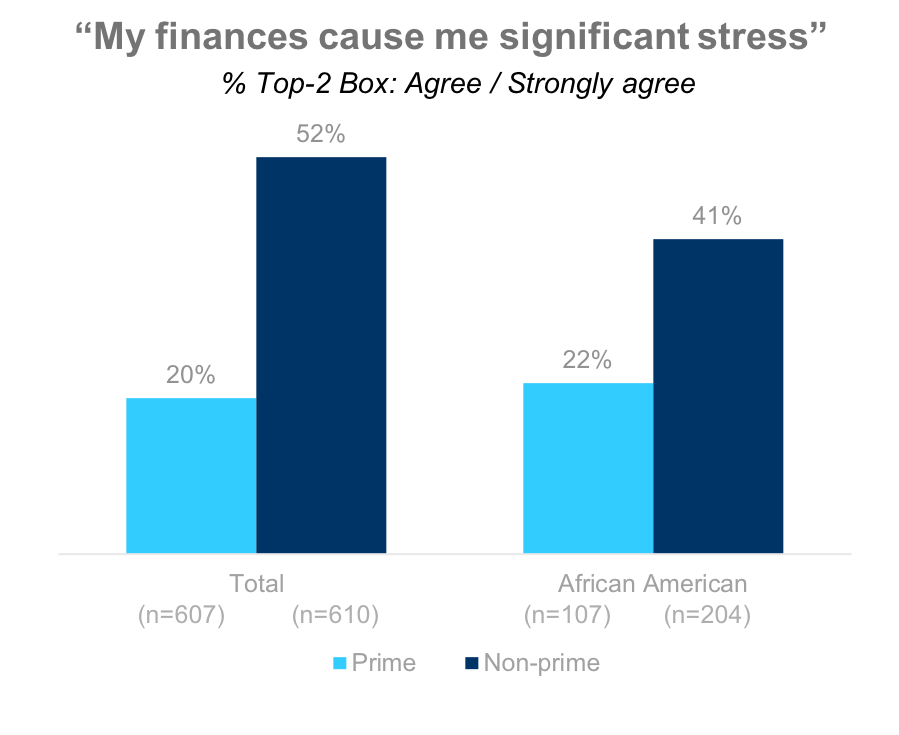

- 41% of non-prime African Americans say their finances cause them significant stress, but they are less likely to say so than general population non-prime

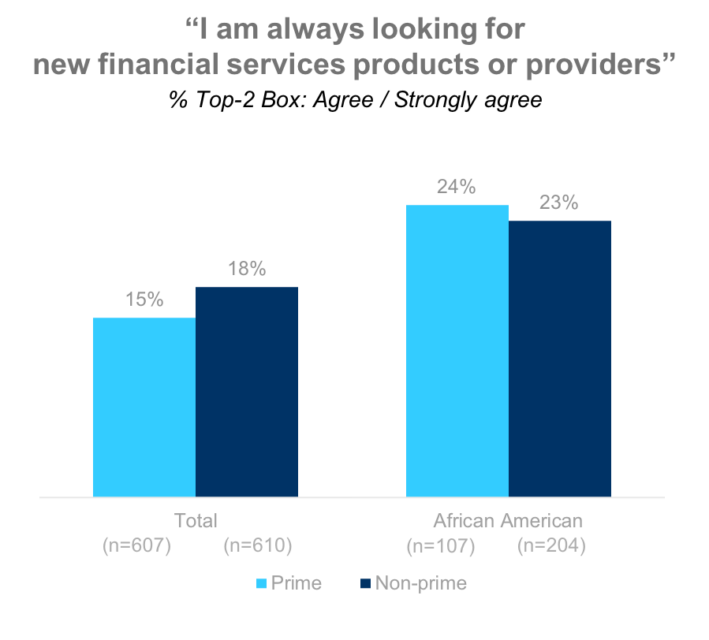

- African Americans are much more likely to say they are looking for new financial services or products

Income and employment

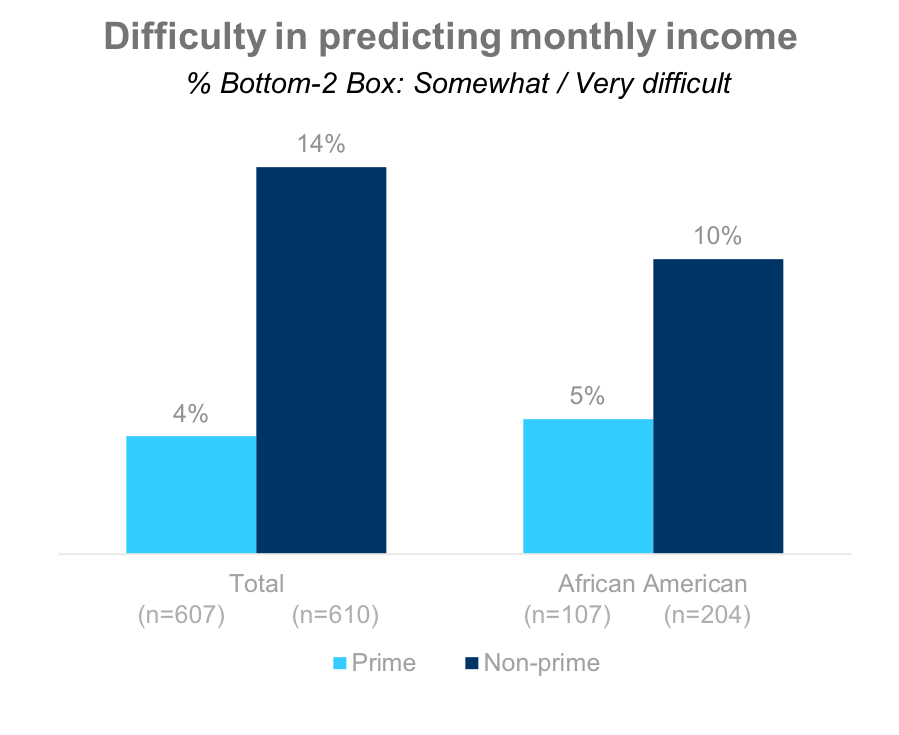

- Non-prime African Americans are 29% less likely than general non-prime to report difficulty predicting income

- African American households are no more likely to report an adverse employment event in the prior 5 years (job loss or pay reduction)

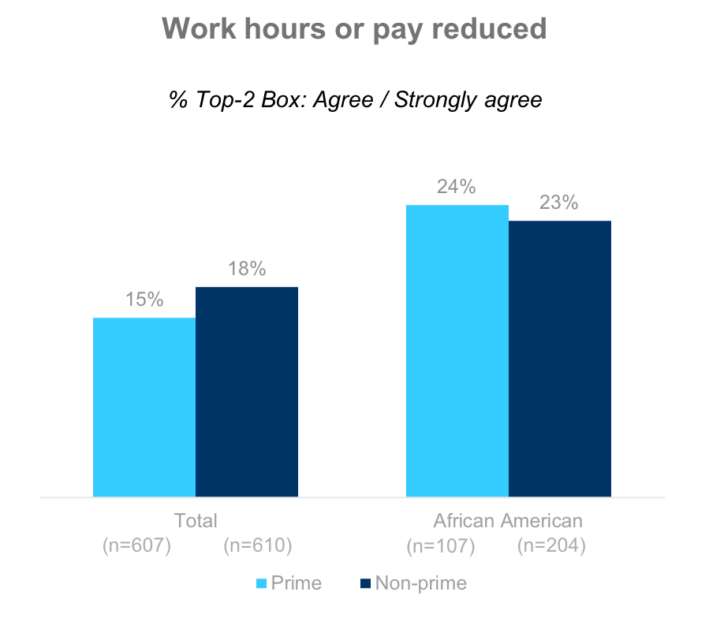

- However, when they do report an adverse employment event, it is much more likely to be a drop in pay or drop in work hours.

Day-to-day financial management

- 51% of non-prime African Americans say that they always find themselves living paycheck-to-paycheck

- African Americans are much less likely to use a credit card for day-to-day purchases and more likely to us cash

Covering a financial emergency

- Only one in six say they would have money available to cover a $1,200 unexpected emergency

- One in eight non-prime African Americans simply say they would not be able to cover it at all

Debt

- Non-prime African Americans are more likely to use payday loans and paycheck advances and much less likely to have bank loans, mortgages, and credit card balances than general non-prime households.

- Prime African Americans are more likely to say they have too much debt compared to other primes and non-prime African Americans are less likely to say so compared to other non-primes.

- More likely than counterparts to have used a payday loan and much more likely to be using one now

- Prime AA are 50% more likely to have a bank loan and non-prime AA are half as likely

Financial planning

- Non-prime African Americans are more likely say that they have the skills to manage their finances well

- Non-prime African Americans are more likely say that they can reach short-term savings goals

- African Americans are less likely to report that they learned financial management from their parents

Finances causing significant stress

Non-prime African Americans are less likely than the general non-prime population to report that their finances are causing them significant stress.

On a scale of 1 to 5, where 1 is ‘strongly disagree’ and 5 is ‘strongly agree’, how much do you agree or disagree with the following statements?

Sense of control

One in five prime African Americans feel like they have little control over what happens to them. They are 50% more likely to think that way compared to the general prime population.

On a scale of 1 to 5, where 1 is ‘strongly disagree’ and 5 is ‘strongly agree’, how much do you agree or disagree with the following statements? Q27_6. I am confident that I can meet my short-term saving goals.

Satisfaction with present financial situation

While non-prime African Americans don’t differ from the general non-prime population on satisfaction with their financial situation, prime African Americans are less likely than the general prime population to report satisfaction.

On a scale of 1 to 5, where 1 is ‘strongly disagree’ and 5 is ‘strongly agree’, how much do you agree or disagree with the following statements?

Circle of people who rely on them

African Americans are much more likely to report that friends and family rely heavily on them for help with finances. One in four prime African Americans have those dependences.

Prime African Americans are 53% more likely to have family or friends that depend on them.

On a scale of 1 to 5, where 1 is ‘strongly disagree’ and 5 is ‘strongly agree’, how much do you agree or disagree with the following statements? Q27_14. Friends and family rely heavily on me to help with their finances.

Looking for new financial services

Prime African Americans are much more likely to always be looking for new financial services product or providers.

On a scale of 1 to 5, where 1 is ‘strongly disagree’ and 5 is ‘strongly agree’, how much do you agree or disagree with the following statements? Q27_19. I am always looking for new financial services products or providers

Income and employment

Predictability of income

Non-prime African Americans are 29% less likely to report difficulty in predicting monthly income than the general non-prime population.

Q11. How easy or difficult is it for you to predict next month’s income for your household? Would you say it is.. ?

Work hours or pay reduced

Prime African Americans are much more likely to have experienced a drop in pay or work hours.

Q28_2. You had your work hours and/or pay reduced -Major Life Events in Past 5 Years -During the past 5 years, has your household experienced any of the following significant major life changes or financial events?

Day-to-day financial management

Using technology when managing finances

Prime African Americans are 38% more likely to report that they use technology to manage their money far more than other people they know.

On a scale of 1 to 5, where 1 is ‘strongly disagree’ and 5 is ‘strongly agree’, how much do you agree or disagree with the following statements? Q27_15. I use technology to manage my money far more than other people I know

Living paycheck to paycheck

Once again, African American prime are less stable than their prime counterparts and African American non-prime are a bit more stable than their non-prime counterparts.

On a scale of 1 to 5, where 1 is ‘strongly disagree’ and 5 is ‘strongly agree’, how much do you agree or disagree with the following statements? Q27_4. I always find myself living paycheck to paycheck –

Paying for day-to-day expenses with a debit card

Once again, the prime African American is a bit of the outlier. They are 53% more likely than general prime to say they use a debit card for day-to-day purchases.

Q22. How do you typically pay for day-to-day expenses (e.g., grocery shopping, etc.)

Paying for day-to-day expenses with a credit card

African Americans are less likely to use credit cards than average for their day-to-day purchases. Prime are 47% less likely and non-prime is 33% less likely.

Q22. How do you typically pay for day-to-day expenses (e.g., grocery shopping, etc.)

Paying for day-to-day expenses with cash

African Americans are more likely to use cash in day-to-day purchases than average.

Prime African Americans are 65% more likely to use cash than their general population counterparts.

Q22. How do you typically pay for day-to-day expenses (e.g., grocery shopping, etc.)

Overdrafted a savings or debit account

Prime African Americans are as likely to overdraft a bank account as the non-prime population.

Q18_16. Overdrafteda savings or debit account -Past 12 Month Financial Activities -Please indicate how often you engaged in the following financial activities

Covering a financial emergency

Money available to cover a $1,200 emergency

Non-prime African Americans have just as much trouble handling a $1,200 emergency with cash available to them.

The dramatic difference is that prime African Americans are 28% less likely than general population primes to have the resources on hand.

Q17. If you had one week to pay $1,200 for an emergency expense, such as a car repair or medical bill, where would you turn first to get the money? Answer: “Money currently in my checking or savings account, or on my prepaid or payroll card, or with cash”

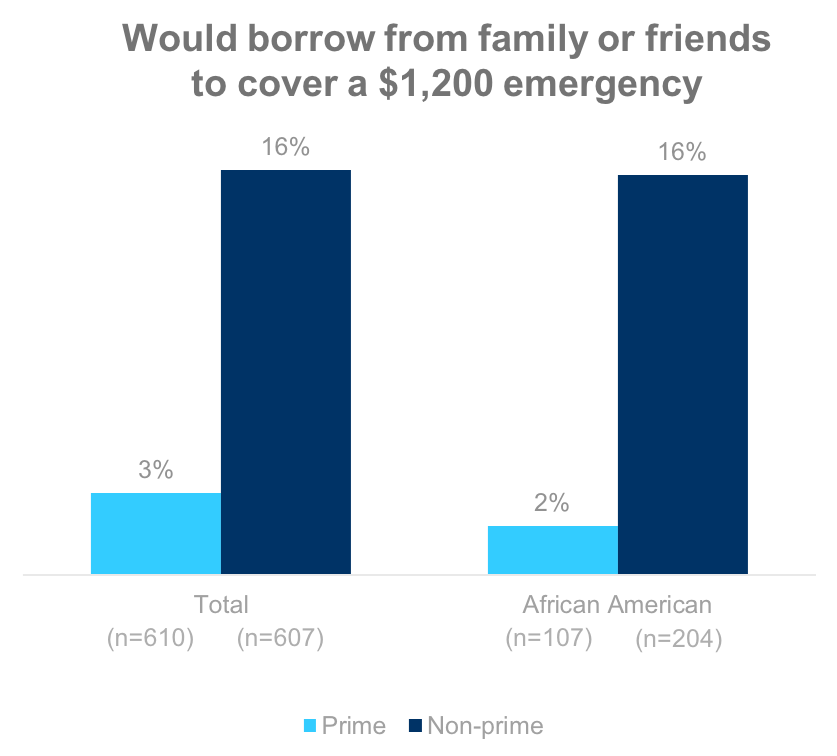

Borrow from family/friends to cover a $1,200 emergency

When comparing to the general population, prime African Americans are less likely to turn to family and friends first in an emergency.

Non-prime African Americans are more likely to.

Q17. If you had one week to pay $1,200 for an emergency expense, such as a car repair or medical bill, where would you turn first to get the money? Answer: “Borrowing from a friend or family member”

Debt

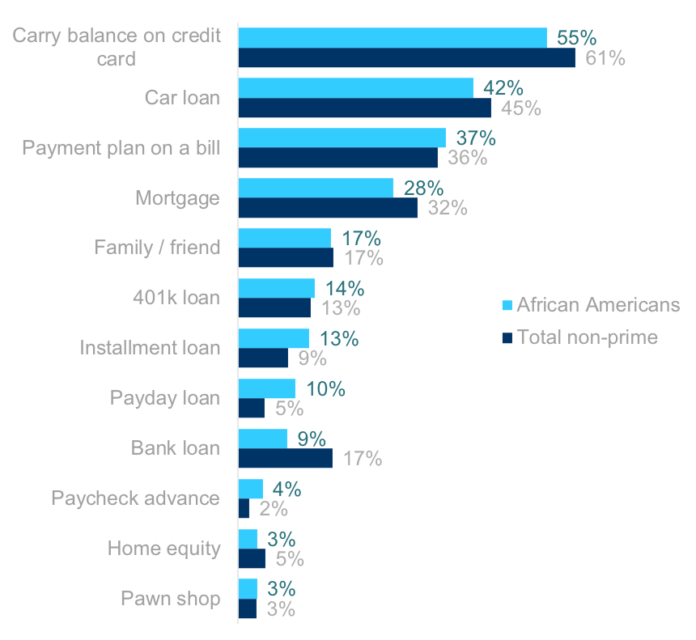

Who non-prime African Americans owe money to

Compared to total non-prime populations, non-prime African Americans are less likely to carry mainstream debt (like credit cards, car loan, mortgage, and bank loans) and more likely to carry non-traditional debt (like installment loans, payday loans, and advance on a paycheck).

Q23. ‘CURRENTLY USE’ SUMMARY TABLE -Frequency of Using Forms of Debt -Which of the following forms of debt have you used? Answer: “Payday loan”

Too much debt

Prime African Americans are 50% more likely than overall prime to say they have too much debt.

Non-prime African Americans are less likely than general non-prime to complain of having too much debt.

On a scale of 1 to 5, where 1 is ‘strongly disagree’ and 5 is ‘strongly agree’, how much do you agree or disagree with the following statements? Q27_10. I have too much debt right now

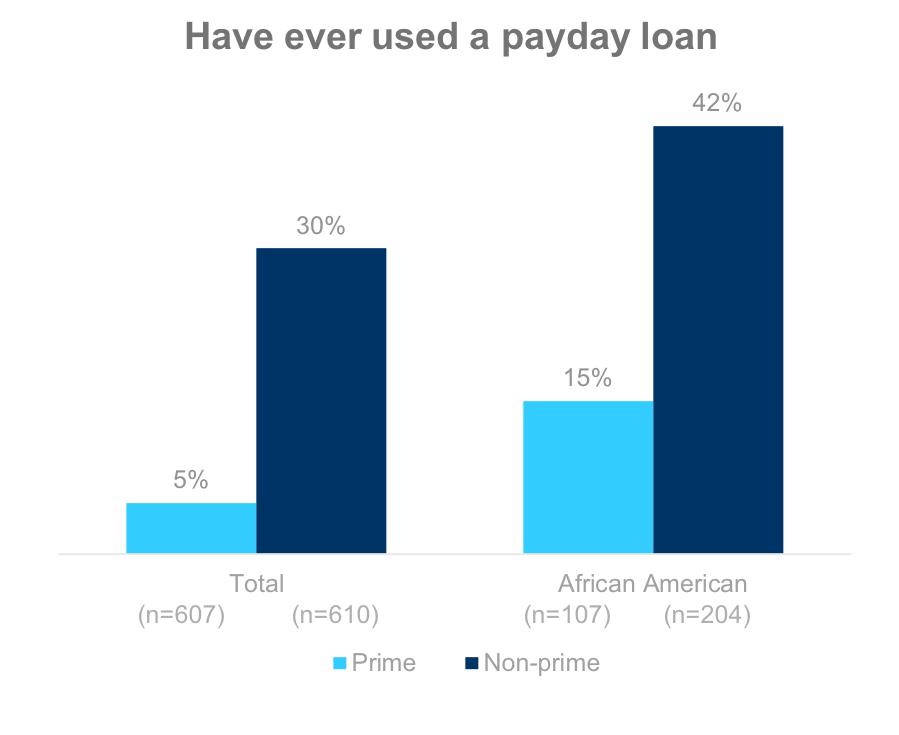

Experience with a payday loan

18% of the general population have ever used a payday loan.

30% of general population non-prime have experience with a payday loan and 42% of non-prime African Americans have.

Q23. ‘NEVER USED’ SUMMARY TABLE -Frequency of Using Forms of Debt -Which of the following forms of debt have you used? Answer: “Payday loan” (Data represents the inverse of ‘Never’)

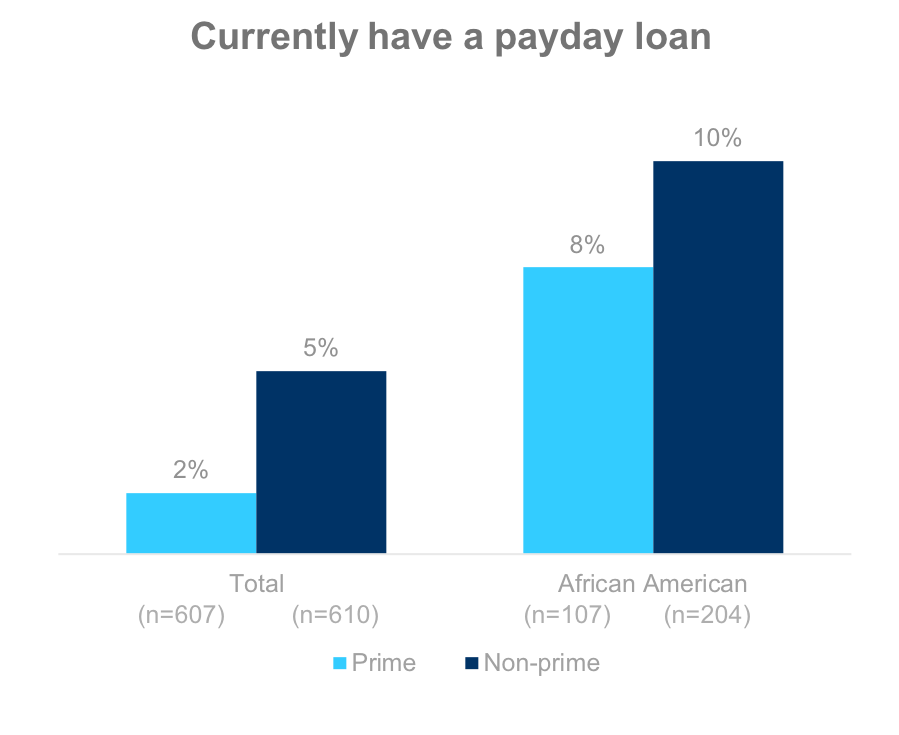

Currently use a payday loan

5 percent of non-prime Americans currently have a payday loan. Non-prime African Americans are twice as likely to have one.

Prime African Americans are four times as likely as prime Americans.

Q23. ‘CURRENTLY USE’ SUMMARY TABLE -Frequency of Using Forms of Debt -Which of the following forms of debt have you used? Answer: “Payday loan”

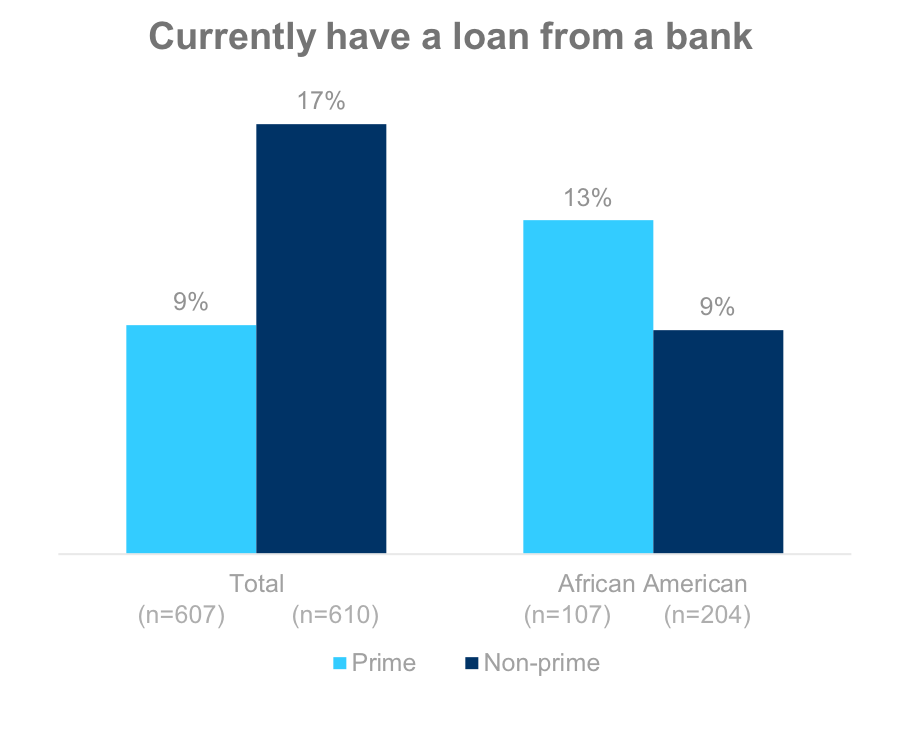

Bank loan?

Prime African Americans are less likely to have a bank loan than overall non-prime people. Non-prime African Americans are almost half as likely as overall non-prime to currently have a bank loan.

Q23. ‘CURRENTLY USE’ SUMMARY TABLE -Frequency of Using Forms of Debt -Which of the following forms of debt have you used? Answer: “Bank loan”

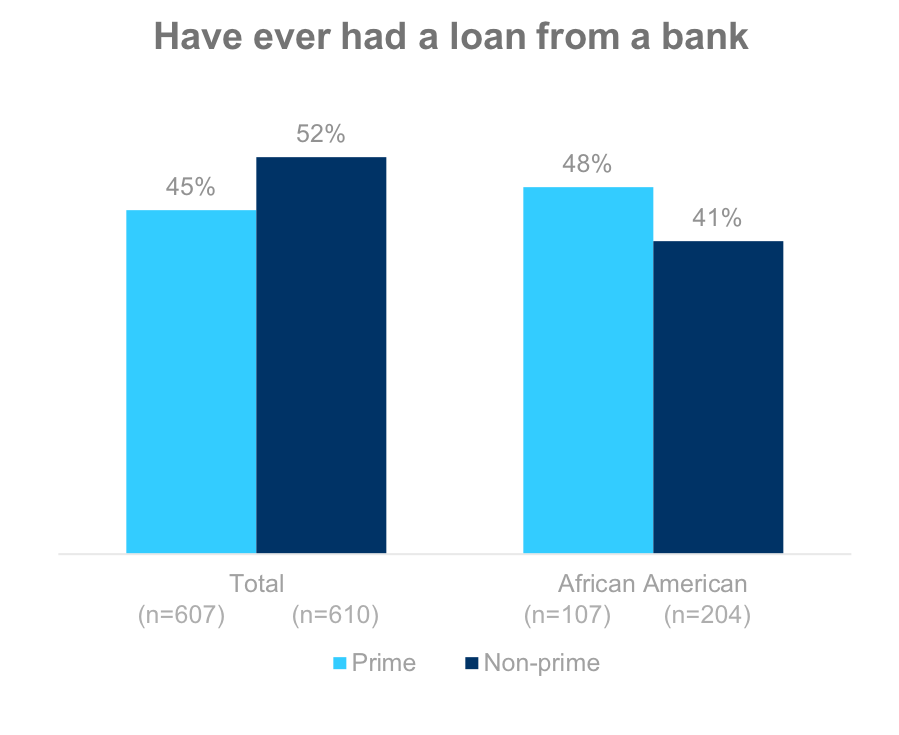

Have ever had a bank loan

Overall prime and prime African Americans just as likely to have ever had a bank loan, but non-prime African Americans are 21% less likely than general to have ever had a bank loan.

Q23. ‘NEVER USED’ SUMMARY TABLE -Frequency of Using Forms of Debt -Which of the following forms of debt have you used? Answer: “Bank loan” (Data represents the inverse of ‘Never’)

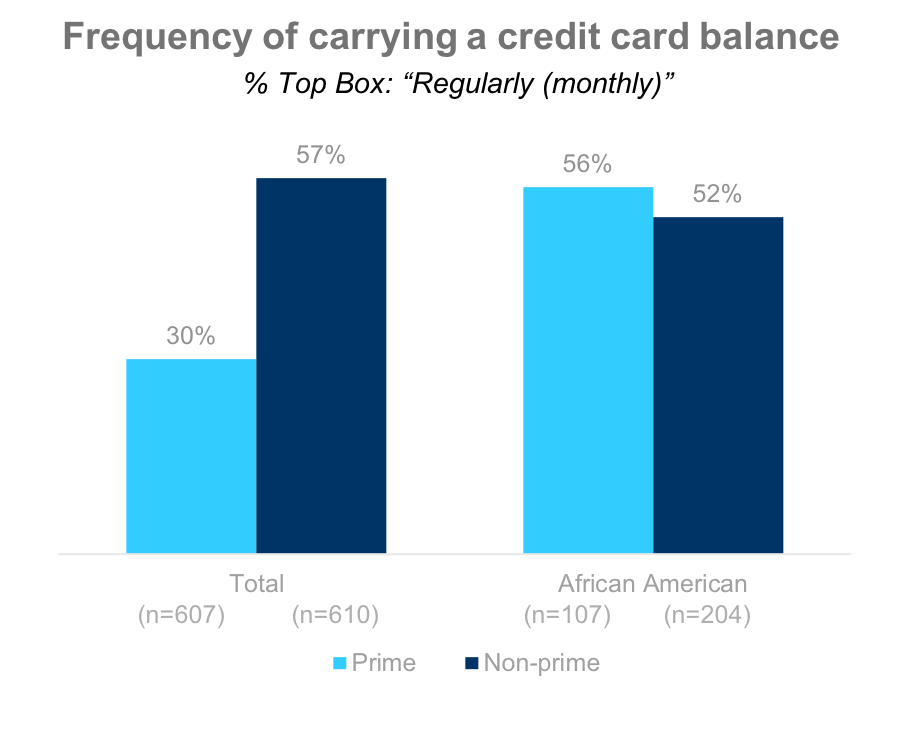

Carried a credit card balance

Prime African Americans are as likely to carry a credit card balance as the non-prime population.

Q18_14. Carried a credit card balance -Past 12 Month Financial Activities -Please indicate how often you engaged in the following financial activities

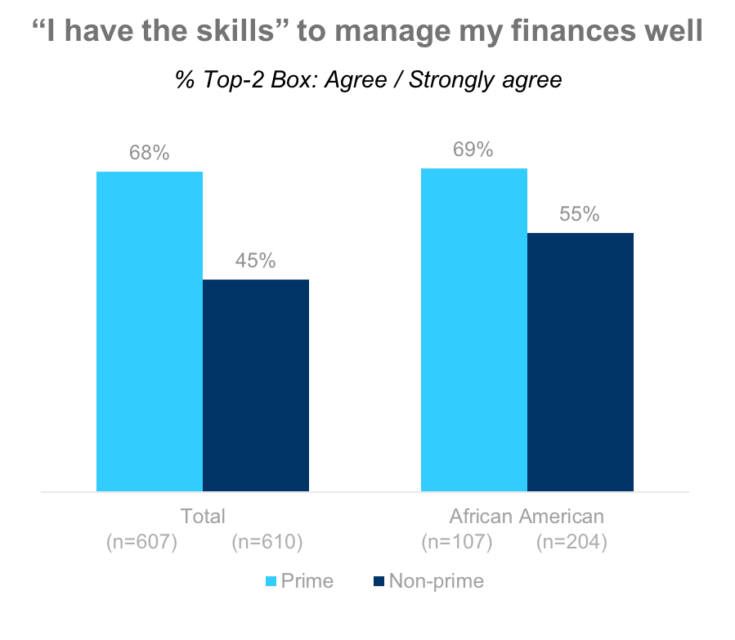

Financial planning

Financial management skills and knowledge

Non-prime African Americans are 22% more likely than the general non-prime population to feel that they have the skills and knowledge necessary to manage their finances well.

On a scale of 1 to 5, where 1 is ‘strongly disagree’ and 5 is ‘strongly agree’, how much do you agree or disagree with the following statements? Q27_13. I have the skills and knowledge to manage my finances well

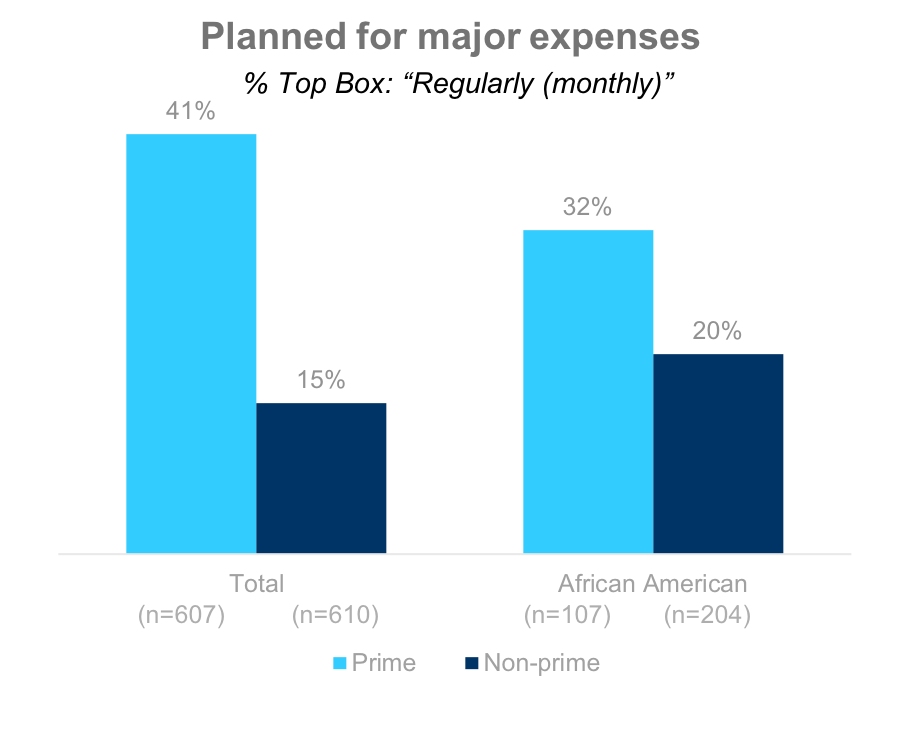

Planning for major expenses

Non-prime African Americans are more likely than the rest of the non-prime population to regularly plan for major expenses.

Q18_2. Planned for major expenses -Past 12 Month Financial Activities -Please indicate how often you engaged in the following financial activities

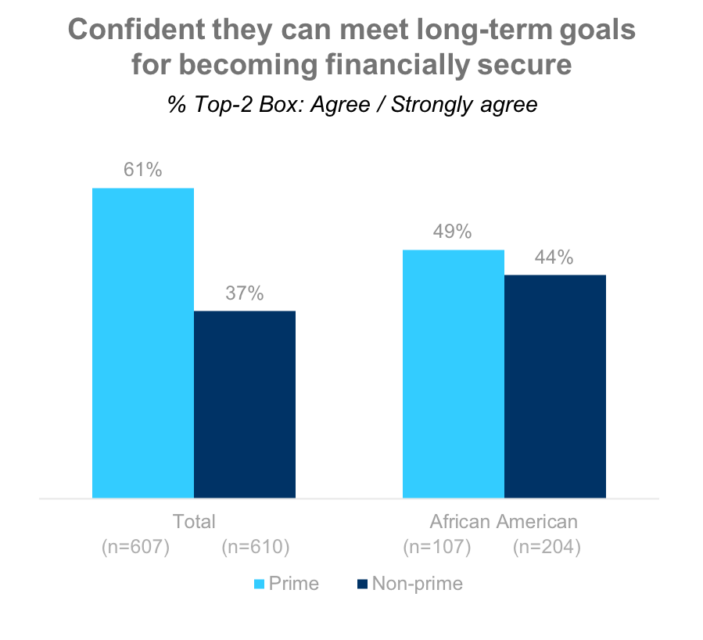

Hope for achieving long-term goals

Strikingly, there is not as much disparity in the African American population for achieving goals for becoming financially secure as there is in the wider population.

On a scale of 1 to 5, where 1 is ‘strongly disagree’ and 5 is ‘strongly agree’, how much do you agree or disagree with the following statements? Q27_5. I am confident that I can meet my long-term goals for becoming financially secure

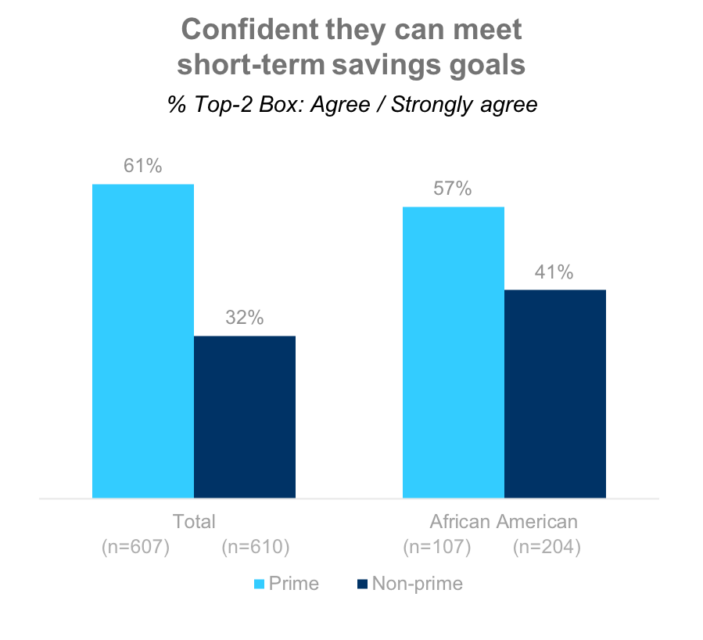

Short term savings goals

Non-prime African Americans are more confident than general population non-primes that they can reach short-term savings goals.

On a scale of 1 to 5, where 1 is ‘strongly disagree’ and 5 is ‘strongly agree’, how much do you agree or disagree with the following statements? Q27_6. I am confident that I can meet my short-term saving goals

Learning financial management

African Americans are less likely to report that they learned financial management skills from their parents.

Q25. Select all the ways in which you learned how to manage your finances: Parent’s instruction

Methodology

The primary purpose of this study was to determine how nonprime Americans were similar or different from those with prime credit on a range of behaviors and attitudes.

Interview Dates: December 6-14, 2016

Sample Specs:

- Total Respondents = 1,217

- Sample Source: Research Now Consumer Panel

Qualification Criteria:

- Ages 18-64

- Personal income: Any

- Geography –U.S. Rep

- Has primary or shared responsibility managing HH finances

- Employment: No students or unemployed

- Has a checking or savings account

Survey Instrument: 15 minute online questionnaire

About Elevate’s Center for the New Middle Class

Elevate’s Center for the New Middle Class conducts research, engages in dialogue, and builds cooperation to generate understanding of the behaviors, attitudes, and experiences of America’s growing “New Middle Class.”