Introduction

The broad discussion in many circles about the plight of the non-prime consumer often uses assumptions about how these consumers think, what matters to them, and even what would be good for them. However, there is limited data that really explains their circumstances.

Elevate’s Center for the New Middle Class set out to understand the differences in attitudes, experiences and behavior between consumers with prime credit and those with non-prime credit.

This study represents results from the survey of 1,217 Americans, using interviews conducted December 6-14, 2016.

Executive Summary

How non-prime Millennials learned how to manage their finances:

- Trial and error = 72%

- Parents of prime Millennials did a better job helping their children

- 44% conduct personal research

How non-prime Millennials feel about their finances:

- Half feel their finances cause them significant stress

- Only 22% are highly satisfied with their present financial condition

- Are more optimistic about their long-term financial prospects than Gen-X or Baby Boomers

- Prime and non-prime Millennials are equally confident in their ability to meet the needs of a future job market

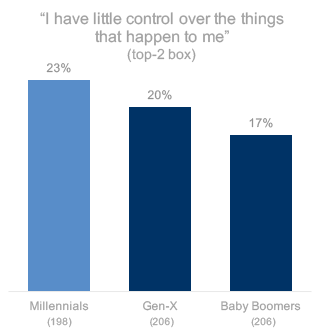

- 1 in 4 non-prime Millennials feel they have little control over the things that happen to them; higher than for non-primes of other generations

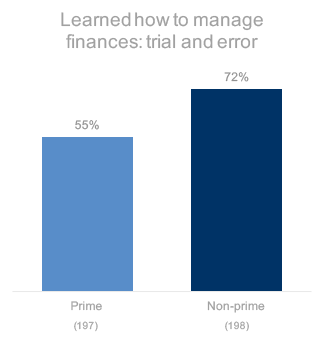

Learning to manage finances on their own

31% more non-prime Millennials admitted to learning how to manage their finances through the school of hard knocks.

Q25. Select all the ways in which you learned how to manage your finances:

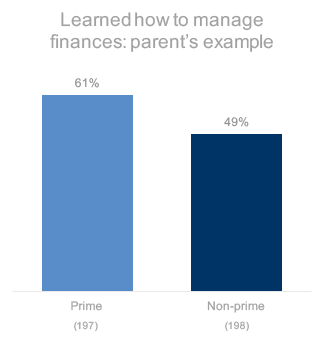

A parent’s example

Non-prime Millennials didn’t benefit as widely as their prime counterparts from seeing how their parents managed their finances.

Q25. Select all the ways in which you learned how to manage your finances:

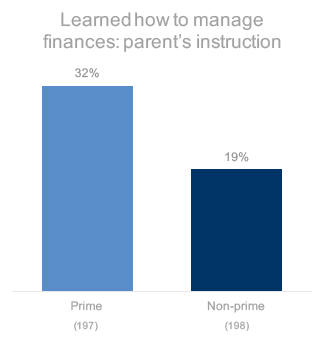

Personal finance home schooling

A third of prime Millennials were actively taught financial management skills from their parents.

Only 1 in 5 of their non-prime counterparts received instruction at home.

Q25. Select all the ways in which you learned how to manage your finances:

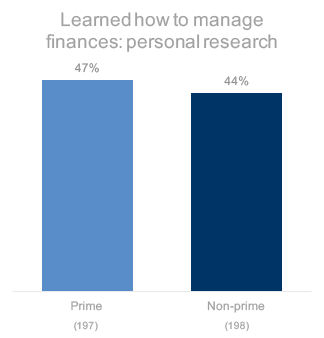

Hitting the books

Nearly half of all non-prime Millennials have engaged in personal research to learn how to manage their finances.

Q25. Select all the ways in which you learned how to manage your finances:

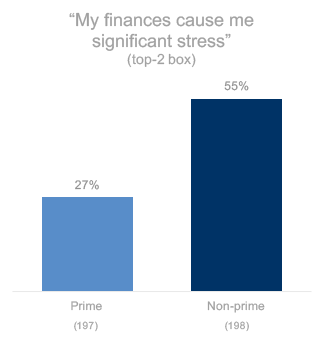

Finance-induced stress

Non-prime Millennials are twice as likely as their prime counterparts to say that their finances cause them significant stress.

More than half of them live with the meaningful drone of financially-induced stress in their lives.

Q27. On a scale of 1 to 5, where 1 is ‘strongly disagree’ and 5 is ‘strongly agree’, how much do you agree or disagree with the following statements?

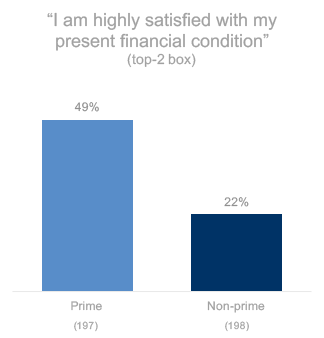

It’s all good

Only 1 in 5 non-prime Millennials are satisfied with their present financial situation.

Q27. On a scale of 1 to 5, where 1 is ‘strongly disagree’ and 5 is ‘strongly agree’, how much do you agree or disagree with the following statements?

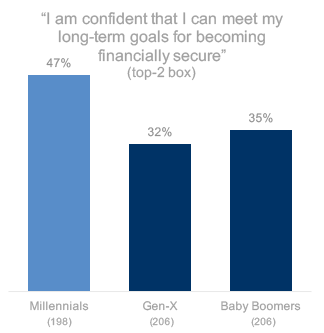

Confidence in the future

Non-prime Millennials are more optimistic than Gen-X or Baby Boomers that they can attain their goals for financial security.

Q27. On a scale of 1 to 5, where 1 is ‘strongly disagree’ and 5 is ‘strongly agree’, how much do you agree or disagree with the following statements?

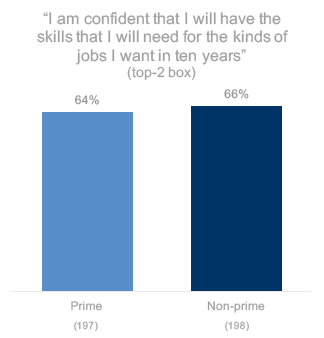

Confidence in job skills for the future

Both prime and non-prime Millennials believe in their ability to meet the needs of a future jobs market.

Q27. On a scale of 1 to 5, where 1 is ‘strongly disagree’ and 5 is ‘strongly agree’, how much do you agree or disagree with the following statements?

At the whim of fate

Almost 1 in 4 non-prime Millennials feel that they have little control over what happens to them.

They are 23% more likely to feel they are at the whim of fate compared to non-Millennial non-prime Americans.

Q27. On a scale of 1 to 5, where 1 is ‘strongly disagree’ and 5 is ‘strongly agree’, how much do you agree or disagree with the following statements?

Nonprime Americans

“Subprime” is often used to represent people with scores below 640. People with 641 to 700 are sometimes called “near prime.” We have elected to use the clearer designation of “nonprime” for all consumers with scores below 700.

“Nonprime Americans” represent the New Middle Class. These are Americans with a credit score below 700, meaning that their access to credit is limited or curtailed. It is the Center’s objective to better understand their experiences, attitudes, and behavior.

Methodology

The primary purpose of this study was to determine how non-prime Americans were similar or different from those with prime credit on a range of behaviors and attitudes.

Interview Dates: December 6-14, 2016

Sample Specs:

- Total Respondents = 1,217

- Sample Source: Research Now Consumer Panel

Qualification Criteria:

- Ages 18-64

- Personal income: Any

- Geography – U.S. Rep

- Has primary or shared responsibility managing HH finances

- Employment: No students or unemployed

- Has a checking or savings account

Survey Instrument: 15 minute online questionnaire