Introduction

The broad discussion in many circles about the plight of people with nonprime credit scores often uses assumptions about how these Americans think, what matters to them, and even what would be good for them. However, there is limited data that really explains their circumstances.

We set out to understand the differences in attitudes, experiences and behavior between married Americans with prime credit and those with nonprime credit.

This study represents results from two research projects: a survey of 610 nonprime Americans with 607 Americans with prime credit scores conducted December 6-14, 2016; and, a qualitative online discussion with 41 individuals conducted on January 25, 2017.

Executive Summary

- Nonprime Americans are 24% less likely to be married and 45% more likely to be divorced than people with prime credit scores

- Married nonprime Americans find it hard to plan:

- Only 1 in 5 married nonprime Americans say they can regularly put aside money for savings

- 66% less likely to say they save money “regularly” than married nonprimes

- Only 1 in 4 married nonprimes feel like they can reach short-term savings goals

- 60% less likely to say they regularly plan for major expenses

- 66% less likely to say they regularly plan for unexpected expenses

- Financial lives of married nonprimes are tenuous:

- Over half run out of money every 2-3 months or more often

- 2x as likely to say they regularly carry a credit card balance

- 1.6x as likely to say they have too much debt right now

- 2x as likely to have lost a job

- 1.4x as likely to have had their pay or work hours reduced

- 1 in 8 have had a checking account closed by their bank in the prior 5 years

- Married nonprimes feel the stress of their insecurity:

- 42% less likely to declare confidence with dealing with day-to-day financial matters

- Almost 3x more likely to worry over their monthly expenses

- 50% less likely to feel they can meet long-term financial goals

- 1.5x likely to admit that their finances cause significant stress

- 1 in 5 say they have little control over the things that happen to them

- Couples experience financial conflict primarily over major purchase and debt

- Couples work their finances depending on their desire to be actively engaged in them and their degree of cooperation

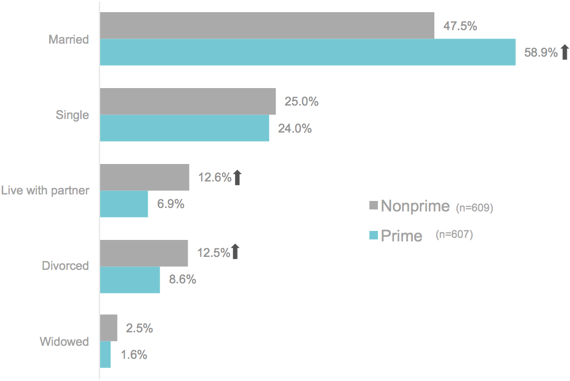

Marital status

Prime Americans are 24% more likely to be married. Nonprime are 83% more likely to live with their partner and 45% more likely to be divorced.

Marital Status

Q4: What is your marital status?

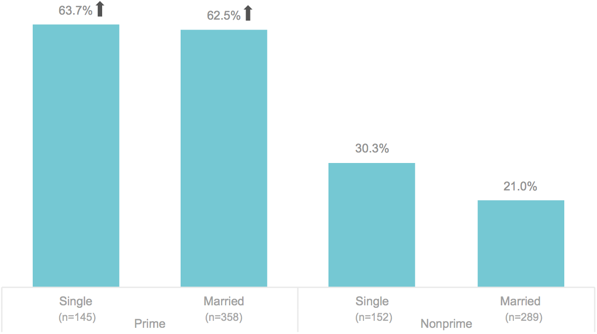

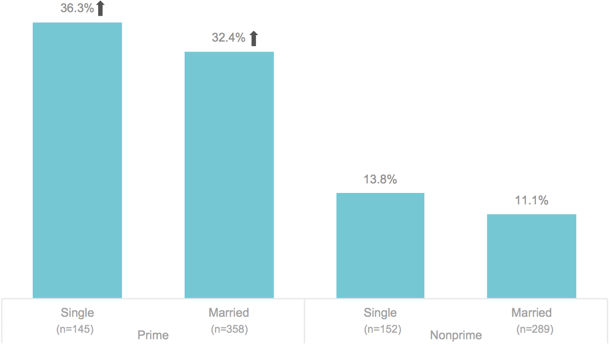

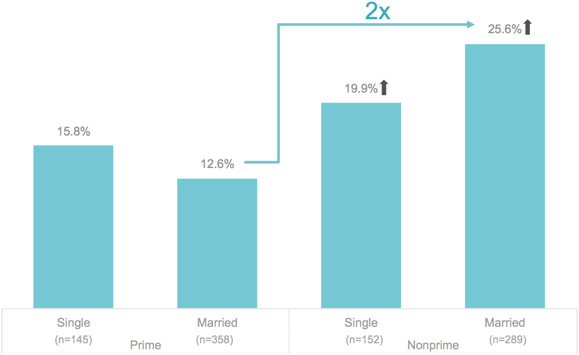

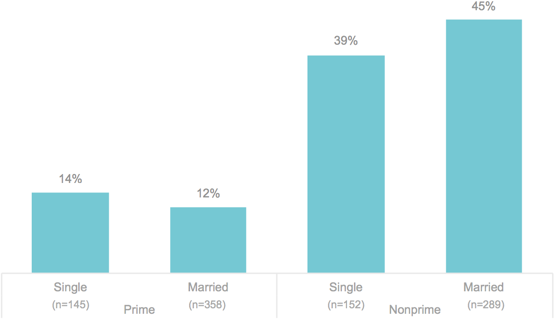

Comparison of regularly saving

Married prime Americans are three times as likely to regularly save money compared to their nonprime counterparts.

Married nonprime Americans are 30% less likely to save regularly compared to their single counterparts.

Put aside money for savings

(“regularly”)

Q4: What is your marital status? * Q18r: Put aside money for savings – Please indicate how often you engaged in the following financial activities in the last 12 months. * hClassification: Hidden question (Prime, nonprime)

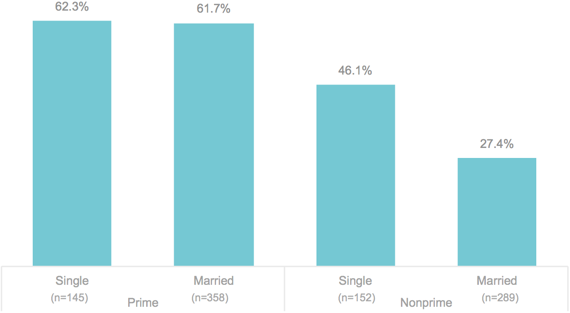

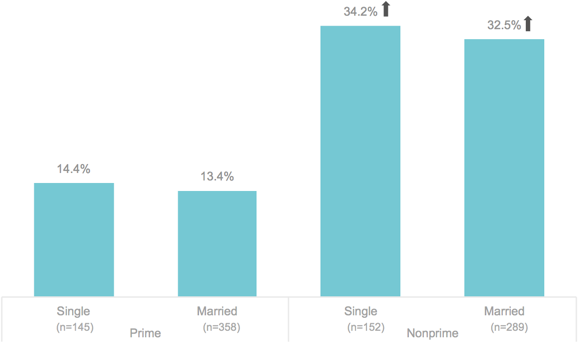

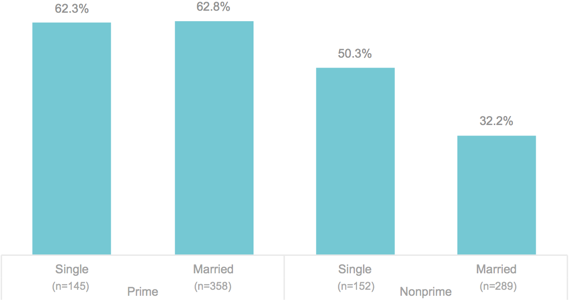

Short-term saving goals

Less than half of nonprime singles are confident they can meet their short-term savings goals. For married nonprimes, the number drops to nearly 1 in 4.

I am confident that I can meet

my short-term saving goals

* Top 2 Box; Q4: What is your marital status? * Q27r14: On a scale of 1 to 5, where 1 is ‘strongly disagree’ and 5 is ‘strongly agree’, how much do you agree or disagree with the following statements? * hClassification: Hidden question (prime / nonprime)

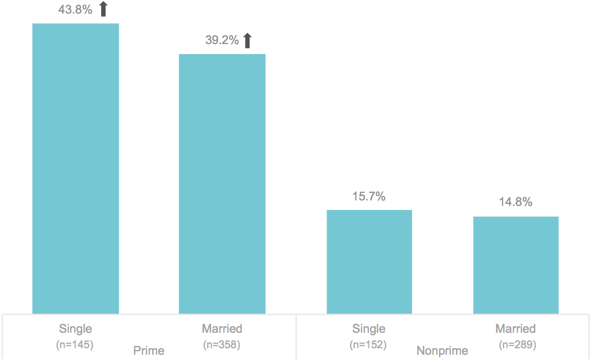

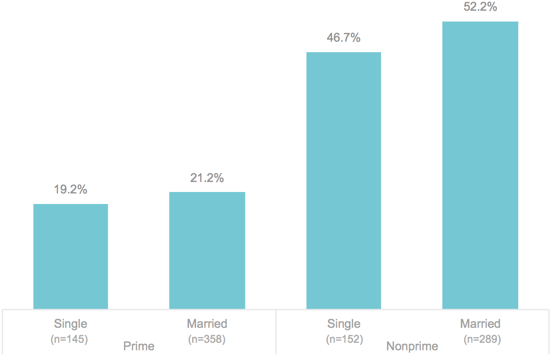

Planning for major expenses

Married couples don’t have significantly more trouble planning for “major expenses.” The difficulty is found in the nonprime Americans who are more than 60% less likely to say they plan for major expenses.

Planned for major expenses

(“regularly”)

Q4: What is your marital status? * Q18r: Planned for major expenses- Please indicate how often you engaged in the following financial activities in the last 12 months. * hClassification: Hidden question (Prime, nonprime)

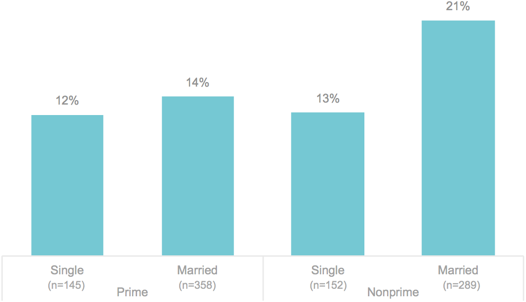

Planning for unexpected expenses

Married couples don’t have significantly more trouble planning for “unexpected expenses.” The difficulty is found in being nonprime.

Planned for unexpected expenses

(“regularly”)

Q4: What is your marital status? * Q18r: Planned for unexpected expenses- Please indicate how often you engaged in the following financial activities in the last 12 months. * hClassification: Hidden question (Prime, nonprime)

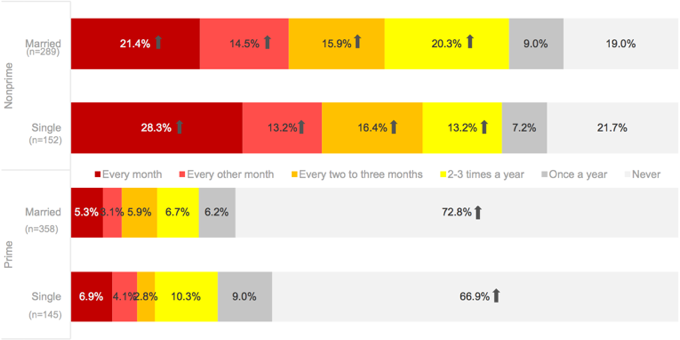

Running out of money

Nonprime marrieds are less likely to run out of money every month, but more likely to run out of money at some point in the year. 4 out of 5 nonprimes run out of money at least once during a year.

How often do you run out of money?

Q4: What is your marital status? * Q12: In the past 12 months, how often has your household run out of money before the end of the month, including when you had to use credit to get by? * hClassification: Hidden question (Prime, nonprime)

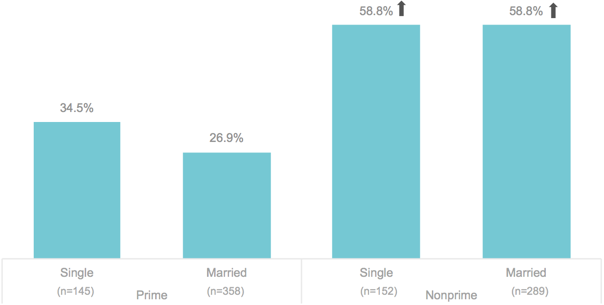

Carried a credit card balance

Married prime Americans are the least likely group to carry a credit card balance every month. They are 22% less likely than single primes.

3 out of 5 nonprime Americans (married or otherwise) carry a balance monthly.

Carried a credit card balance

(“regularly”)

Q4: What is your marital status? * Q18r: Carried a credit card balance- Please indicate how often you engaged in the following financial activities in the last 12 months. * hClassification: Hidden question (Prime, nonprime)

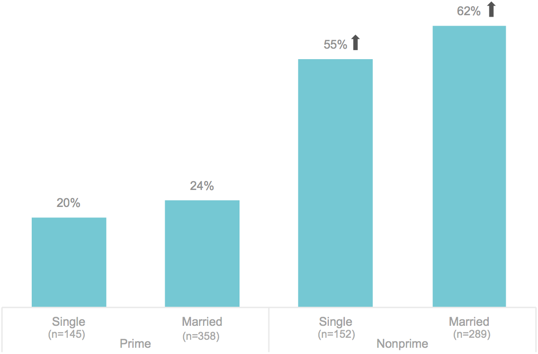

Carrying too much debt

Nonprime Americans are twice as likely as prime to think they carry too much debt.

Almost 2 out of 3 married nonprimes feel consumed with their debt.

I have too much debt right now

(Top-2 Box: Strongly Agree/Agree)

Q4: What is your marital status? * Q27r14: On a scale of 1 to 5, where 1 is ‘strongly disagree’ and 5 is ‘strongly agree’, how much do you agree or disagree with the following statements? * hClassification: Hidden question (prime / nonprime)

Job loss in the household

Married nonprime Americans are twice as likely as their prime counterparts to have lost a job sometime in the prior 5 years.

In nonprime households, uncertainty compounds with marriage rather than dissipates.

Household lost a job

(within the last 5 years)

Q4: What is your marital status? * Q28r: Lost a job – During the past 5 years, has your household experienced any of the following significant major life changes or financial events? * hClassification: Hidden question (Prime, nonprime)

Work hours reduced

Married nonprimes are 2.5x as likely to have experienced a reduction in pay or work hours.

Work hours or pay reduced

(within the last 5 years)

Q4: What is your marital status? * Q28r: You had your work hours and/or pay reduced – During the past 5 years, has your household experienced any of the following significant major life changes or financial events? * hClassification: Hidden question (Prime, nonprime)

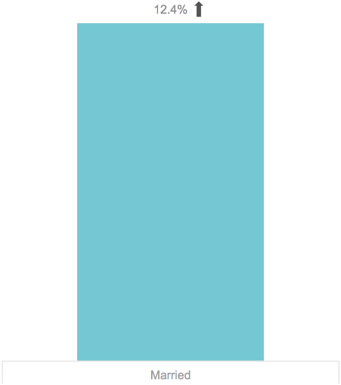

Bank closed their checking account

1 in 8 married nonprimes had their checking account closed by their bank within the last five years.

Bank closed my checking account

(within the last 5 years)

(Statistically significant compared with prime married Americans.)

Q4: What is your marital status? * Q28r: Bank closed my checking account – During the past 5 years, has your household experienced any of the following significant major life changes or financial events? * hClassification: Hidden question (Prime, nonprime)

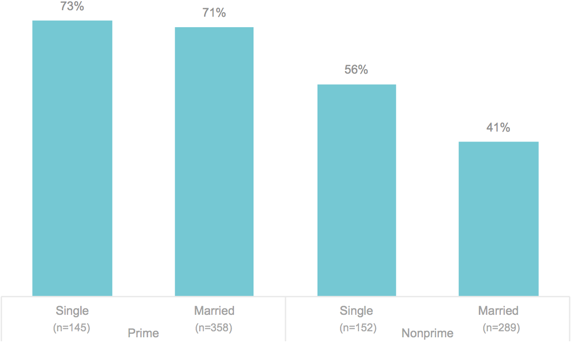

Confidence with day-to-day finances

Confidence with financial matters drops with nonprime Americans and plummets for nonprime married people.

I am good at dealing with day-to-day financial matters

(Top-2 Box: Strongly agree/Agree)

Q4: What is your marital status? * Q27r14: On a scale of 1 to 5, where 1 is ‘strongly disagree’ and 5 is ‘strongly agree’, how much do you agree or disagree with the following statements? * hClassification: Hidden question (prime / nonprime)

Worry over monthly expenses

Married nonprimes are four times as worried about meeting monthly living expenses as their prime counterparts.

I worry all the time about being able

to meet monthly living expenses

(Top-2 Box: Strongly agree/Agree)

Q4: What is your marital status? * Q27r14: On a scale of 1 to 5, where 1 is ‘strongly disagree’ and 5 is ‘strongly agree’, how much do you agree or disagree with the following statements? * hClassification: Hidden question (prime / nonprime)

Long-term financial security

Married nonprimes are half as likely to be confident that they are on track for long-term goals for becoming financially secure.

I am confident that I can meet

my long-term goals for becoming financially secure

(Top-2 Box: Strongly agree/Agree)

Q4: What is your marital status? * Q27r14: On a scale of 1 to 5, where 1 is ‘strongly disagree’ and 5 is ‘strongly agree’, how much do you agree or disagree with the following statements? * hClassification: Hidden question (prime / nonprime)

Finance-inducing stress

Unsurprisingly, nonprime Americans feel that their finances cause them significant stress as more than twice the rate of prime Americans.

More than half of married nonprimes experience that stress.

My finances cause me significant stress

(Top-2 Box: Strongly agree/Agree)

Q4: What is your marital status? * Q27r14: On a scale of 1 to 5, where 1 is ‘strongly disagree’ and 5 is ‘strongly agree’, how much do you agree or disagree with the following statements? * hClassification: Hidden question (prime / nonprime)

Sense of control in their lives

Married nonprimes are much less likely to feel they have control in their lives compared to prime people and even when compared to their single nonprime counterparts.

I have little control over the things that happen to me

(Top-2 Box: Strongly agree/Agree)

Q4: What is your marital status? * Q27r14: On a scale of 1 to 5, where 1 is ‘strongly disagree’ and 5 is ‘strongly agree’, how much do you agree or disagree with the following statements? * hClassification: Hidden question (prime / nonprime)

What drives relationship conflicts over money?

In a qualitative study, where we interviewed 61 people, we asked what the biggest disagreement the person had with their partner over money. While the reasons varied, some broad themes emerged:

Life-sized purchases

“Buying a new car we couldn’t afford”

“We were talking about possibly saving up to get a house, but with our budget tight like it is, I did not know how we could possibly do it. We aregued for days and days about it.”

Financial management

“We disagreed about how much of a down payment (from savings) we wanted to put down on a car.”

“How to pay back student loans”

Big, discretionary purchases

“How much to spend, when we are buying things for our place.”

“Over how much money to spend on our vacation.”

Managing a financial crisis

“How to spend money when we were going through hard times, financially. We both had different ideas of what we could be doing with what money we had at the time.”

“about how to split the rent while I wasn’t working”

Day-to-day spending

“Credit cards. He sees them as free money, and doesn’t worry about paying them off.”

“He thinks I shouldn’t spend it”

“Eating out so often”

Financial betrayal

“One of my girlfriends in college stole my credit card and went on a mini shopping spree with it. That ended the relationship.”

Bringing debt into the relationship

“Partner’s debt with credit cards, student loans and other bills”

Finances in a relationship

Relationship and money can be categorized by two propensities: how active the individuals in the relationship are in the household finances and how cooperatively they work. The following are representative quotes that represent the different behaviors: cooperative vs. independent; and, passive vs. active.

Cooperative

- Passive: “I nag until he gives in” or “I usually defer to her since she errs on the side of frugality”

- Active: “We talk until we figure it out” or “Usually if we can’t both agree that something is necessary, we’ll drop the issue for the time being”

Independent

- Passive: “My husband is more-so than me because he makes the majority of the money. We do it together but he is responsible for making the bills.”

- Active: “We typically just agree to disagree. We each have our own money and different accounts so it rarely gets too heated.”

Nonprime Americans

“Subprime” is often used to represent people with scores below 640. People with 641 to 700 are sometimes called “near prime.” We have elected to use the clearer designation of “nonprime” for all consumers with scores below 700.

“Nonprime Americans” represent the New Middle Class. These are Americans with a credit score below 700, meaning that their access to credit is limited or curtailed. It is the Center’s objective to better understand their experiences, attitudes, and behavior.

Methodology

Quantitative study

The primary purpose of this study was to determine how nonprime Americans were similar or different from those with prime credit on a range of behaviors and attitudes.

Interview Dates: December 6-14, 2016

Sample Specs:

- Total Respondents = 1,217

- Sample Source: Research Now Consumer Panel

Qualification Criteria:

- Ages 18-64

- Personal income: Any

- Geography – U.S. Rep

- Has primary or shared responsibility managing HH finances

- Employment: No students or unemployed

- Has a checking or savings account

Survey Instrument: 15 minute online questionnaire

Arrows indicate statistical significance at 90%, over prime/unprimed cohort

Qualitative study

The primary purpose of this study was to explore how couples managed money in the context of their relationships.

Interview Dates: January 25, 2017

Sample Specs:

- Total Respondents = 41

- Sample Source: Remesh

Qualification Criteria:

- Ages 18-64

- Personal income: Any

- Geography: U.S.

- In a committed relationship

Survey Instrument: 30 minute online conversation executed through the Remesh platform