Introduction

The broad discussion in many circles about the plight of the non-prime consumer often uses assumptions about how these consumers think, what matters to them, and even what would be good for them. However, there is limited data that really explains their circumstances.

Elevate’s Center for the New Middle Class set out to understand the differences in attitudes, experiences and behavior between Hispanic consumers with prime credit and those with non-prime credit.

This study represents results from a survey of 1311 U.S. consumers (878 Hispanic and 433 drawn from the general population). Of the 1311, 473 identified as non-prime, 170 as credit “invisibles” (meaning they did not have enough credit history to have a credit score), and 668 as prime.

Interviews were conducted July 5-18, 2018.

Non-prime Americans

“Non-prime Americans” represent the New Middle Class. These are Americans with a credit score below 700, meaning that their access to credit is limited or curtailed. Non-prime is also often further divided into “near prime,” “sub-prime,” and “deep sub-prime.”

It is the Center’s objective to better understand non-prime experiences, attitudes, and behavior.

The following report seeks to understand the financial experience of prime, non-prime, and credit invisible Hispanics in the United States. This does so by comparing to general populations.

| Key Topline Findings | ||

| Income / Employment | Non-prime Hispanics are more likely to experience stable income compared to the general non-prime population.•Non-primes report higher levels of employment, experience more employment flux, and seek entrepreneurial opportunities.• They experience less difficulty in predicting month-to-month shifts in income | |

| Expenses | Most U.S. Hispanics tend to plan for bills and expenses•Non-prime Hispanics are less likely to spend on vacations, routine medical expenses, and life insurance; but, more likely to spend on entertainment, furniture, and appliances.•Non-prime Hispanics feel more comfortable that they could cover a significant unexpected expense and are even more likely to be able to cover it from savings. | |

| Banking | Non-Prime Hispanics are far more comfortable with banking technologies then the general non-prime population. •Non-prime Hispanics are less likely to have a checking account (or write physical checks), but more likely to visit a bank’s physical location.•They are much more likely to use banking technologies: mobile banking app, payment with smartphones, and sharing money electronically. | |

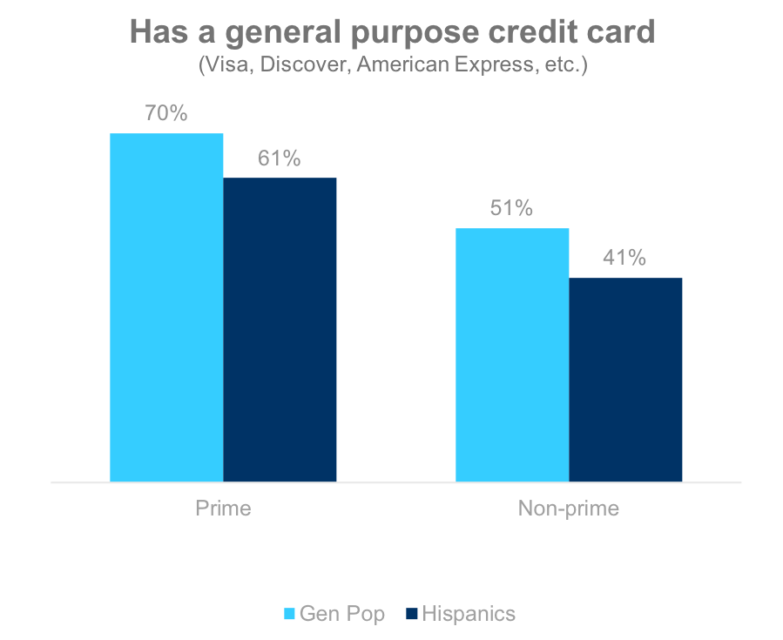

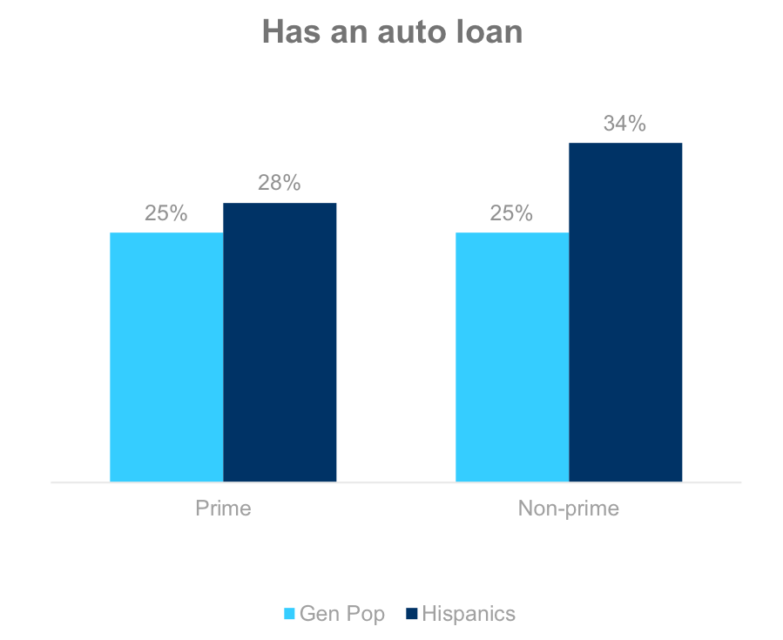

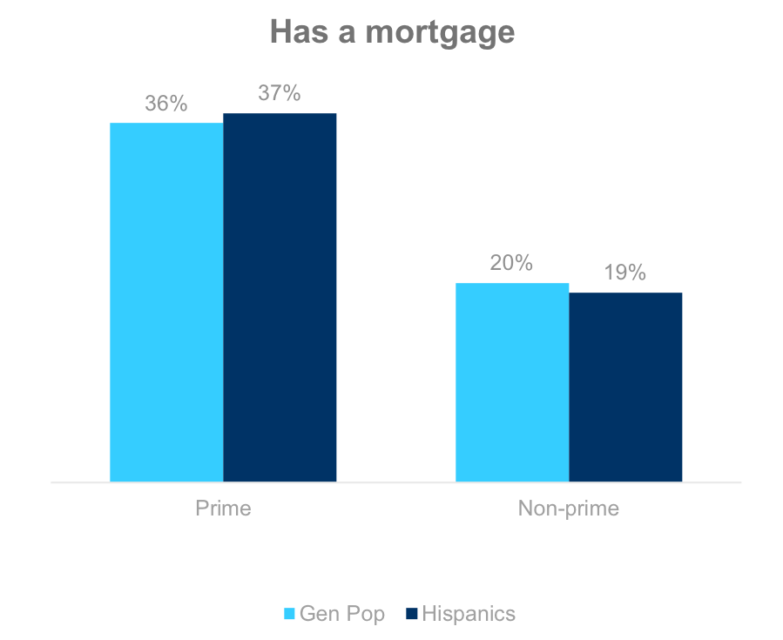

| Debt | Hispanics borrow, but often in different ways.•They have similar rates of mortgage, but are more likely to have auto loans and personal loans.•They are less likely to have a general purpose credit card | |

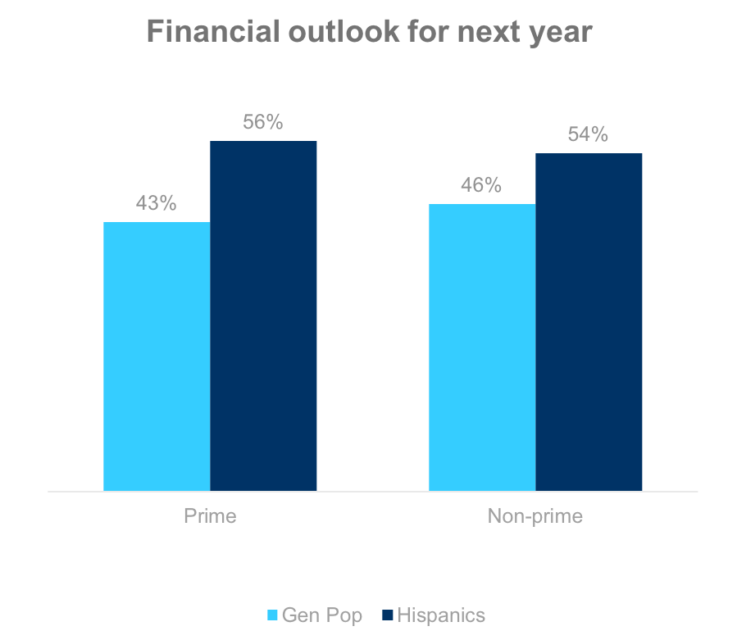

| Financial planning | Hispanics do a better job than the general population in financial planning and consequently feel less stress and more optimism about their finances.•Hispanics are more likely to plan for unexpected or major purchases and non-prime Hispanics are more apt to regularly save money than general non-prime consumers. .•Non-prime Hispanics are much more satisfied than the general non-prime population with their current financial situation, more of them report being stable, and being on track to meet their financial goals.•Hispanics are more likely to turn to technology when seeking financial literacy education.•Hispanics in general have a more optimistic view of their financial outlook for next year. | |

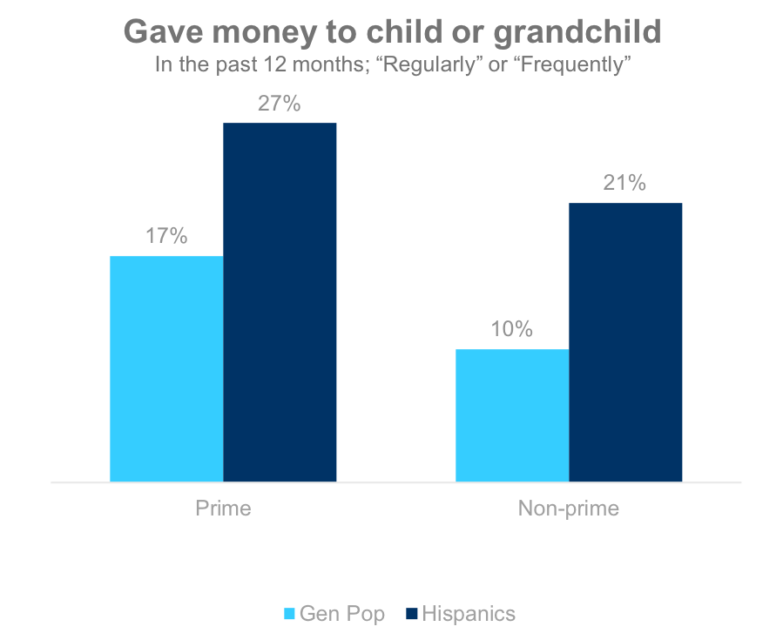

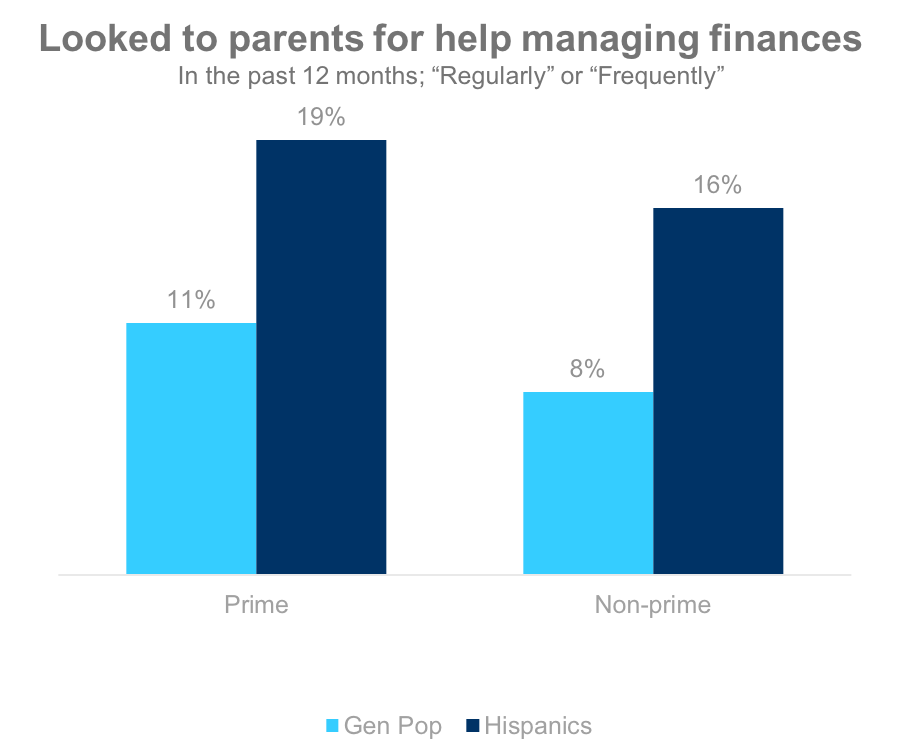

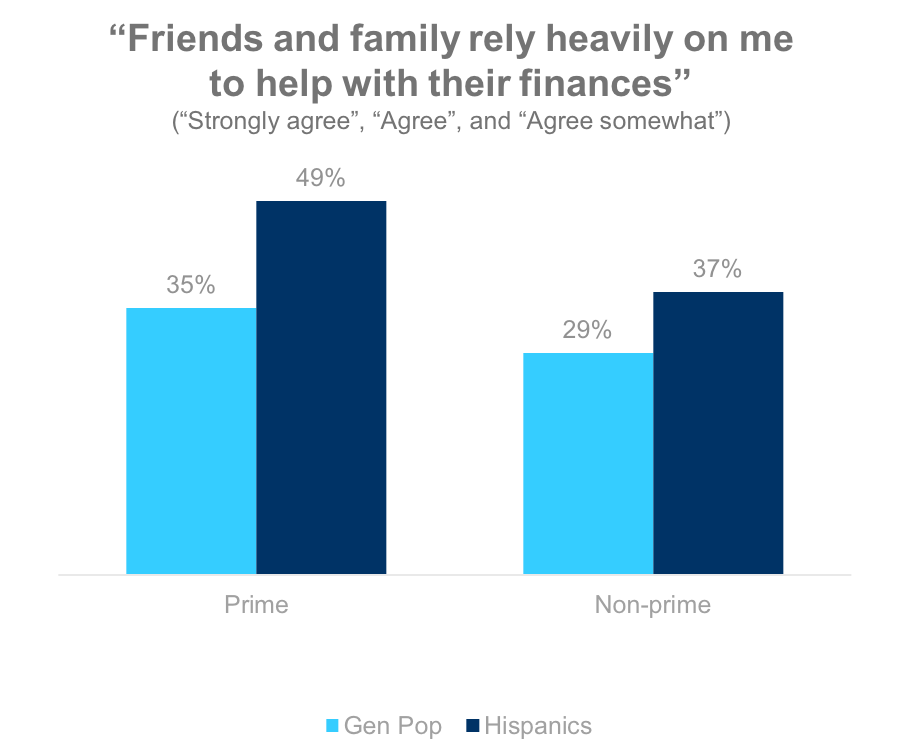

| Family and Money | Hispanic families are more financially integrated than the general population.•Hispanics are more likely to regularly give money to their children or grandchildren.•They are more likely to seek help in managing their finances from their parents. | |

| Acculturation | Non-prime Hispanics are as acculturated as their prime counterparts.•One in four Hispanic invisibles are “unbanked.”•Rates of un-acculturation appear to be correlated to credit status.•Non-prime Hispanics are more likely to be English-dominant and prime Hispanics are more likely to be bicultural. |

Income and employment

Hispanic employment

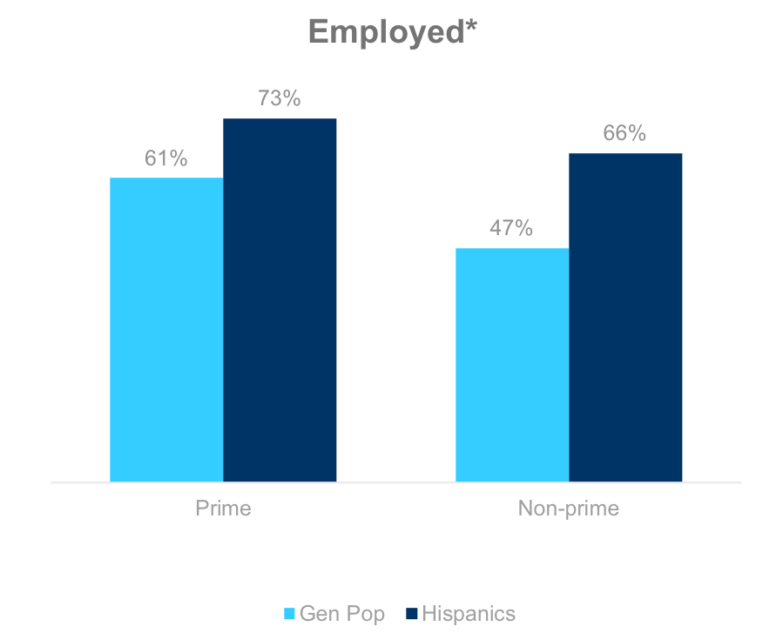

Hispanics are more likely than the general population to report being employed.

Non-prime Hispanics are 40% more likely to report being employed than the general non-prime population.

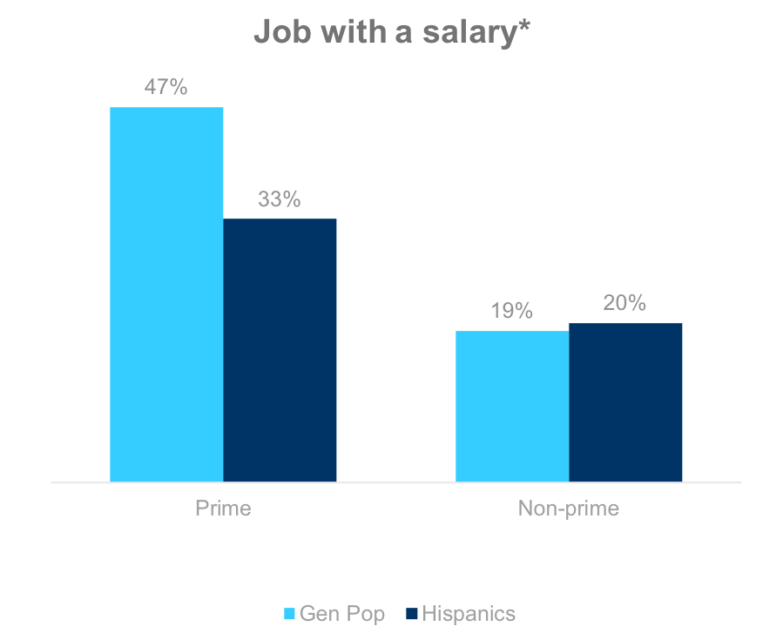

Salaried employment

Non-prime Hispanics are no less likely than the general non-prime population to report holding a salaried job, but prime Hispanics are 30% less likely to be salaried than the general population.

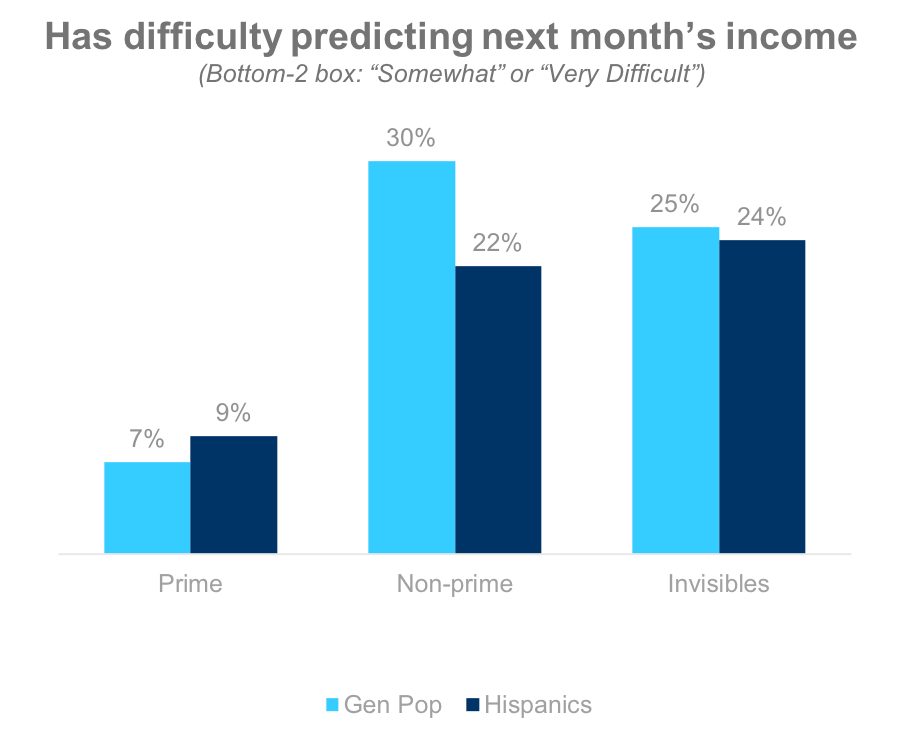

Predicting month-to-month income

One in three general population non-prime consumers has difficulty predicting monthly income. Non-prime Hispanics are better able to predict monthly income.

One in four invisibles has difficulty.

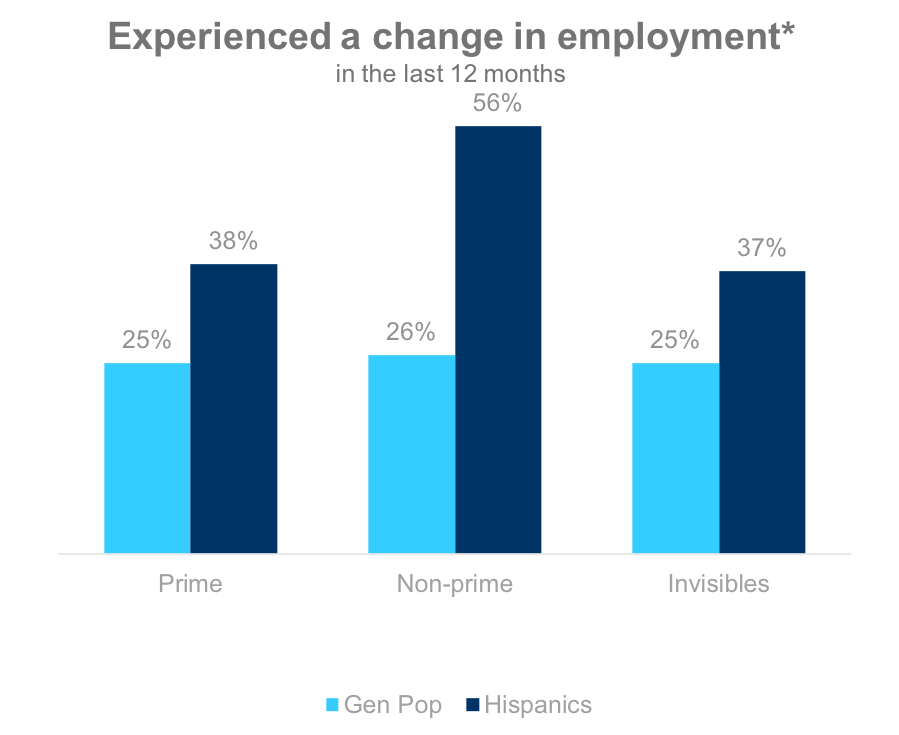

Experienced a change in employment

Hispanics, regardless of where they sit on the credit

spectrum are much more likely to experience changes in their employment situation. Non-prime Hispanics are more than twice as likely as the general population to experience a change in the prior 12 months.

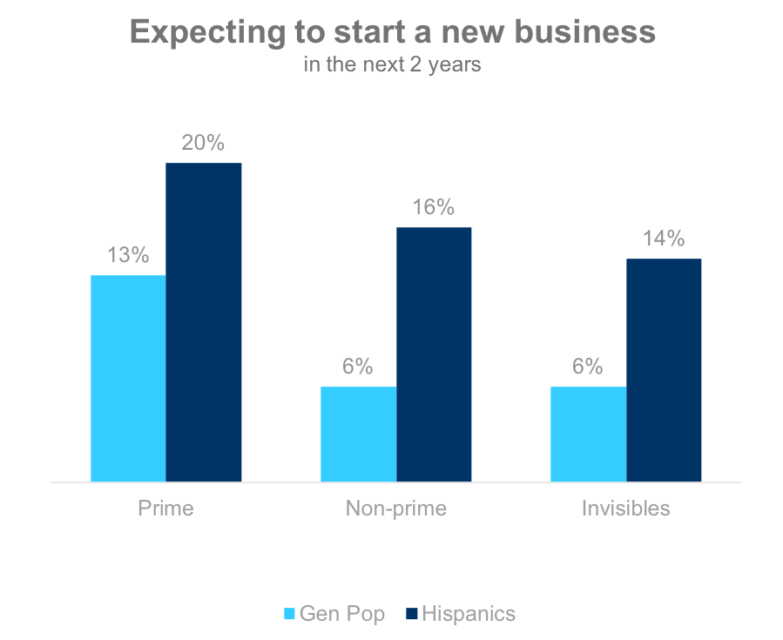

Expecting to start a new business in the next 2 years

Hispanics, regardless of where they fall on the credit spectrum, are more likely to feel the pull of entrepreneurship.

Expenses

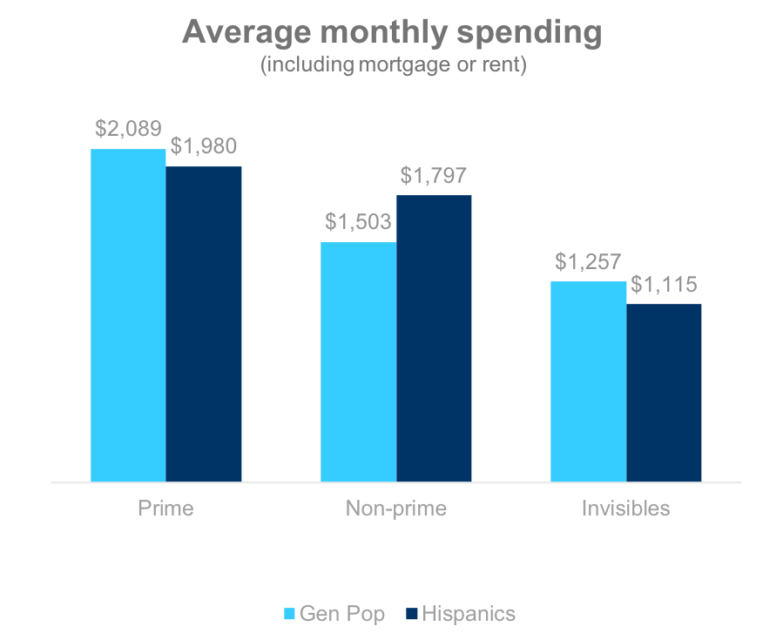

Total monthly expenses

Hispanics’ self-reported spending does not differ dramatically from the general population. Non-prime Hispanics do appear to spend a bit more.

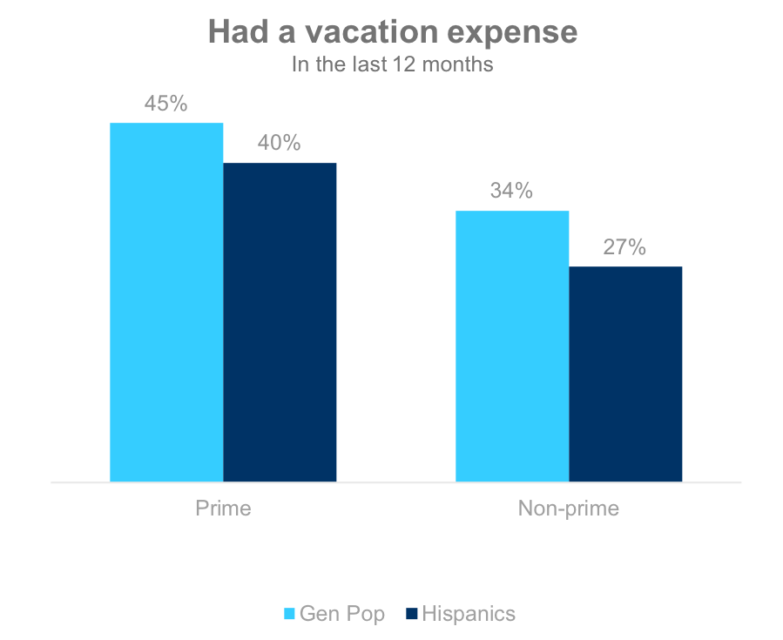

Spending money on a vacation

Hispanics are less likely than the general population to free up money to take a vacation.

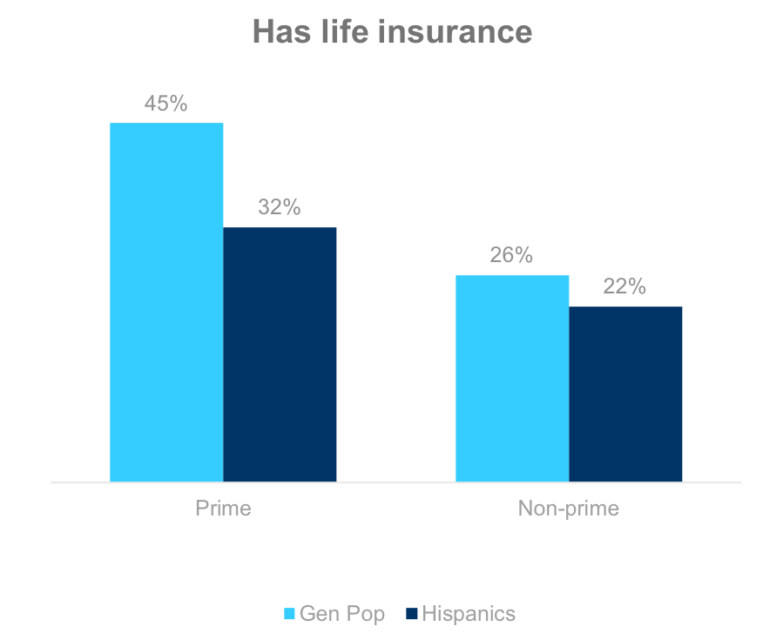

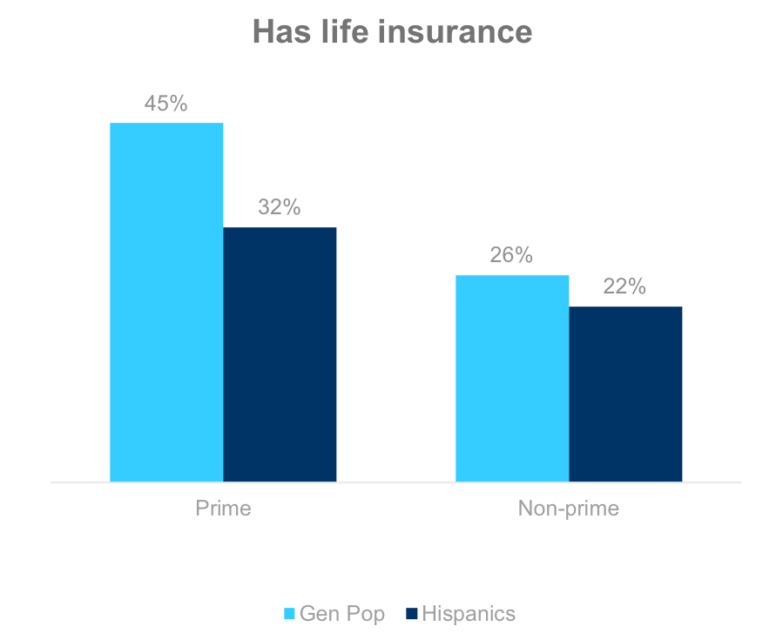

Carrying life Insurance

Less than half of the population carry life insurance. Prime Hispanics are 29% less likely and non-prime Hispanics 15% less likely to carry it compared to the general population.

Carrying life Insurance

Less than half of the population carry life insurance. Prime Hispanics are 29% less likely and non-prime Hispanics 15% less likely to carry it compared to the general population.

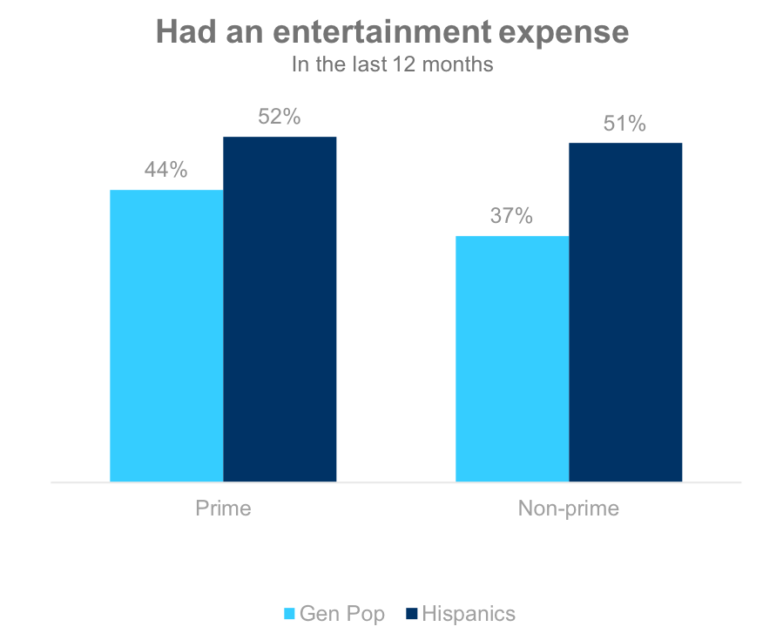

Spending money on entertainment

Hispanics are more likely to spend money on entertainment.

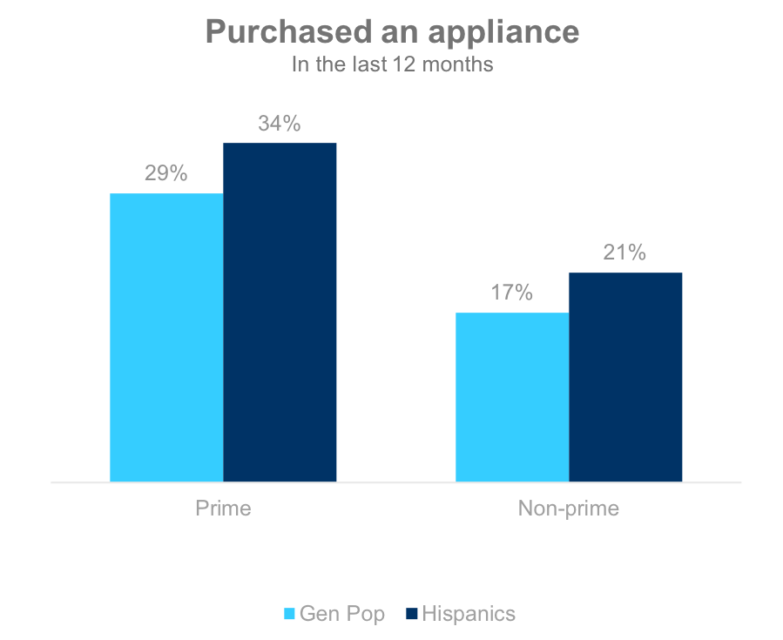

Appliance purchase

Hispanics are also more likely to need to spend money on a new appliance.

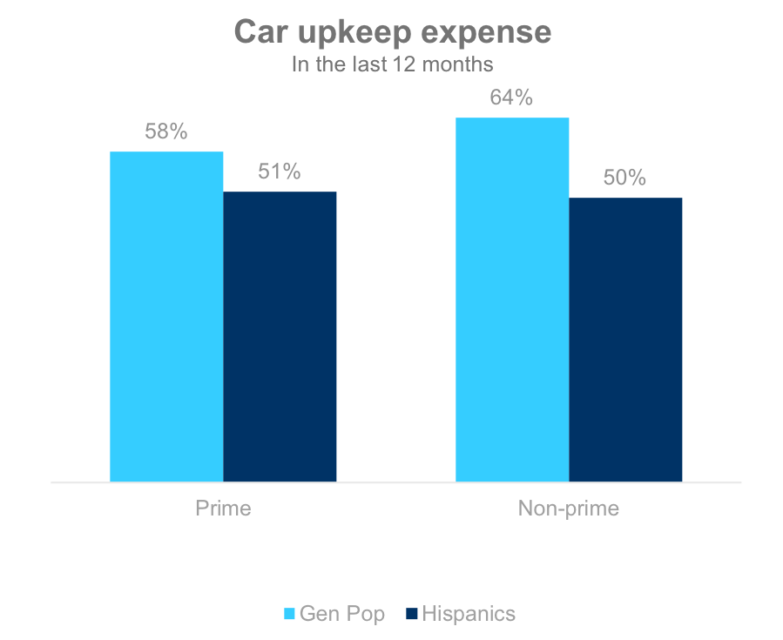

Car upkeep expenses

More Hispanics are able to avoid car upkeep expenses.

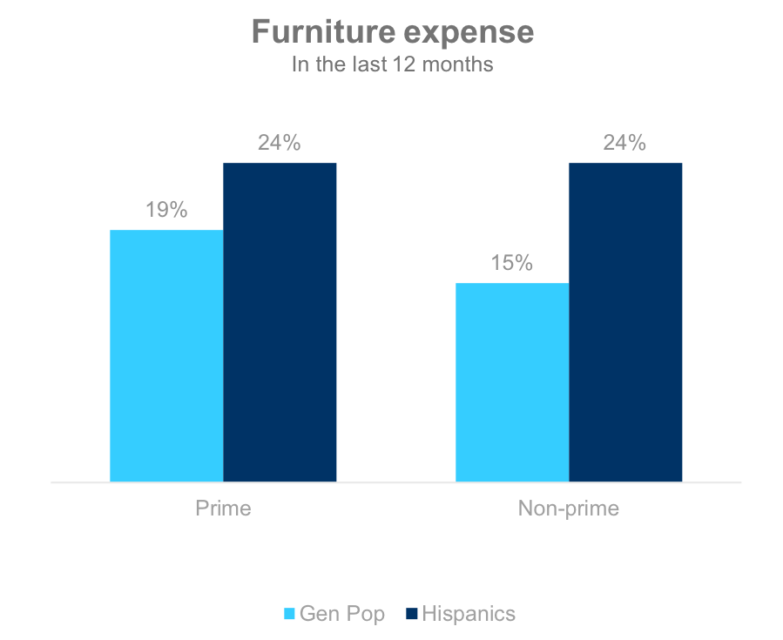

Buying furniture

One in four Hispanics reported buying furniture in the prior 12 months.

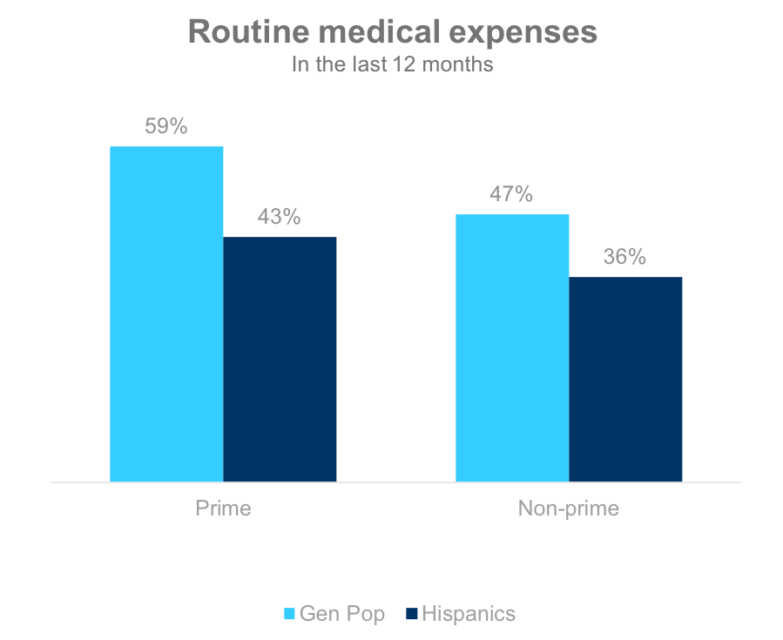

Experiencing routine medical expenses

Hispanics are less likely to spend on routine medical expenses in a given year.

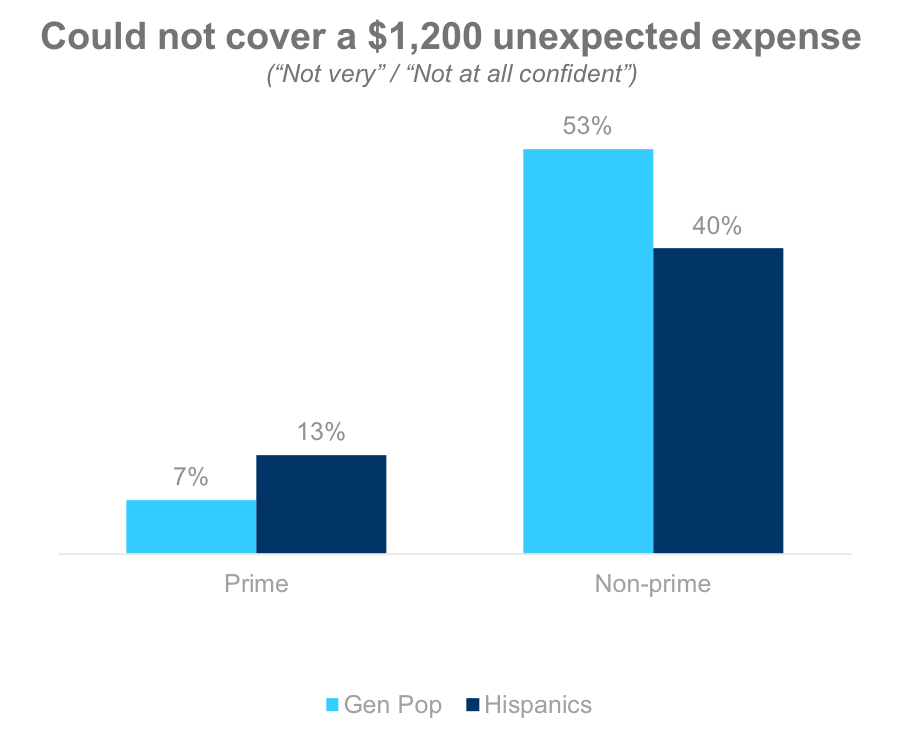

Lack of confidence in covering a significant expense

Prime Hispanics are more likely—but non-prime Hispanics are less likely—to report that they simply would not be able to cover an unexpected $1,200 expense should it arise.

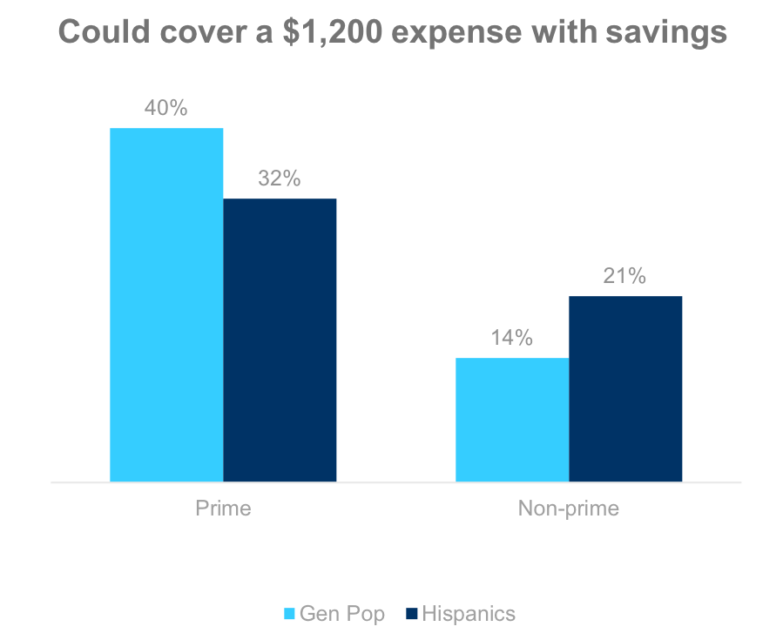

Covering a significant expense with savings

While Prime Hispanics are less likely than the general population to say they could cover an unexpected expense of $1,200 with savings, non-prime Hispanics are actually 50% more likely than the general non-prime population to feel like their savings could cover it.

Banking

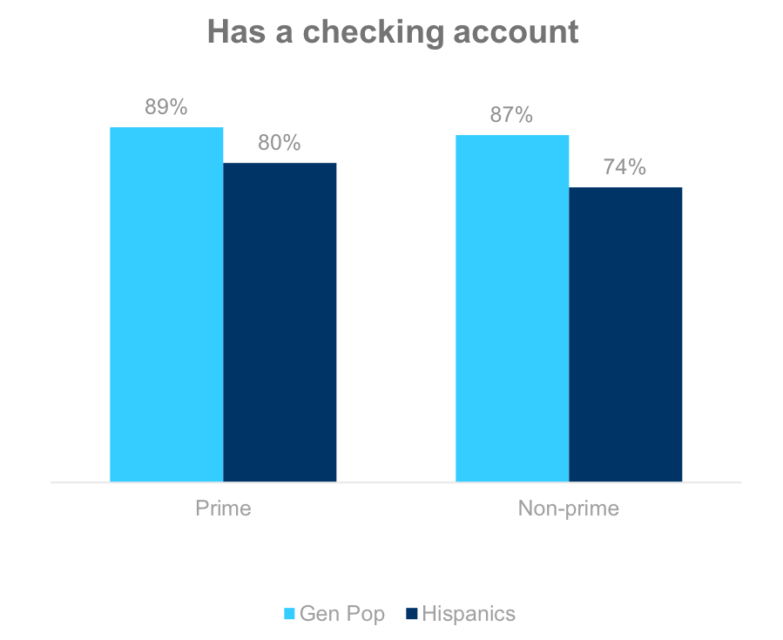

Non-prime Hispanics and checking accounts

Hispanics are less likely to have a checking account than the general population.

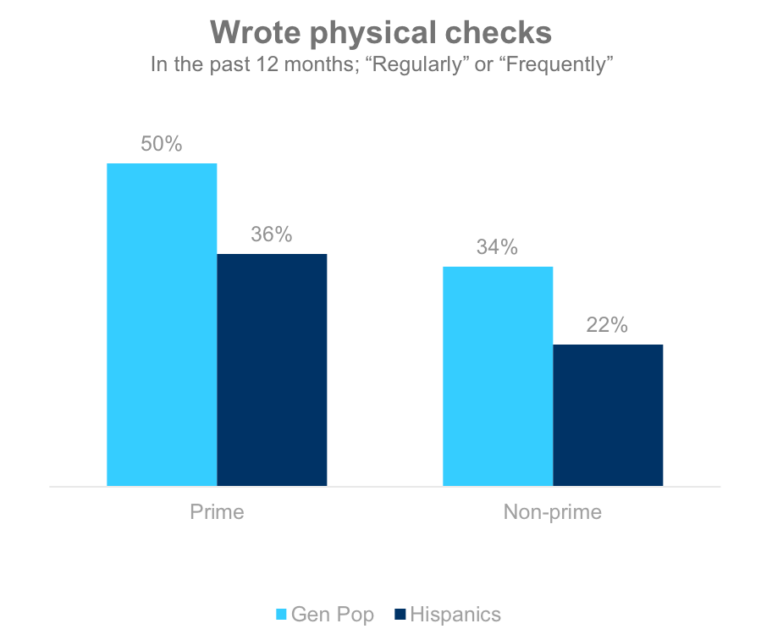

Regularly writes physical checks

And they are significantly less likely to actually write a physical check.

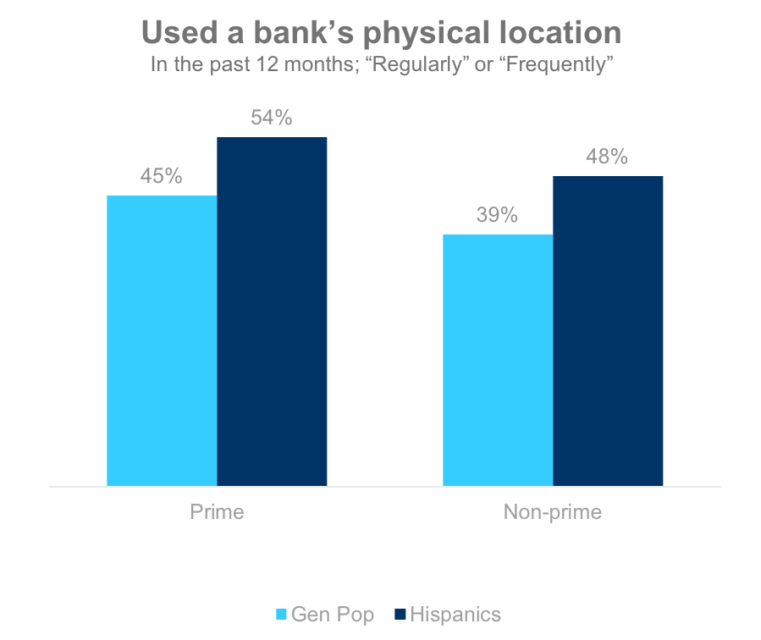

Regularly Uses a bank’s retail location

Hispanics are also more likely to go into a bank’s retail location.

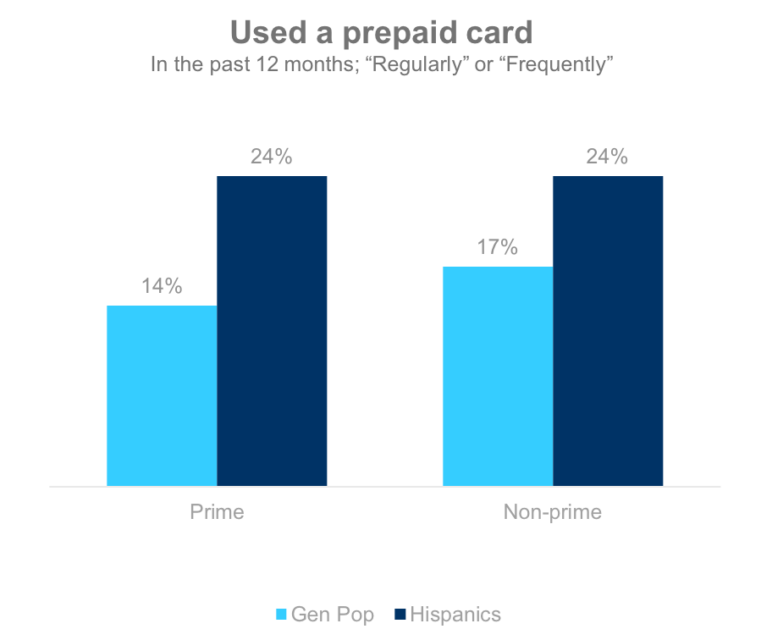

Regularly uses a prepaid card

One in four Hispanics, regardless of their place on the credit spectrum, use a prepaid card on a regular basis.

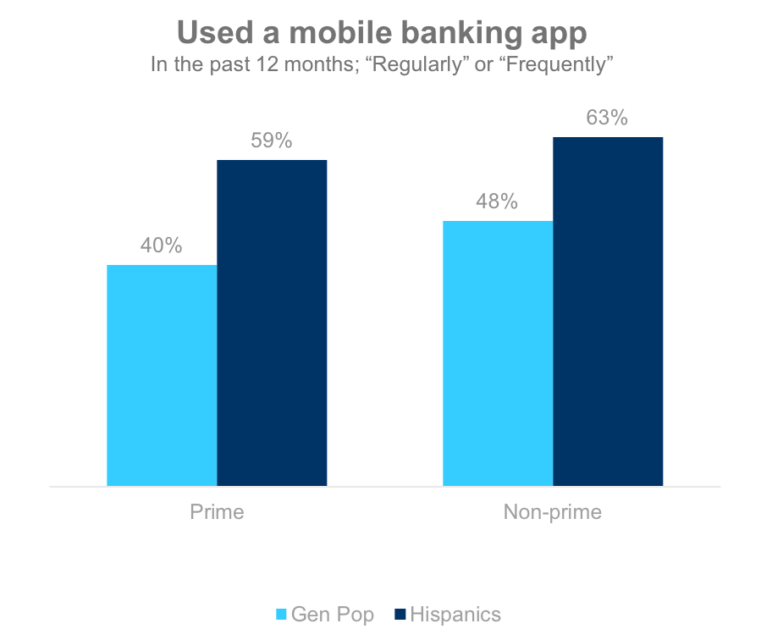

Regularly uses a mobile banking app

Hispanics are much more likely to use a mobile banking app than the general population.

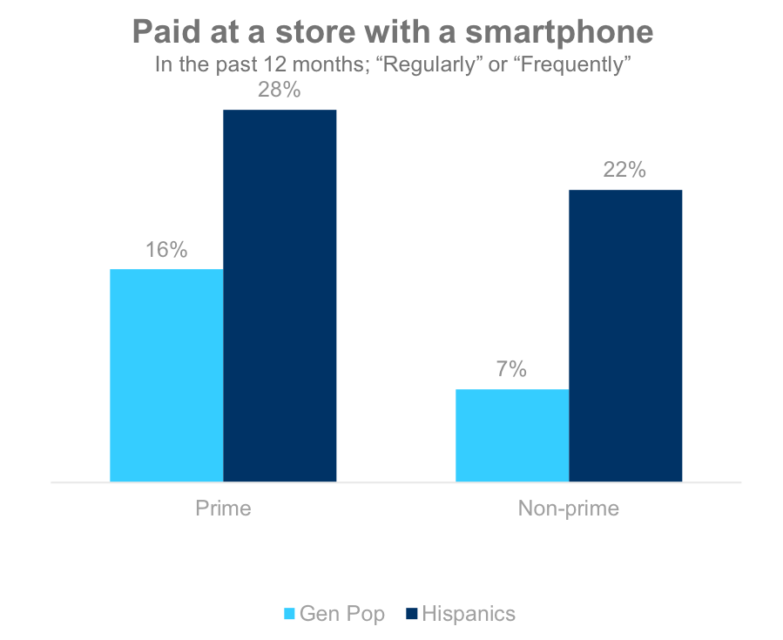

Regularly pays by smartphone at retail

They are also much more likely to regularly pay at retail with a smartphone.

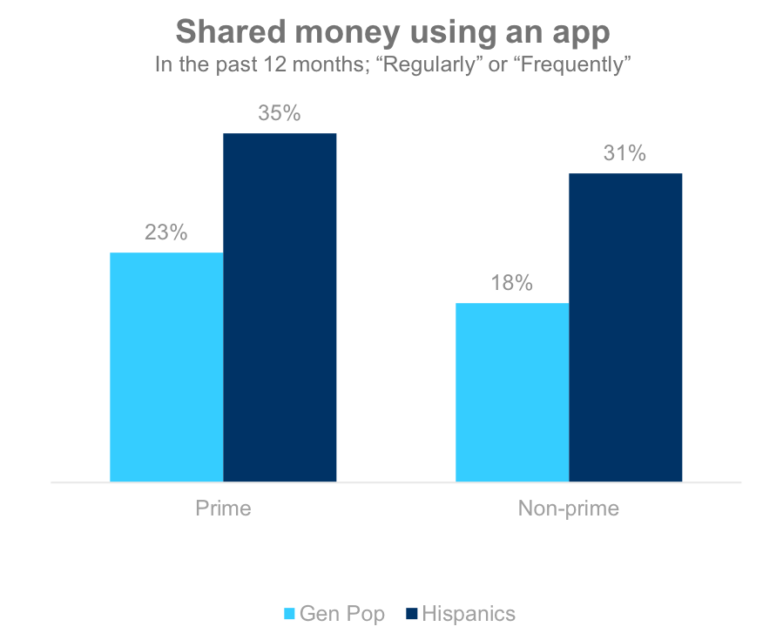

Regularly shares money electronically

A third of Hispanics regularly share money using a money-sharing app.

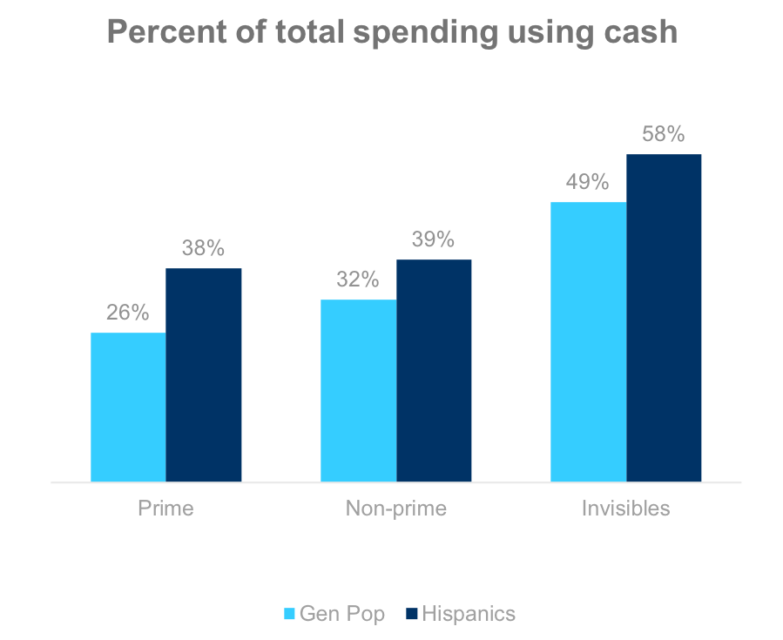

Propensity to use cash in daily purchases

Hispanics also make a greater percentage of their spending using cash.

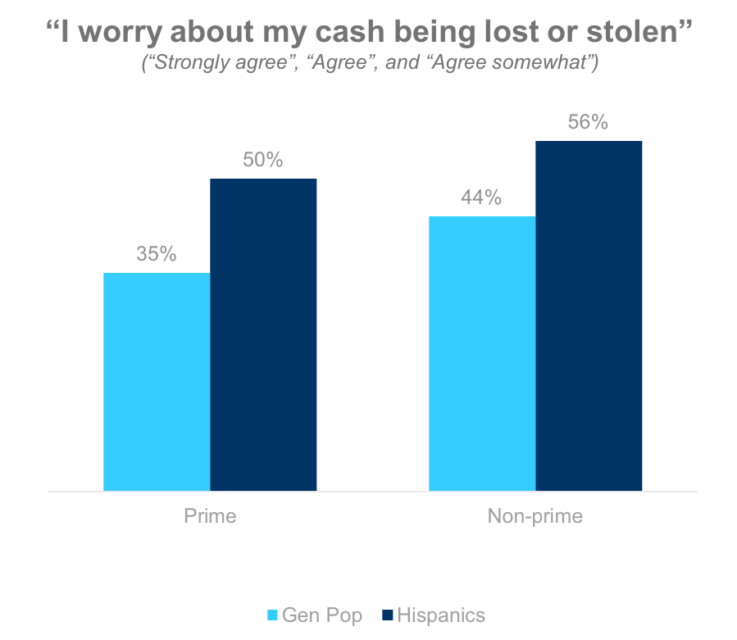

The stress of having cash on hand

Hispanics are more likely to feel anxiety about the cash they have on hand, even half of prime Hispanics harbor the fear of losing their cash.

Debt

Has a general purpose credit card

The dangers of plastic

A third of prime Hispanics feel credit cards lead them into financial trouble. Half of non-prime Hispanics feel the same way, although they are less likely to say so than the general non-prime population.

Has an auto loan

A third of non-prime Hispanics say they currently have an auto loan. One in four people in the other cohorts do.

Has a mortgage

Hispanics are just as likely as the general population to have a mortgage.

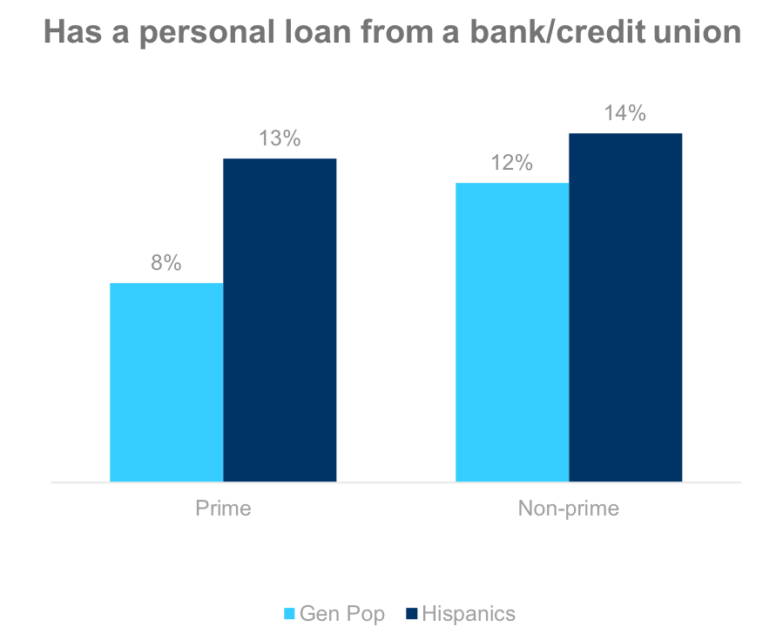

Has a personal loan from a bank / credit union

Prime Hispanics are 50% more likely to report that they currently have a personal loan from a bank or credit union.

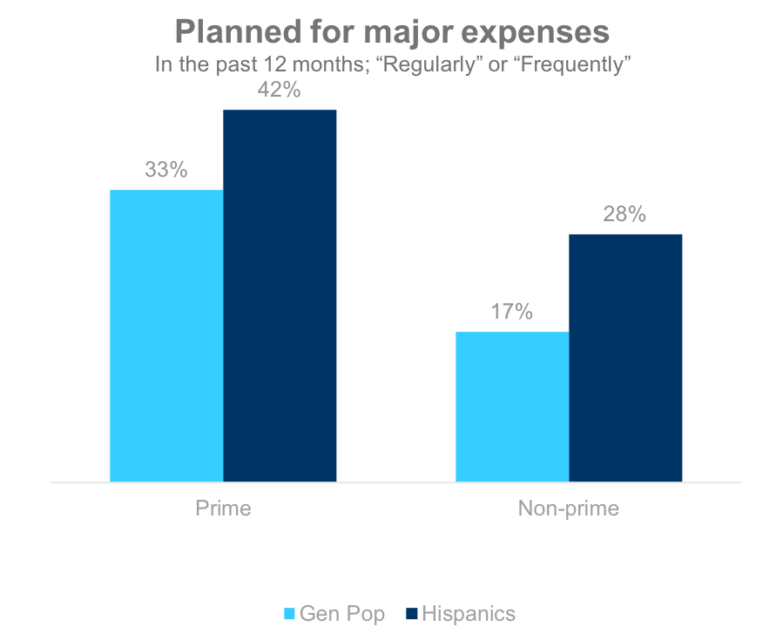

Planned for major expenses

Non-prime Hispanics are 65% more likely to plan for major expenses than the general non-prime population.

Even prime Hispanics are 27% more likely to plan for major expenses.

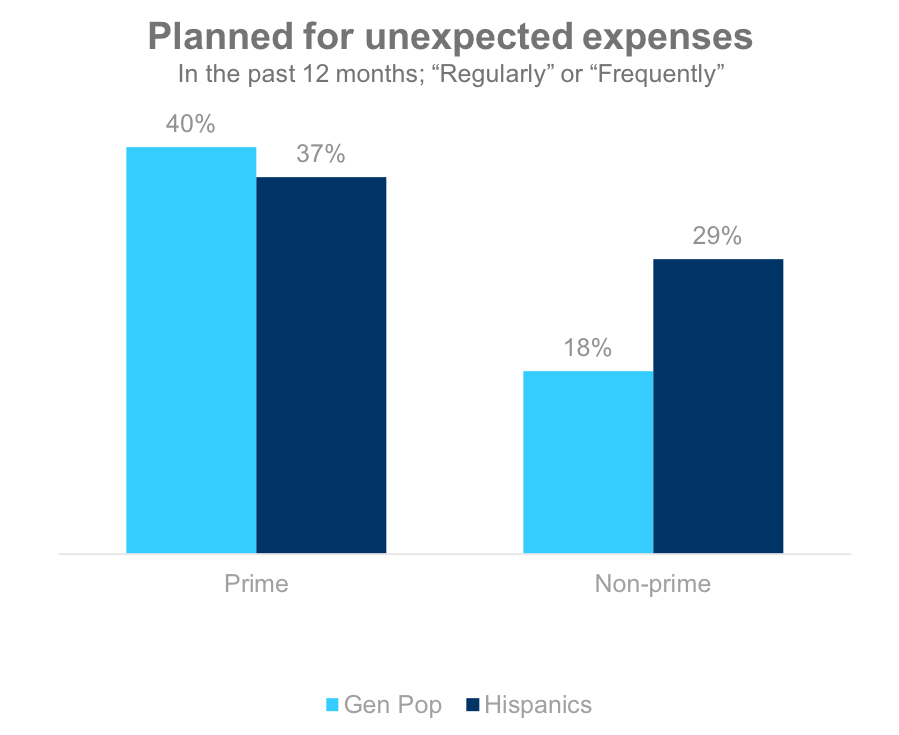

Planned for unexpected expenses

While prime Hispanics are no more likely than the general population to plan for unexpected expenses, non-prime Hispanics are still 50% more likely to than their non-prime general population counterparts.

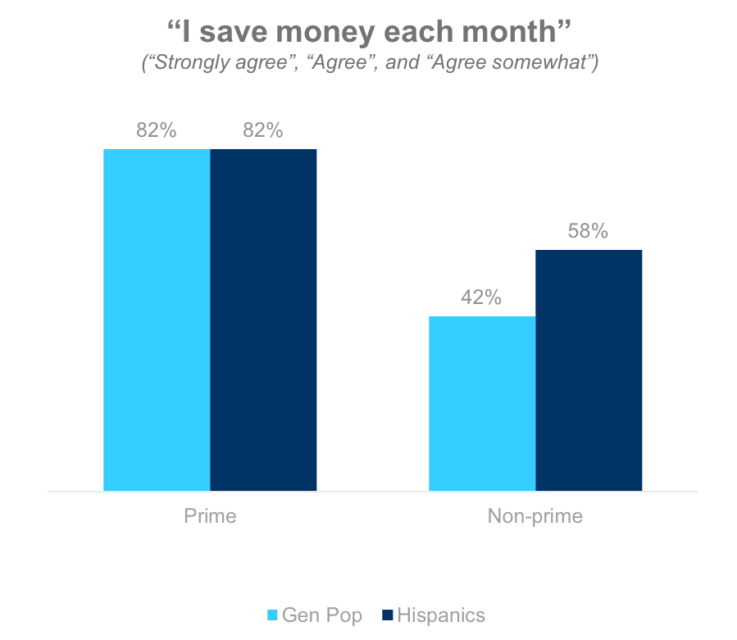

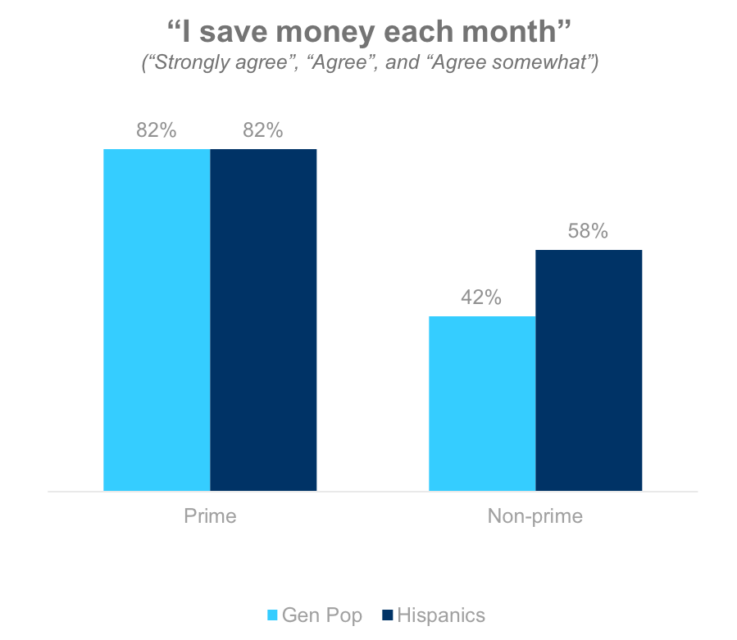

Saving money each month

Non-prime Hispanics’ tendency to plan can be found in their increased likelihood versus the general non-prime population to say that they save money each month.

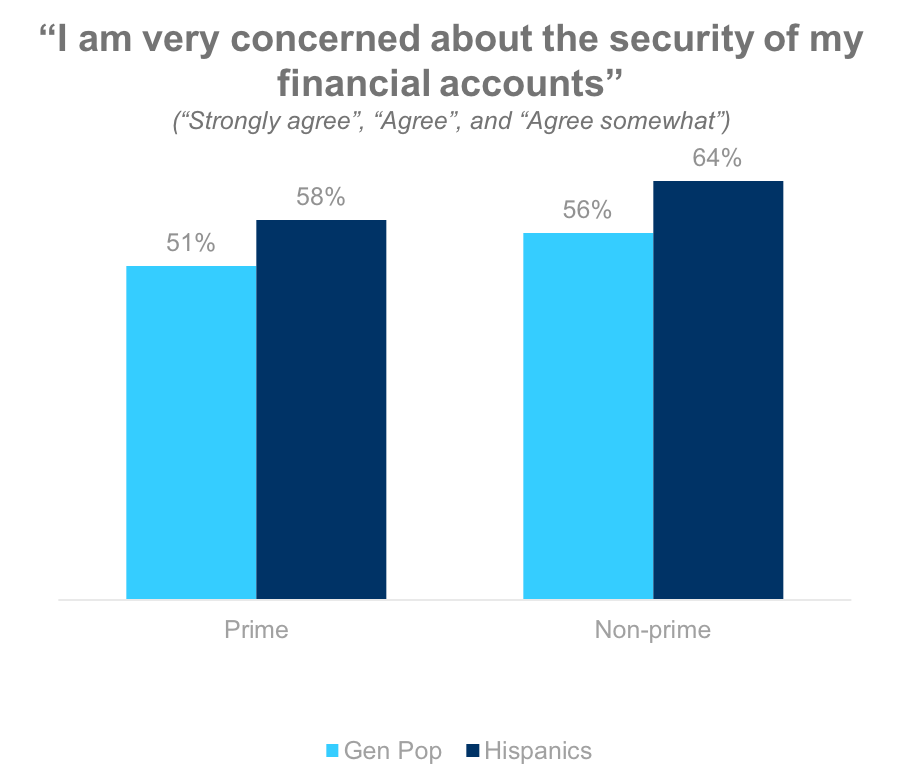

Concern with their financial security

Hispanics feel greater concern about the security of their financial accounts.

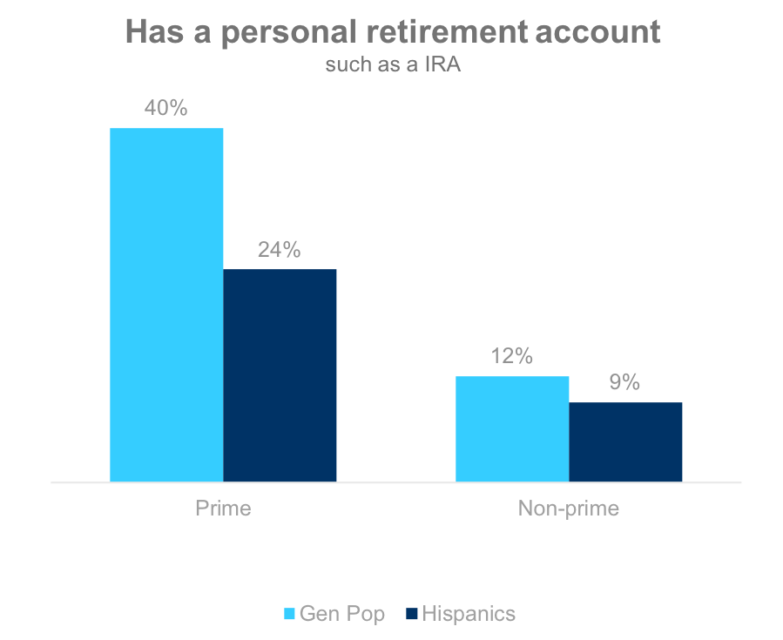

Has a retirement account

Less than one in ten non-prime Hispanics have a retirement account. And prime Hispanics are much less likely to have one than their prime counterparts.

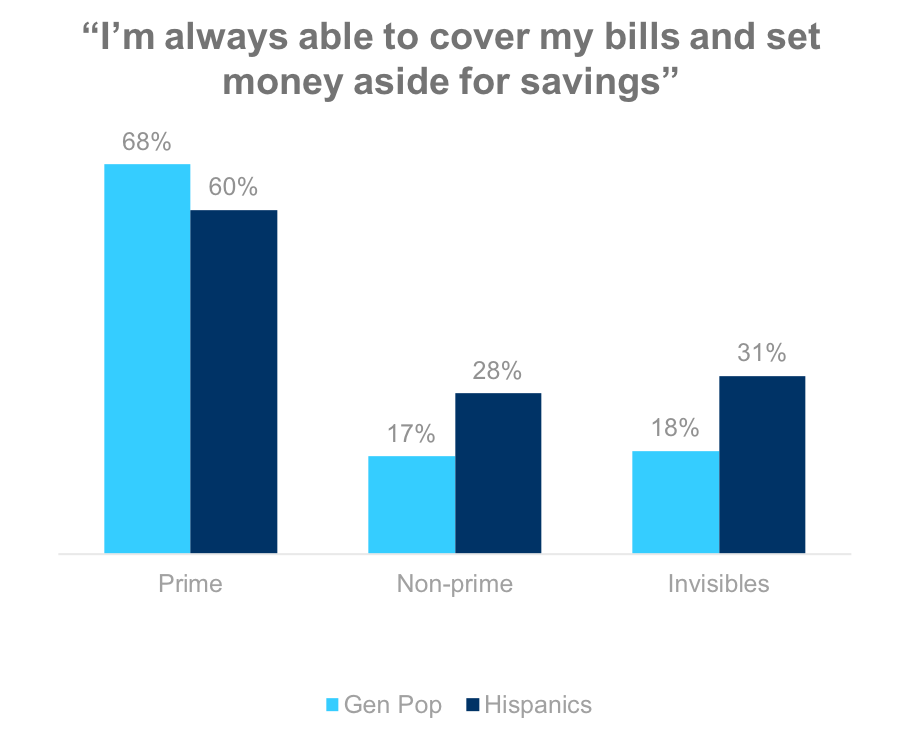

Sense of month-to-month stability

Hispanic non-prime and invisibles are much more likely to say that they are always able to cover their bills in a given month.

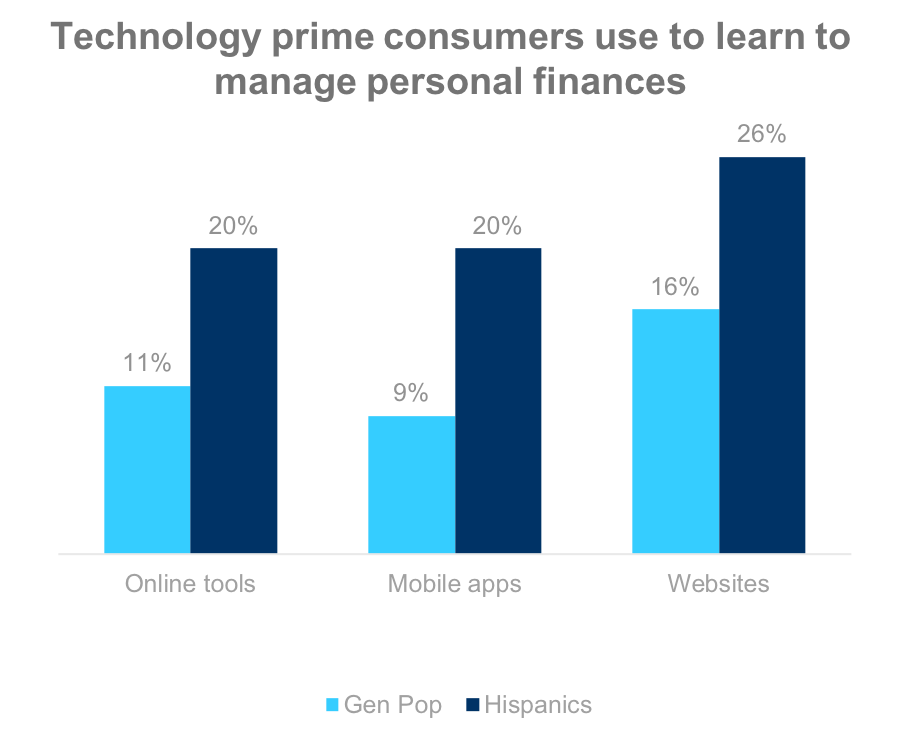

Role of technology in personal financial education

Hispanics are much more likely to engage with technology as they seek information that will help them improve the management of their personal finances.

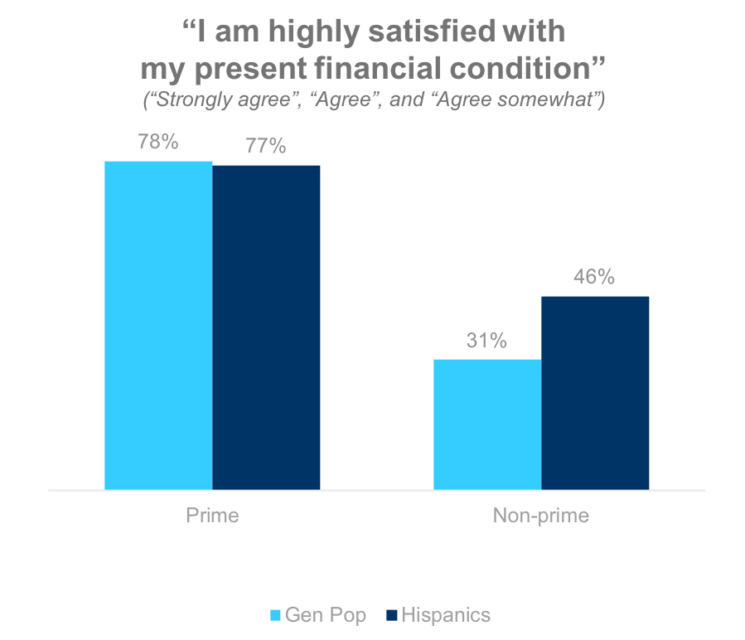

Overall satisfaction with financial condition

Nearly half of non-prime Hispanics are highly satisfied with their present financial condition. That is 48% more likely than the general non-prime population.

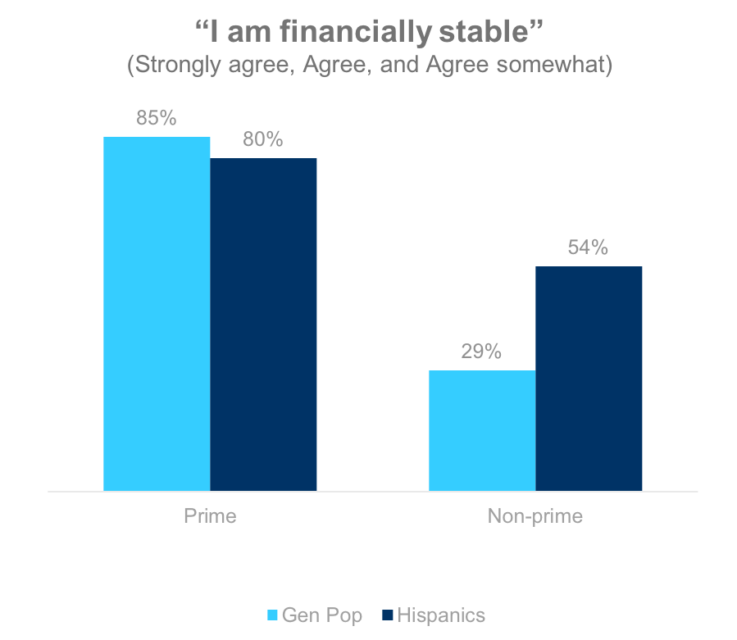

Feeling of financial stability

Non-prime Hispanics’ reward for their planning is that they are 86% more likely to feel financially stable.

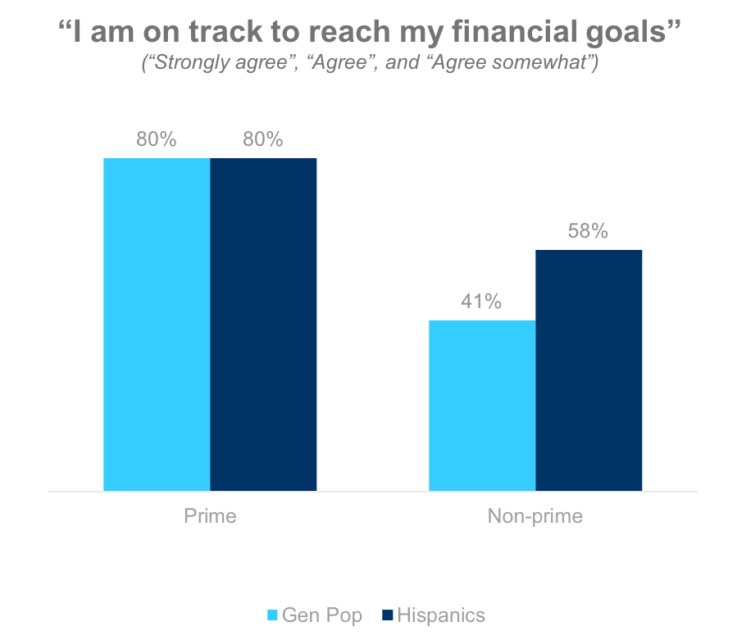

On track to achieve financial goals

Non-prime Hispanics are 42% more likely to agree that they are on track to reach their financial goals compared to the general non-prime population.

Financial optimism

Both prime and non-prime Hispanics are optimistic for their financial outlook for the coming year.

Family and money

Supporting children and grandchildren

Non-prime Hispanics are more than twice as likely to regularly give money to a child or grandchild then the general non-prime population.

Sought financial help from parents

Hispanics are twice as likely to seek help from their parents when it comes to managing their personal finances.

Helping family and friends with their finances

Hispanics are also much more likely to help friends and family with their finances than the general population.

Acculturation and Language

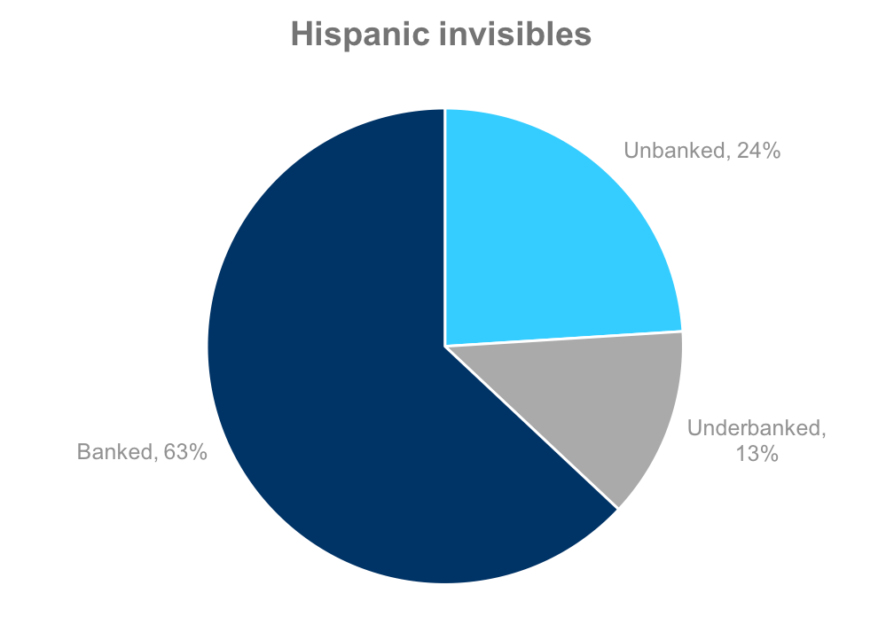

How banked are Hispanic invisibles?

One in five invisible Hispanics hasno financial footprint.

Only 6% of non-prime Hispanics are underbanked.

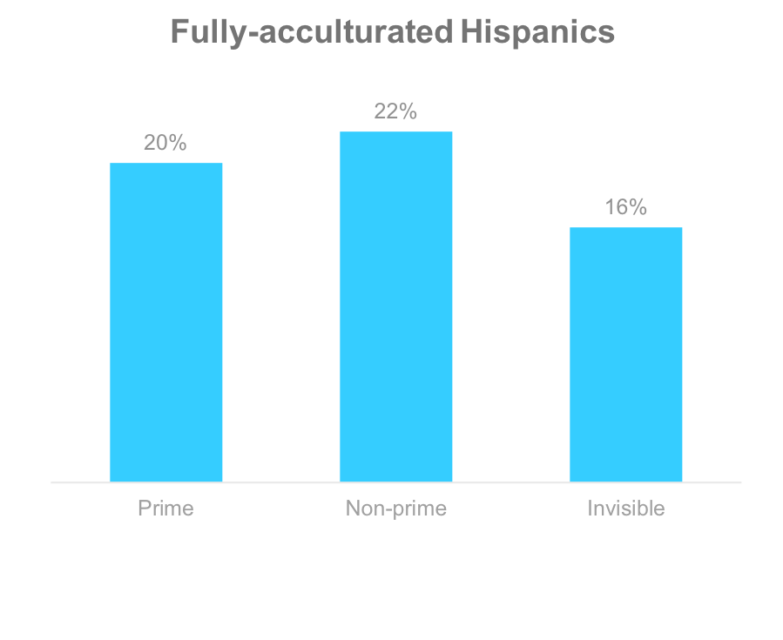

Non-prime acculturation

Non-prime Hispanics are no less likely to be acculturated than prime.

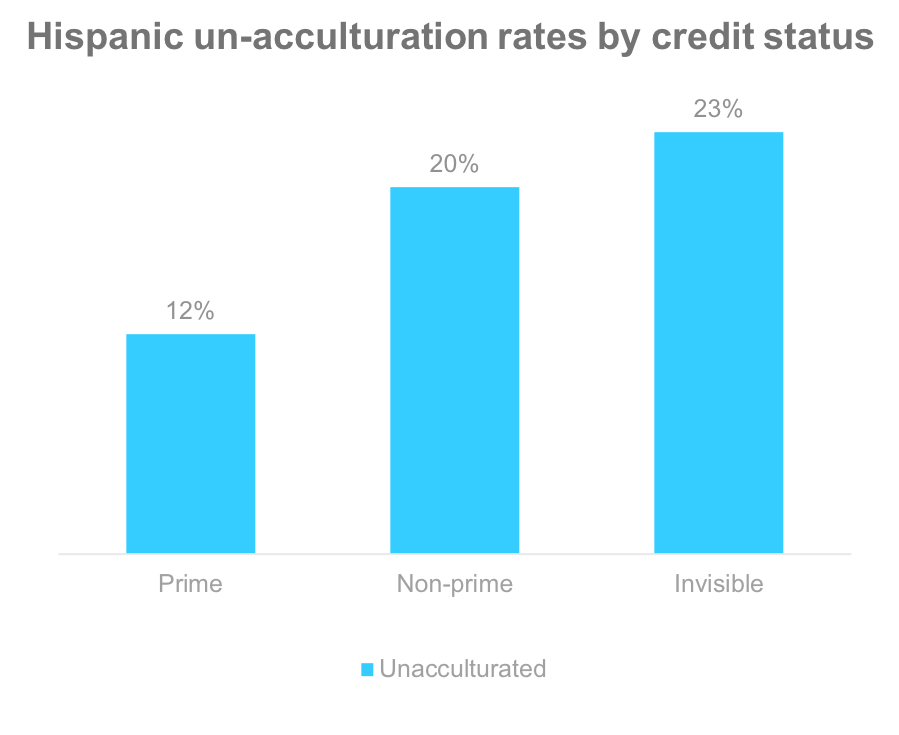

Un-acculturation

Non-prime and credit invisible Hispanics are much more likely to be un-acculturated.

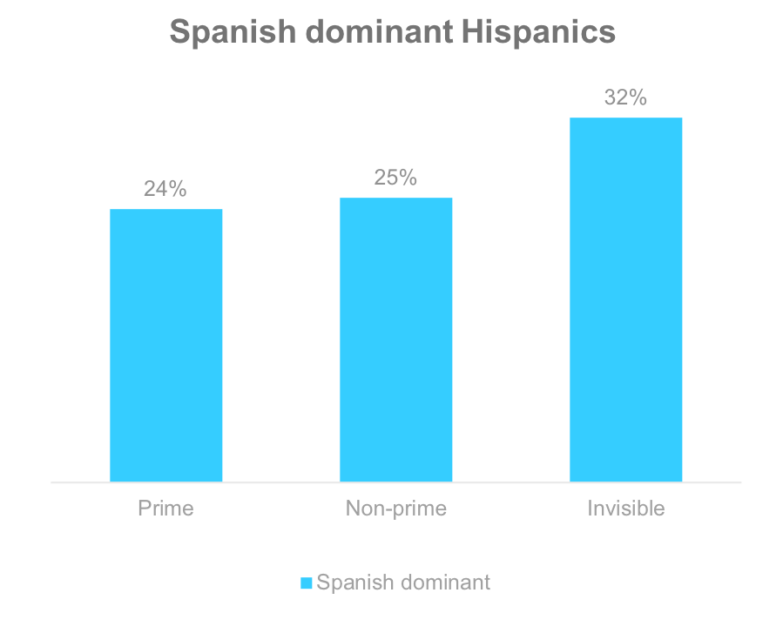

Invisibles are more likely to be Spanish Dominant

Spanish dominance is identical for prime and non-prime Hispanics, but a third of inivisibles are Spanish dominant.

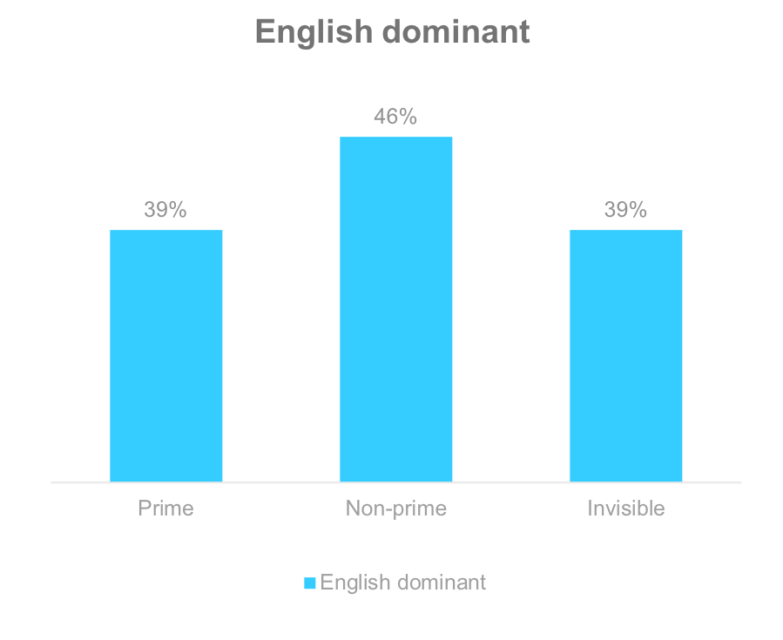

Non-prime are more likely to be English Dominant

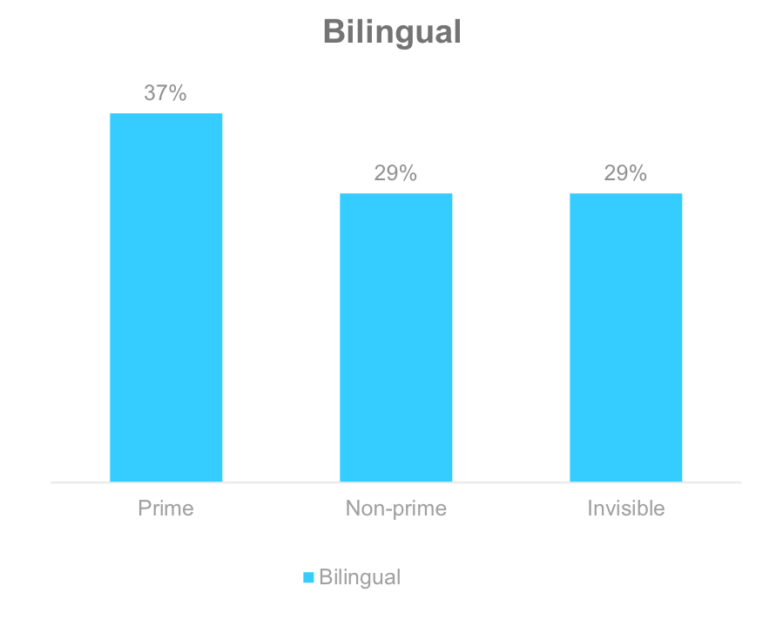

Prime are most likely to be bilingual

Methodology

The primary purpose of this study was to determine how non-prime Hispanic-Americans were similar or different from those with prime credit on a range of behaviors and attitudes.

Interview Dates: July 5-18, 2018

Market Research Vendor: C + R Research

Sample Specs:

•Total Respondents = 1,311

•Sample Source: Online panel and mall intercepts

•Language: English and Spanish

Qualification Criteria:

•Ages 18+

•Personal income: Any

•Geography – U.S. Rep

•Has primary or shared responsibility managing HH finances

•Employment: Any type

Survey Instrument: 15 minute questionnaire

About

About Elevate’s Center for the New Middle Class

Elevate’s Center for the New Middle Class conducts research, engages in dialogue, and builds cooperation to generate understanding of the behaviors, attitudes, and experiences of America’s growing “New Middle Class.”

For more information, visit: www.elevate.com/NewMiddleClass

Contact

Email: NewMiddleClass@elevate.com

Twitter: @NewMidClass

Facebook.com/NewMiddleClass