Introduction

The broad discussion in many circles about the plight of the non-prime consumer often uses assumptions about how these consumers think, what matters to them, and even what would be good for them. However, there is limited data that really explains their circumstances.

Elevate’s Center for the New Middle Class set out to understand the differences in attitudes, experiences and behavior between consumers with prime credit and those with non-prime credit.

This study represents results from a survey of 1011 U.S. consumers (501 with non-prime and 510 with prime credit scores). Interviews were conducted January 12-17, 2017 to learn about actual behavior in the most recent holiday period.

Executive Summary

Holiday consumers most often overspend when they attempt to save money chasing sales and clipping coupons.

- Those who chase sales to control spending actually are 45 percent more likely to admit to spending more than they planned during the holidays

- Coupon clippers are 22 percent more likely to admit to over-spending

- Paying for expenses in cash is the most effective way to keep from over-spending: non-prime credit card users are 89 percent more likely than cash users to over-spend

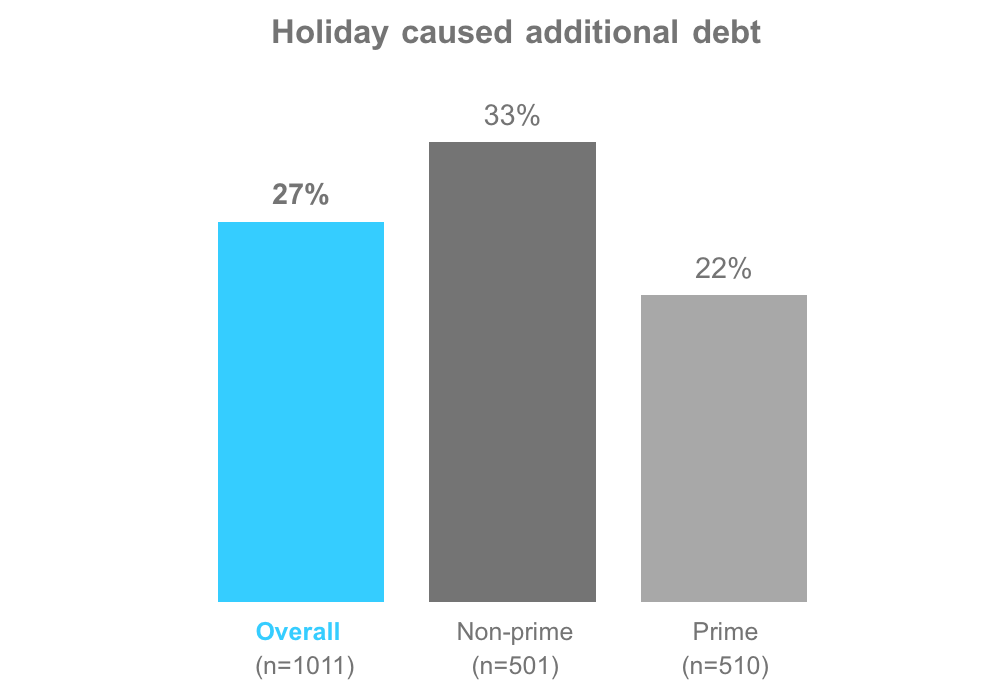

- A third of non-prime—and one in five prime—acquire new debt over the holidays

Most Americans spend 15 percent more on holiday spending than they planned. They fail when they plan passively.

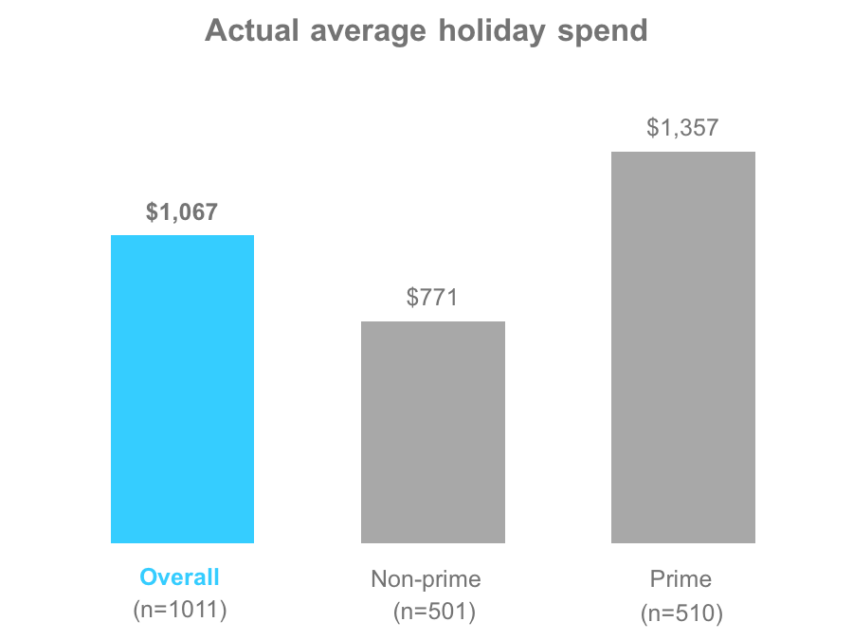

- Americans spent $1,067 on holiday related items

- 39 percent of U.S. consumers spend more than they planned during the holidays

- 27 percent of U.S. consumers incurred holiday-related debt for an average amount of $847

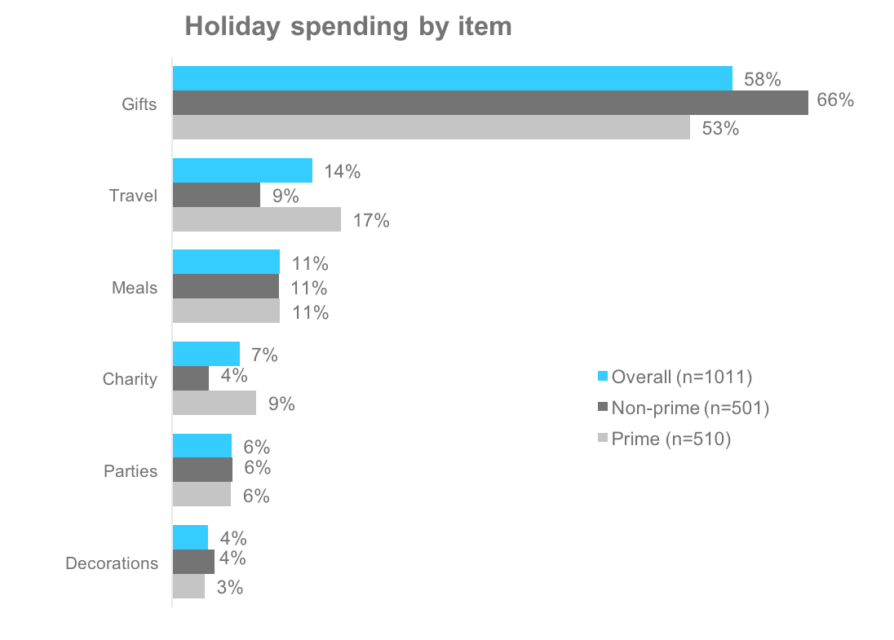

- 42 percent of holiday spending is on items other than gifts

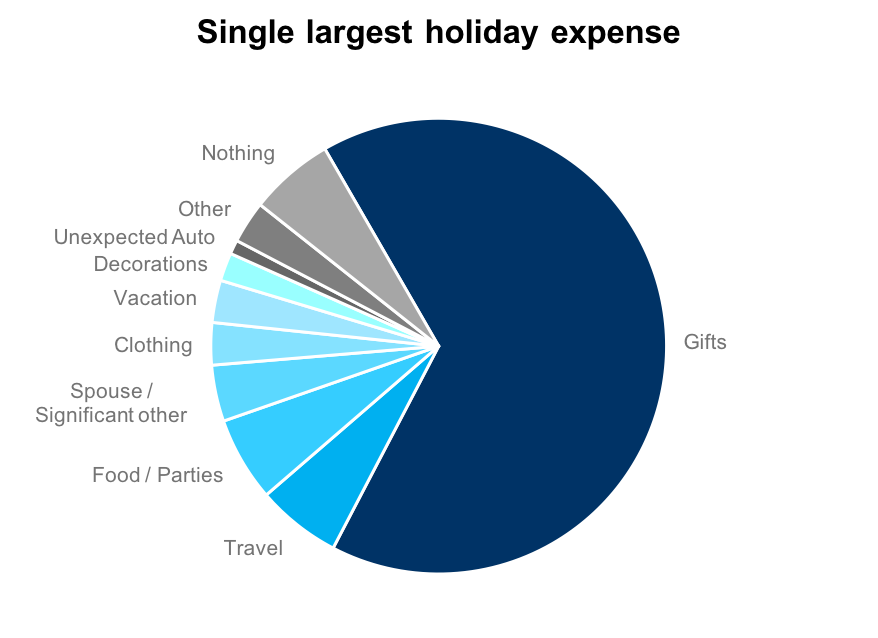

- 34 percent of respondents say that the largest holiday expense were not gifts

- The most effective way to keep from over-spending is to set strict spending limits. Those who fail to plan at all spend 125% more than the limiters.

- Non-prime consumers are 60 percent more likely than prime to say they spent less than planned (and are no more likely to say they spend more than planned)

Unexpected expenses can upend household finances

- 59 percent of non-prime and 54 percent of prime consumers experienced an unexpected expense

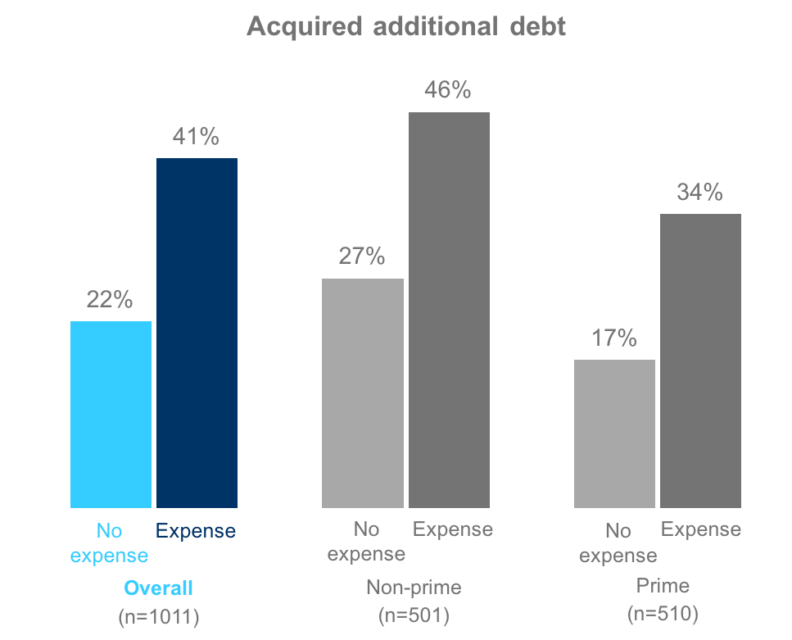

- Non-prime who experience unexpected expenses are 70 percent more likely to acquire additional debt over the holidays; prime are 100 percent more likely

U.S. consumers spend an average of $1,067 on holiday-related items

Prime consumers spend 76% more than non-prime.

Q.14: Now, we would like to understand how you spent your money this holiday season. In each case, your best guess is fine. How much do you think you spent on…?

42% of all holiday spending is on items other than gifts

Financially planning for the holidays requires more than just thinking about the costs of gifts.

Q.14: We would like to understand how you spent your money this holiday season. In each case your best guess is fine. How much do you think you spent on…?

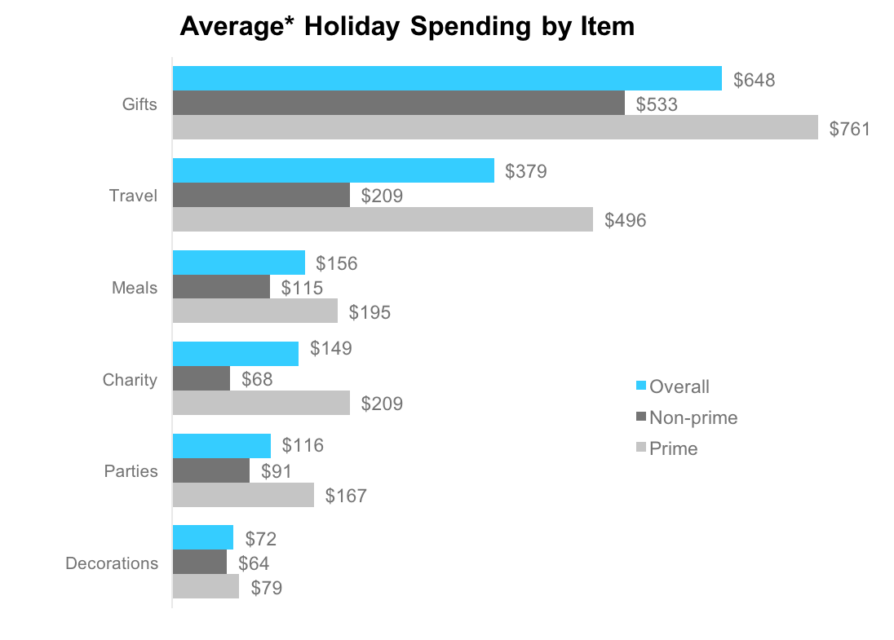

U.S. consumers spend the most money in gifts and travel

Unsurprisingly, prime consumers spend more than non-prime in every category. However, the disparity in travel and charity is higher than in other categories.

Q.14: We would like to understand how you spent your money this holiday season. In each case your best guess is fine. How much do you think you spent on…? *Average based only on those who spend in the category.

A third of consumers report that gifts were not the single largest holiday expense

34% of the respondents admitted that non-gift related items ended up being their largest holiday expense.

Q.12: What was your biggest holiday related expense this season?

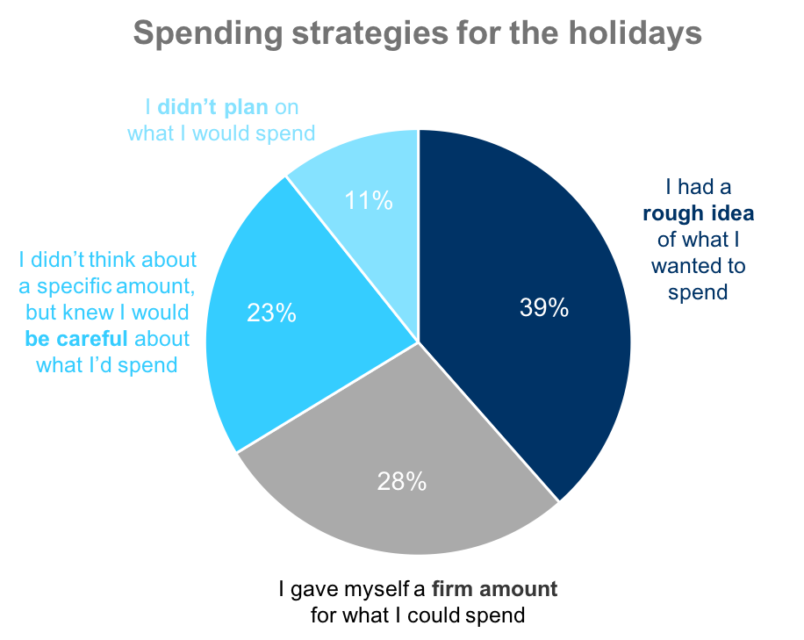

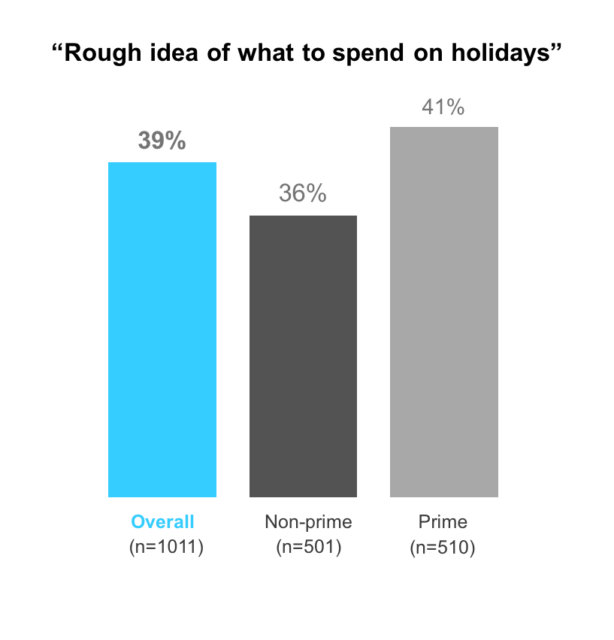

Most U.S. consumers employ the “rough idea” style of holiday spending

U.S. Consumers are split by the degree to which they plan their spending with a plurality just keeping a “rough idea” in mind.

Only 28% gave themselves a firm amount.

n. b Numbers don’t sum to 100% due to rounding

Q.8: Which statement below best describes your attitude towards spending prior to the holiday season starting?

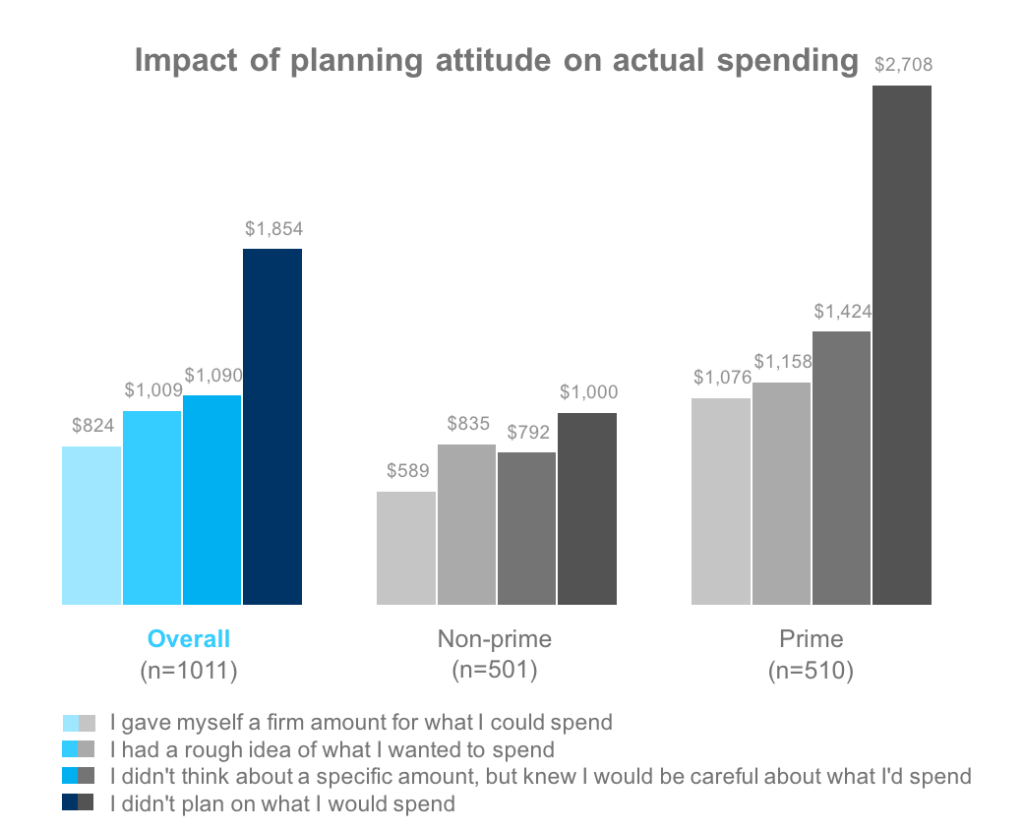

Planning is crucial in controlling holiday spending

Setting a strict spending limit significantly curtails spending. Having a rough idea of how much to spend or just being careful isn’t as effective. Having no plan equates to significant spending.

(The overall and prime “didn’t plan” numbers are skewed by extremely high spending individuals.)

Q8: Which statement below best describes your attitude towards spending prior to the holiday season starting?

Q.14: We would like to understand how you spent your money this holiday season. In each case your best guess is fine. How much do you think you spent on…?

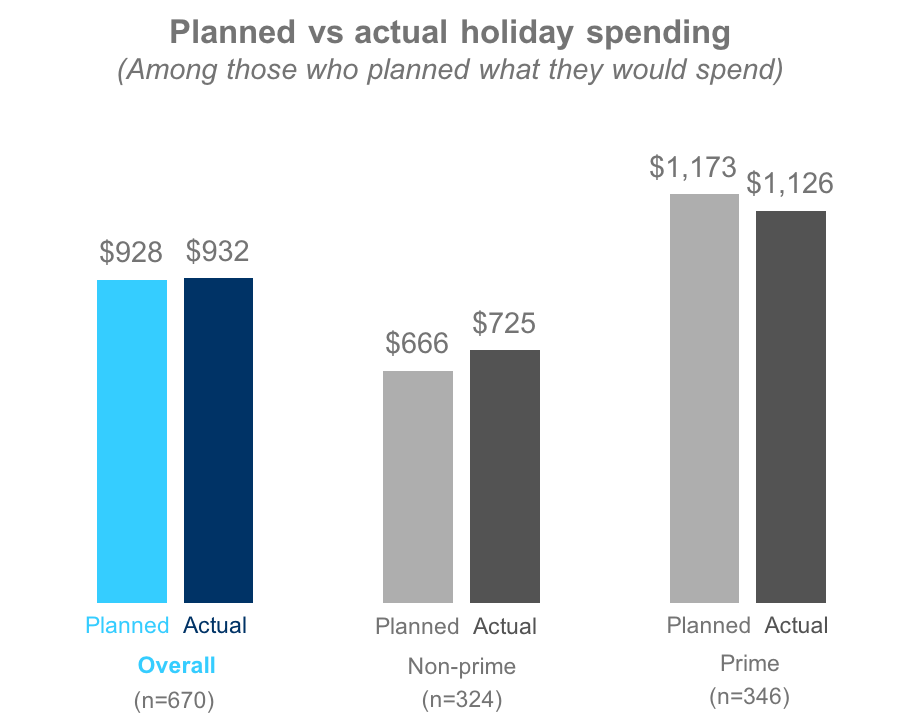

Americans who have a spending plan are less at risk of overspending

On average, Americans who carefully think about what they want to spend on the holidays, usually stick to that plan.

Non-prime spent slightly more than they planned, while prime consumers barely underspent according to their plan.

Q.8: Which statement below best describes your attitude towards spending prior to the holiday season starting?

Q.9: Please enter the total $ amount you planned on spending for the holidays?

Q.14: Now we would like to understand how you spent your money this holiday season. How much do you think you spent?

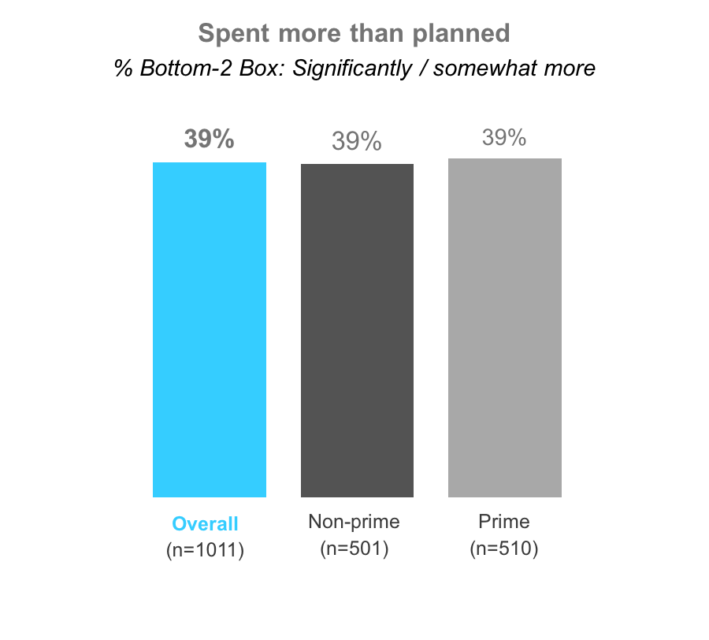

Two in five people came out of the holidays admitting that they spent more than intended

People with poor credit are no more likely to overspend than people with good credit.

Q.10: How would you describe you actual spending compared to what was planned for the holidays?

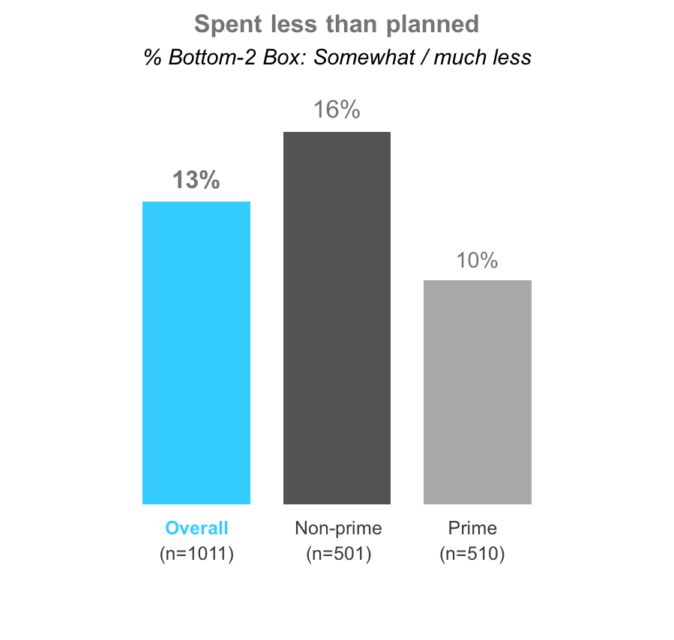

Spending less than planned is less common than over-spending

Overall, only 13% of U.S. consumers manage to spend less than they planned.

However, non-prime consumers are 67% more likely than prime to report that they spent somewhat or much less than they planned for the holiday.

Q.10: How would you describe you actual spending compared to what was planned for the holidays?

Prime consumers are more likely to employ the “rough idea” approach to holiday spending

Non-prime consumers are slightly less likely to approach holiday spending with just a rough idea of what they want to spend.

Q.8: Which statement below best describes your attitude towards spending prior to the holiday season starting?

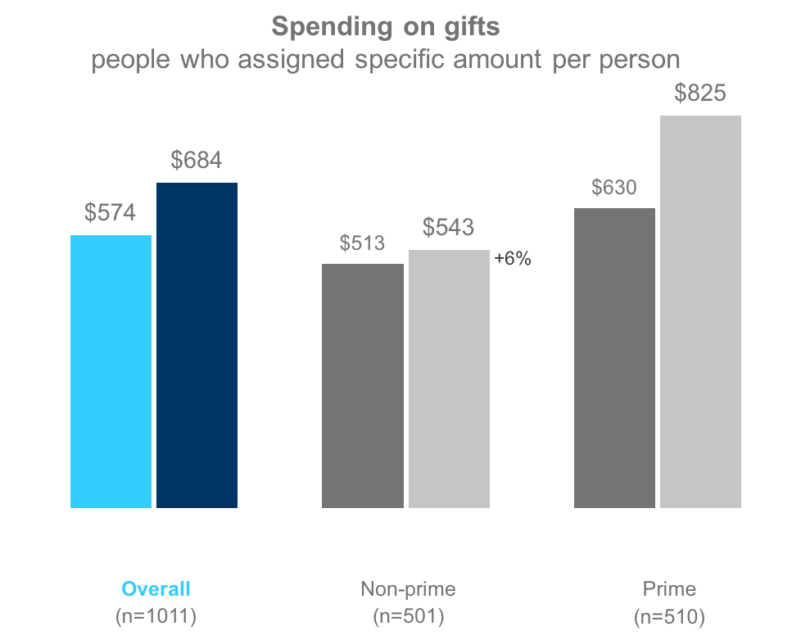

Prime consumers are much more likely to spend more on gifts when they don’t set per person spending limits

Those who don’t set a specific amount per person spend $110 (or 19%) more than those who don’t.

When prime consumers fail to set per person spending limits, they spend $194 (or 31%) more than those who do.

Non-prime consumers spend $30 (or 6%) more.

n.b. Averages are based only on people who spent on gifts.

Q.9: Please enter the total $ amount you planned on spending for the holidays? Q.11: What methods, if any, did you use to control your spending this holiday?

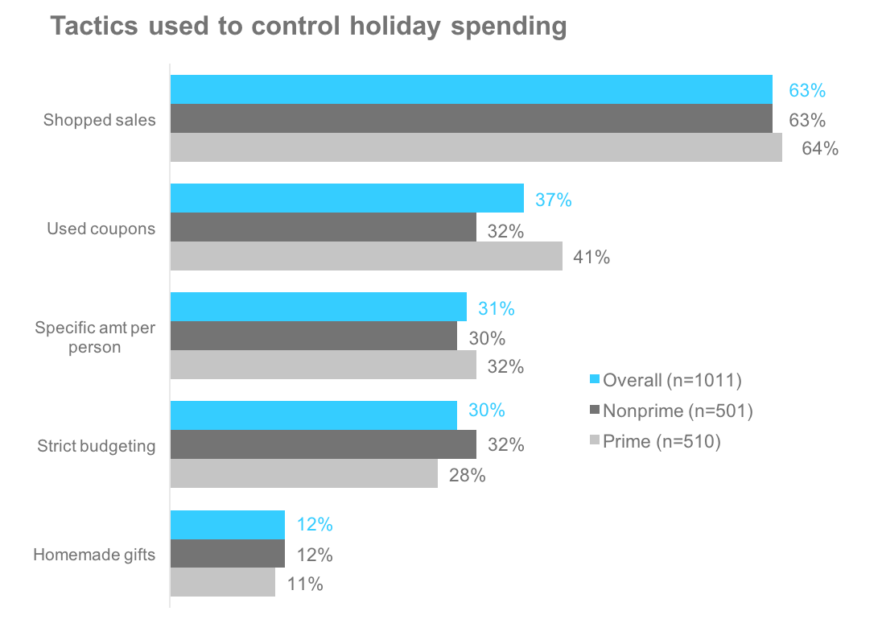

Shopped sales and self-discipline are the tactics most used to control holiday spending

Two-thirds of U.S. consumers shopped sales as a way to control spending during the holidays, but personal discipline tactics (setting spending goals and setting a specific amount per person) is also popular: 51% of respondents used a discipline tactic.

Q.11: What methods, if any, did you use to control your spending this holiday?

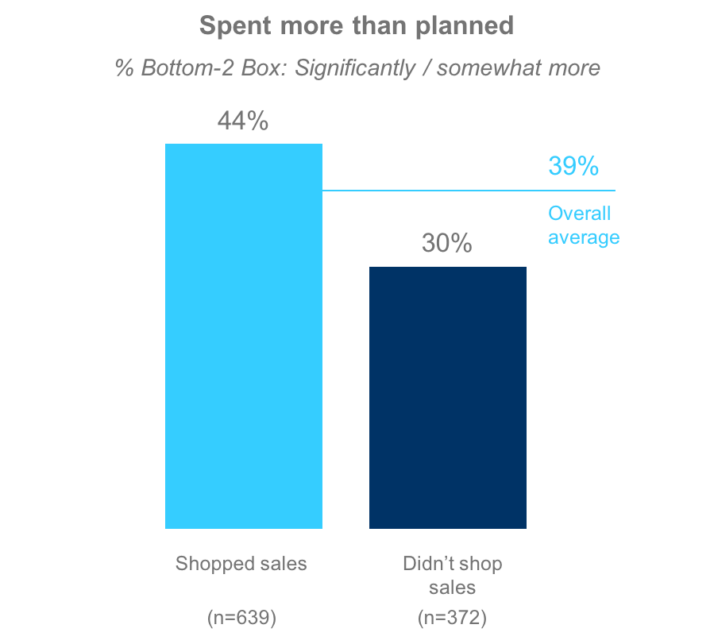

Shopping sales is significantly more likely to lead to overspending

Consumers who said that they shopped sales to control their holiday spending were 45% more likely to report that they overspent their budget during the holidays.

Q.11: What methods, if any, did you use to control your spending this holiday? Q.10: How would you describe you actual spending compared to what was planned for the holidays?

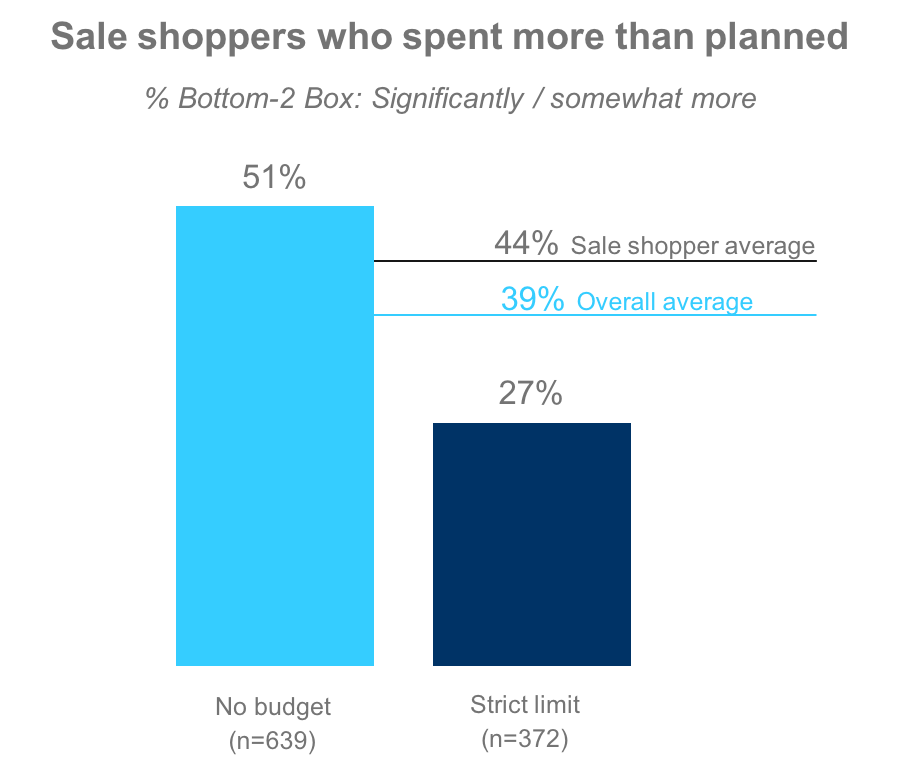

Shopping sales is especially dangerous when unanchored by a strict spending limit

Sale shoppers who did not set a strict spending limit were 87% more likely than budgeters to report that they spent more than they planned for the holiday.

Q.11: What methods, if any, did you use to control your spending this holiday? Q.10: How would you describe you actual spending compared to what was planned for the holidays?

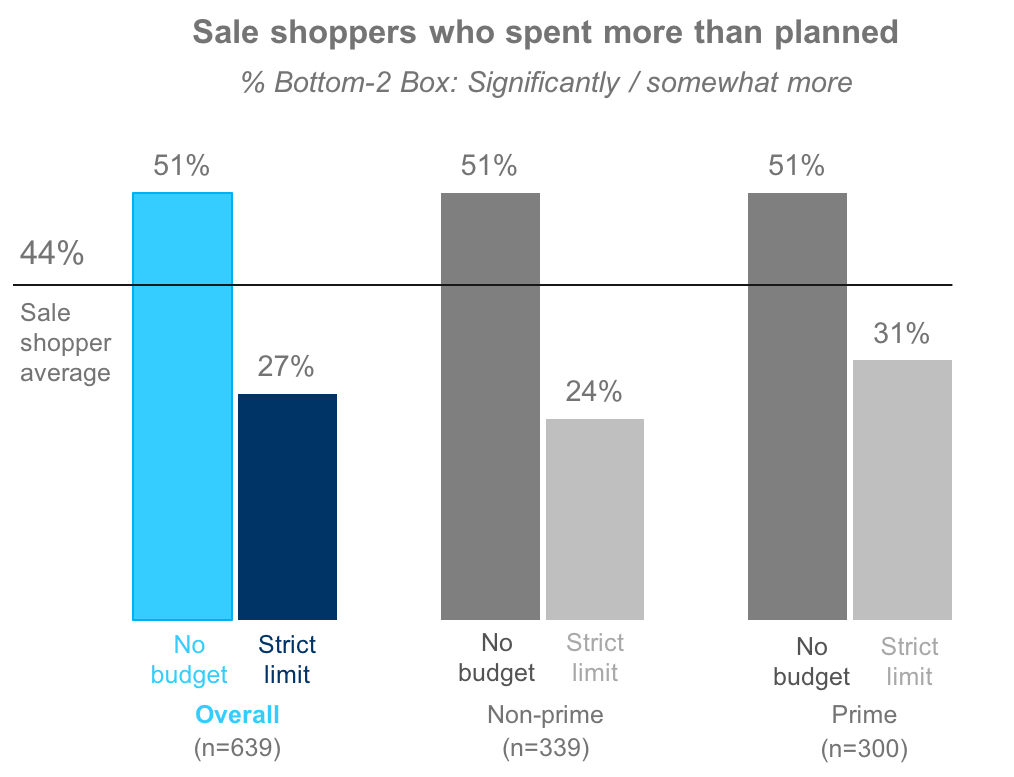

Non-prime gain more from strict spending limits than prime do when hitting the sales

Non-prime sale shoppers were significantly less likely to say they over-spent. They benefited from strict spending limits more than prime.

Q.11: What methods, if any, did you use to control your spending this holiday? Q.10: How would you describe you actual spending compared to what was planned for the holidays?

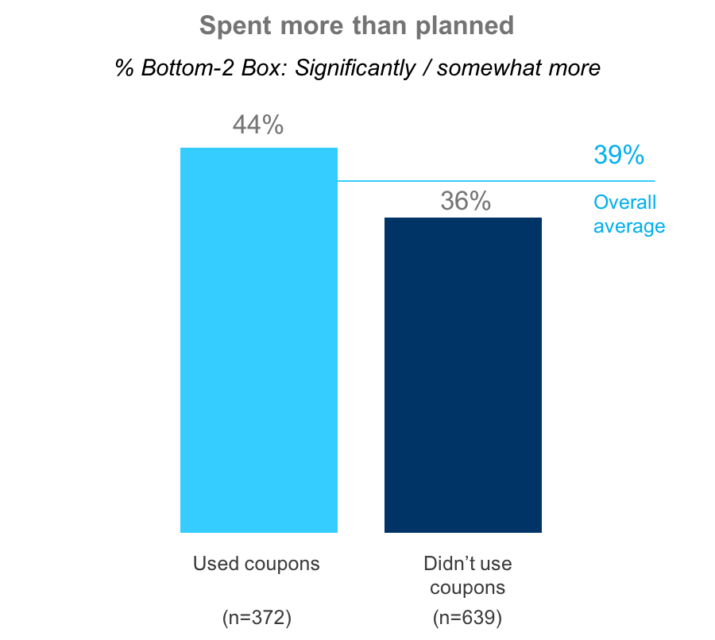

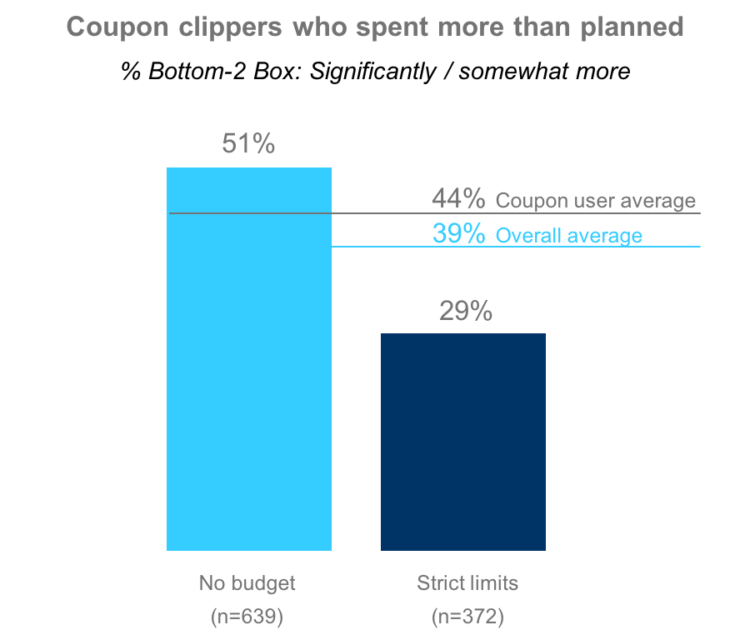

Coupon clippers are also more likely to report overspending during the holidays

Consumers who clipped coupons in an effort to control holiday spending were 22% more likely to report spending more than they planned.

Q.11: What methods, if any, did you use to control your spending this holiday? Q.10: How would you describe you actual spending compared to what was planned for the holidays?

Clipping coupons without setting strict spending limits is especially dangerous

Coupon clippers who did not set strict spending limits were 76% more likely than budgeters to report that they spent more than they planned for the holiday.

Q.11: What methods, if any, did you use to control your spending this holiday? Q.10: How would you describe you actual spending compared to what was planned for the holidays?

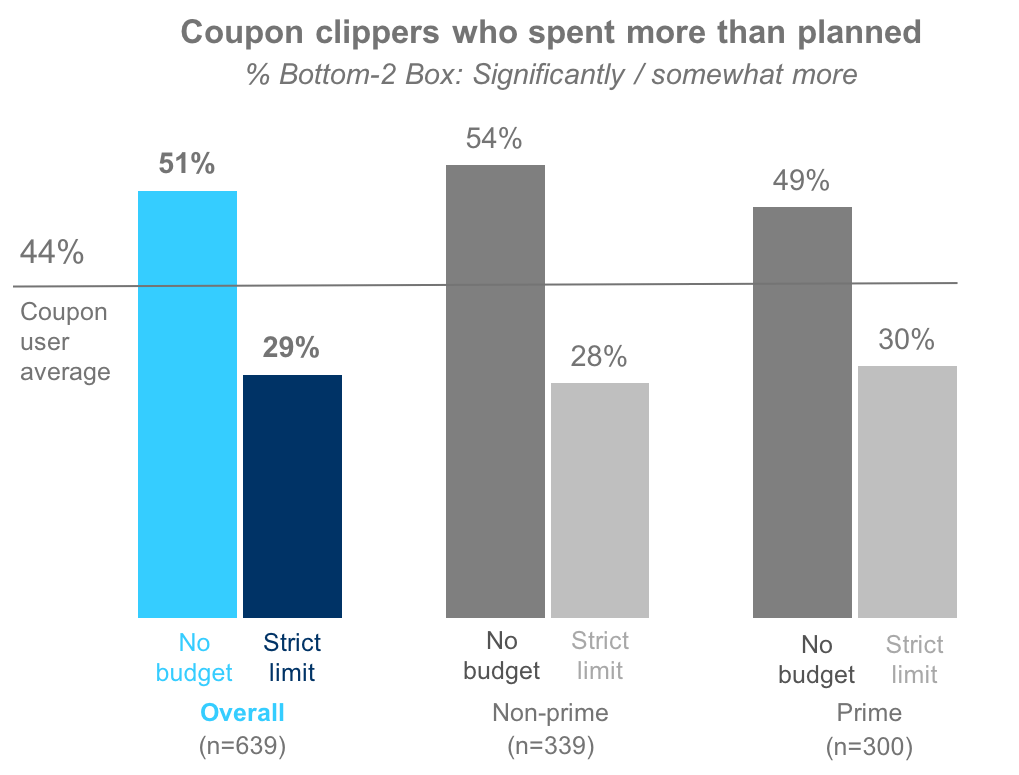

Non-prime gained more from strict spending limits than prime did when clipping coupons

Prime coupon clippers who did not set strict spending limits didn’t fare as poorly as their non-prime counterparts

Q.11: What methods, if any, did you use to control your spending this holiday? Q.10: How would you describe you actual spending compared to what was planned for the holidays?

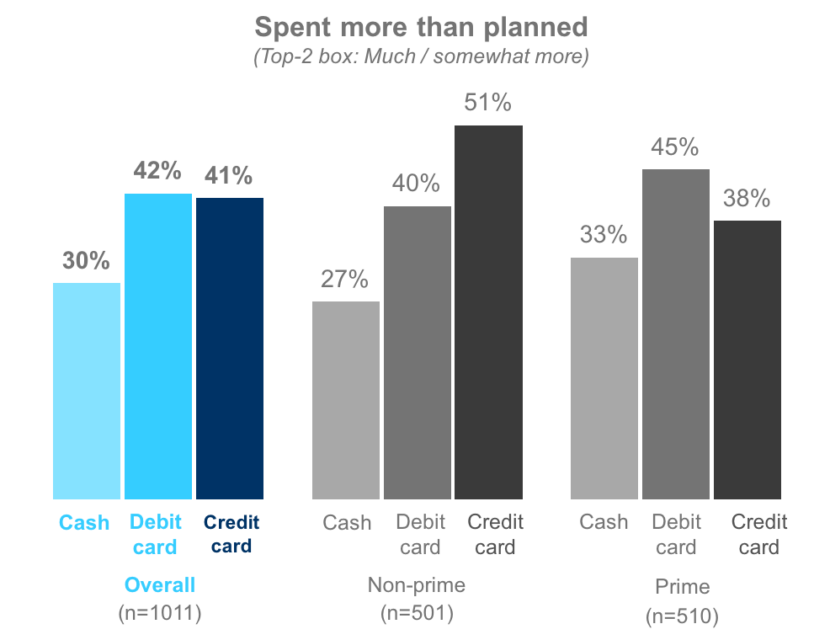

Paying with cash is the most effective way to keep from overspending

U.S. consumers are 38% more likely to overspend when they use plastic as their most frequent payment method.

Non-prime consumers who usually pay with credit cards are 89% more likely to overspend than those who use cash. Even debit card users are 48% more likely to overspend.

Q18: Which payment method did you use most frequently? Q.10: How would you describe you actual spending compared to what was planned for the holidays?

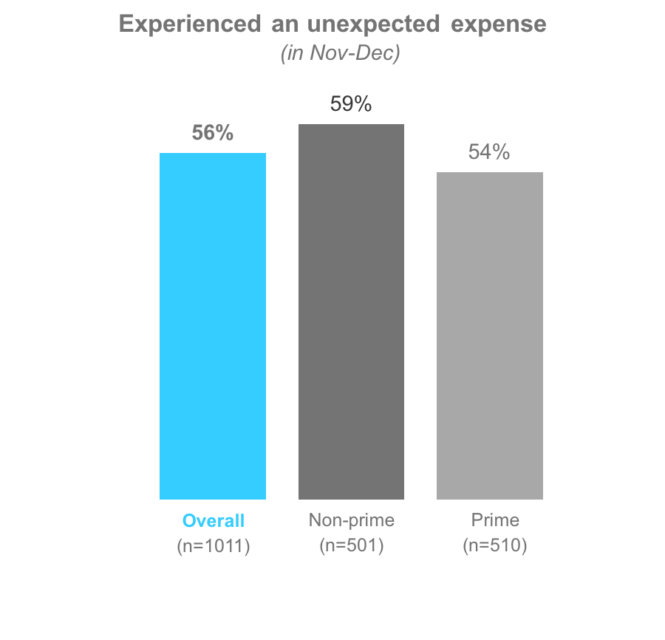

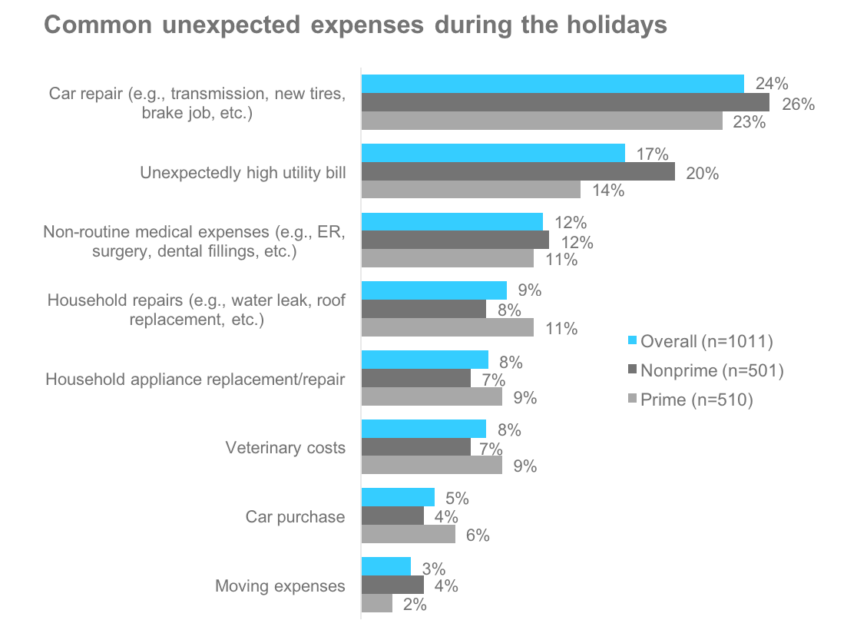

More than half of respondents reported an unexpected expense during the holiday period

Holiday spending isn’t the only thing U.S. consumers need to worry about. A majority of consumers are hit with an unexpected expense during the holiday time period. Non-prime consumers are most likely to be caught with a disrupting financial event.

Q.16: Which of the following expenses hit you in November or December? (select all that apply)

Unexpected expenses drive debt acquisition during the holidays

Overall, U.S. consumers were almost twice as likely to incur debt if they experienced an unexpected expense during the holidays.

Q.16: Which of the following expenses hit you in November or December? (select all that apply); Q21 Did this holiday cause you to carry additional debt?

Car repairs, utilities, and medical bills are the holiday’s top unexpected expenses

Car repairs are the most common expenses, but non-prime respondents also cited unexpectedly high utility bills. Non-routine medical bills came in third.

Q.16: Which of the following expenses hit you in November or December? (select all that apply)

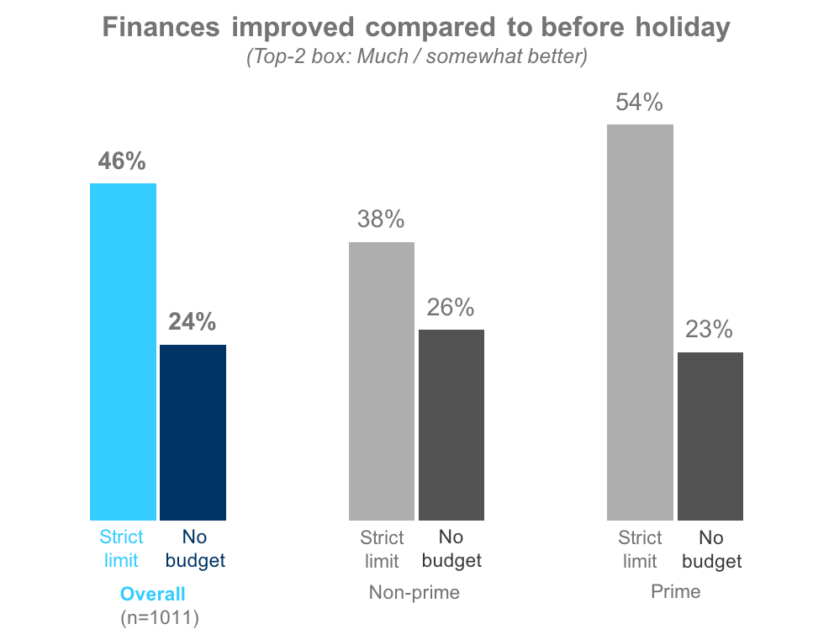

Strict holiday spending budgeting improves post-holiday financial prospects

Setting strict holiday spending limits doubles prime consumers’ chance of improved finances after the holiday. Non-prime also see a benefit, but not as pronounced.

“I gave myself a firm amount for what I could spend on the holidays” Q8: Which statement below best describes your attitude towards spending prior to the holiday season starting? Q7: How would you describe your current financial situation compared to what it was before the holiday season? Would you say it is…?

Over one in four U.S. consumers acquire additional debt over the holidays

Non-prime are 50% more likely than prime consumers to say that the holidays caused them to acquire new debt.

Q.7. How would you describe your current financial situation compared to what it was before the holiday season?

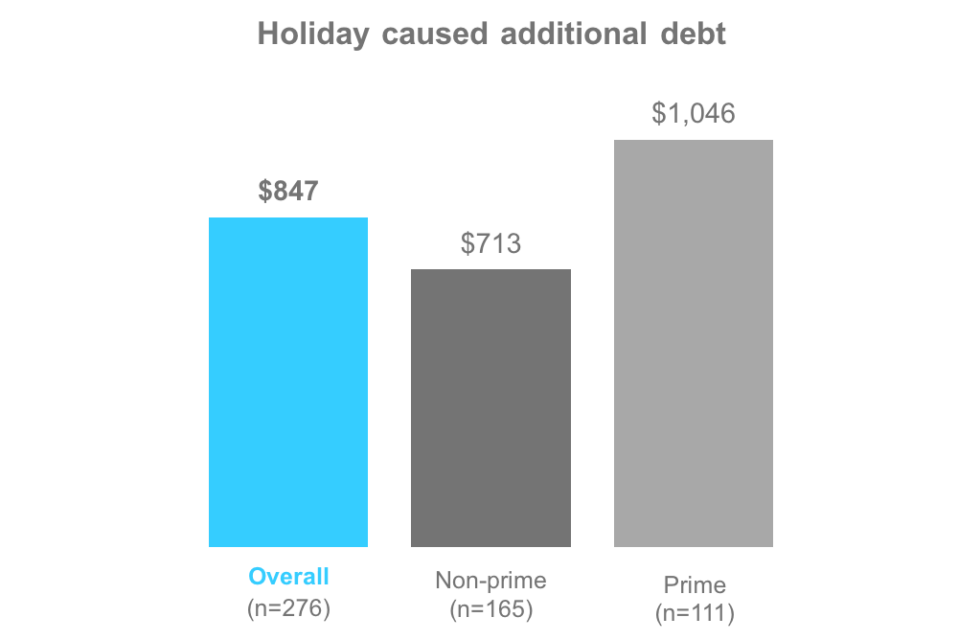

Holiday-related debt are significant amounts

When holiday-related circumstances caused people to carry additional debt, it amounted to $850.

Q22: How much additional debt did this holiday cause you to carry?

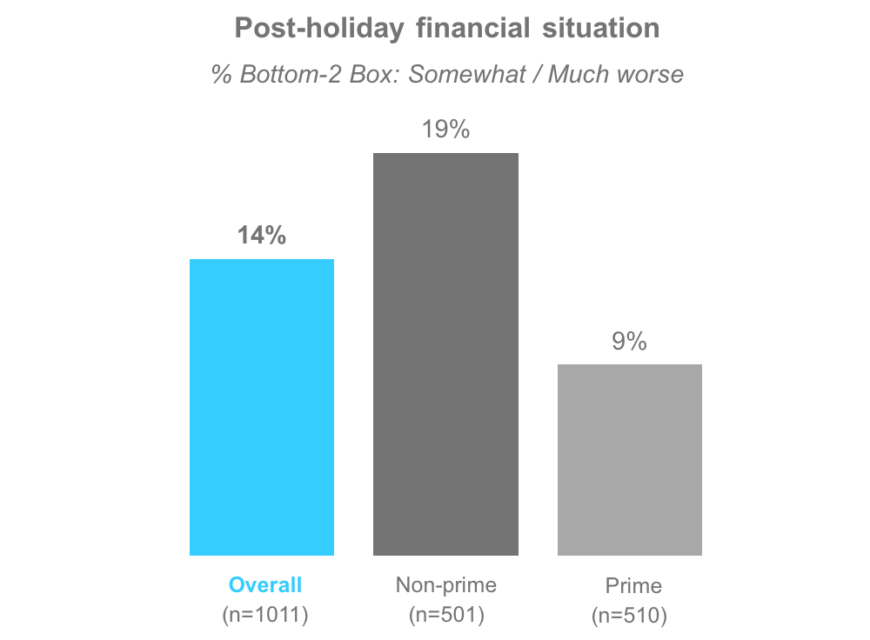

Nearly one in six U.S. consumers reported that their financial situation was worse after the holidays

Non-prime are twice as likely as prime to say their finances were worse after the holidays.

Q.7. How would you describe your current financial situation compared to what it was before the holiday season?

Methodology

The primary purpose of this study was to determine how non-prime consumers were similar or different from those with prime credit when it came to spending during the 2016 holiday period, a precursor to the 2017 holiday period.

Interview Dates: January 12 – 17, 2017

Sample Specs:

- Total Consumers = 1,011 (Non-prime = 501; Prime = 510)

- Sample Source: Research Now Consumer Panel

Qualification Criteria:

- Ages 18-64

- Household income: More than $25,000 per anum

- Geography – U.S. Rep

- Has primary or shared responsibility managing household finances

- Employment: No students or unemployed

- Has a checking or savings account

Survey Instrument: online questionnaire

About Elevate’s Center for the New Middle Class

Elevate’s Center for the New Middle Class conducts research, engages in dialogue, and builds cooperation to generate understanding of the behaviors, attitudes, and experiences of America’s growing “New Middle Class.”

For more information, visit: www.elevate.com/NewMiddleClass