Introduction

The broad discussion in many circles about the plight of the non-prime consumer often uses assumptions about how these consumers think, what matters to them, and even what would be good for them. However, there is limited data that really explains their circumstances.

Elevate’s Center for the New Middle Class set out to understand the differences in attitudes, experiences and behavior between consumers with prime credit and those with non-prime credit.

This study represents results from a survey conducted in January of 2018. The 2018 results include 508 Americans with non-prime credit scores and 518 Americans with prime credit scores, using interviews conducted January 12-16, 2018.

Non-prime Americans

“Non-prime Americans” represent the New Middle Class. These are Americans with a credit score below 700, meaning that their access to credit is limited or curtailed.It is the Center’s objective to better understand their experiences, attitudes, and behavior.

Executive Summary

• Budgeting is the most powerful method of control over one’s finances during the holidays

• Non-prime consumers are significantly more likely to have used this method to control their finances than prime consumers.

• Non-prime consumers who simply planned were 61% more likely to have overspent than those who employed a strict budget. There was also a 28% gap among prime consumers.

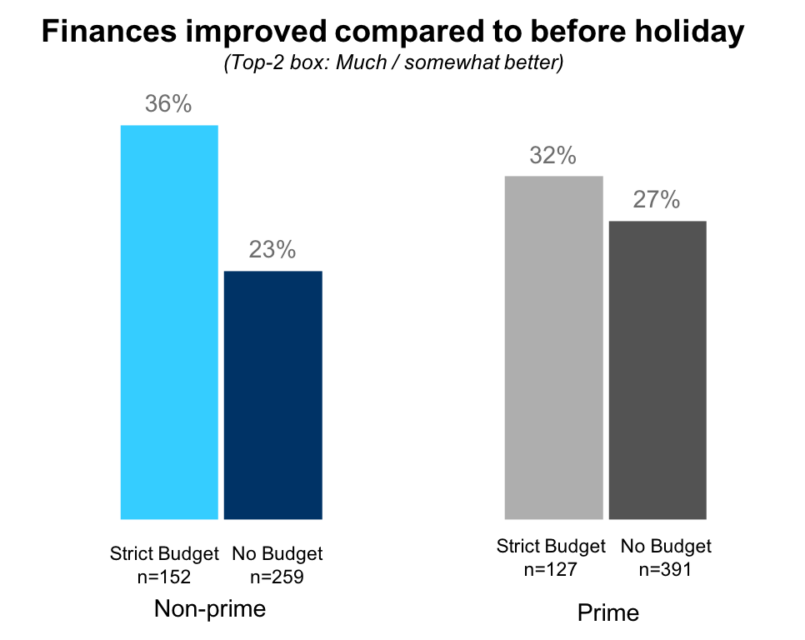

• Non-prime consumers who budgeted were more likely to say they saw an improvement in their finances after the holidays. Prime consumers were not significantly more likely to have seen improvement.

• Sales shopping and couponing can lead to overspending

• On average, consumers who shopped sales were 50% more likely to say they spent more than they thought they would, compared to those who did not shop sales.

– Non-prime sales shoppers were 62% more likely to have overspent than those who didn’t shop sales.

• Non-prime consumers who shopped with coupons were 49% more likely to have overspent during the holidays (prime consumers were 28% more likely to have done so).

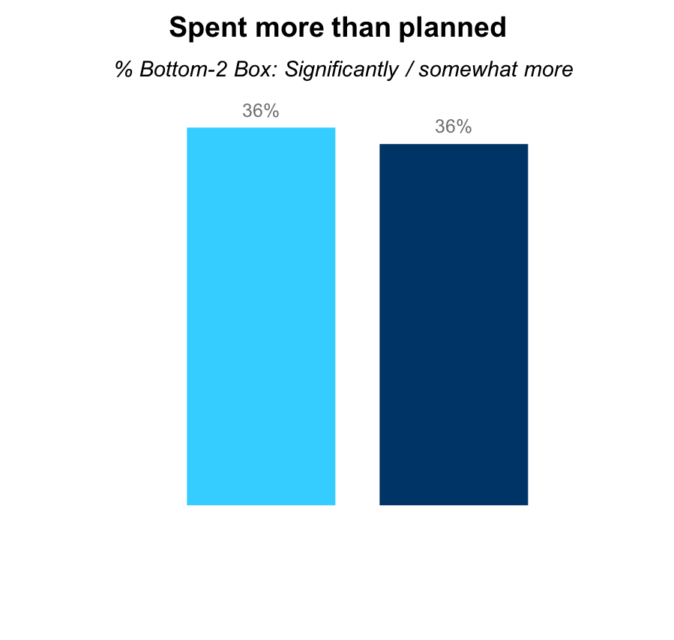

• Holidays don’t necessarily take a larger toll on non-prime consumers

•The non-prime was equally likely to have said they spent more than they thought as prime consumers.

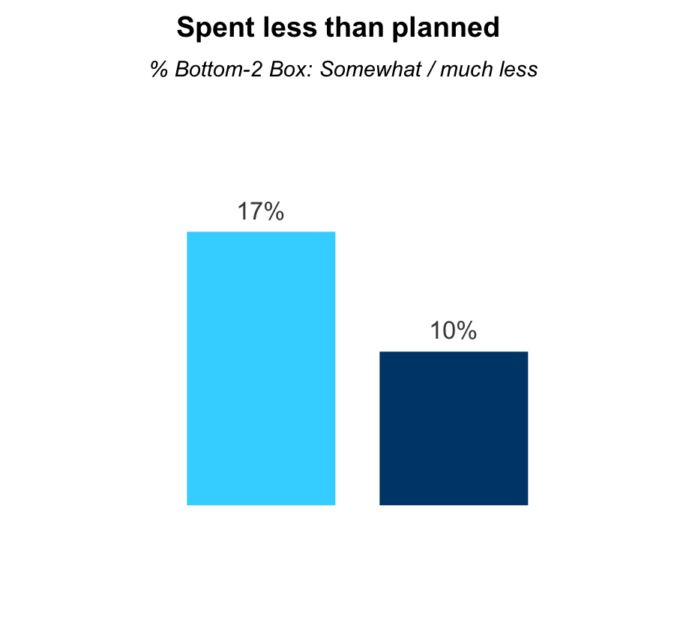

–In fact, they were significantly more likely than prime consumers to say they spent less than they thought they would (17% vs. 10%).

• Unexpected expenses hindered the non-prime less, with non-prime consumers being 85% more likely to take on new debt if they experienced an unexpected expense, and prime consumers 159% more likely to do so if they experienced a financial setback during the holidays.

• With that said, the non-prime are 62% more likely than prime consumers to take on new debt overall.

Spending

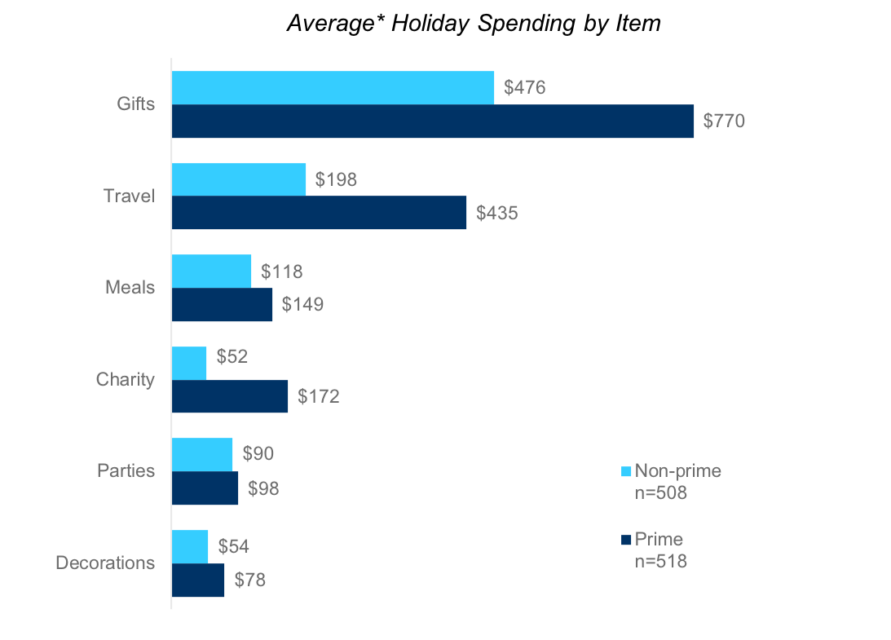

Non-prime consumers are most outspent by prime consumers on charity (231%), travel (120%), gifts (61%).

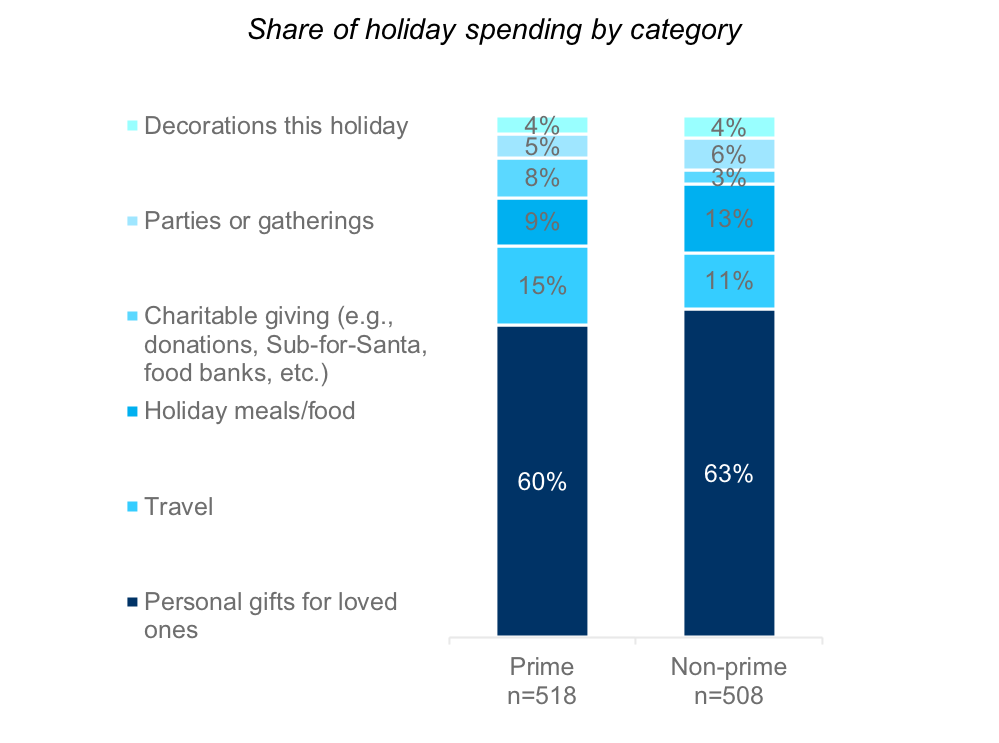

Share of spending by category

Personal gifts made up the largest share of expenditures by consumers.

Non-prime consumers spent about one-third as much of their total holiday spend share on charitable giving.

Overspending

Non-prime consumers no more likely than prime consumers to spend more than planned.

Spending less than planned

Non-prime consumers are 78% more likely to report that they spent somewhat or much less than they planned for the holiday.

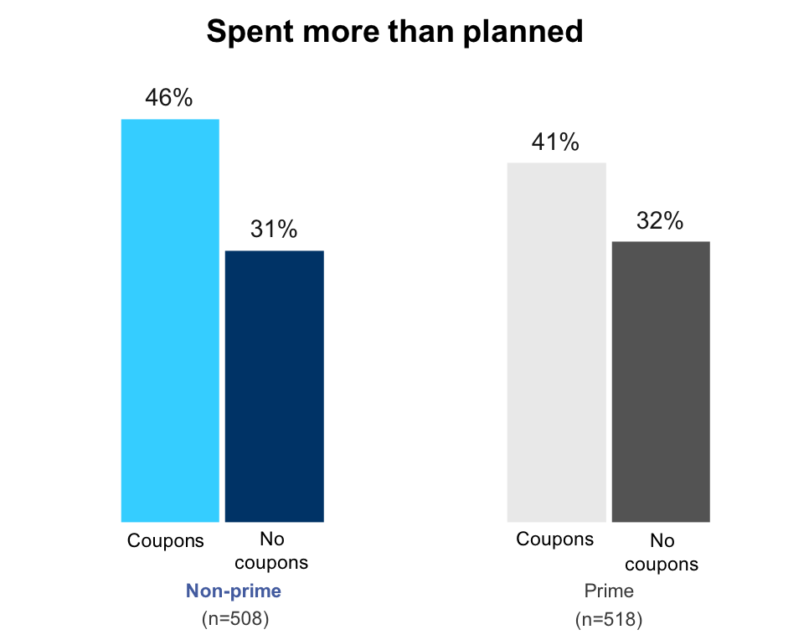

Using coupons and overspending

Coupons contribute to overspending. Non-prime consumers who shopped with coupons were 49% more likely to have overspent during the holidays (prime consumers were 28% more likely to have done so).

Planned vs. Budgeted

Strict budgeting, though perhaps employed out of necessity, was a spending control tactic that led to less overspending compared to simply having a plan.

Non-prime consumers who planned were 61% more likely to have overspent than those who employed budgeting.

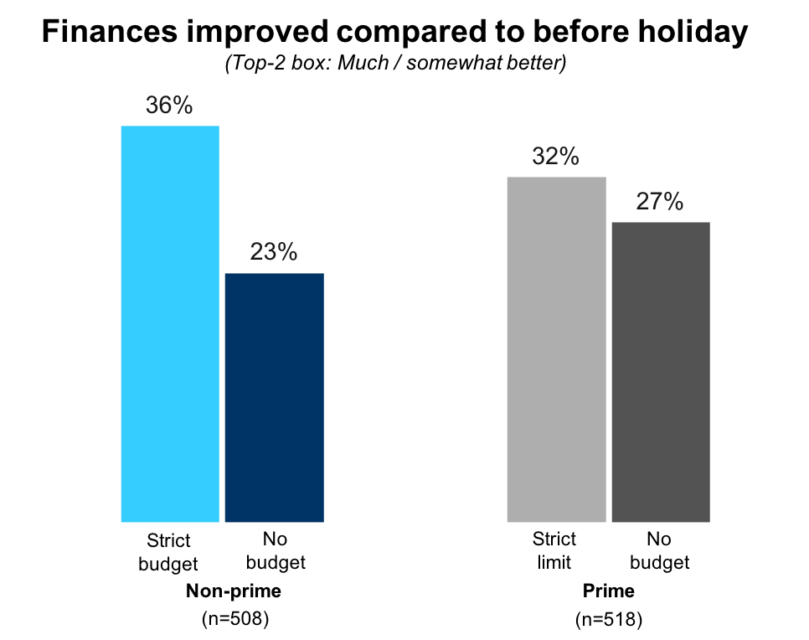

Strict budgeting and financial improvement

Non-prime consumers were more likely to see the benefits of strict budgeting over the holiday season. Those who strictly budgeted were 56% more likely to have said their finances were improved after the holidays. There were not significant differences among prime consumers either way.

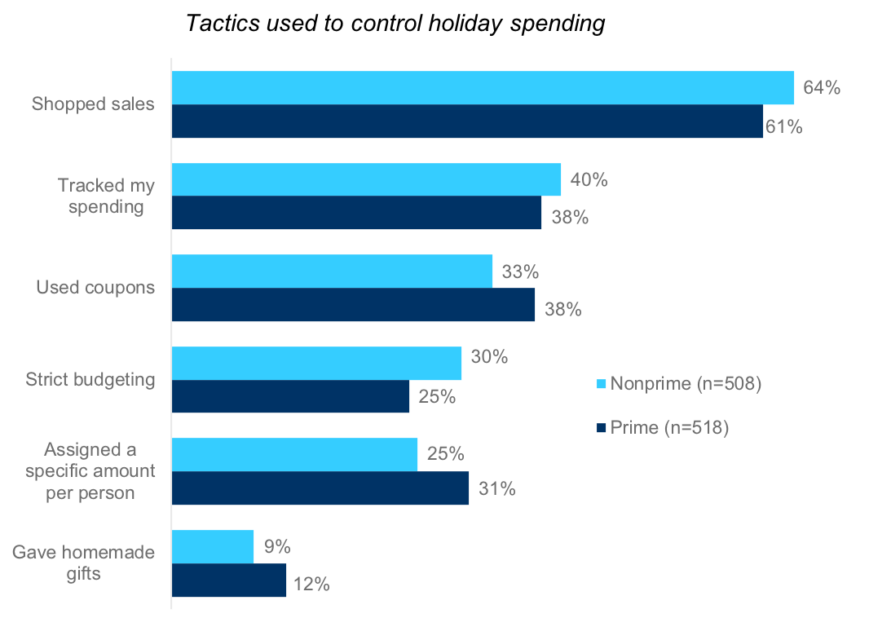

Methods of controlling holiday spending

Shopping sales was most commonly utilized to control spending, followed by tracking spending and using coupons.

Non-prime consumers were 22% more likely than prime consumers to utilize strict budgeting.

Sales shopping and overspending

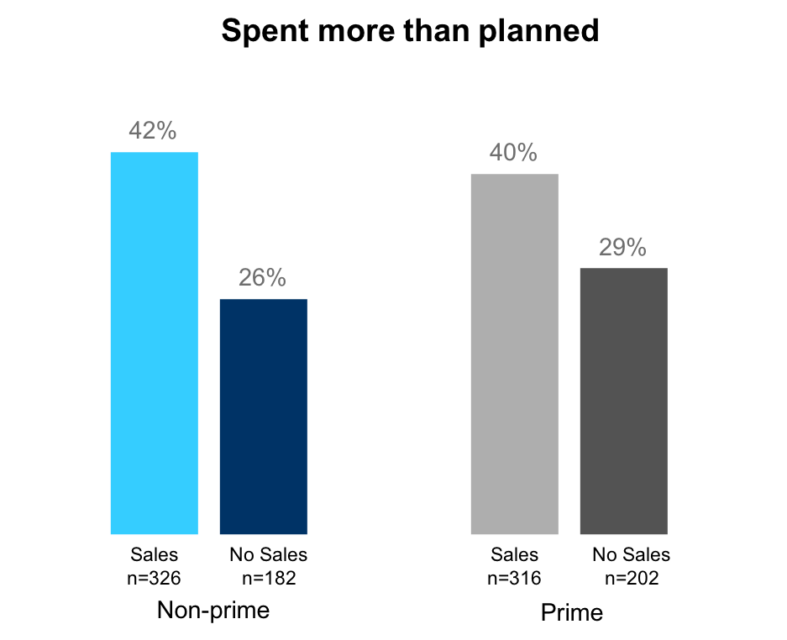

Consumers who said that they shopped sales to control their holiday spending were on average 50% more likely to say they overspent on the holidays than those who did not shop sales.

Non-prime sales shoppers were 62% more likely to have overspent than those who didn’t shop sales.

Unexpected Expenses and Debt

Unexpected Expenses

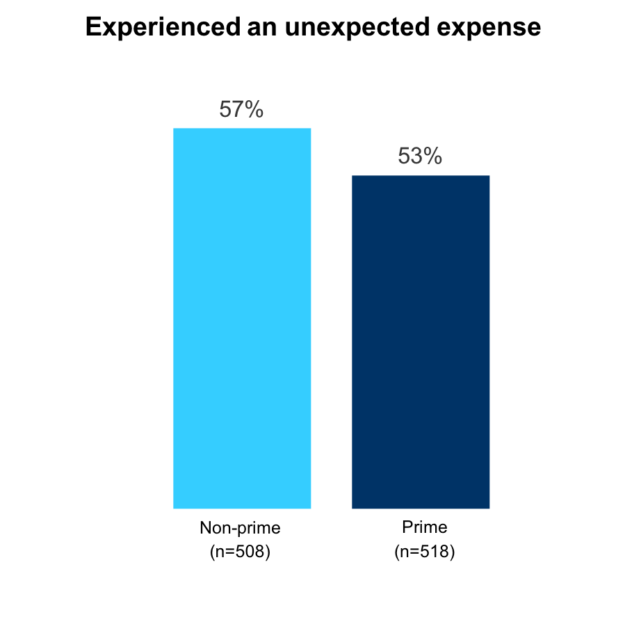

Almost 60% of non-prime consumers reported an unexpected expense during the holidays which put added pressure on their finances. Over half of prime consumers experienced an unexpected expense as well.

Unexpected expenses

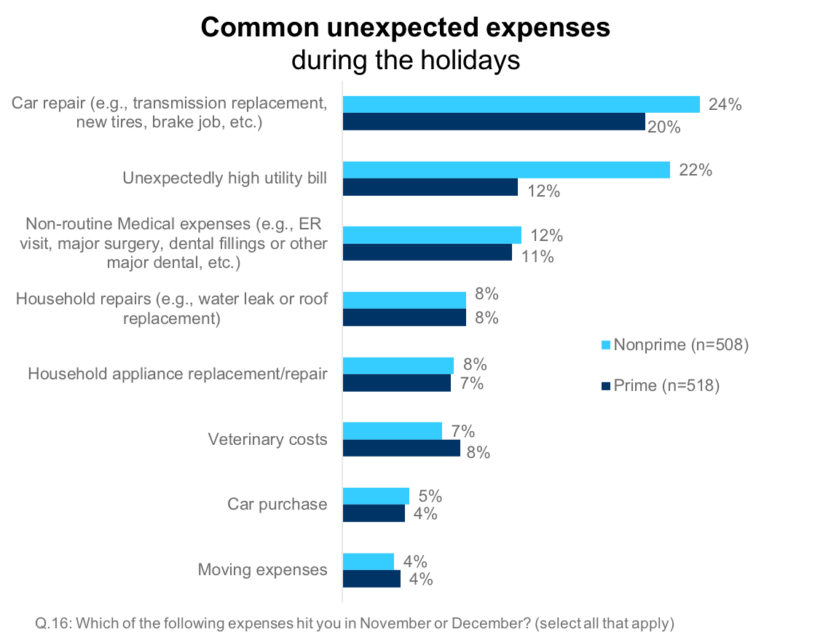

Car repairs are the most common expenses, but non-prime respondents also cited unexpectedly high utility bills. Non-routine medical bills came in third.

Unexpected expenses drive debt acquisition during the holidays

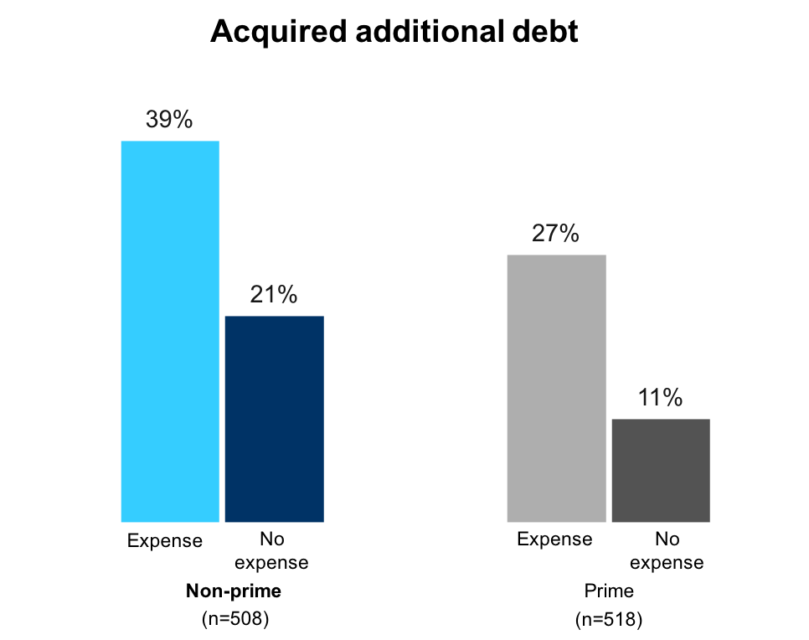

Non-prime consumers who experienced an unexpected expense were a little less than 2x more likely to take on new debt (and prime were 2.5x more likely). Non-prime consumers were more likely than non-prime consumers to acquire additional debt due to an expense.

Holiday debt

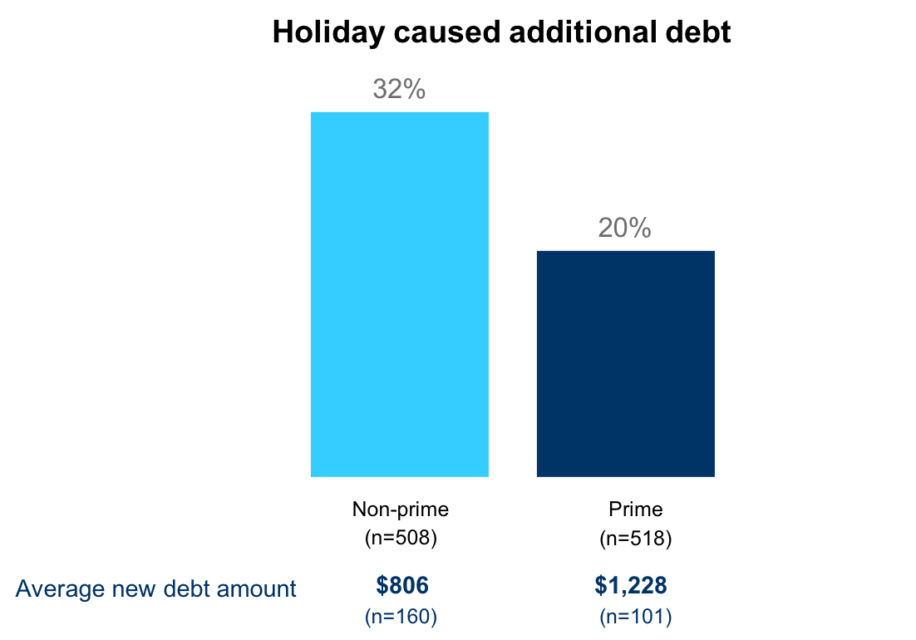

About a third of non-prime consumers incurred additional debt during the holiday season.

Non-prime are 62% more likely to say that the holidays caused them to acquire new debt than their prime counterparts.

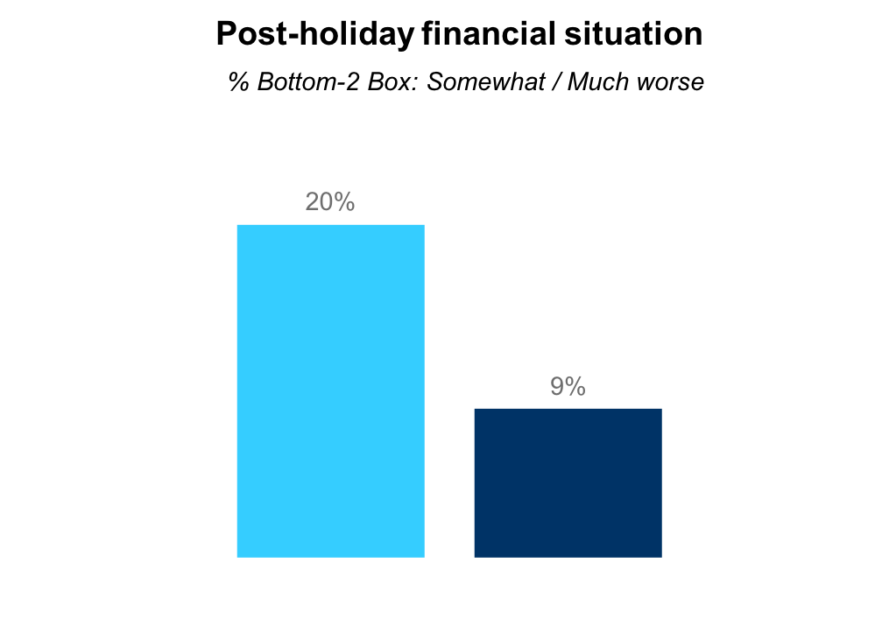

Worsened financial situation

Non-prime are more than twice as likely to say their finances were worse after the holidays.

Financial improvement and budgeting

Setting strict holiday spending limits increases non-prime consumers’ chance of improved finances by 58% after the holiday. Prime consumers saw a smaller but still increased chance of 15%.

Methodology

The primary purpose of this study was to determine how non-prime consumers were similar or different from those with prime credit when it came to spending during the holidays.

Interview Dates: January 12 – 16, 2018

Sample Specs:

• Total Consumers = 1,026 (Non-prime = 508; Prime = 518)

• Sample Source: Research Now Consumer Panel

Qualification Criteria:

• Ages 18-64

• Personal income: Any

• Geography – U.S. Rep

• Has primary or shared responsibility managing HH finances

• Employment: No students or unemployed

• Has a checking or savings account

Survey Instrument: online questionnaire

About

About Elevate’s Center for the New Middle Class

Elevate’s Center for the New Middle Class conducts research, engages in dialogue, and builds cooperation to generate understanding of the behaviors, attitudes, and experiences of America’s growing “New Middle Class.”

For more information, visit: www.elevate.com/NewMiddleClass

Contact

Email: NewMiddleClass@elevate.com

Twitter: @NewMidClass

Facebook.com/NewMiddleClass