Introduction

The broad discussion in many circles about the plight of the non-prime consumer often uses assumptions about how these consumers think, what matters to them, and even what would be good for them. However, there is limited data that really explains their circumstances.

For this study, Elevate’s Center for the New Middle Class set out to understand the impact of medical expenses on consumers with non-prime credit scores and those with prime credit scores.

This study represents results from a survey of 1,544 adults 18-64 in the United States. Of the 1,544, 773 self-identified as having non-prime credit scores and 771 self-identified as having prime credit scores.

Interviews were conducted April 22, 2019 though May 13, 2019.

Non-prime Americans

“Non-prime Americans” represent the New Middle Class. These are Americans with a credit score below 700, meaning that their access to credit is limited or curtailed. Non-prime is also often further divided into “near prime,” “sub-prime,” and “deep sub-prime.” “Invisibles” are people who are unlikely to have a credit score at all because they have so little credit history.

It is the Center’s objective to better understand non-prime experiences, attitudes, and behavior.

Financial hardship due to medical expenses

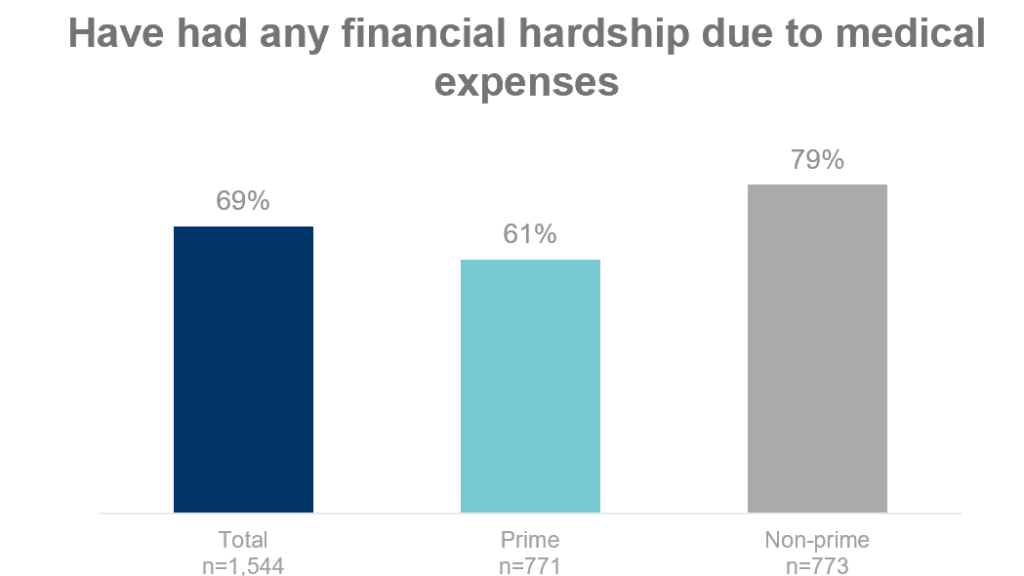

8 in 10 non-prime consumers, and 6 in 10 prime consumers have some level of financial hardship in the face of medical bills in the past 5 years.

Catastrophic hardship due to medical expenses

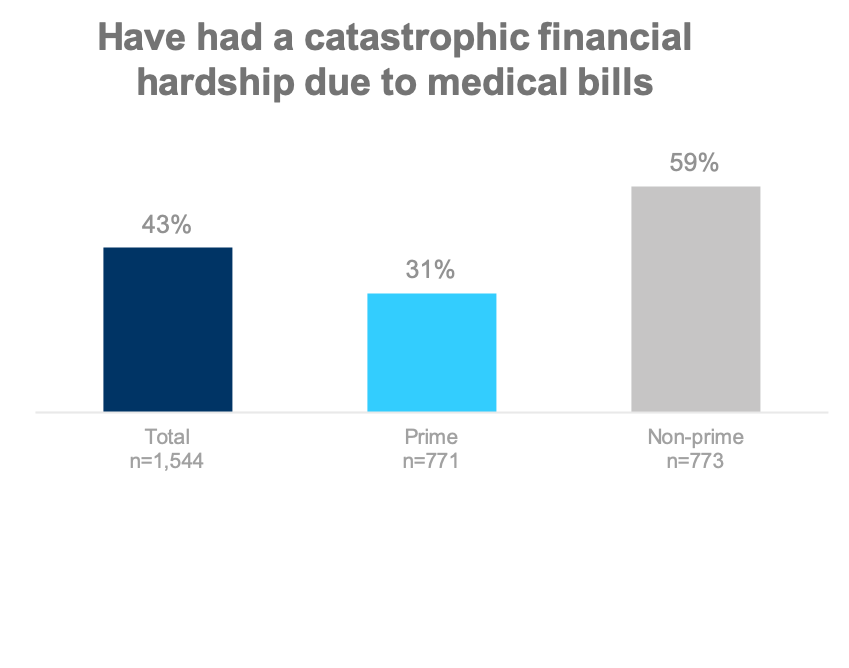

Non-prime consumers were nearly twice as likely to have had a catastrophic disruption to their finances, meaning they could not pay their bills or have the things they needed.

Health Insurance

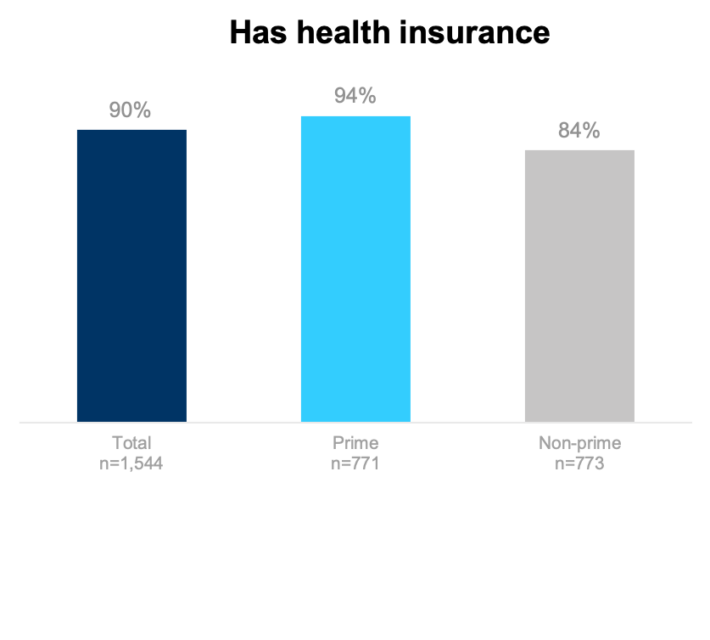

90% of consumers have health insurance.

Non-prime consumers are less likely to currently have health insurance.

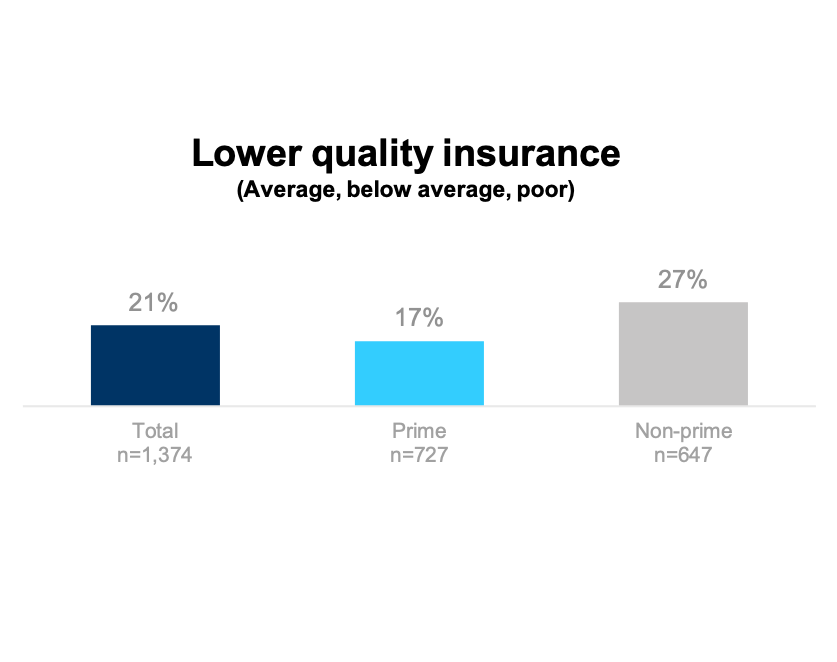

Perceived Quality of Insurance

Non-prime consumers are 59% more likely to say their insurance is just average, below average, or poor quality than prime consumers.

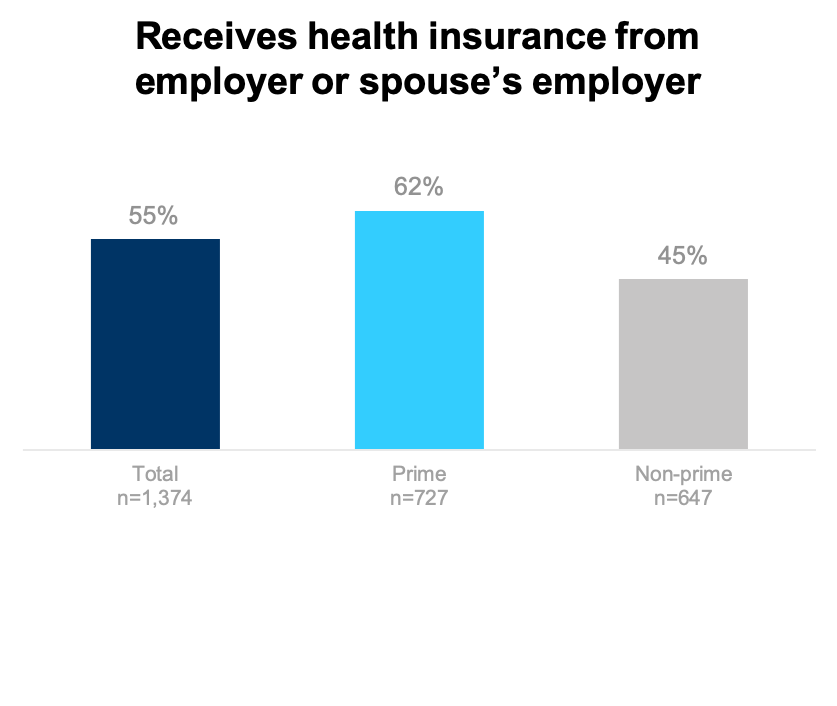

Employer-provided Insurance

Non-prime consumers are about a quarter less likely to have health insurance through an employer.

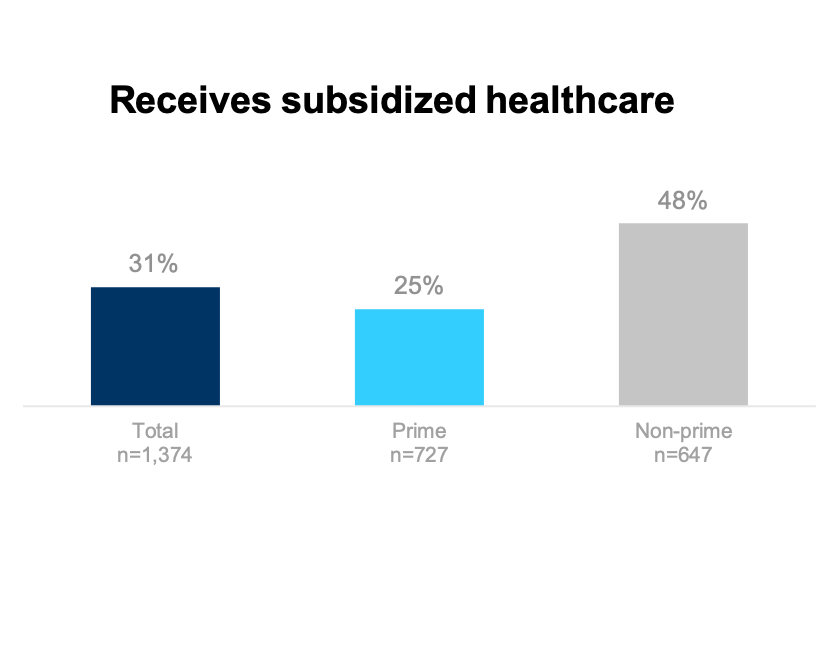

Subsidized healthcare

Non-prime consumers are nearly twice as likely to receive a form of government subsidized healthcare (Medicare or Medicaid).

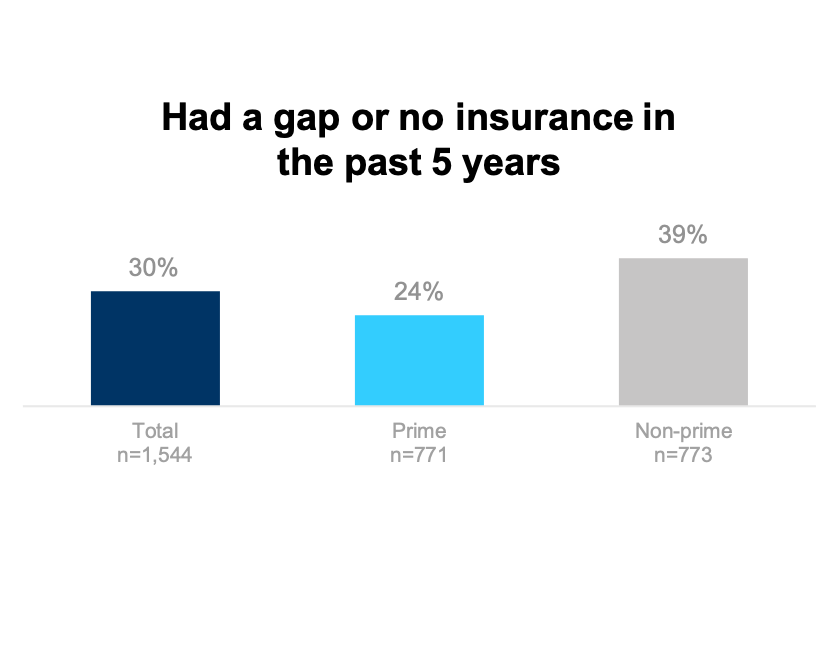

Had a gap or no insurance in past 5 years

Non-prime consumers 63% more likely than prime consumers to have had a period without health insurance over the past 5 years.

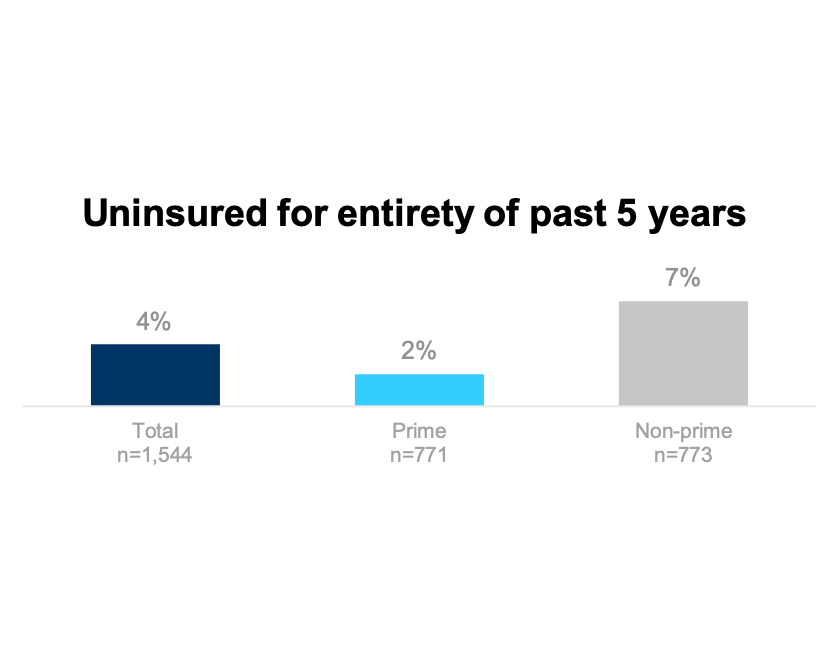

No insurance over the last 5 years

4% of consumers have gone without insurance for the entirety of the past 5 years.

Non-prime consumers are more than 3 times as likely to have been uninsured for the entirety of the past 5 years.

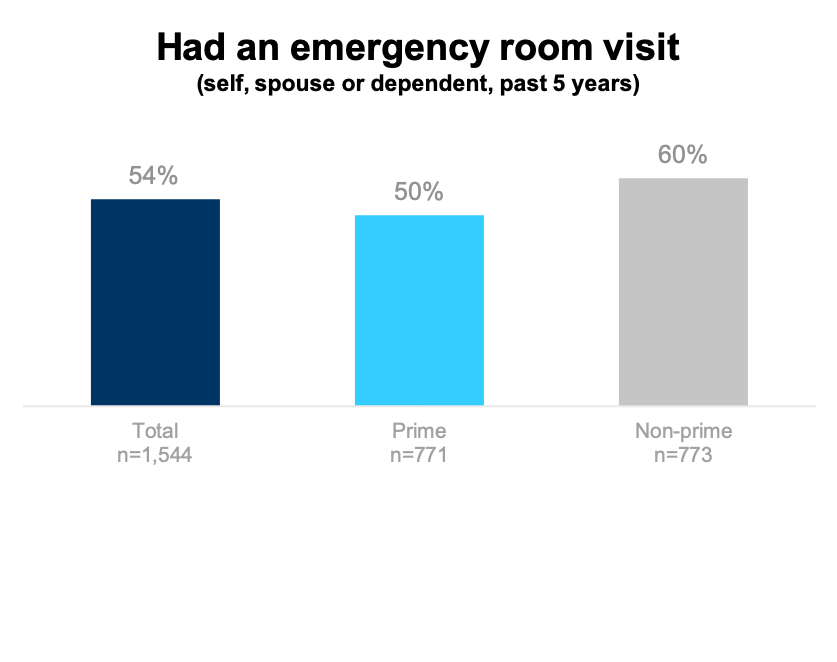

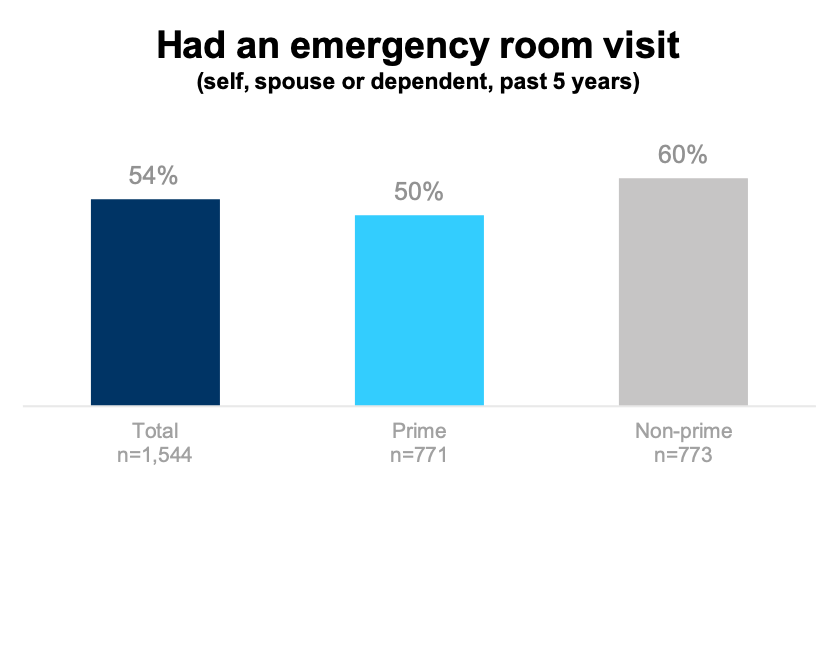

Emergency room visit

Over half of consumers have had an ER visit for someone in their household over the past 5 years.

Non-prime consumers are 20% more likely to have had an ER visit as a medical expense over the past 5 years.

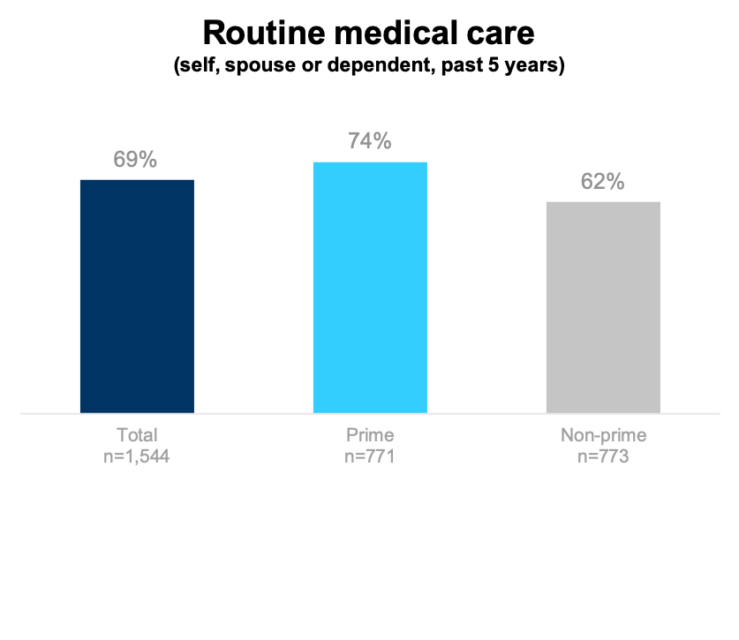

Routine medical care

Non-prime consumers are 17% less likely to have had routine medical care as an expense over the past five years.

This indicates that about one-quarter of prime Americans, and about one-third of non-prime Americans are forgoing routine medical care such as well visits on a regular basis.

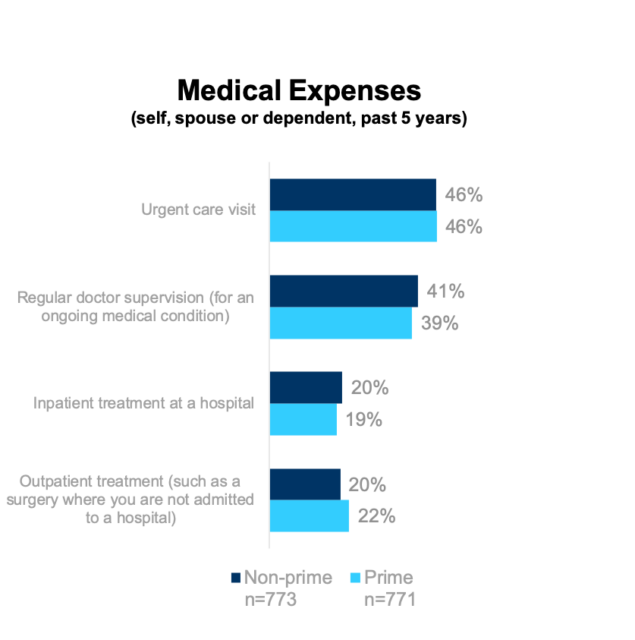

Medical expenses, past 5 years

Outside of ER visits and routine medical care, non-prime and prime consumers experience most medical expenses at similar rates.

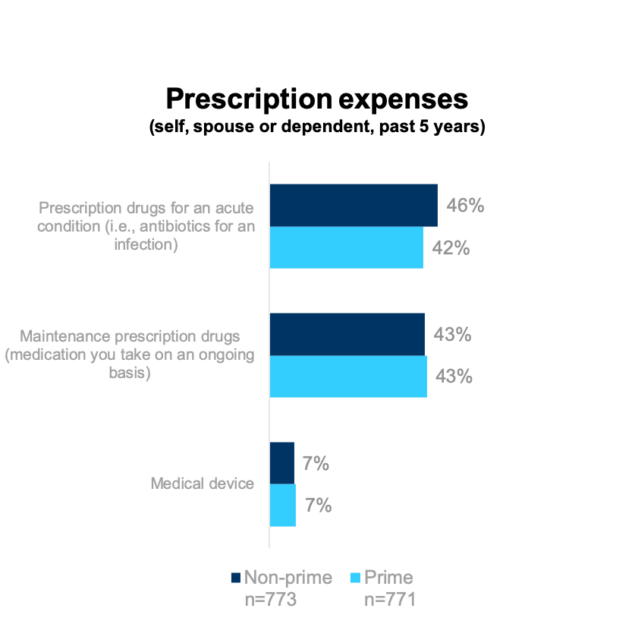

Prescription expenses, past 5 years

Non-prime and prime consumers had similar incidence of prescription drug and medical devices costs.

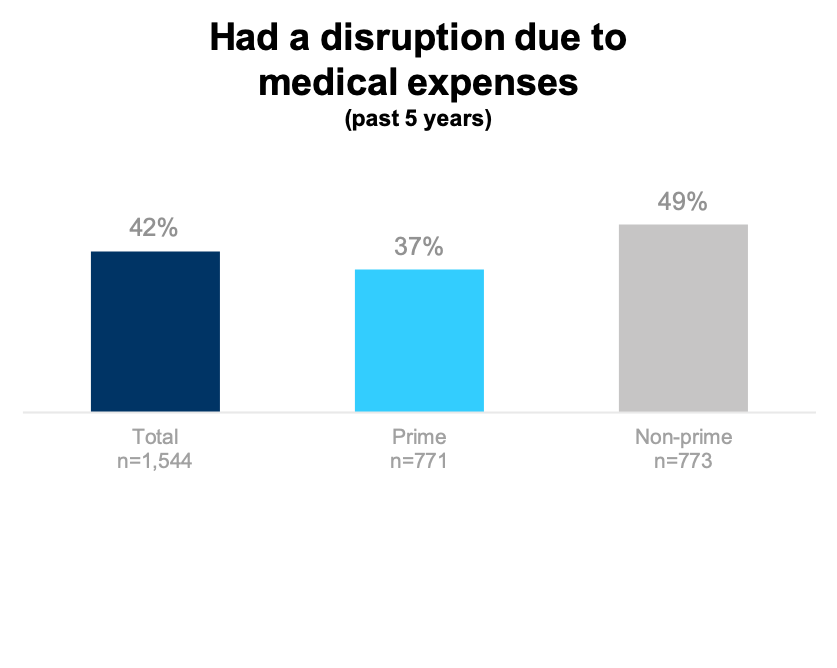

Disruption due to medical expenses

4 in 10 consumers have had a financial disruption due to medical expenses over the past 5 years.

Non-prime consumers are 32% more likely to have faced a financial disruption due to medical expenses over the past 5 years.

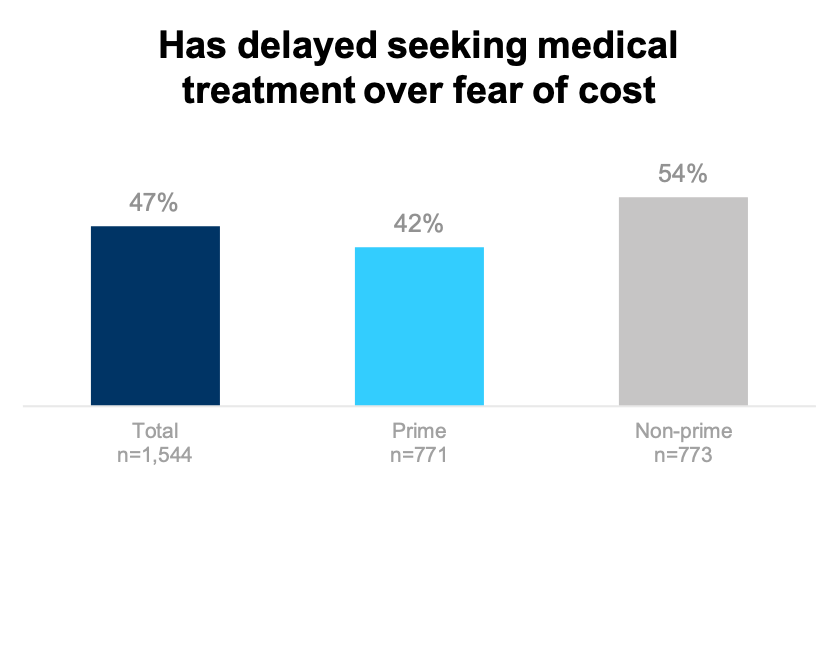

Delaying treatment over fear of cost

Non-prime consumers are 29% more likely to have delayed medial treatment over fears of cost.

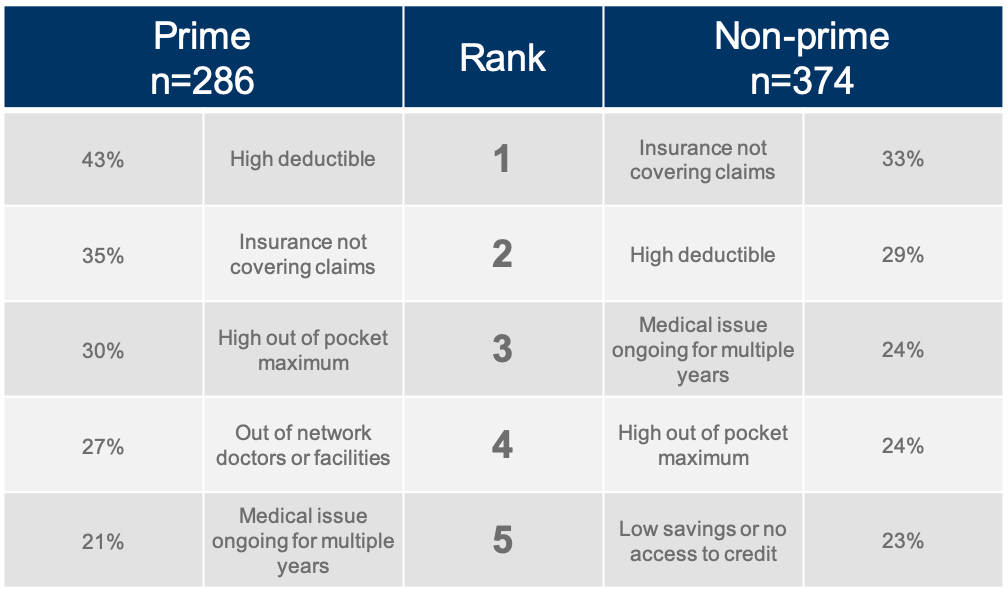

Top 5 reasons for disruption from medical expenses

Non-prime and prime consumers cited insurance issues such as insurance not covering claims, high deductibles, and high out of pocket maximums as top reasons for their financial disruption due to medical expense.

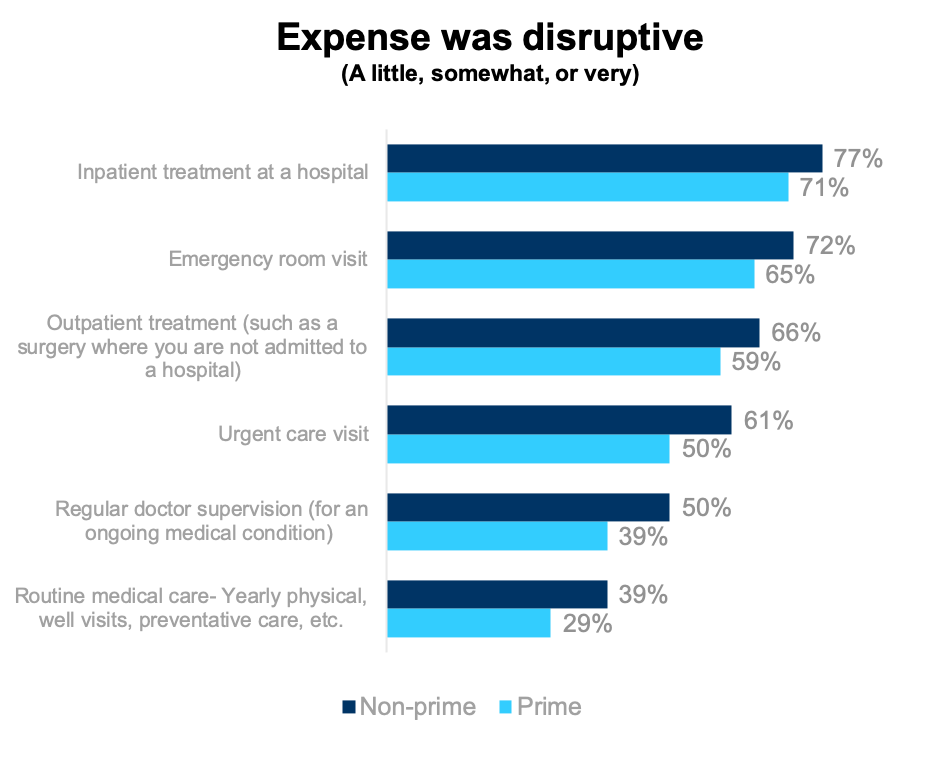

Disruption of medical expenses, past 5 years

While for the most part non-prime and prime consumers experience most expenses at a similar rate, non-prime consumers are more likely to feel financially disrupted by medical expenses.

Prime and non-prime consumers feel similarly disrupted by hospital treatments (inpatient and outpatient), with around 2 in 3 households feeling disrupted.

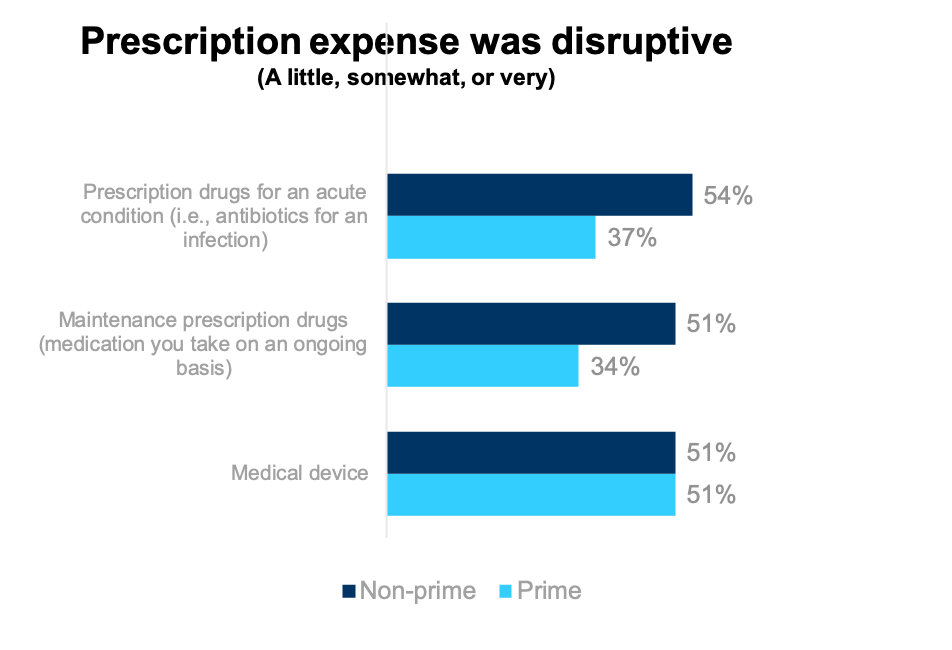

Disruption of prescription expenses, past 5 years

While non-prime and prime consumers experience prescription and medical device costs at a similar incidence, non-prime consumers are more likely to be negatively impacted with a financial disruption due to prescription drug costs.

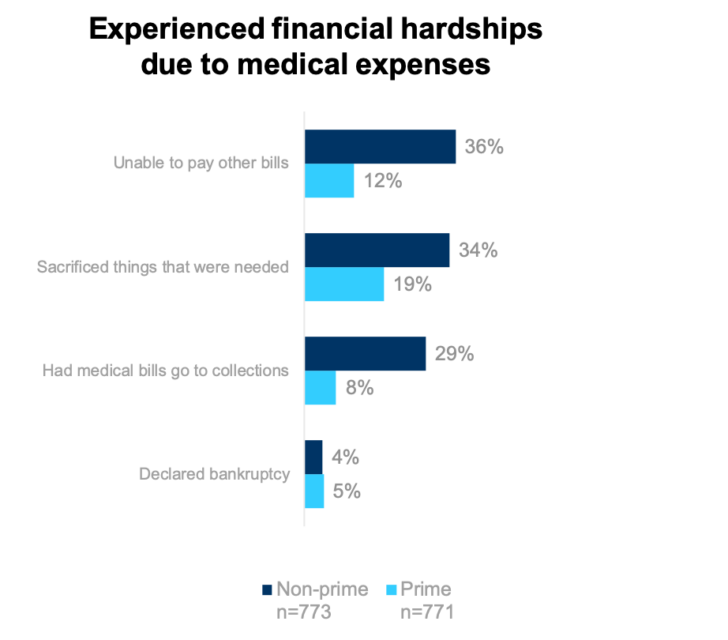

Consequences of medical expenses- catastrophic

Most common financial consequences for medical expense for non-prime consumers were inability to pay other bills and having to sacrifice things that were needed, followed by having bills go to collections. Non-prime consumers experienced these at a significantly higher rate than prime consumers.

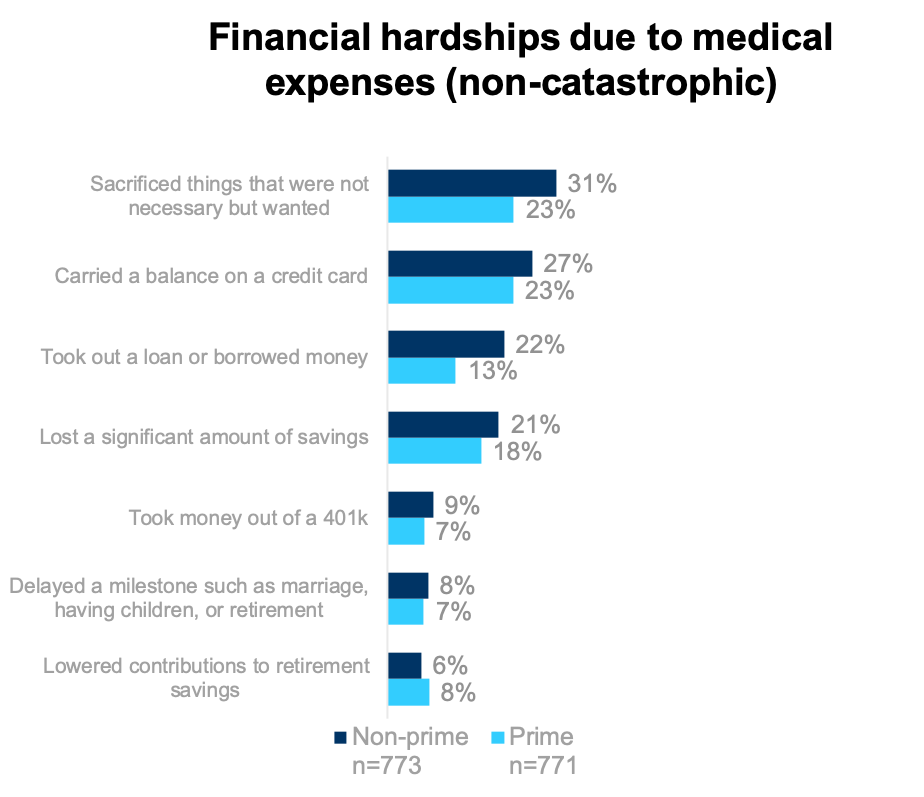

Consequences of medical expenses- setbacks

Sacrificing things that were not necessary but wanted, carrying a balance on a credit card, and taking out loans or borrowing money were the top non-catastrophic setbacks for non-prime consumers.

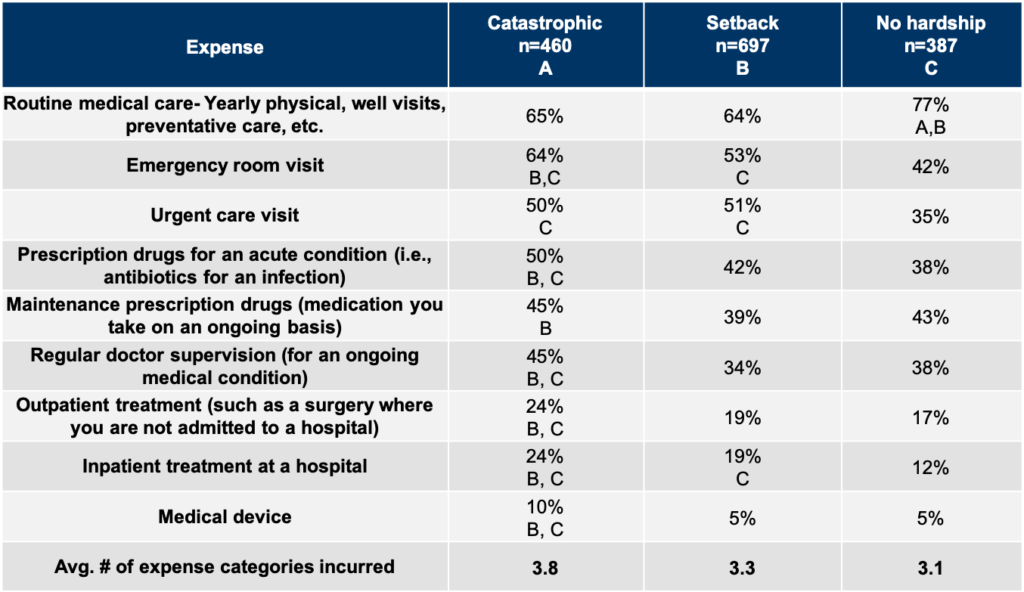

Types of expenses incurred by hardship category

Those who experienced a catastrophic financial hardship due to medical bills incurred more costs across categories, and experienced most expenses at a higher incidence.

Compared to those with no hardship, those facing a setback experienced ER visits, urgent care, and inpatient treatments at the hospital at a higher rate.

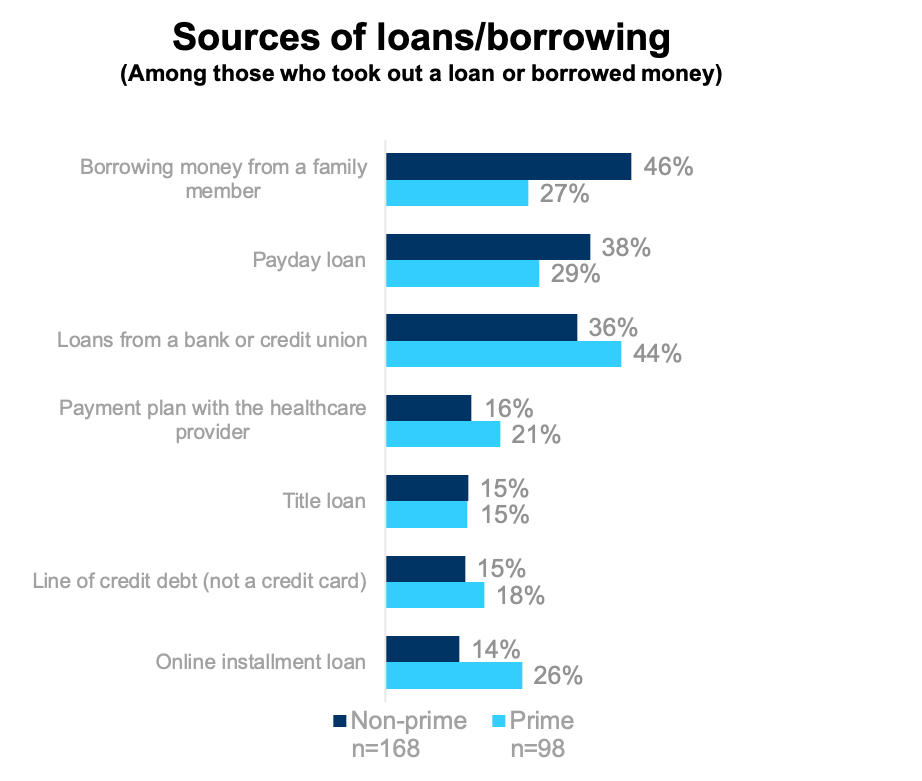

Sources of loans

The top 3 sources for loans to pay off medical bills for both prime and non-prime consumers were family, banks and credit unions, and payday loans.

Non-prime consumers were significantly more likely to borrow from family.

Emergency room visit

Over half of consumers have had an ER visit for someone in their household over the past 5 years.

Non-prime consumers are 20% more likely to have had an ER visit as a medical expense over the past 5 years.

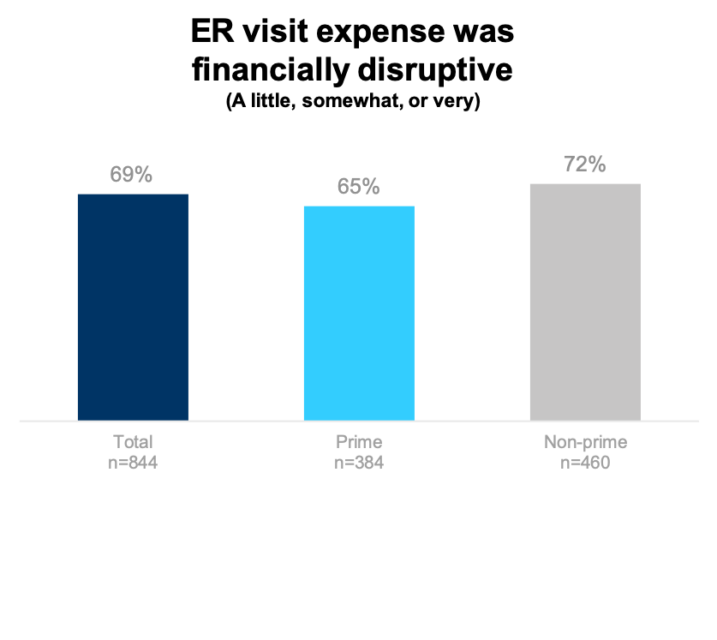

Emergency room visit was disruptive

7 in 10 consumers who have had an ER visit in their household said it was at least a little disruptive of their household finances.

Non-prime consumers were 11% more likely to have felt disrupted.

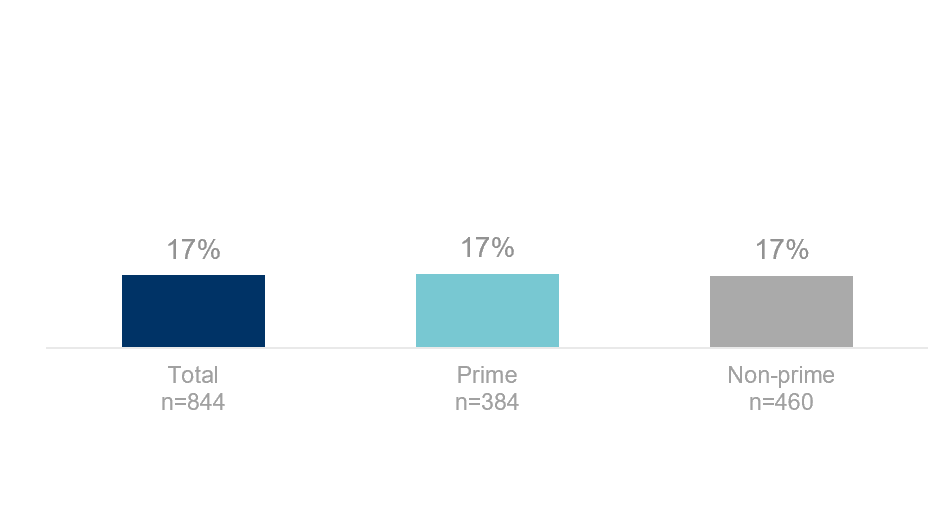

Emergency room visit was very disruptive

Nearly 2 in 10 of all consumers who have had a emergency room visit in the past 5 years say the emergency room visit was very disruptive, regardless of credit status.

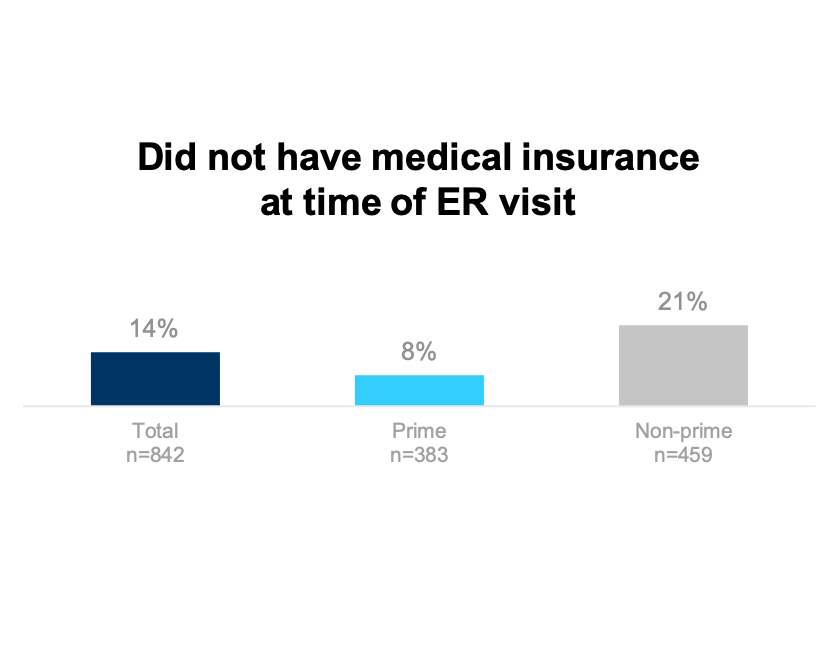

Insurance at time of ER visit

Non-prime consumers were over twice as likely to have been uninsured at the time of an ER visit.

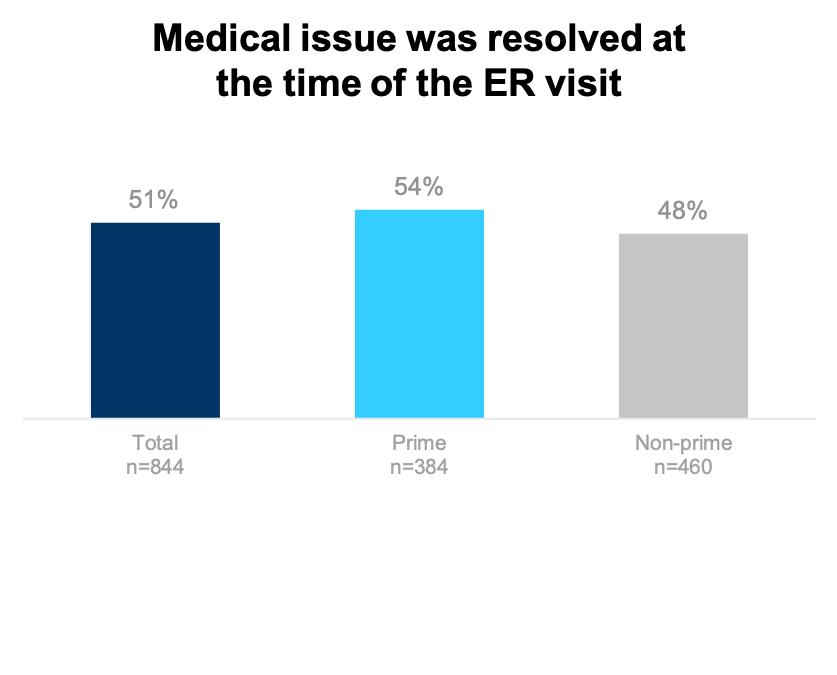

Resolution of medical issue at time of visit

Only about half of those with ER visits found a resolution to their medical issue at the time of the visit.

Non-prime consumers were 11% less likely to have had their medical issues resolved at the time of their ER visit.

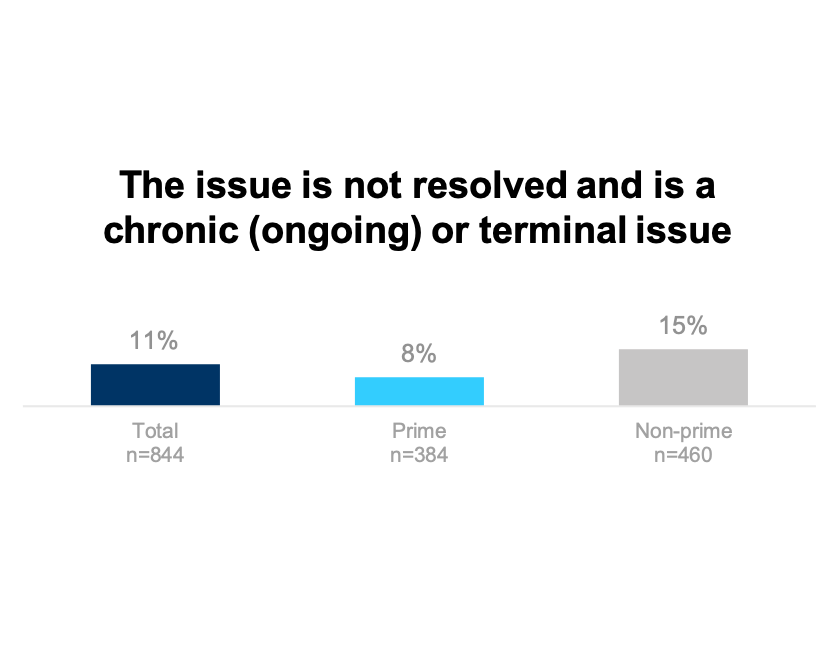

ER visits and chronic or terminal condition

Non-prime consumers were about twice as likely to use ER visits as part of chronic care.

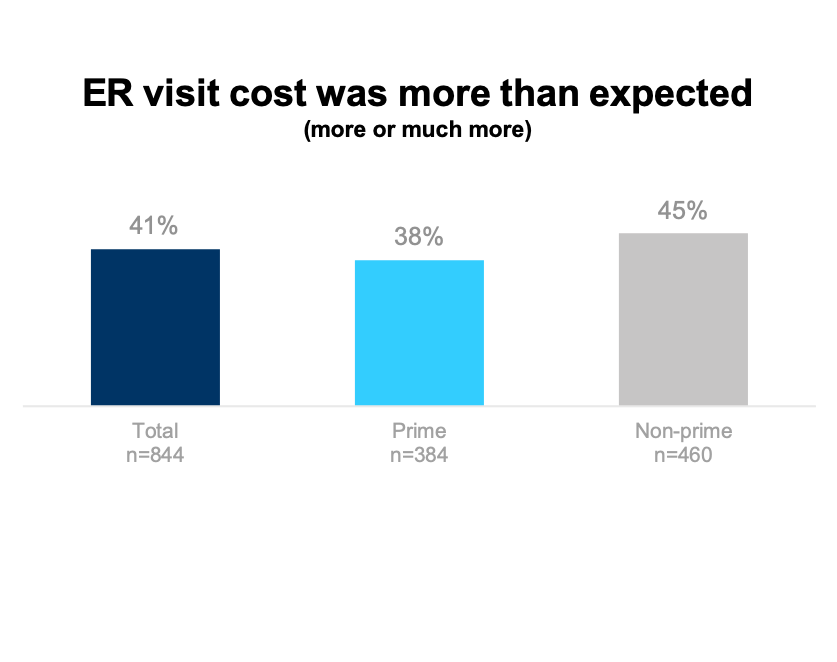

ER costs were more than expected

Non-prime consumers were 18% more likely to have felt their ER costs were more than expected.

In general, about 4 in 10 consumers feel their ER visit cost more than they expected.

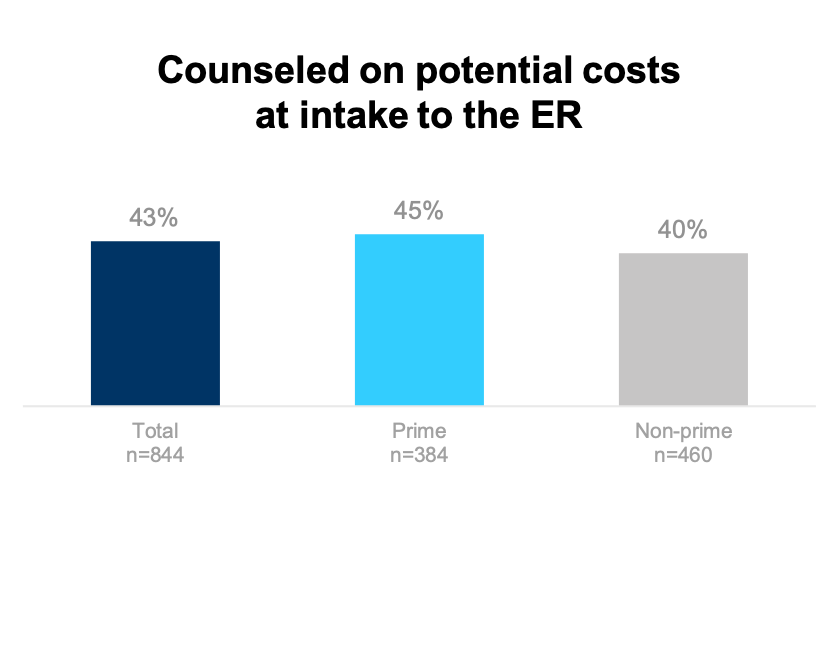

Counseled on ER costs at intake

Only about 4 in 10 Americans who have had an ER visit in the past 5 years, regardless of credit status, report being counseled on potential costs at intake.

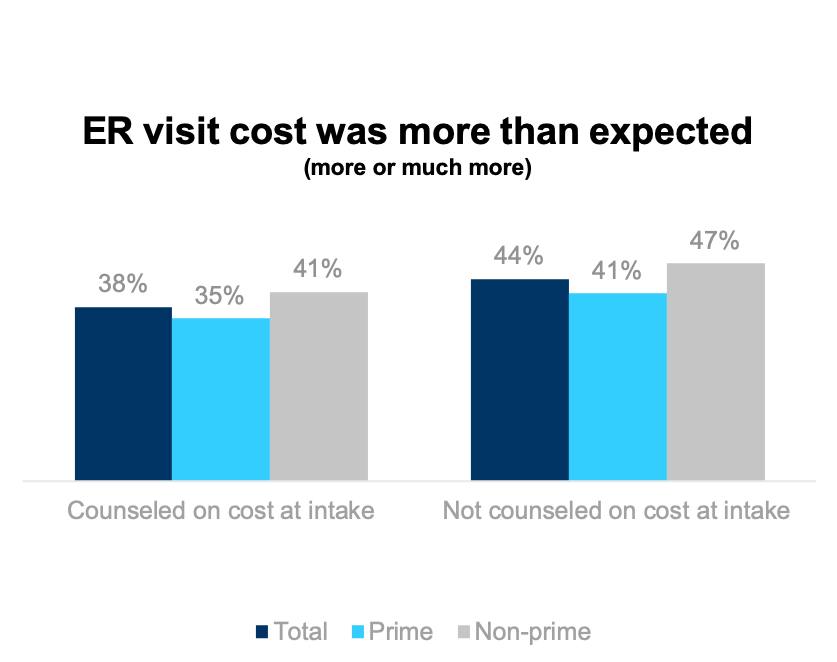

Costs and Expectations- counseled at intake vs. not

Among total, consumers who were counseled on costs were significantly less likely to feel their costs were more than expected.

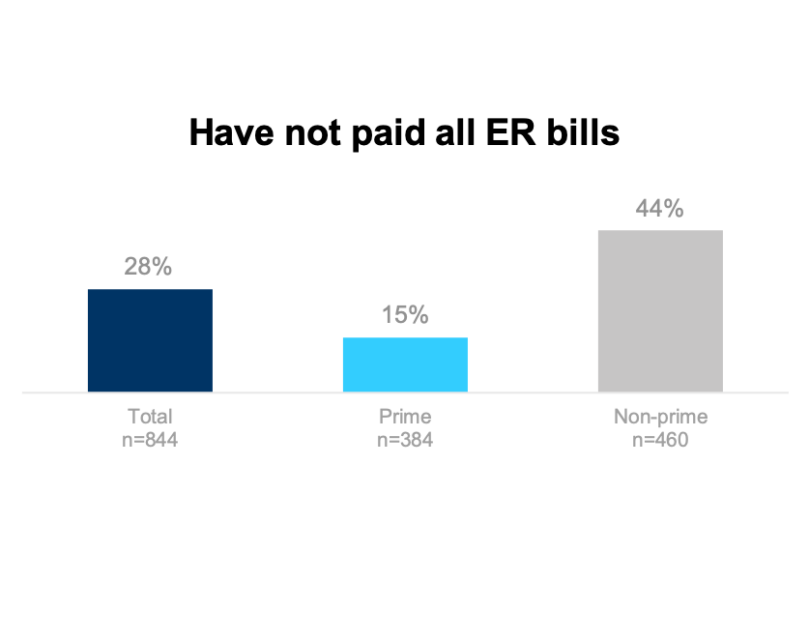

Have not paid all ER bills

In total, nearly 3 in 10 consumers who have used the ER have outstanding bills.

Non-prime consumers are nearly 3 times as likely to have not yet paid off their ER bills.

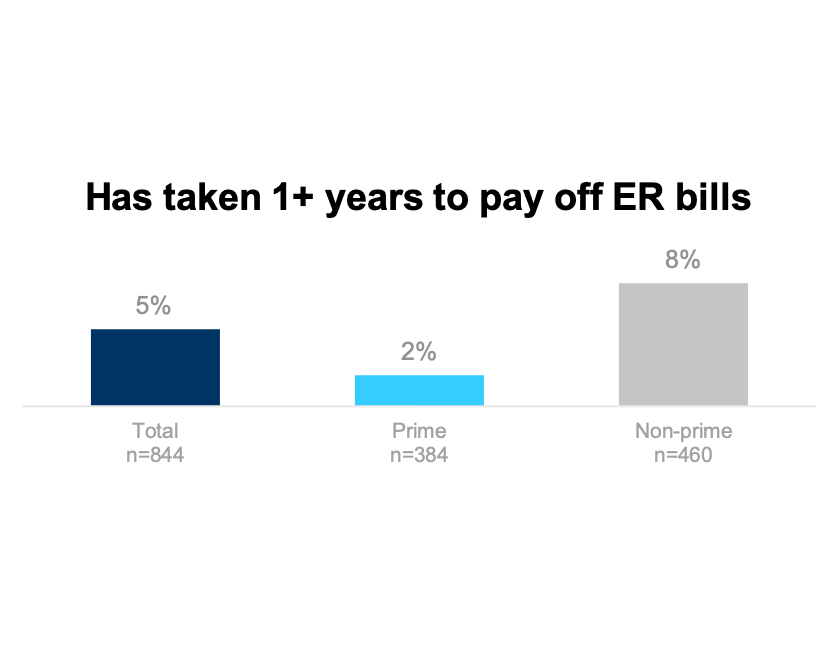

Time taken to pay ER bills

5% of those with an ER visit have taken a year or more to pay off the bills associated with that visit.

Non-prime consumers are over 3 times as likely to have ER bills linger over a year.

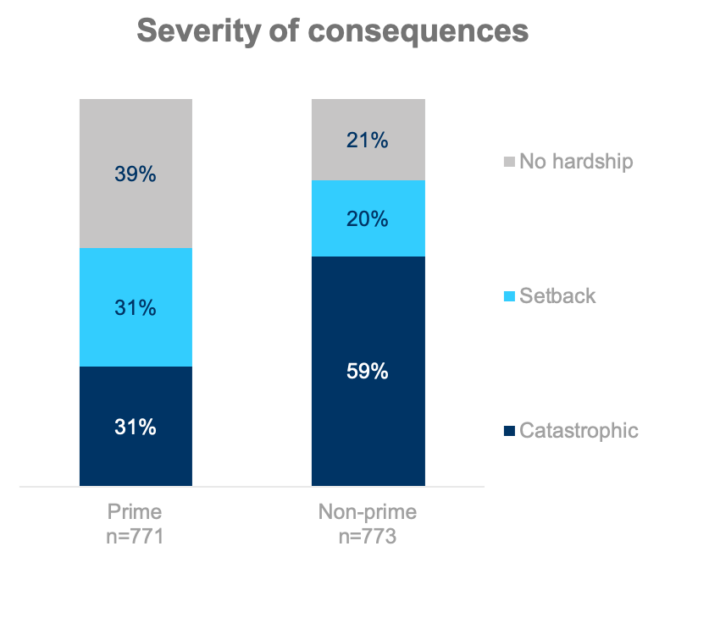

Consequences of medical expenses

Non-prime consumers were twice as likely to have had a catastrophic disruption to their finances, meaning they could not pay their bills or have the things they needed.

With that said, 8 in 10 non-prime consumers, and 6 in 10 prime consumers faced some level of financial sacrifice in the face of medical bills.

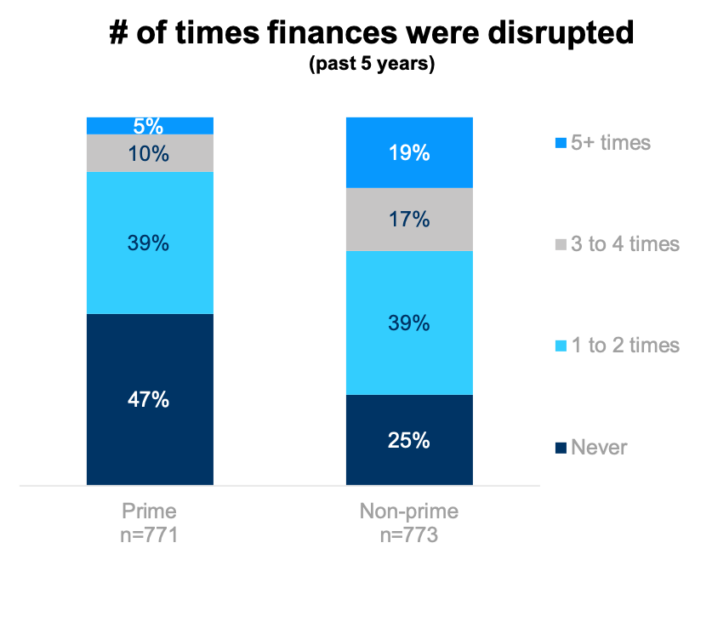

Financial Disruption

Non-prime consumers are half as likely to have never had a financial disruption in the past 5 years, and four times more likely to have had five or more financial disruptions in the past 5 years. They are nearly 4 times as likely to have had 5 or more financial disruptions over the past 5 years.

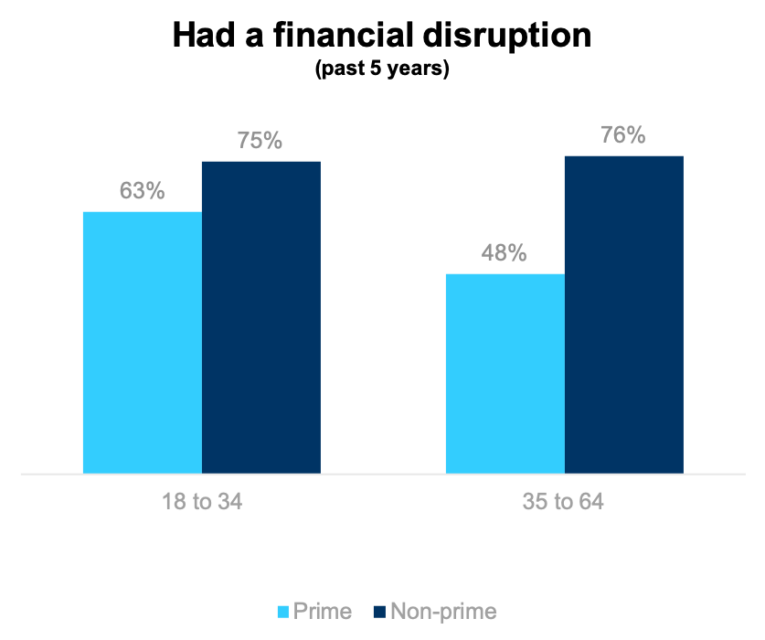

Financial Disruption and Age

For non-prime consumers, age is not a factor in being more or less likely to have a financial disruption. 3 in 4 have had one.

Younger prime consumers are 31% more likely than their older prime counterparts to have had a disruption.

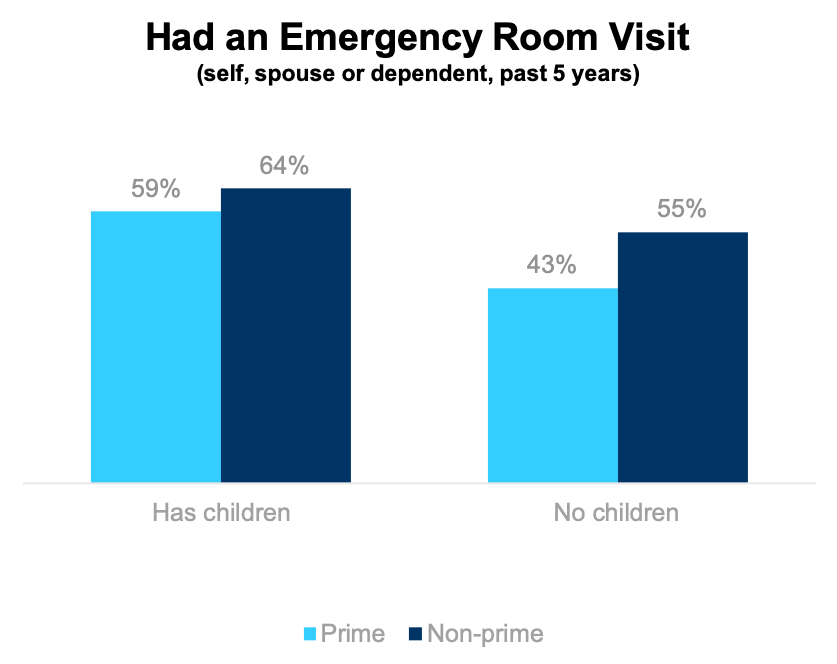

Emergency room expense and children

Regardless of credit, consumers with children are more likely to have incurred ER expenses than their counterparts with no children.

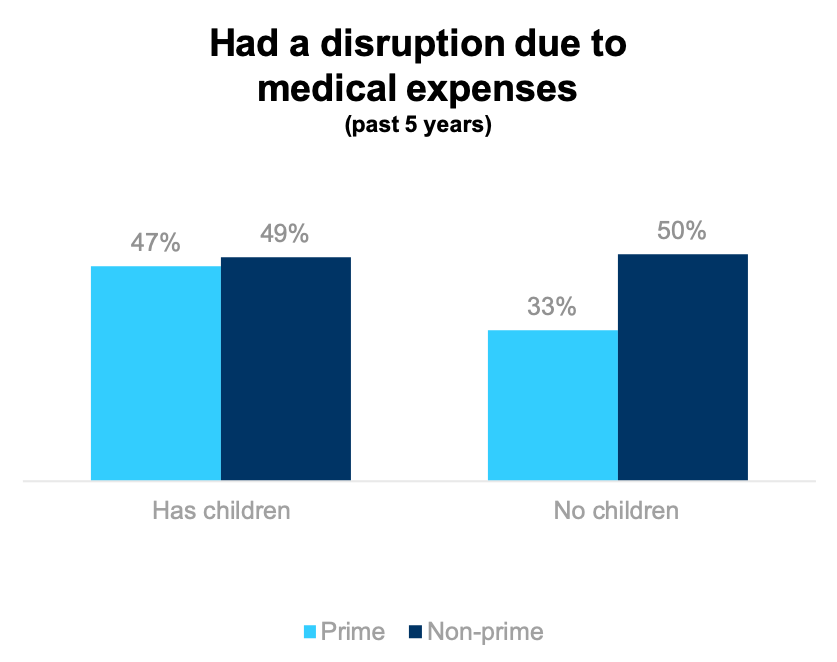

Disruption due to medical expenses and children

Regardless of presences of children in the home, non-prime consumers have faced similar rates of disruption due to medical expenses.

Prime consumers with children were 42% more likely than their child-free counterparts to have faced a financial disruption due to medical expenses.

Methodology

Interview Dates: April 22, 2019 to May 13, 2019

Sample Specs:

•Total Respondents = 1,544

•Sample Source: Online panel

•Language: English

Qualification Criteria:

•Ages 18-64

•Shares in, makes most decisions or sole decision-maker in household finances

•Shares in, mostly responsibly or solely responsible in household medical decisions

Survey Instrument: 10-minute questionnaire

About

About Elevate’s Center for the New Middle Class

Elevate’s Center for the New Middle Class conducts research, engages in dialogue, and builds cooperation to generate understanding of the behaviors, attitudes, and experiences of America’s growing “New Middle Class.”

For more information, visit: www.elevate.com/NewMiddleClass

Contact

NewMiddleClass@elevate.com

@NewMidClass

Facebook.com/NewMiddleClass