Introduction

The broad discussion in many circles about the plight of the nonprime consumer often uses assumptions about how these consumers think, what matters to them, and even what would be good for them. However, there is limited data that really explains their circumstances.

We set out to understand the differences in attitudes, experiences and behavior between consumers with prime credit and those with nonprime credit.

This study represents results from a survey of 502 nonprime Americans with 525 Americans with prime credit scores, using interviews conducted June 27- July 1, 2016.

Executive Summary

Financial volatility keeps nonprime Americans focused on the near-term

- Nonprime Americans are twice as likely to see their incomes change 25% or more year-to-year

- More than half of nonprimes say their income fluctuates month-to-month

- Nonprimes are more than twice as likely to be focused on short-term financial matters than long-term ones

- Nonprimes say they can go only four months with a drop in income vs. the eight months that prime respondents say they can go

- Nonprimes are 14% more likely to hold more than one job

Nonprime Americans have larger households

- Nonprimes have more people in their households; they are 20% more likely to have three or more people in their households

- Nonprimes are almost twice as likely to have elderly parents in their households than primes

Nonprime Americans are more likely than Prime to say their current economic situation is worse than when they grew up

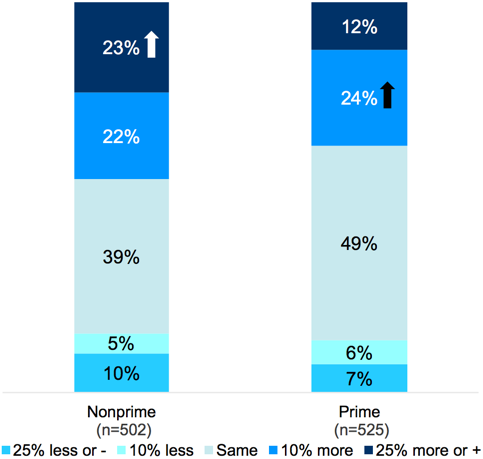

One in three Nonprime Americans have had their income change by 25% year-over-year

Nonprime Americans are more likely to have made significant gains over last year, but it comes at the cost of volatility.

Change in HH Income vs. Year Ago

(% who say more/same/less)

Q.12: Compared to one year ago, approximately how has your household income changed, if at all? S

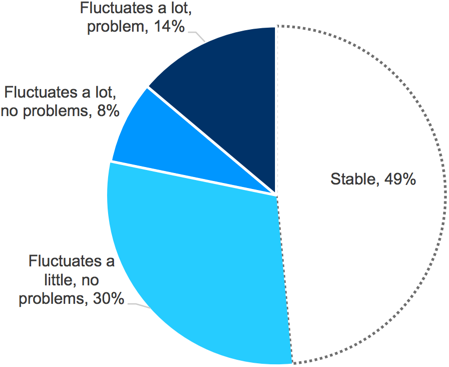

More than half of nonprimes experience month-to-month income fluctuation

Income fluctuation is common amongst nonprimes, but most feel it doesn’t cause problems.

Stability of your monthly income

Q.11: Thinking of the previous 12 months, which statement best describes your monthly household income?

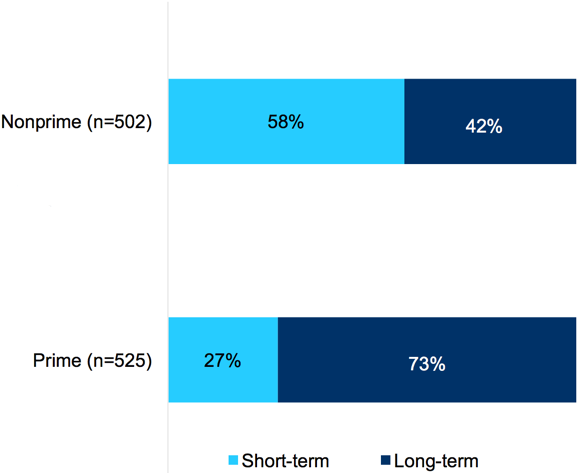

Nonprime Americans are more than twice as likely to be focused on short-term financial matters than long-term financial matters

Nonprime Americans must spend more of their energy on meeting their short-term needs.

% who plan…

Q.5f: When thinking about your financial decisions, how far out do you plan?

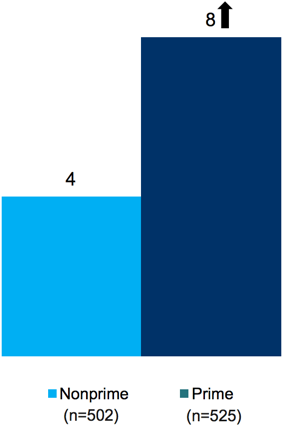

Nonprimes say they can go only four months with a drop in income vs. prime’s eight months

Nonprime Americans are much less resilient to a drop or loss of income than Prime Americans. This leaves them much more vulnerable.

Number of Months HH Can Go with No Income

Mean # of Months

Q.13: How long could your household make ends meet if you faced a long-term illness, job loss, economic downturn, or other emergency that caused a drop or loss in income?

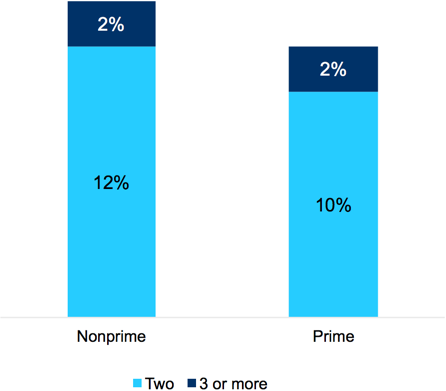

Nonprime Americans are 17% more likely than primes to hold more than one job

Nonprime Americans are more likely to hold more jobs than Prime Americans.

% of respondents with more than one job

Q.6: How many jobs do you currently hold?

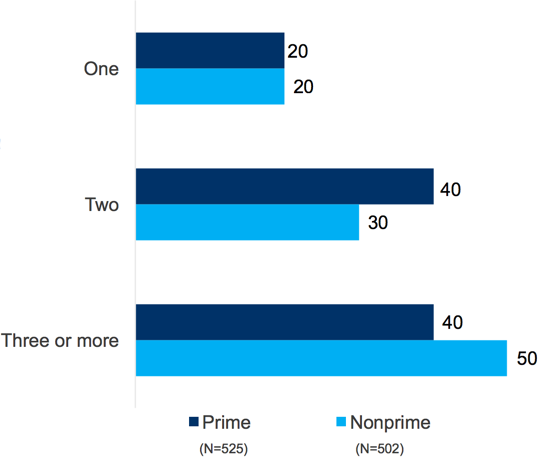

Nonprimes have more people in their households

Nonprime Americans are 20% more likely to live in households of three or more people.

HH Size

(%)

Q.19: Including yourself, how many people currently live in your household?

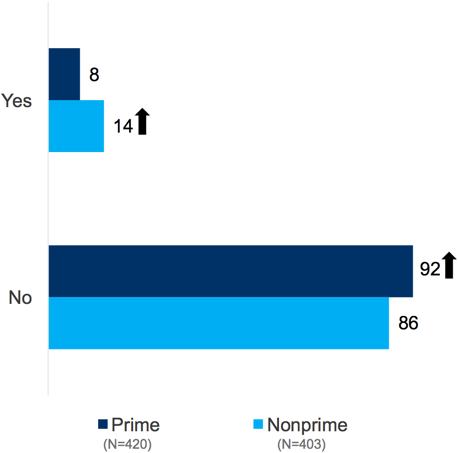

Presence of elderly parents in the home

Nonprime Americans are more likely to be care-givers to elderly parents. They are almost twice as likely as primes to have elderly parents in their household.

Elderly Parents in the HH

(%)

Q.21: Are there any elderly parents or disabled adults currently living in your household?

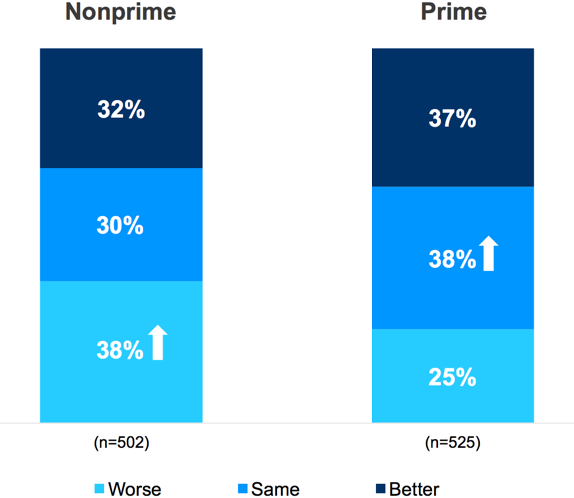

Financial situation: now compared to childhood

Nonprimes are more likely to say current financial situation is worse than when they grew up.

Nonprime Americans

“Subprime” is often used to represent people with scores below 640. People with 641 to 700 are sometimes called “near prime.” We have elected to use the clearer designation of “nonprime” for all consumers with scores below 700.

“Nonprime Americans” represent the New Middle Class. These are Americans with a credit score below 700, meaning that their access to credit is limited or curtailed. It is the Center’s objective to better understand their experiences, attitudes, and behavior.

Methodology

The primary purpose of this study was to determine how nonprime consumers were similar or different from those with prime credit on a range of attitudes, behaviors and experiences.

Interview Dates: June 27 – July 1, 2016

Sample Specs:

- Total Consumers = 1,027 (Nonprime = 502; Prime = 525)

- Sample Source: Research Now Consumer Panel Qualification Criteria:

- Ages 18-64 • Personal income: Any

- Geography – U.S. Rep • Has primary or shared responsibility managing HH finances

- Employment: No students or unemployed

- Has a checking or savings account

Survey Instrument: 10 minute online questionnaire

Arrows indicate statistical significance at 90%