Introduction

The broad discussion in many circles about the plight of the nonprime consumer often uses assumptions about how these consumers think, what matters to them, and even what would be good for them. However, there is limited data that really explains their circumstances.

We set out to understand the differences in attitudes, experiences and behavior between consumers with prime credit and those with nonprime credit. Specifically, we explore whether prime and nonprime Americans can sustain similar levels of unexpected expenses.

This study represents results from a survey of 502 nonprime Americans with 525 Americans with prime credit scores, using interviews conducted June 27- July 1, 2016.

Executive Summary

Much is made about how Americans can’t come up with money for an emergency. But, a blanket amount may not adequately explain people’s situation due to income, geography, and access to credit.

Aspects to the unexpected expense issue:

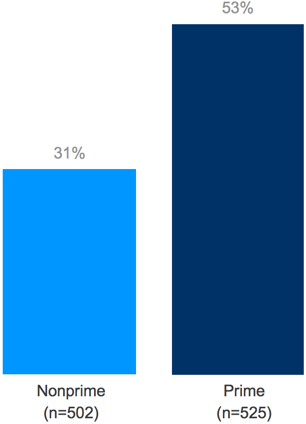

- Nonprime Americans can only weather an unexpected expense of 31% of their monthly income. Prime, 53%

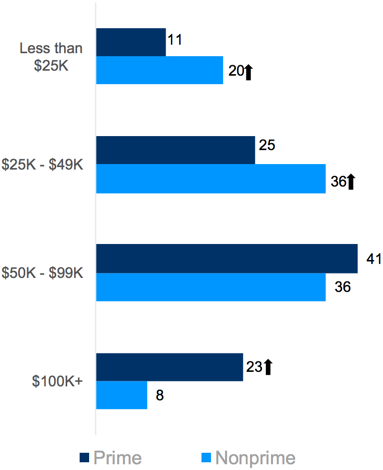

- Nonprime Americans are significantly more likely to have lower incomes.

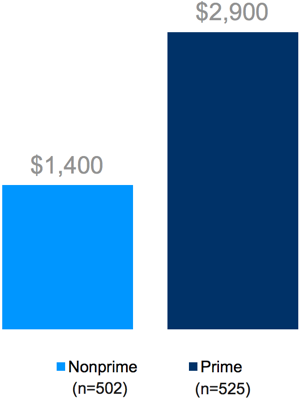

- A bill becomes a crisis for nonprime Americans at $1,400. For Prime, it’s $2,900.

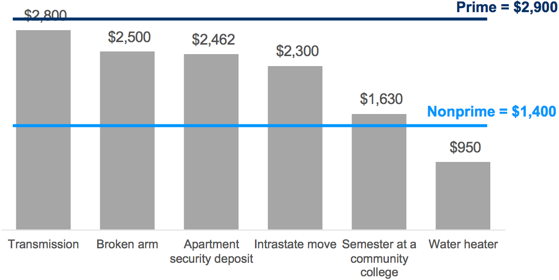

- Many common expenses are above that threshold for nonprime Americans, but below it for prime Americans.

- Half of nonprime Americans have an income that fluctuations month to month.

- Almost half of nonprime Americans have more than three disrupting expense events a year.

- Nonprime Americans can survive only half as long as prime Americans after a drop in income.

Americans struggle to come up with funds for an emergency

Publications have widely reported the fact that Americans struggle to come up with funds to cover emergency expenses.

The Washington Post – The shocking number of Americans who can’t cover a $400 expense

The Atlantic – The secret shame of middle-class Americans

NPR – Could you come up with $400 if disaster struck?

AP – Poll: Two-thirds of US would struggle to cover $1,000 crisis

Local purchasing power

Different locals makes a difference on how far a dollar goes. Adjusting local purchasing power, $100 in Tulsa, OK acts more like $131 in Kansas City, MO and a mere $77 in New York, NY.

This purchasing power contributes to making a financial emergency a disruption.

| City | Value of $100 |

| Kansas City, MO | $131 |

| Atlanta, GA | $113 |

| Denver, CO | $103 |

| Tulsa, OK | $100 |

| Chicago, IL | $97 |

| Philadelphia, PA | $90 |

| Tallahassee, FL | $84 |

| San Francisco, CA | $81 |

| New York, NY | $77 |

| Honolulu, HI | $69 |

Source: Numbeo

When does a bill become a crisis?

An unexpected expense becomes a significant disruption to prime Americans when it is 53% of their monthly income. Nonprime Americans can only swallow a 31% impact to their income.

Unexpected expense that would significantly

disrupt your normal finances

(as a % of monthly income)

Q.14 Think about the smallest unexpected expense that would significantly disrupt your normal finances. What percent of your household monthly income would that expense need to be?

Nonprime Americans have lower monthly incomes

Not surprisingly, nonprime Americans have lower overall incomes than prime Americans. They have fewer resources to absorb financial shocks.

Personal Income

(% of respondents)

Sample Size – Prime: N=525; Subprime: N=502

Prime customers can weather twice the unexpected expense nonprime can

Nonprime Americans can swallow a $1,400 expense without it being a significant disruption. Prime Americans can handle more than twice that.

This does not mean that they have this cash on hand. Rather, it is the amount that an expense becomes a crisis and not just a challenge.

Smallest amount that would

“significant disrupt your normal finances”

Q.14 Think about the smallest unexpected expense that would significantly disrupt your normal finances. What percent of your household monthly income would that expense need to be?

Nonprime American’s expense threshold falls below many common expenses

Nonprime Americans can swallow a $1,400 expense which would not cover the average cost of replacing a transmission, covering the out-of-pocked on a broken arm, or even making an intrastate move.

Common Expenses

Q.14 Think about the smallest unexpected expense that would significantly disrupt your normal finances. What percent of your household monthly income would that expense need to be?

Sources of costs: broken arm, intrastate move, apartment first/last rent, transmission, semester at community college, water heater.

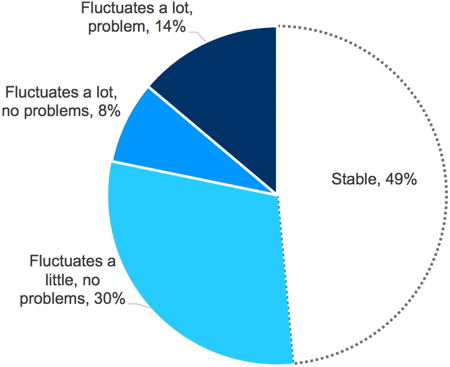

Income fluctuation amongst the nonprime

More than half of nonprimes experience month-to-month income fluctuation. While it usually doesn’t cause problems, when a drop in income corresponds with an unexpected expense, it can leave little slack for making up a shortfall.

Stability of your monthly income

Q.11: Thinking of the previous 12 months, which statement best describes your monthly household income?

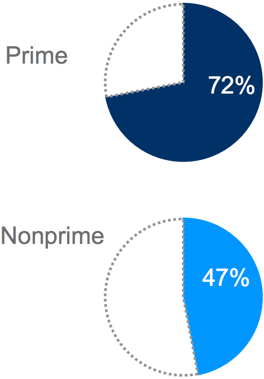

Unexpected expenses hit nonprime Americans significantly more frequently

More than half of nonprime Americans hit their unexpected expense threshold more than three times a year. Personal financial crisis can often seem like a way of life.

Experiences LESS than 3

unexpected expenses a year

Q.15: In the past 12 months, how often has your household experienced an unexpected expense that caused a significant disruption to your finances?

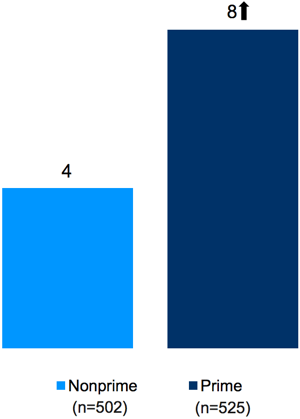

Nonprime Americans can survive only half as many months as prime when income drops

Higher income, more financial slack, and better access to financing options help prime Americans to go twice as long as nonprime Americans on a drop in income.

Number of months HH can go with drop in income

(mean # of months)

Q.13: How long could your household make ends meet if you faced a long-term illness, job loss, economic downturn, or other emergency that caused a drop or loss in income?

Nonprime Americans

“Subprime” is often used to represent people with scores below 640. People with 641 to 700 are sometimes called “near prime.” We have elected to use the clearer designation of “nonprime” for all consumers with scores below 700.

“Nonprime Americans” represent the New Middle Class. These are Americans with a credit score below 700, meaning that their access to credit is limited or curtailed. It is the Center’s objective to better understand their experiences, attitudes, and behavior.

Methodology

The primary purpose of this study was to determine how nonprime consumers were similar or different from those with prime credit on a range of attitudes, behaviors and experiences.

Interview Dates: June 27 – July 1, 2016

Sample Specs:

- Total Consumers = 1,027 (Nonprime = 502; Prime = 525)

- Sample Source: Research Now Consumer Panel Qualification Criteria:

- Ages 18-64

- Personal income: Any

- Geography – U.S. Rep

- Has primary or shared responsibility managing HH finances

- Employment: No students or unemployed

- Has a checking or savings account

Survey Instrument: 10 minute online questionnaire

Arrows indicate statistical significance at 90%More in Reports