The Non-Prime Consumer Sentiment Tracker, an initiative of the Center for the New Middle Class (CNMC), tracks the differences and similarities in financial sentiment, attitude, and behavior between consumers with prime and non-prime credit scores. These differences have been pronounced due to the effects of the COVID economic crisis. The results of this report provide necessary, and occasionally counterintuitive, insights into the way these two groups have been affected.

Background

In October of 2018, Elevate’s Center for the New Middle Class launched a long term tracking study to follow financial health, employment trends, and other sentiments among two cohorts:

1) those with credit scores of 700 and above (prime), and

2) those with credit score below 700 (non-prime).

We divide the population at a 700 credit score for a simple practical reason: only those above that mark can always expect to have access to mainstream credit products.

We largely left the tracker untouched for the first 14 months. Each month, a 10 minute survey went out to approximately 300 people, half in the high credit score cohort, and half in the low credit score cohort.

As the COVID-19 pandemic took hold in America in March, we saw the vital need to increase the amount of data we collected. Rather than collecting 300 responses monthly, we began to collect them weekly, resulting in 800 responses each month from March to present.

Methodology

This report accumulates pre-COVID responses together, meaning we take the 12 previous months of data and average them out for a general snapshot of conditions from March 2019-March 2020. Then, we compare to the months since. The advantage to that is that it creates an extremely robust sample size: we have 3,602 pre-COVID responses and 2,233 after March 2020 when the COVID pandemic took hold in the U.S.

This tells the story of the fragility of American households, government economic assistance, fear for the future, and even hope.

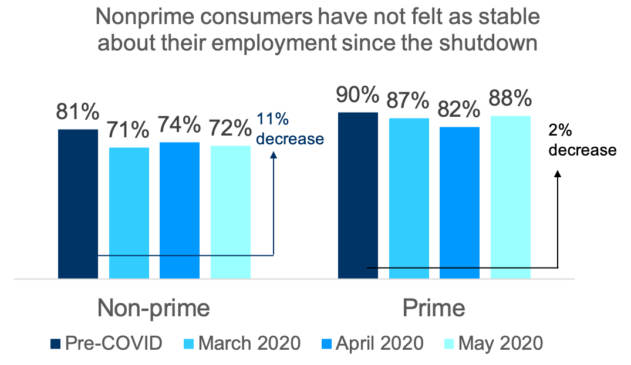

Employment Stability Throughout Shutdown

Feelings of employment stability dropped for both prime and non-prime respondents in the months following the economic shutdown. A sense of stability has largely returned for prime respondents while non-prime households have yet to attain their pre-COVID levels.

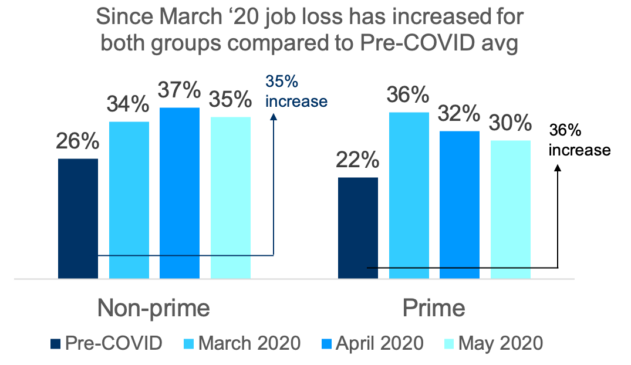

Job Loss Has Impacted Both Prime and Non-Prime

As has been amply reported, millions of Americans have lost their jobs. What is represented in the Sentiment Tracker is just how many households have experienced a layoff. Both prime and non-prime households have experienced job loss above the baseline, pre-COVID periods. What might challenge conventional wisdom is the fact that prime households experienced a more pronounced jump in job loss.

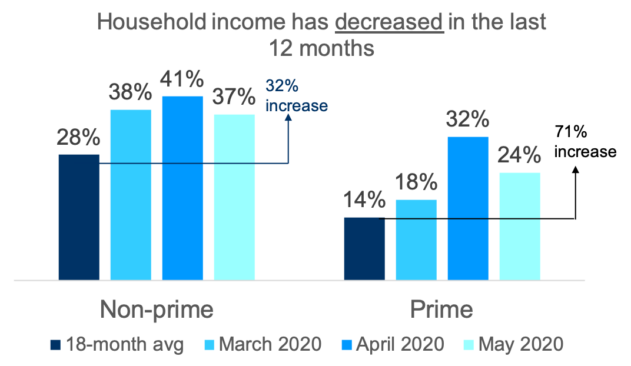

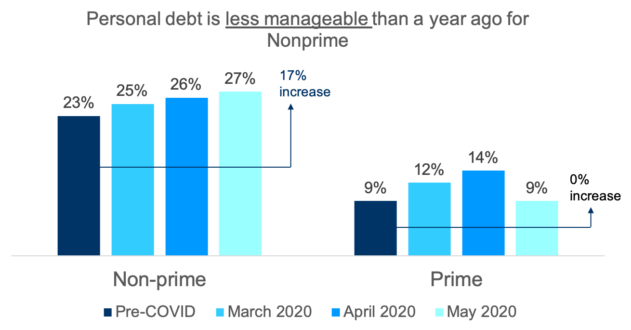

Perceptions Of Debt Burden Developed Differently For Prime And Non-Prime

Another place prime households experienced more volatility after COVID is in the manageability of household debt. However, by May, prime households appear to have recovered their equilibrium while non-prime households increasingly struggled.

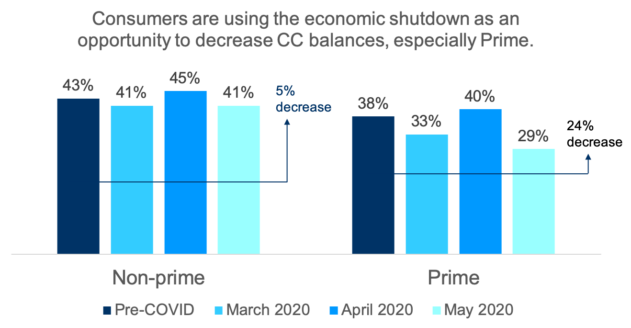

Neither Prime Nor Non-Prime Consumers Are Seeing Elevated Levels Of Credit-Card Debt

Perhaps surprisingly, the early and later debt management challenges never led to more respondents acquiring credit card balances.

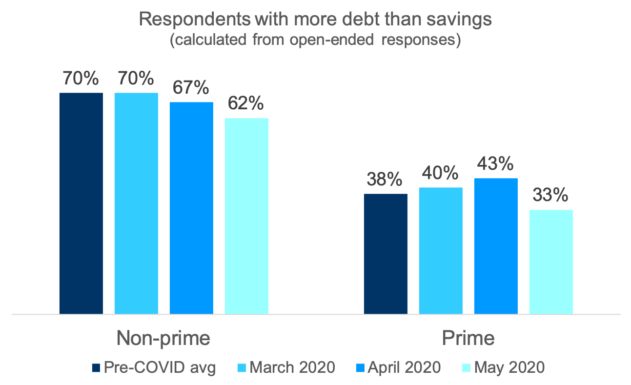

Net Debt For Non-Prime Consumers Is Decreasing

American households appear to exhibit prudence in debt acquisition throughout the COVID crisis. In fact. the percentage of non-prime consumers who have more debt than savings is decreasing in April and May compared to pre-COVID levels. The proportion of prime consumers with more debt than savings, meanwhile, gradually increased from pre-COVID to April 2020 before drastically falling in May.

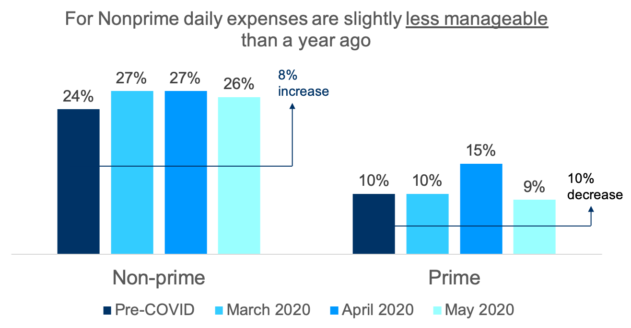

Non-Prime Consumers Reported Less Manageable Expenses During The Pandemic

Non-prime respondents reported feeling daily expenses were less manageable March-May than during the same time in 2019, but the increase was not appreciable. Prime consumers experienced similar sentiment toward the affordability of daily expenses, but have largely returned to pre-COVID levels.

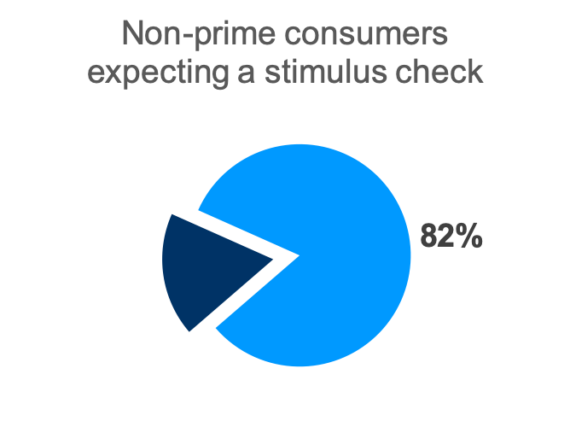

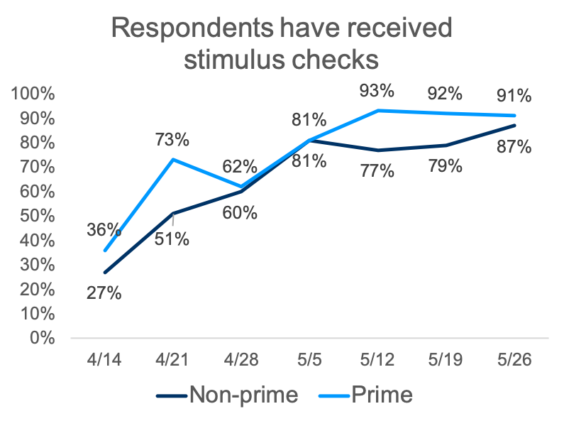

Non-Prime Consumers Reported Receiving Stimulus Checks More Slowly Than Prime Counterparts

More than eight in ten non-prime consumers expected to receive stimulus checks from the government, but reported receiving those checks at a slower pace than their prime counterparts. The non-prime consumer cohort lagged behind prime consumers by as much as 10 to 20% in mid-April. This trend is largely consistent with data on non-prime consumers, which reports that non-prime Americans often lack access to traditional bank accounts and the direct deposit system used by the United States Treasury to distribute stimulus funds.

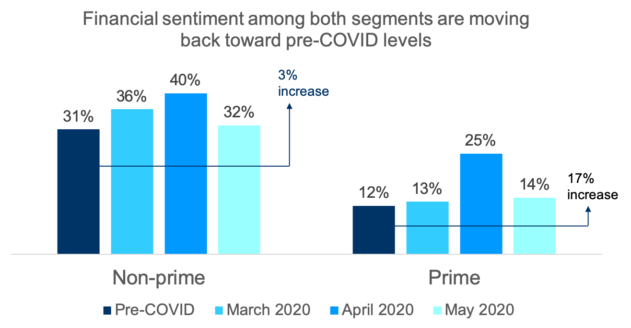

Despite A Rise During The Pandemic’s Height, Financial Security For Both Groups Has Returned To Pre-COVID Levels

In the most uncertain part of the COVID crisis (April), unsurprisingly both non-prime and prime consumers reported feeling less financially secure than they were a year ago. Despite the ongoing challenges of the pandemic, in May both groups reported feeling as financially secure as they did before COVID-19. As states continue to reopen and Americans return to work, feelings of financial insecurity are likely to trend downward.

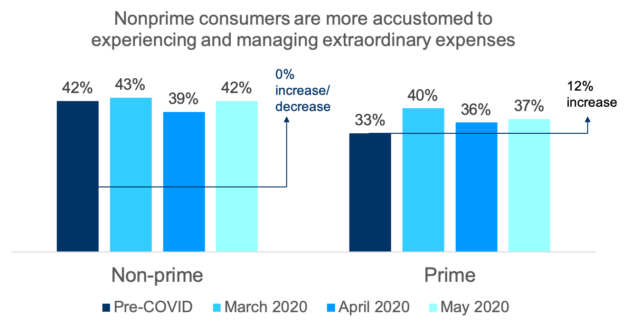

Non-Prime Consumers Are More Accustomed To Financial Disruptions

Likely one of the most surprising findings to those unfamiliar with the daily financial challenges of the non-prime population is that non-prime respondents reported not feeling significantly disrupted by extraordinary expenses at the height of the COVID-19 crisis. Non-prime consumers understand how better to manage through financial uncertainty because they experience more income fluctuations and financial insecurity more frequently. Prime consumers, by comparison, have less experience planning for sudden emergency expenses and were therefore more likely to report more financial disruption or uncertainty during the crisis, especially at its height in April.

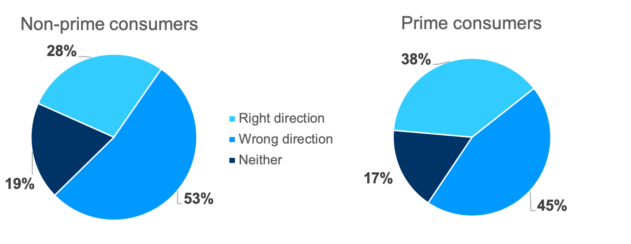

The Pandemic’s Uncertainty Has Affected Consumers’ Opinions About Country’s Direction

The uncertainty introduced by the COVID-19 crisis surprised many Americans, and when asked about the direction of the country as a whole, more than half of non-prime respondents reported feeling like the country is headed in the wrong direction. Prime consumers were almost as likely to report the same, with 45% of respondents reporting similar sentiment.

Conclusion

The COVID-19 crisis produced one of the most unusual economic conditions where layoffs were extensive, but not necessarily permanent; where the government stimulated the economy with money that flowed into the households of those who were unaffected as well as affected; and, where there was deep uncertainty as to the severity or length of the economic challenges.

That changing story can be seen in the data.

The data can also give us a sense for where we are going from here. So many households continue to be economically fragile. Surprisingly, some of the most fragile are those households unused to the challenging conditions brought on by economic uncertainty.

The current economic crisis has led to a bifurcation of effects. On the one hand, are households who are directly affected and must struggle to make ends meet. These households face uncertainty about where their next job will come from and whether the economy will rebound before they slip further into economic difficulty.

The other group are households who have yet to be directly affected by COVID. They have held their jobs and their income. They have avoided costs that they might otherwise have borne (like fuel for their cars, entertainment, and travel). Many of these households received stimulus checks which bolstered their finances and they often used that extra money to pay down their debts and put them into a better situation than they were before.

From here, the question will be how the next phase of this economic crisis plays out and which households will be able to weather it and which will continue to struggle.