As the COVID pandemic continues and the subsequent economic recession takes effect, the Center for the New Middle Class is continuing to release our research monthly on how consumers are faring on the road to economic recovery. While the pandemic has not been discriminatory on who feels it’s impact, prime and non-prime consumers have both felt the change – but in different ways.

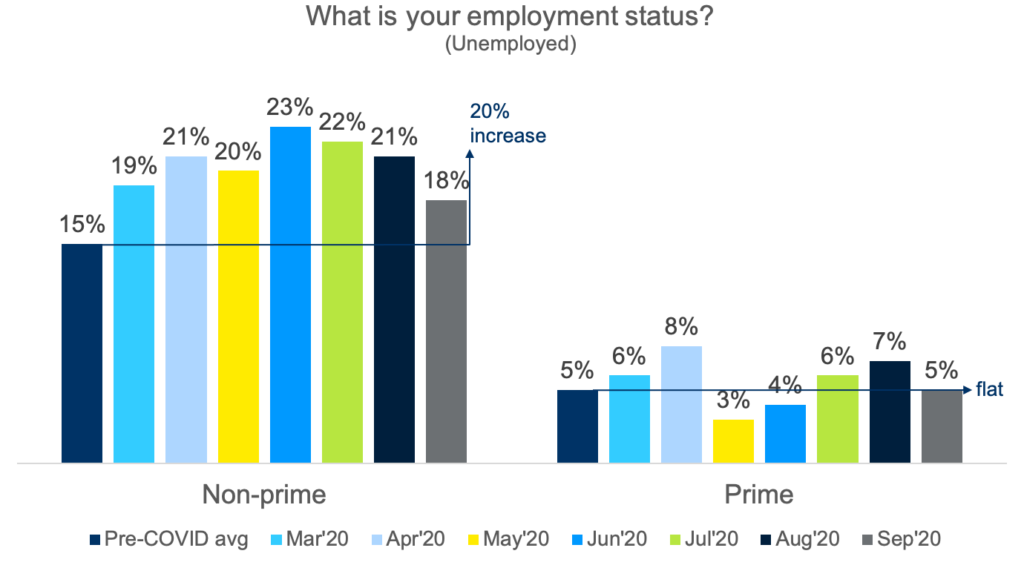

Unemployment is a key metric to monitor as we measure our economic recovery. As shown in the graph above, both prime and non-prime consumers have had fluctuation in unemployment rates, non-prime consumers are having a more difficult recovery. Since before the pandemic began, non-prime consumers have experienced a 20% increase in unemployment. While unemployment is trending downward, there is still a long road to achieve pre-COVID employment levels.

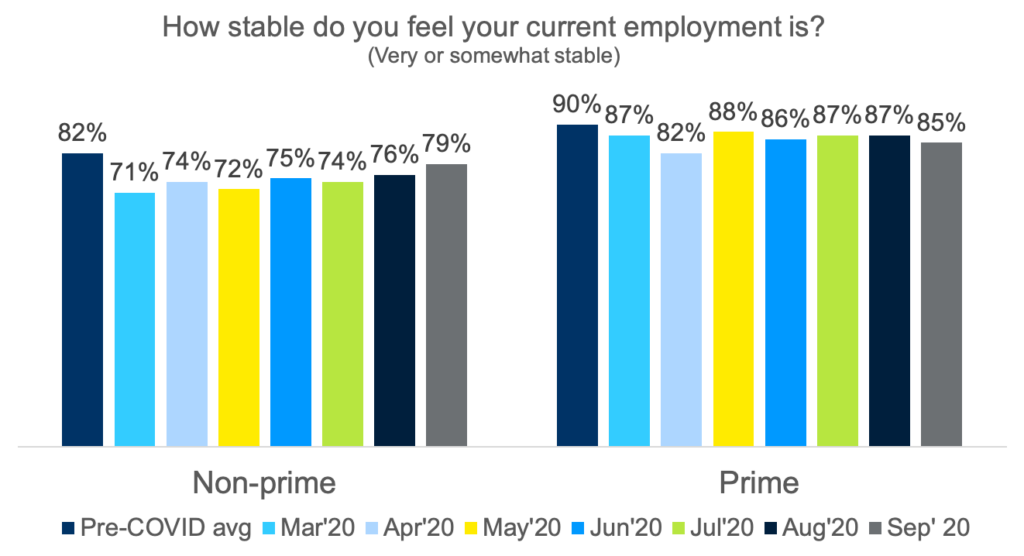

Employment stability can signal consumer sentiment on their employment and economic outlook. It is important to note that a sense of stability in employment has been trending downward since the COVID pandemic began. Non-prime sentiment has begun to tick upward the past two months, which could be a signal that consumers are beginning to feel more secure as the economy recovers. Prime consumer sentiment is lower than their pre-COVID level, but sentiment remains fairly high.

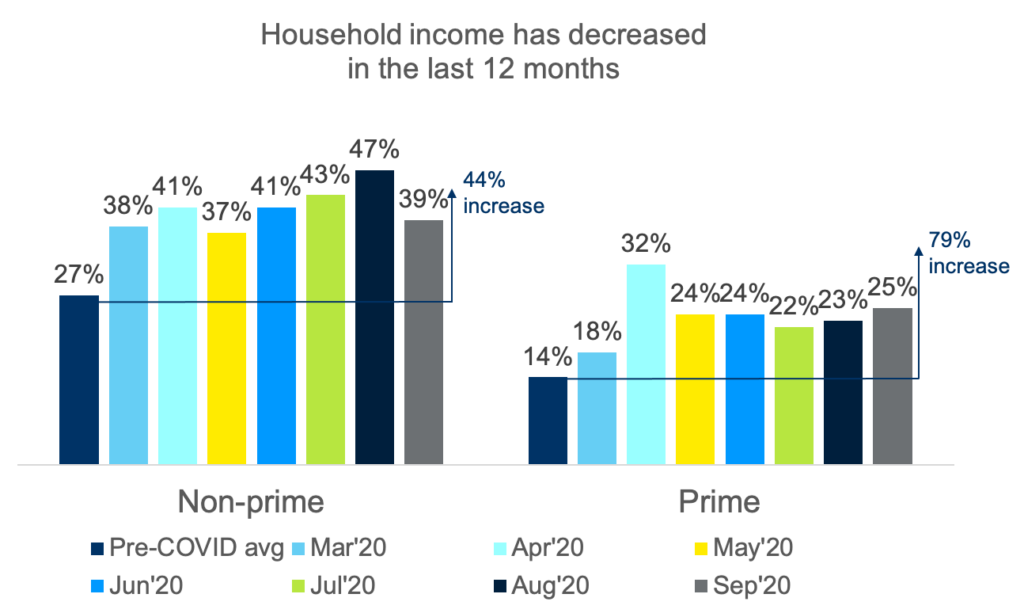

Another important metric to measure our economic recovery is household income. Household income has decreased for families, prime and non-prime alike. Non-prime families experience this decrease at an overall higher frequency, but prime families have seen a very dramatic increase since COVID began. We hope to see these numbers stabilize as the economy and job market recovers.