Introduction

The broad discussion in many circles about the plight of the non-prime consumer often uses assumptions about how these consumers think, what matters to them, and even what would be good for them. However, there is limited data that really explains their circumstances.

Elevate’s Center for the New Middle Class set out to understand the differences in attitudes, experiences and behavior between consumers with prime credit and those with non-prime credit.

This study represents results from the survey of 1,117 Americans, using interviews conducted December 6-14, 2016. It focuses on the unique challenges of non-prime members of the Gen-X generation (those born between 1965 and 1980).

Executive Summary

Members of Generation-X now sit at the age where they anchor the country’s economic and social structure. Yet, when we look at non-prime Gen-Xers, we see a group in the throes of economic challenges which perpetually keep them off balance.

- Non-prime Gen-Xers have experienced more disruption in their employment than their prime counterparts. They are twice as likely to be laid off in the prior year and almost three times as likely to be laid off in the prior 5 years.

- They also suffer from difficulty in predicting their monthly income. Consequently, they act like cash accountants in managing their day-to-day finances. Non-prime Gen-Xers are therefore the least likely generational cohort to be able to save money.

- Uncertainty bleeds into other aspects of their lives as they are more likely to be surprised by medical bills and car repairs. They admit to failing at planning for big or unexpected expenses. Indeed, they show the biggest planning gap between prime and non-prime of any generational cohort.

- When they look for credit to smooth over the rough patches of their finances, they struggle to identify reliable options. They are more likely to be credit omnivores, even turning to overdraft as a short-term borrowing option.

- Non-prime Gen-Xers are significantly more likely to run into capital-erasing events that make it difficult for them to make progress. So, it is not surprising that 1 in 8 have run into bankruptcies and foreclosures in the prior 5 years.

All Hands on Deck

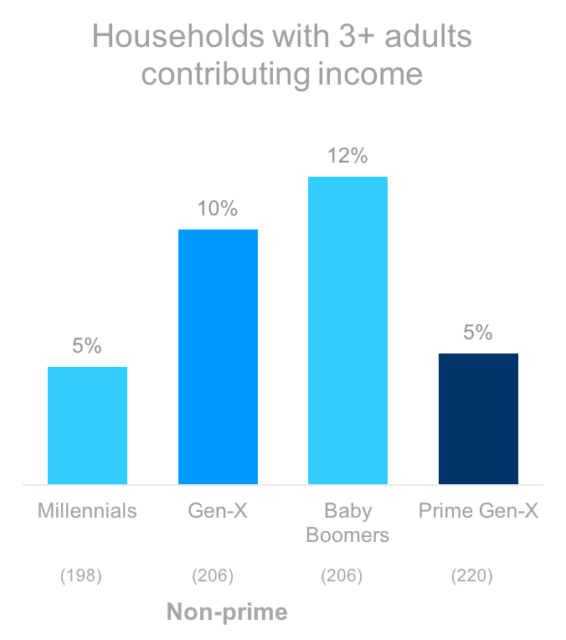

Non-prime Gen-Xers are twice as likely as their prime counterparts to live in households with three or more adults contributing income.

Q9. Including yourself, how many adults in your household earn an income from outside employment, a business you/they own, or retirement/trust/investment disbursements? * Caution: small sample sizes

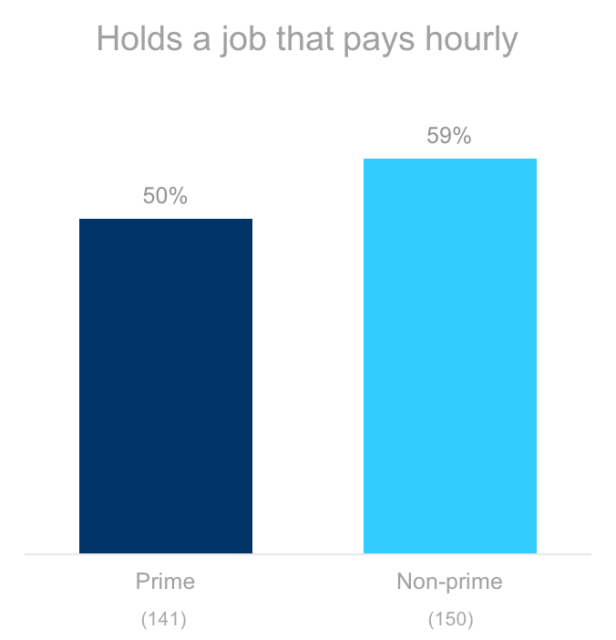

Hourly Employment

Non-prime Gen-Xers are more likely to hold a job that pays an hourly wage.

Q8. Please indicate below how you are paid by your employer(s)?

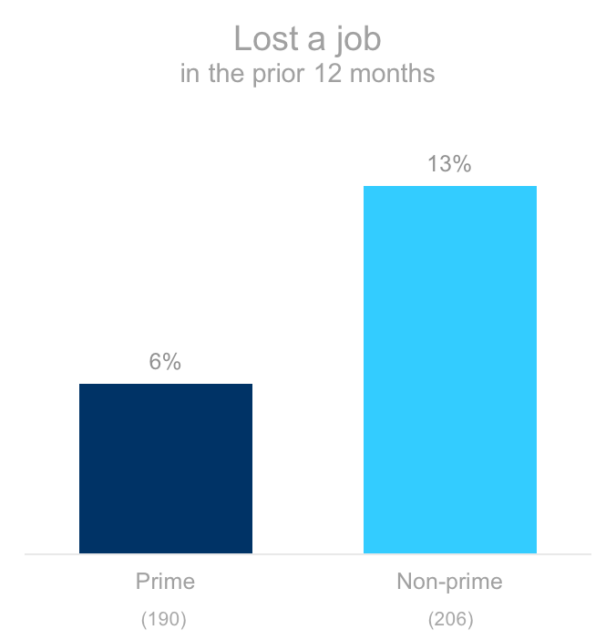

Laid Off

Non-prime Gen-Xers are twice as likely to have lost a job in the prior 12 months.

1 in 8 was laid off in the last year.

Q10. Which of the following employment events occurred to you or someone in your household in the previous 12 months? “Lost a job (e.g., laid off)”

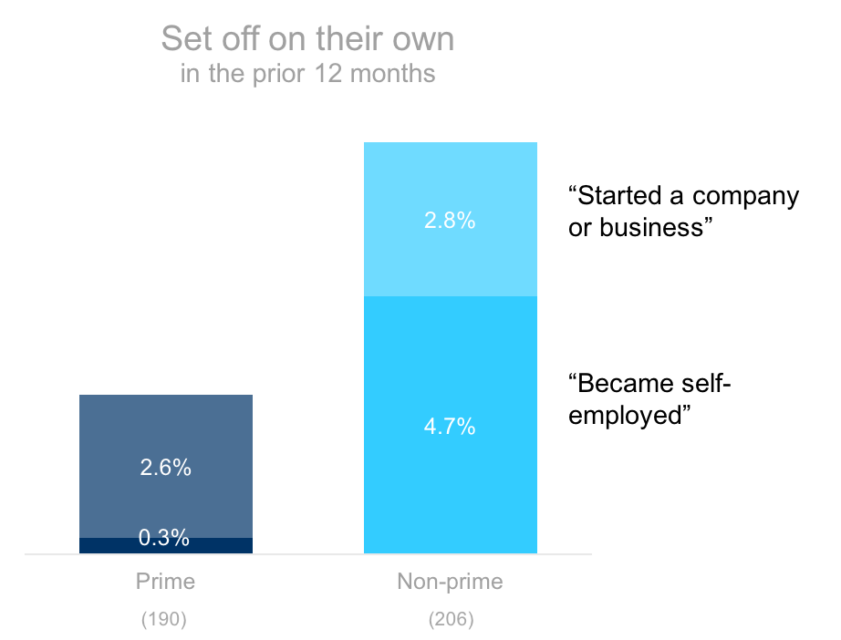

Finding a Way

Non-prime Gen-Xers are 1.6x more likely than prime to have set off on their own in the last 12 months.

Q10. Which of the following employment events occurred to you or someone in your household in the previous 12 months? “Lost a job (e.g., laid off)” and “Started a company or business”

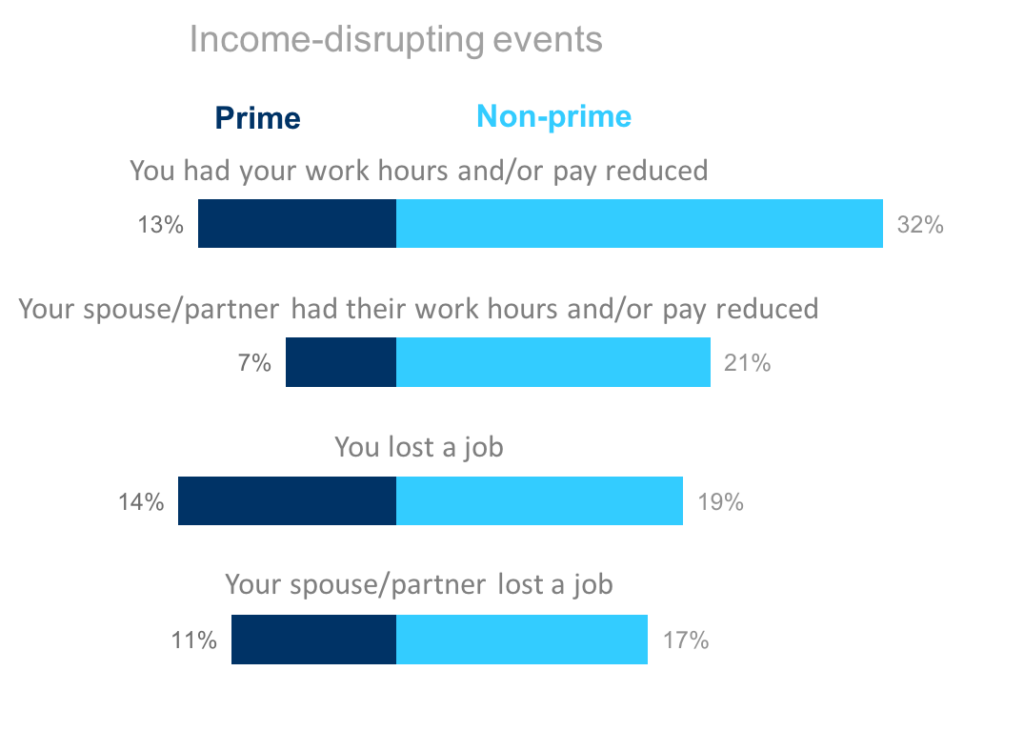

Income Disruption in the Prior 5 Years

Non-prime Gen-Xers have suffered significantly more income-disrupting events in the prior 5 years than prime Gen-Xers have.

Q28. Major Life Events in Past 5 Years – During the past 5 years, has your household experienced any of the following significant major life changes or financial events?

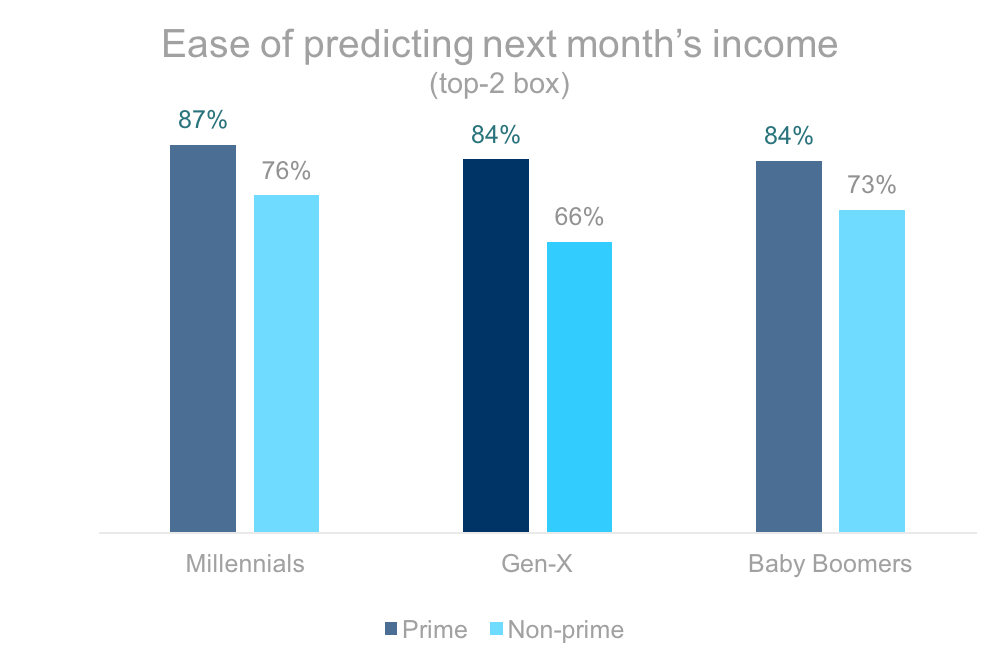

Predictability of Monthly Income

Non-prime Gen-Xers have the most difficult time of any generational cohort in predicting their month-to-month income.

Q11. How easy or difficult is it for you to predict next month’s income for your household? Would you say it is…?

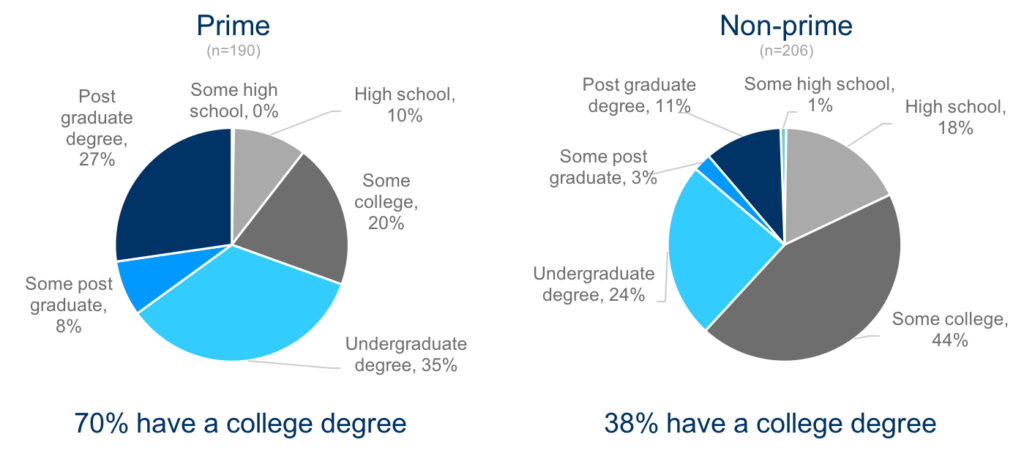

Motarboard and Tassels

Non-prime Gen-Xers don’t have as much education as their prime counterparts. As a result, they might be more exposed to the shifting job market.

S7. What is the highest level of education you have completed?

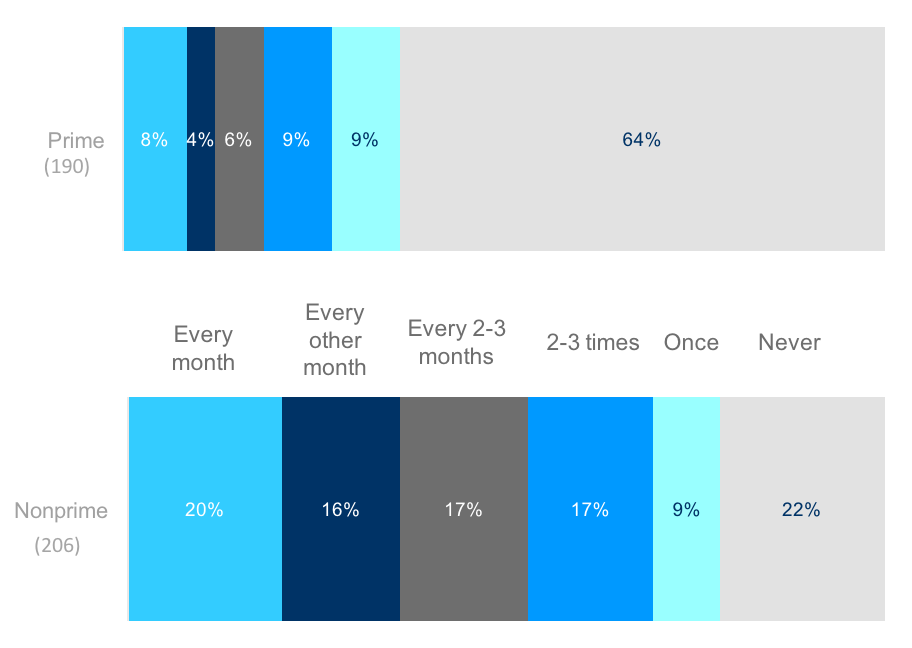

How Often Have Gen-Xers Run Out of Money in the Prior 12 Months?

1 in 5 non-prime Gen-Xers are running out of money every month. Only 1 in 5 never do.

Q12. In the past 12 months, how often has your household run out of money before the end of the month, including when you had to use credit to get by?

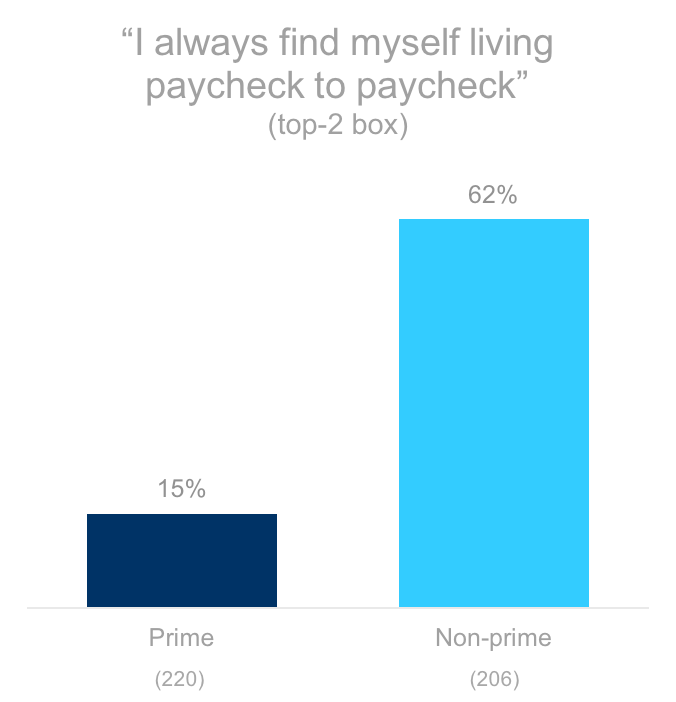

Paycheck to Paycheck

Non-prime Gen-Xers are 4x as likely to be living paycheck to paycheck compared to their prime counterparts.

Q27. On a scale of 1 to 5, where 1 is ‘strongly disagree’ and 5 is ‘strongly agree’, how much do you agree or disagree with the following statements?

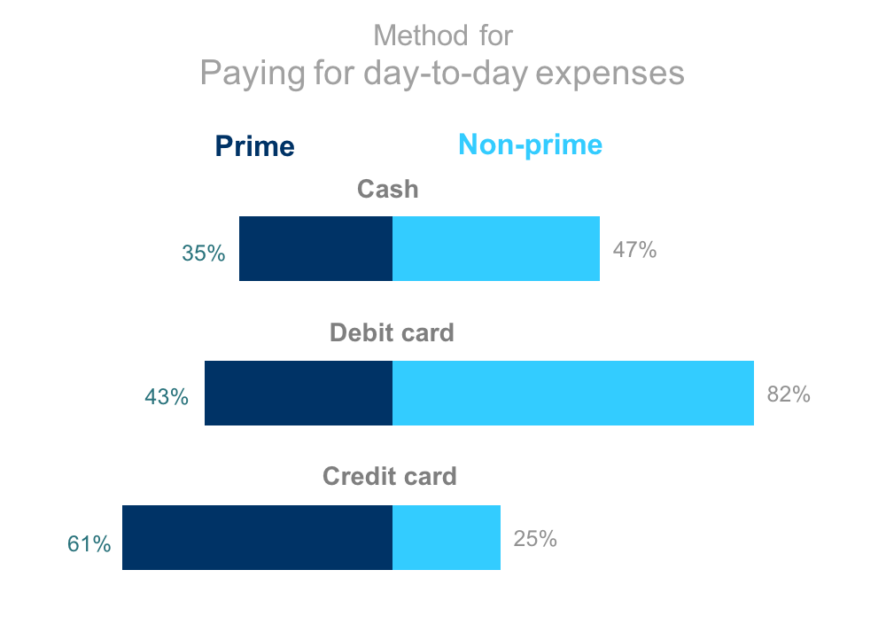

Cash Accountants

Non-prime Gen-Xers conduct their lives on a cash basis, primarily using what cash they have in the bank. Prime Gen-Xers have more flexibility and often use credit cards on a day-to-day basis.

Q22. How do you typically pay for day-to-day expenses (e.g., grocery shopping, etc.)

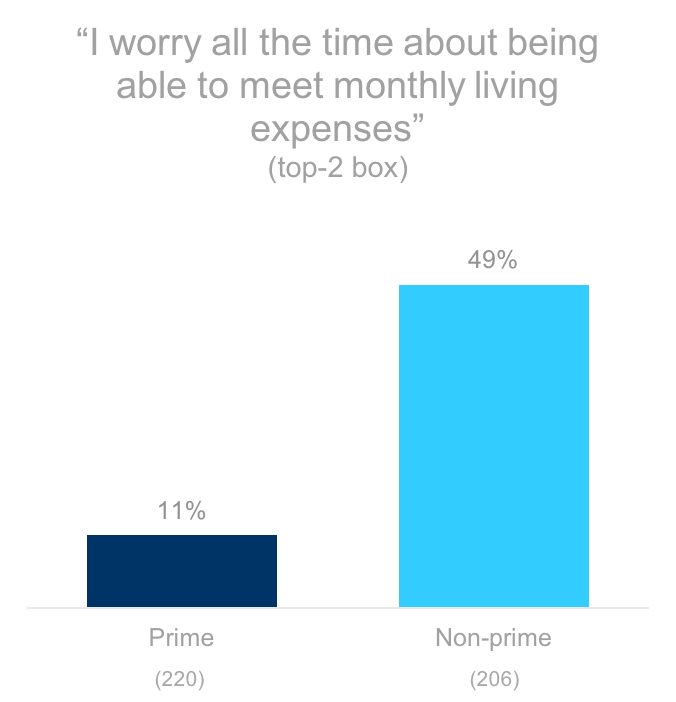

Worry About Monthly Expenses

Non-prime Gen-Xers are 4x as likely to be living paycheck to paycheck compared to their prime counterparts.

Q27. On a scale of 1 to 5, where 1 is ‘strongly disagree’ and 5 is ‘strongly agree’, how much do you agree or disagree with the following statements?

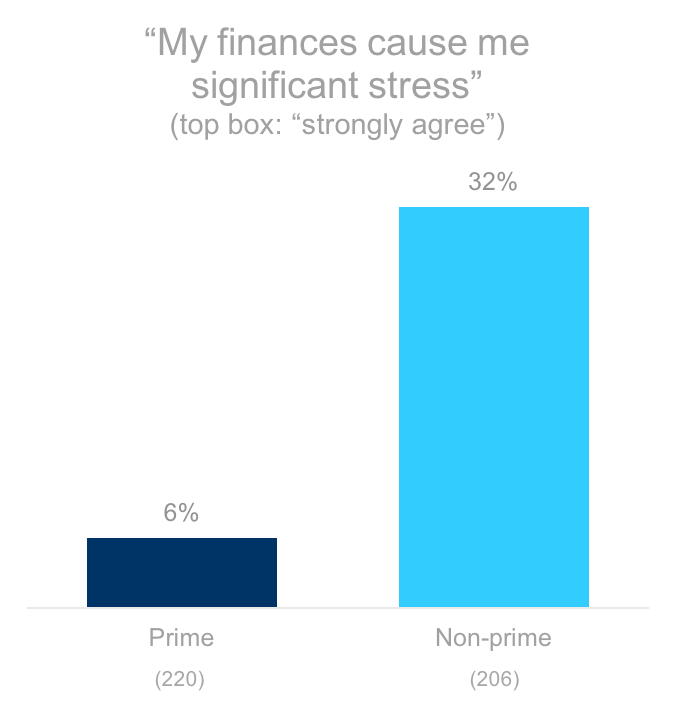

Significant Stress

Non-prime Gen-Xers are 5x as likely to feel significant stress over their finances.

Q27. On a scale of 1 to 5, where 1 is ‘strongly disagree’ and 5 is ‘strongly agree’, how much do you agree or disagree with the following statements?

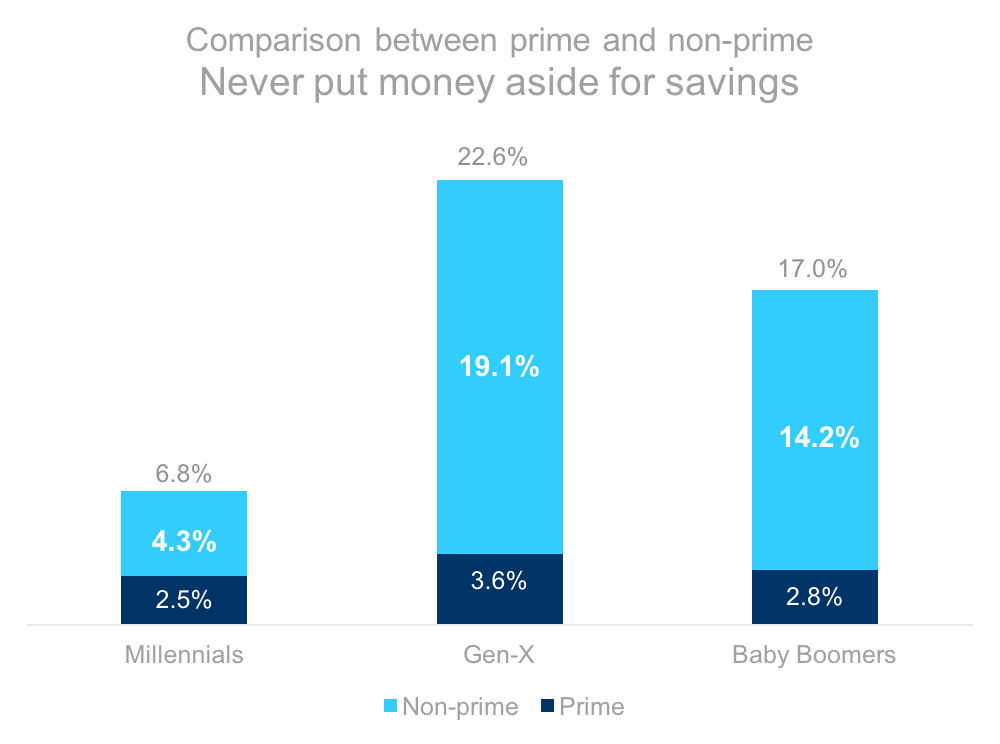

The Savings Gap

Non-prime Gen-Xers struggle more than their generational counterparts to put money aside for savings.

Q18_4. Put aside money for savings – Past 12 Month Financial Activities – Please indicate how often you engaged in the following financial activities (respondents selected “Never”)

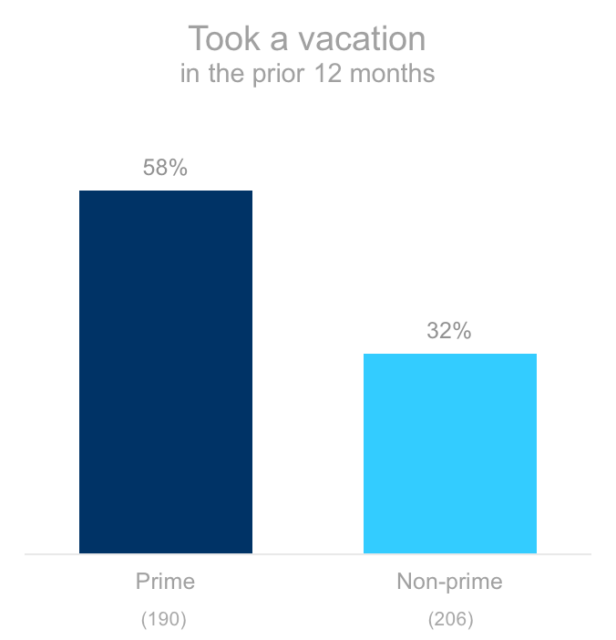

Getting Away

Non-prime Gen-Xers are 82% less likely to have taken a vacation in the last year.

Q13. In the previous 12 months, please indicate if you or anyone else in your household experienced any of the following events?

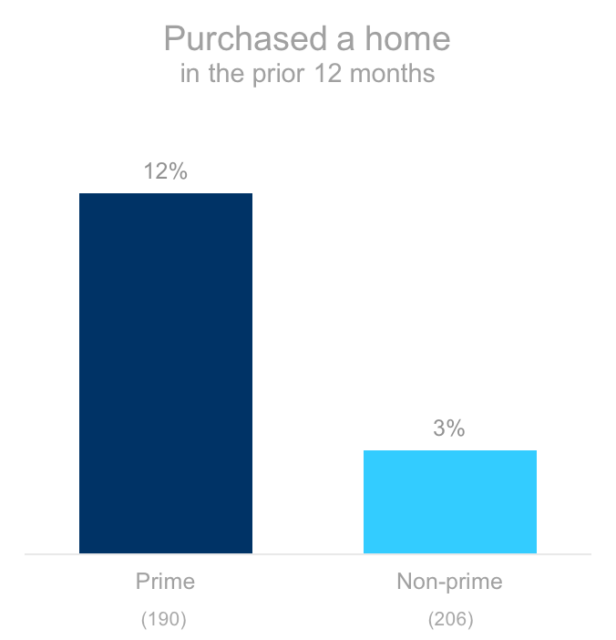

Settling Down

Prime Gen-Xers are 2.5x as likely to have bought a home in the prior year.

Q13. In the previous 12 months, please indicate if you or anyone else in your household experienced any of the following events?

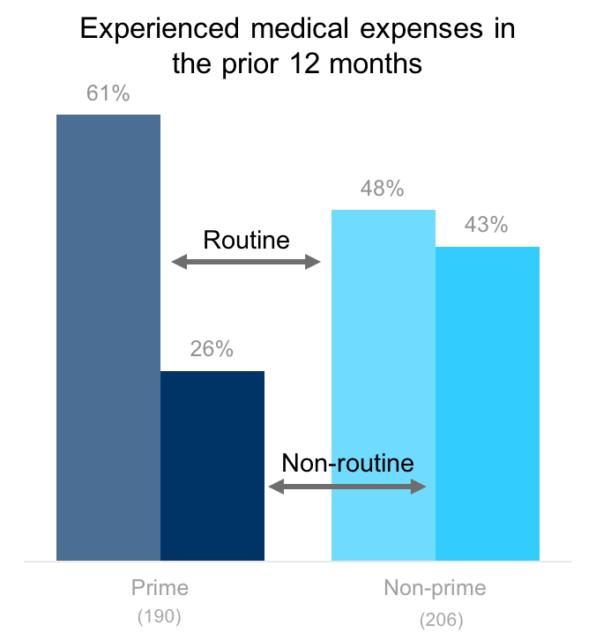

Medical Expenses

Non-prime Gen-Xers are 22% less likely to report a routine medical expense and 64% more likely to report a non-routine medical expense in the prior year.

Q13. In the previous 12 months, please indicate if you or anyone else in your household experienced any of the following events?

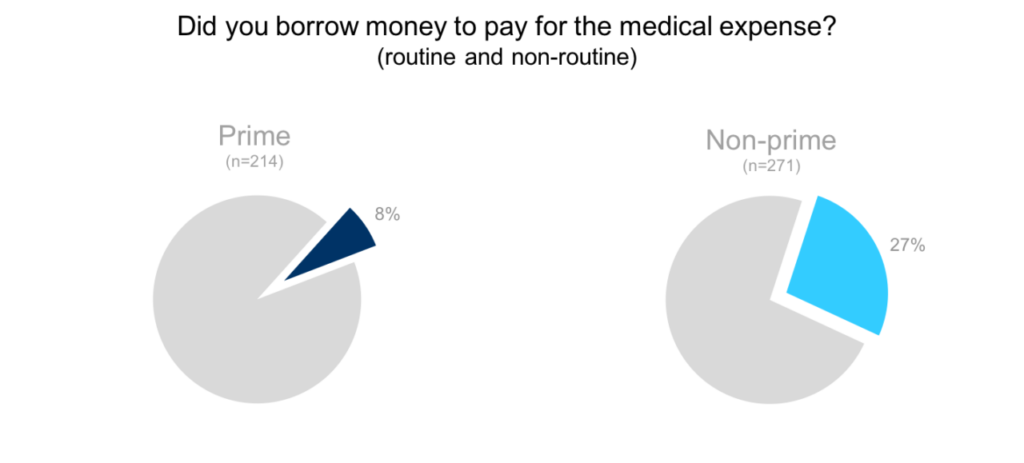

Borrowing for Your Health

Q13. In the previous 12 months, please indicate if you or anyone else in your household experienced any of the following events? Q15. Have any of the following events caused you to borrow money in the last 12 months? Borrowing means any use of credit (e.g., credit cards, loans, family/friends, etc.)

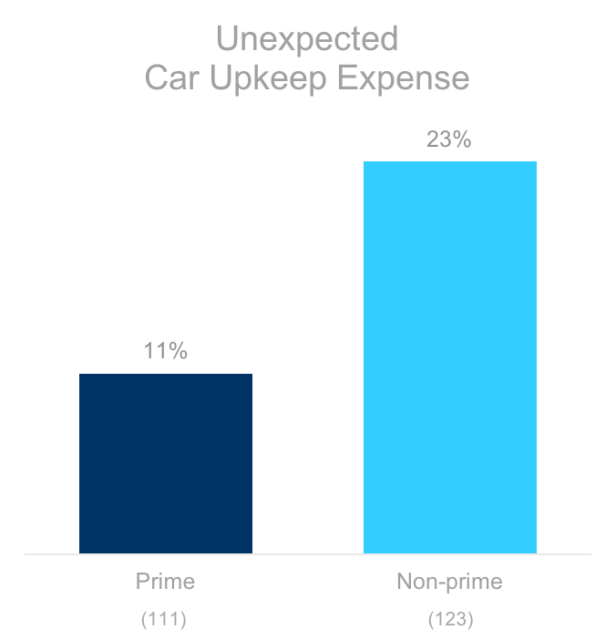

Planning the Little Things

Non-prime Gen-Xers are twice as likely to say that car upkeep expenses were unexpected.

They also don’t compare favorably with non-prime Millennials (19.6%) and non-prime Baby Boomers (13.2%).

Q14_5. Car upkeep – For the events listed below, please indicate whether they were Planned or Unexpected

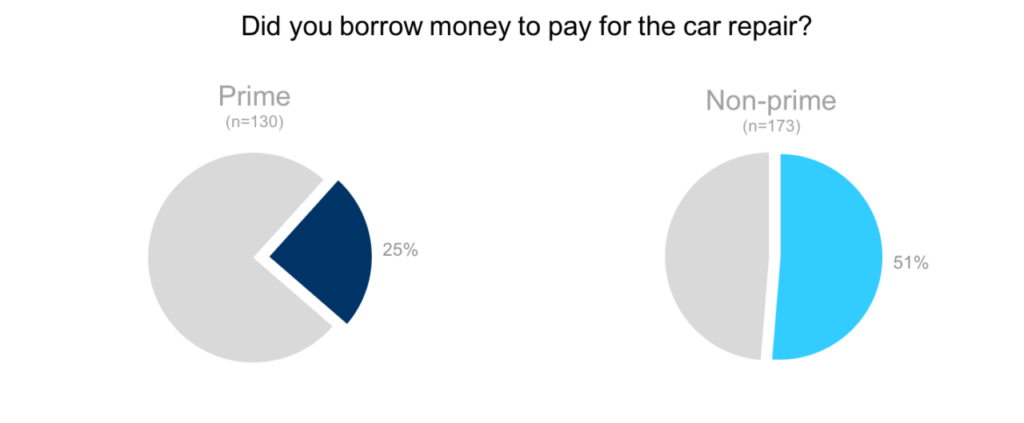

Borrowing for Your Car’s Health

Q13. In the previous 12 months, please indicate if you or anyone else in your household experienced any of the following events? Q15. Have any of the following events caused you to borrow money in the last 12 months? Borrowing means any use of credit (e.g., credit cards, loans, family/friends, etc.)

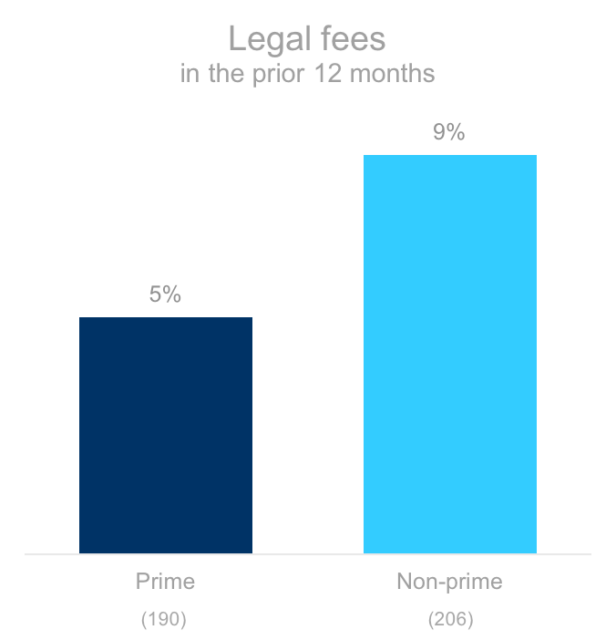

Legal Advice

Non-prime Gen-Xers are 69% more likely to have incurred legal fees in the prior year.

Q13. In the previous 12 months, please indicate if you or anyone else in your household experienced any of the following events?

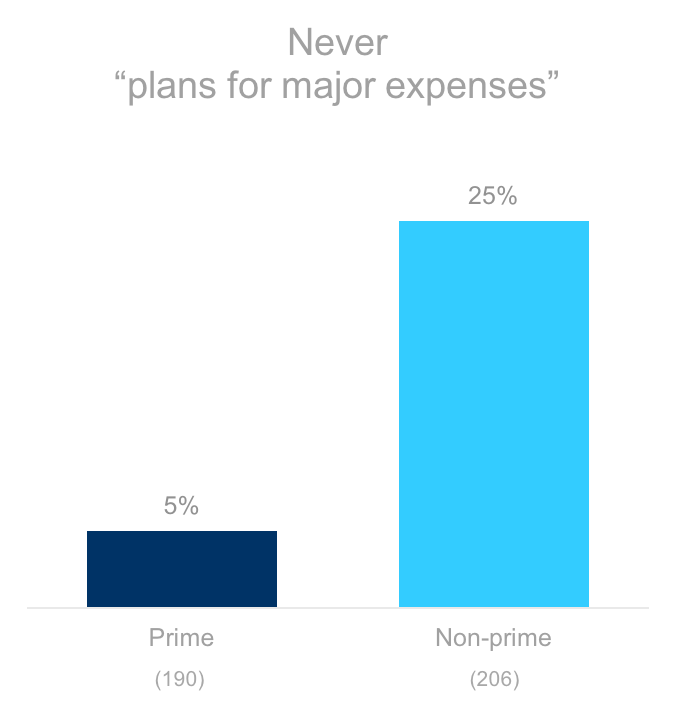

Planning for Big Expenses

Non-prime Gen-Xers are 5x more likely to say that in the prior 12 months they were never able to plan for a major expense.

Q18_2. Planned for major expenses – Past 12 Month Financial Activities – Please indicate how often you engaged in the following financial activities (respondents selected “Never”)

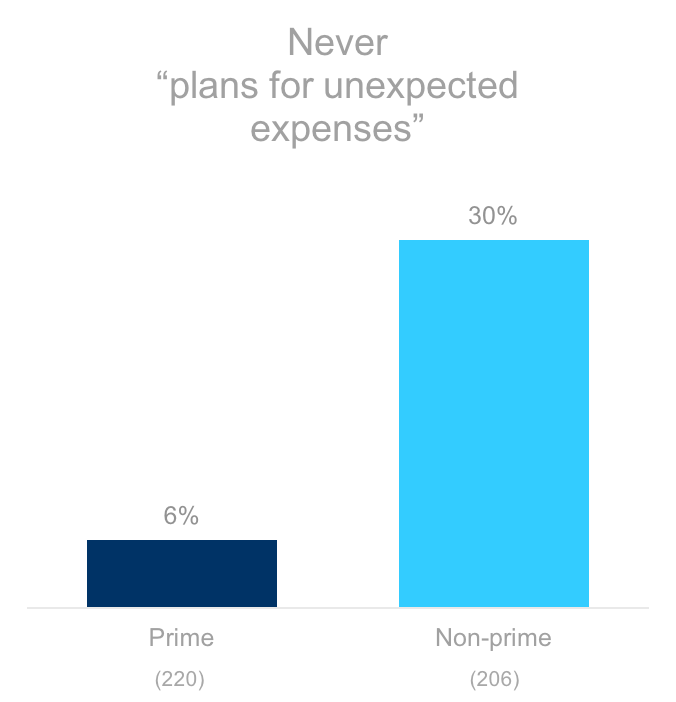

“What’s Next?”

Non-primes are 5x as likely to say that they could never plan for unexpected expenses in the prior 12 months.

Q18_3. Planned for unexpected expenses – Past 12 Month Financial Activities – Please indicate how often you engaged in the following financial activities (respondents selected “Never”)

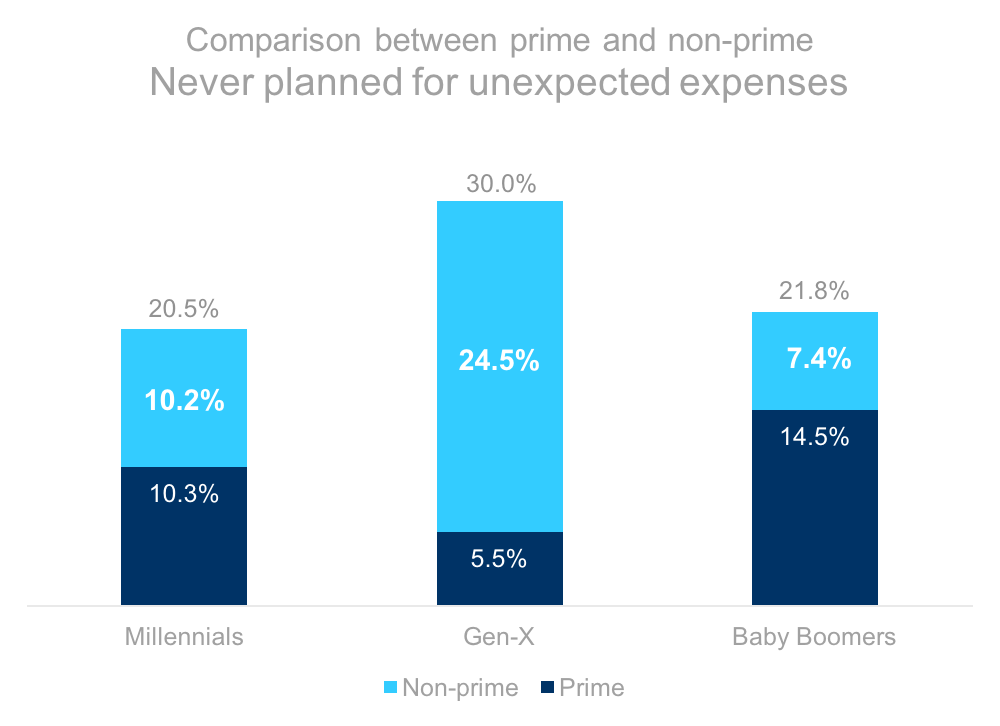

The Planning Gap

The planning gap between prime and non-prime Gen-Xers is wider than any other generation.

30.0% of non-prime say they could never plan for unexpected expenses versus on 5.5% of prime, leaving a gap of 24.5% between the two groups, significantly wider than the other generations.

Q18_3. Planned for unexpected expenses – Past 12 Month Financial Activities – Please indicate how often you engaged in the following financial activities (respondents selected “Never”)

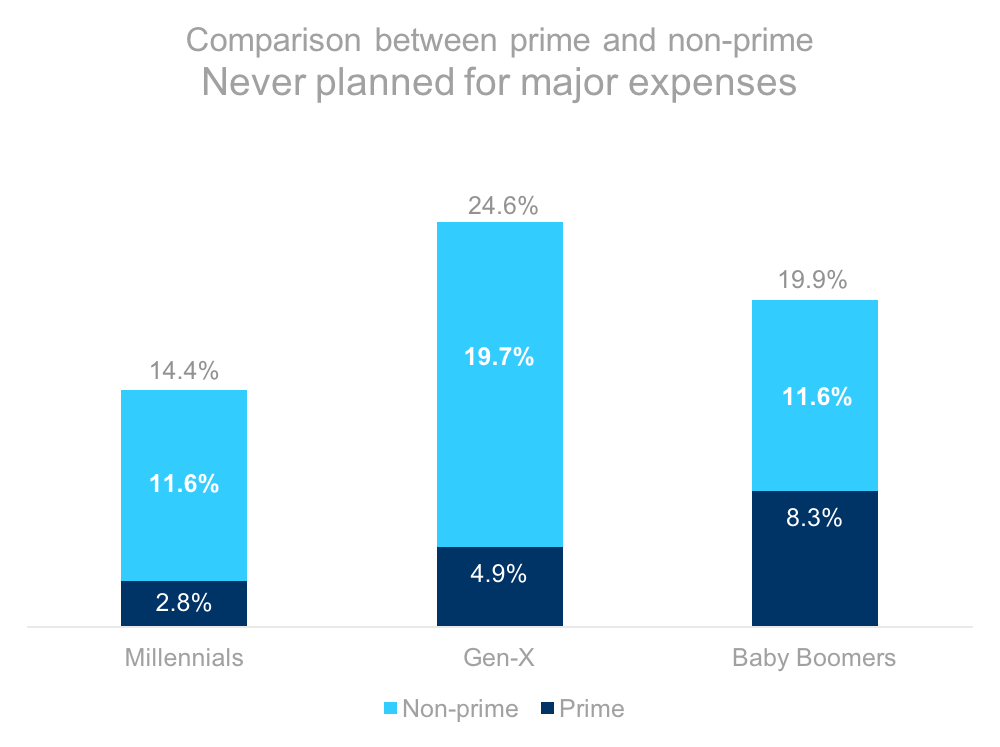

The Planning Gap

The planning gap between prime and non-prime Gen-Xers is wider than any other generation.

24.6% of non-prime say they could never plan for major expenses versus on 4.9% of prime, leaving a gap of 19.7% between the two groups.

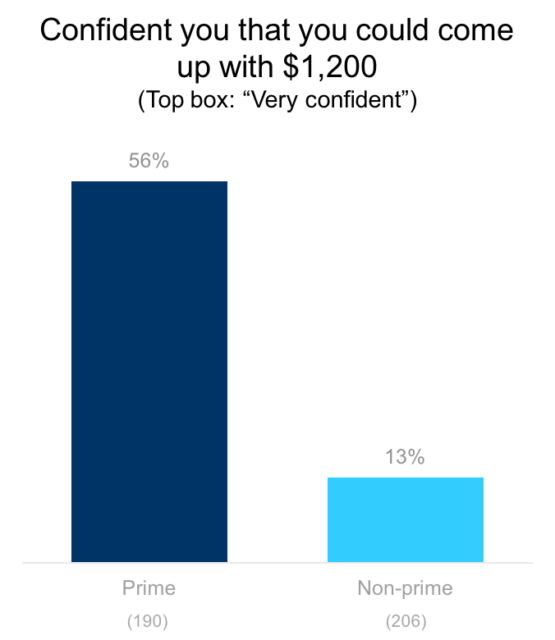

Emergency Fund

Non-prime Gen-Xers do not have confidence that they could come up with emergency funds if the need suddenly arose.

Mild confidence still shows deep ambivalence (top 2 box: 88.1% vs. 31.9%).

Q16. How confident are you that you could come up with $1,200 if an unexpected need arose within the next month?

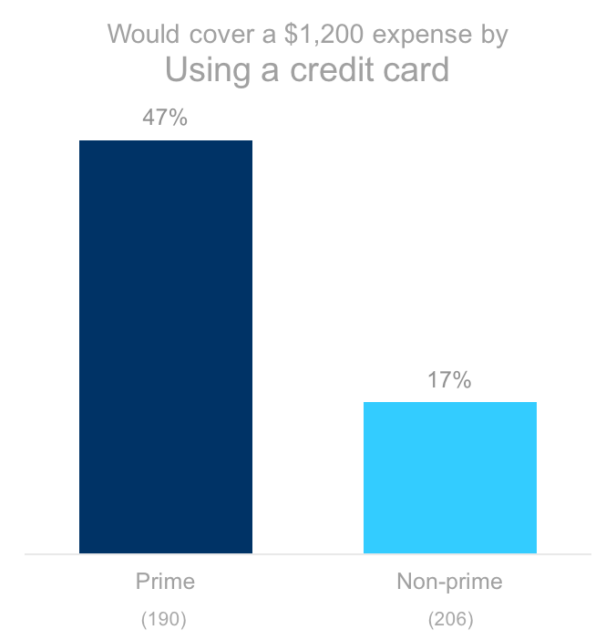

Where Would You Turn First?

Non-prime Gen-Xers can’t turn to credit cards when faced with an unexpected expense that could upend the monthly finances.

Q17. If you had one week to pay $1,200 for an emergency expense, such as a car repair or medical bill, where would you turn first to get the money?

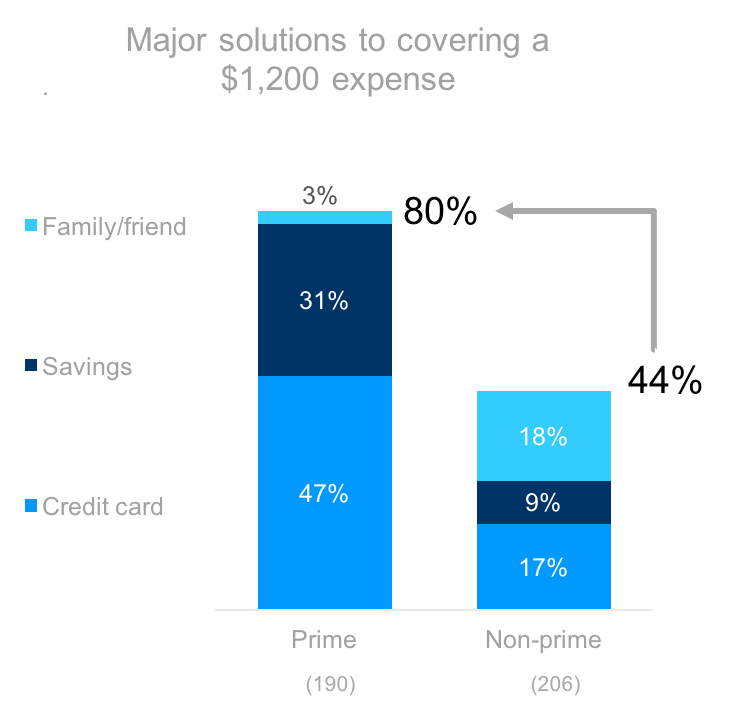

Where Would You Turn First?

A gap exists on reliable solutions for coming up with an emergency $1,200. 80% of prime Gen-Xers have a solid option while only 44% of their non-prime counterparts do.

Less than half of non-prime Gen-Xers have a reliable solution to coming up with the money they would need.

Q17. If you had one week to pay $1,200 for an emergency expense, such as a car repair or medical bill, where would you turn first to get the money?

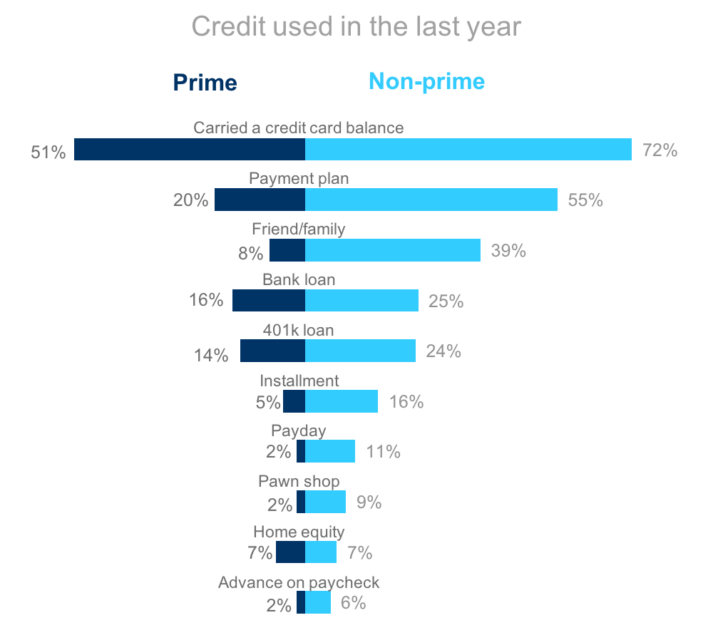

Credit Used in the Last Year

Prime Gen-Xers primarily look to credit cards and payment plans to supply their credit needs. Their non-prime counterparts look to a host of different options.

Q23. Frequency of Using Forms of Debt – Which of the following forms of debt have you used? Respondents who said “Currently use” or “Used in the previous 12 months”

Plastic

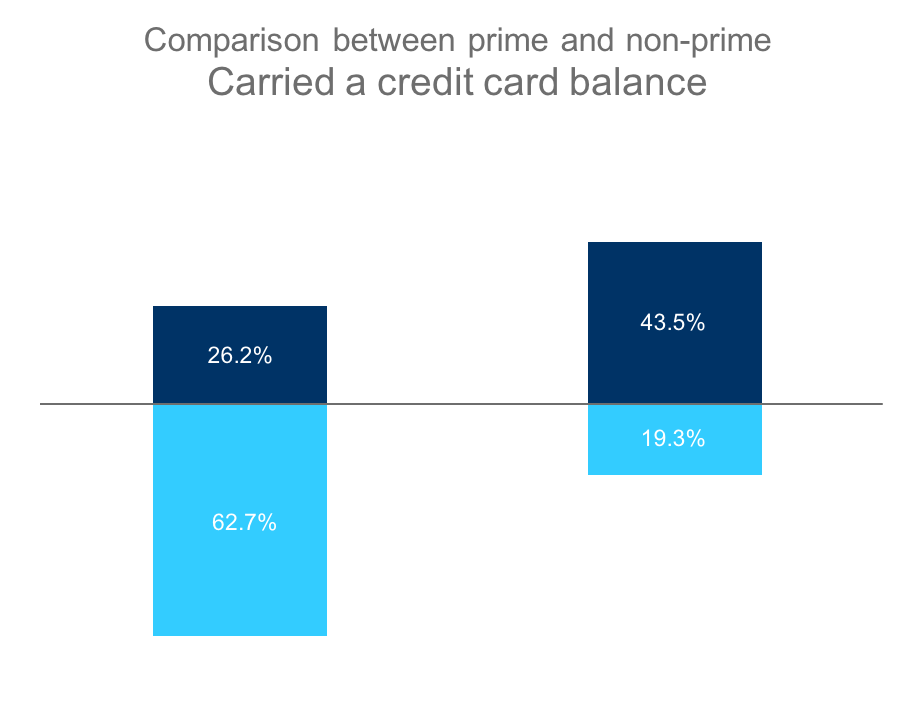

Non-prime Gen-Xers struggle more than their prime counterparts with credit card debt.

Q18_14. Carried a credit card balance – Past 12 Month Financial Activities – Please indicate how often you engaged in the following financial activities (respondents who selected “Regularly (monthly)” and “Never”)

Overdraft

2 in 3 non-prime Gen-Xers used overdraft in the prior 12 months; 24% of them used it every other month or more frequently.

They are 3x more likely to use it than their prime counterparts.

Q18_16. Overdrafted a savings or debit account – Past 12 Month Financial Activities – Please indicate how often you engaged in the following financial activities. Selections: “Regularly (monthly)”; “Occasionally (every other month)”; “Rarely (1-3 times a year)”; and, “Never”

Using Overdraft as Credit

While both prime and non-prime use overdraft as a form of short-term credit, non-prime Gen-Xers are 47% more likely to do it.

* Warning: Low sample size. Results should be considered directional only. Q19. Reasons for Overdrafting – Concerning overdrafting a savings or debit accounts in the past 12 months, which statements apply?

Too Much Debt

Non-prime Gen-Xers are 4x as likely to be living paycheck to paycheck compared to their prime counterparts.

Q27. On a scale of 1 to 5, where 1 is ‘strongly disagree’ and 5 is ‘strongly agree’, how much do you agree or disagree with the following statements?

Capital-erasing Events

Non-prime Gen-Xers are 3x as likely to have had a personal business with financial difficulty and more than 3x to sell a home that was underwater.

Q28. Major Life Events in Past 5 Years – During the past 5 years, has your household experienced any of the following significant major life changes or financial events?

Disruptions

Over a third of non-prime Gen-Xers experienced a health emergency in the prior 5 years. They are twice as likely to have experienced divorce.

Q28. Major Life Events in Past 5 Years – During the past 5 years, has your household experienced any of the following significant major life changes or financial events?

The Effects of Financial Hardship

Non-prime Gen-Xers have seen the effects of financial hardship: 13% have been through bankruptcy and 12% have received an eviction notice.

Q28. Major Life Events in Past 5 Years – During the past 5 years, has your household experienced any of the following significant major life changes or financial events?

Methodology

The primary purpose of this study was to determine how non-prime Americans were similar or different from those with prime credit on a range of behaviors and attitudes.

Interview Dates: December 6-14, 2016

Sample Specs:

- Total Respondents = 1,217

- Sample Source: Research Now Consumer Panel

Qualification Criteria:

- Ages 18-64

- Personal income: Any

- Geography – U.S. Rep

- Has primary or shared responsibility managing HH finances

- Employment: No students or unemployed

- Has a checking or savings account

Survey Instrument: 15 minute online questionnaire