The unique inflationary pressures on household finances have not abated, especially for Americans with credit scores below 700 (or “non-prime). These consumers are less likely to have access to short-term lending options to help them weather temporary financial storms. A record high number of them report day-to-day expenses and personal debt levels being less manageable than a year ago. While the cost of gas continues to strain their finances, utility and grocery costs have pinched a record number of households. This has resulted in a growing number of households who feel less financially secure than they did a year ago.

Key Findings

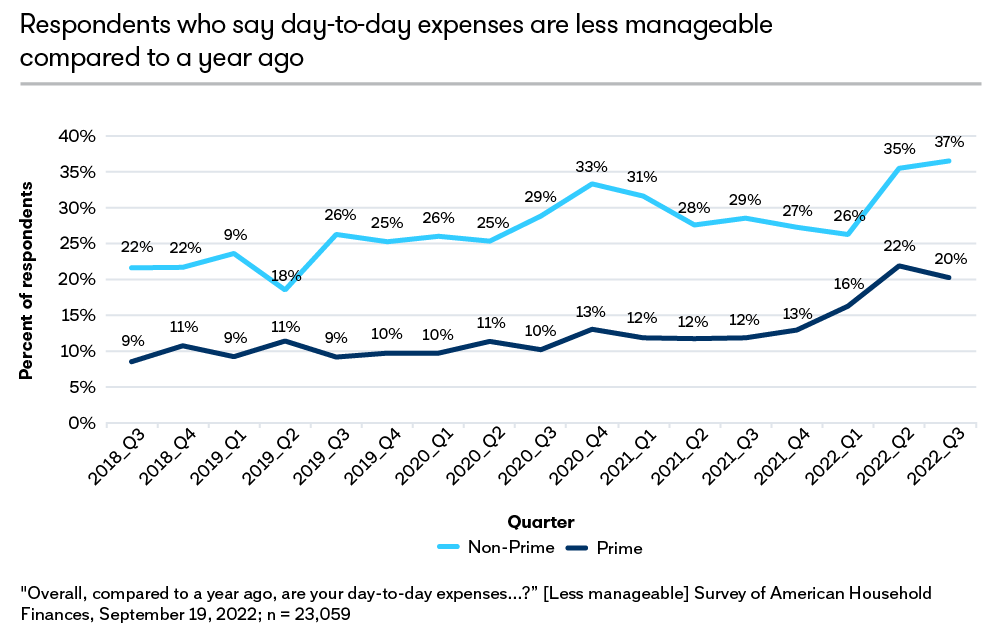

Manageability of day-to-day expenses

- The number of non-prime households who say their day-to-day expenses are less manageable compared to a year ago is up 40% from Q1 2022.

- More than a third of non-prime households say their day-to-day expenses are less manageable.

- The highest recorded percentage of non-prime households say their day-to-day expenses are less manageable

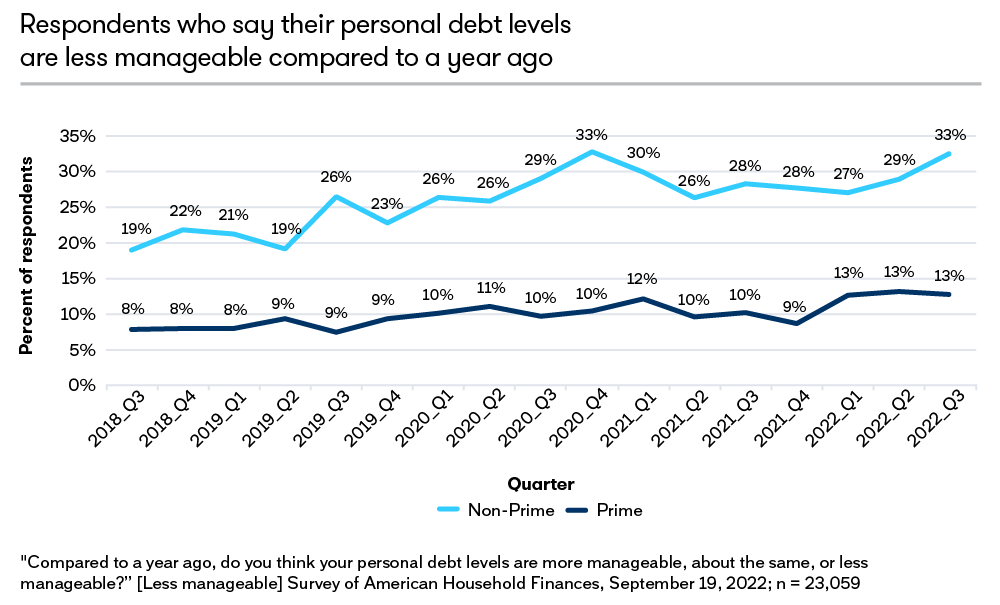

Manageability of Debt Levels

- The percentage of non-prime consumers who say that their personal debt levels are less manageable compared to a year ago is back up to pandemic highs.

- Prime respondents are holding steady for the third quarter on their highest point with 13% of them saying their personal debt levels are less manageable than they were a year ago.

- Prime households who say their personal debt levels are less manageable compared to a year ago is up 53% from pre-pandemic levels.

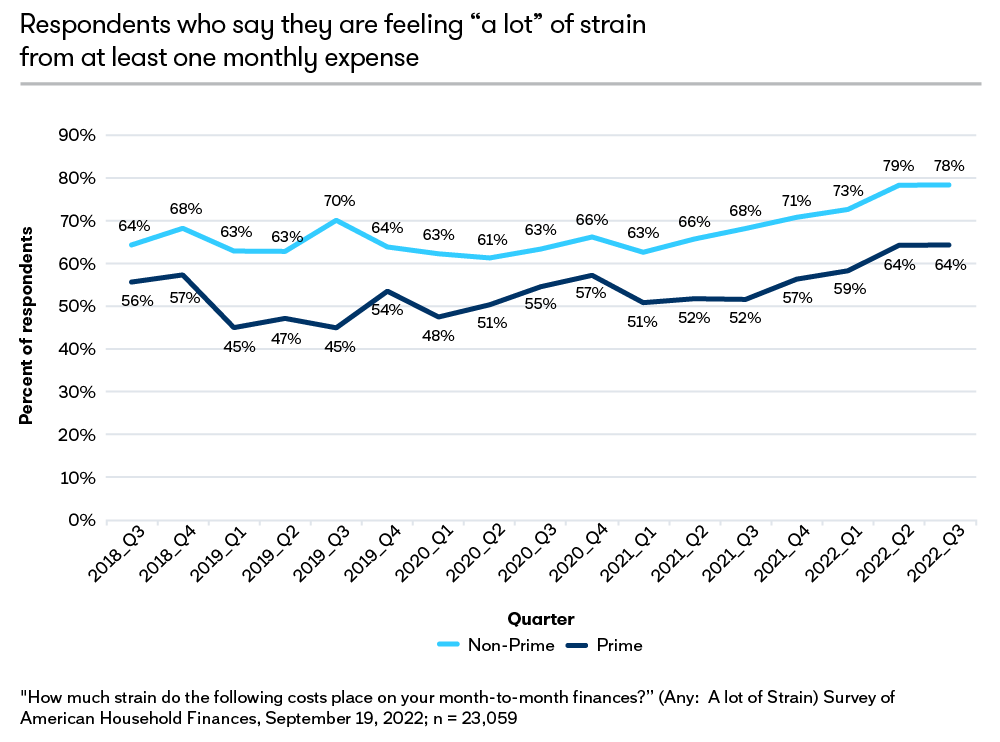

Feeling Strain

- Nearly 4 out of 5 non-prime and 2 in every 3 prime report at least one of their monthly expenses are causing them “a lot” of strain on their finances

- This measure has been growing quarterly and is up 24-25% since Q1 of 2021.

- Q3 represents the first time since Q1 2021 that we did not see quarter-over-quarter increases.

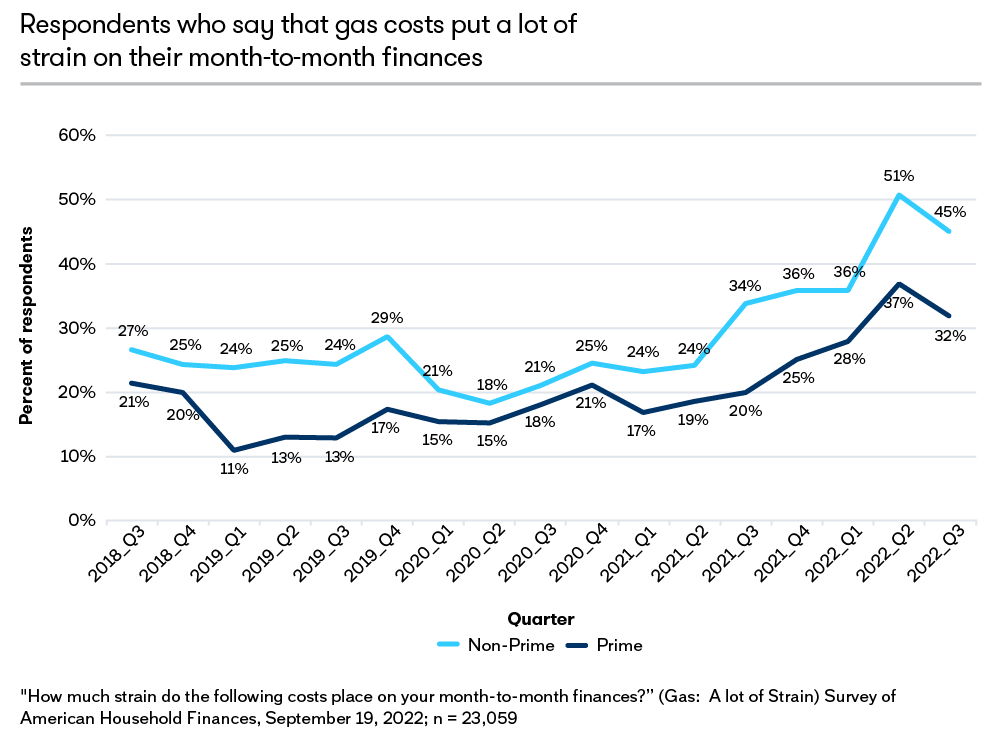

Gas

- While still historically high, the percentage of households who say the cost of gas for the automobile is putting “a lot” of strain on their finances dropped from Q2.

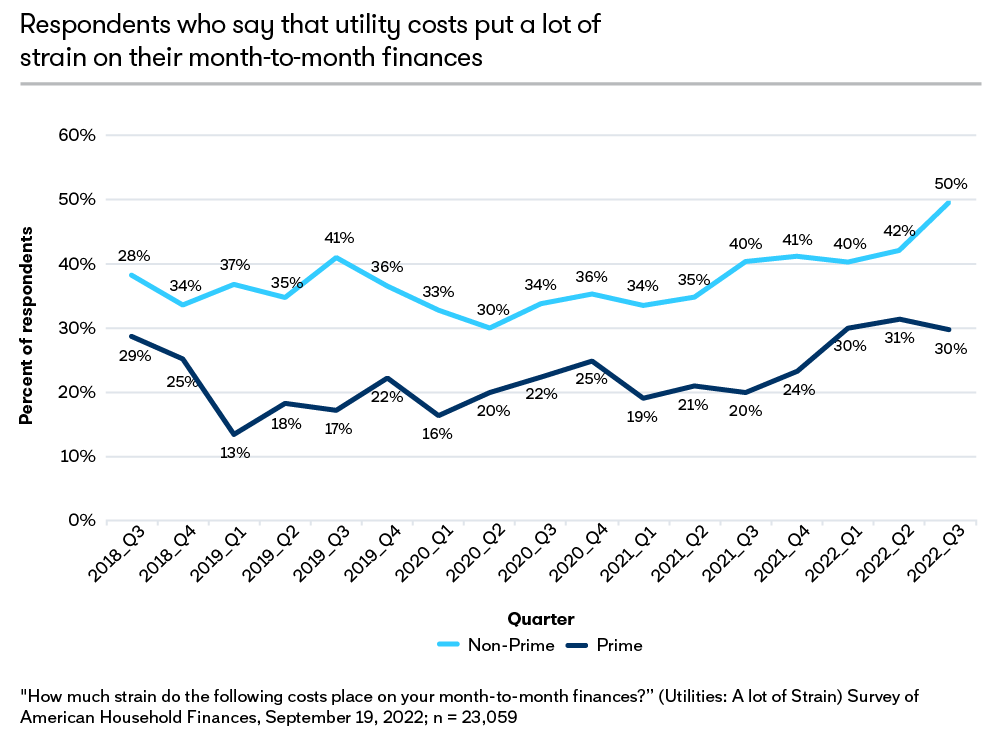

Utilities

- 50% of non-prime households now say that utility costs are putting “a lot” of strain on their finances.

- The number of non-prime households who say that utility costs are putting “a lot” of strain on their finances has risen 66% from the pandemic low in 2020.

- This measure has jumped 17% for non-prime households in the last quarter.

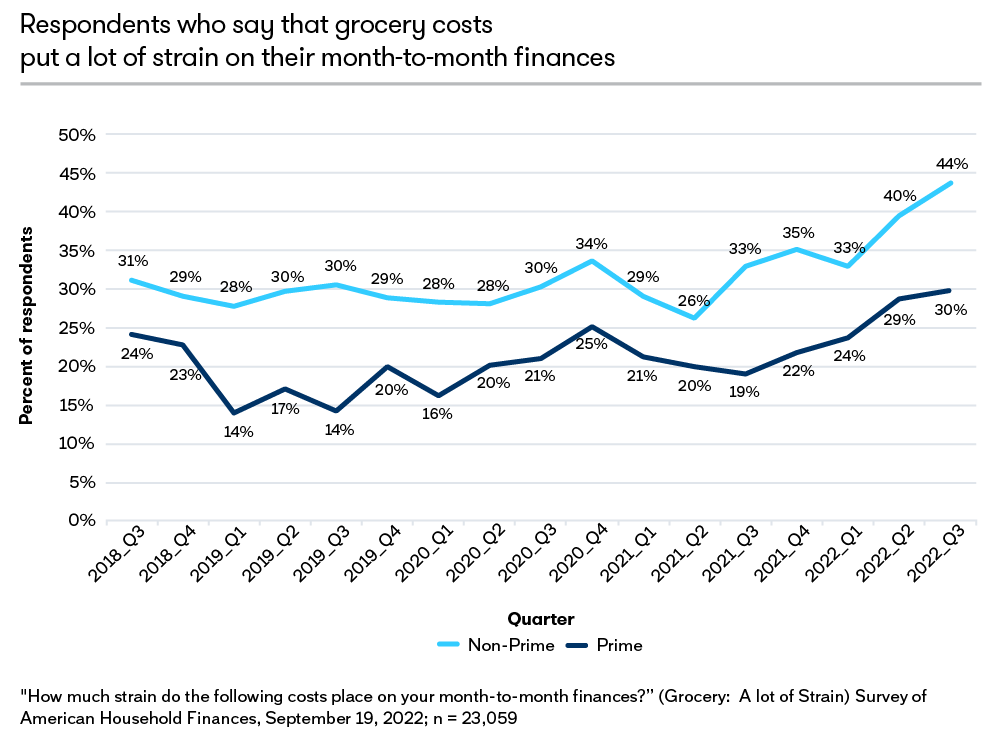

Grocery

- The number of non-prime households who say that the cost of groceries is putting “a lot” of strain on their finances has jumped 33% since Q1 and 67% from the low point during the pandemic.

- 58% more prime households say grocery costs are putting “a lot” of strain on their finances compared to a year ago.

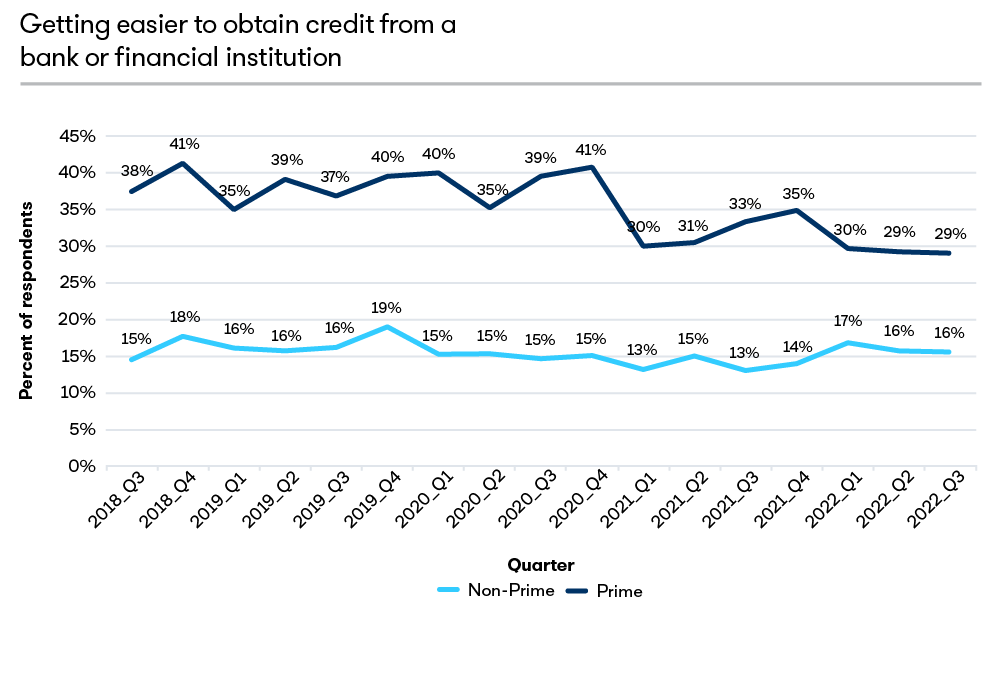

Tightening Credit Market

- The fewest prime consumers ever recorded reported that it is easier to get credit it than it was a year ago. Only 29% of prime respondents felt credit was easier to obtain.

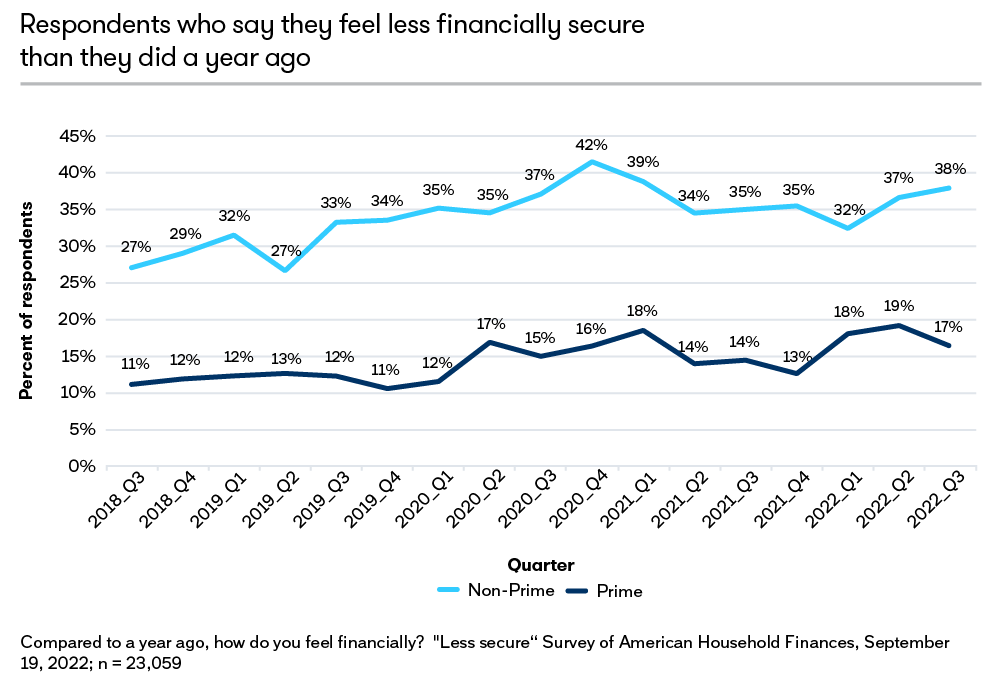

Feeling Less Financially Secure

- The percentage of Americans who say they feel less financially secure compared to a year ago has been gradually climbing.

- More than 1 in 3 non-prime respondents said that they feel less financially secure than they did a year ago.

- The percentage of prime respondents who feel less secure dropped from its high point in Q2, but is still historically high at 17%.

About The Survey of American Household Finances

The survey is a longitudinal study measuring all aspects of American household finances. It collects responses from prime and non-prime consumers every month and has been running since September 2018. This analysis included 23,338 completed surveys of a questionnaire which measures over 50 variables related to personal and household finances.