Introduction

The broad discussion in many circles about the plight of the non-prime consumer often uses assumptions about how these consumers think, what matters to them, and even what would be good for them. However, there is limited data that really explains their circumstances.

Elevate’s Center for the New Middle Class seeks to understand the differences in attitudes, experiences and behavior between consumers with prime credit and those with non-prime credit.

This study represents results from a survey of 319 U.S. nonprime consumers. Interviews were conducted in September 2018 to learn about how consumers move into nonprime status.

Non-prime Americans

“Non-prime Americans” represent the New Middle Class. These are Americans with a credit score below 700, meaning that their access to credit is limited or curtailed. Non-prime is also often further divided into “near prime,” “sub-prime,” and “deep sub-prime.”

It is the Center’s objective to better understand non-prime experiences, attitudes, and behavior.

The following report seeks to understand the financial implications of prime and non-prime consumers’ ability to cover their child’s college expenses.

Executive summary

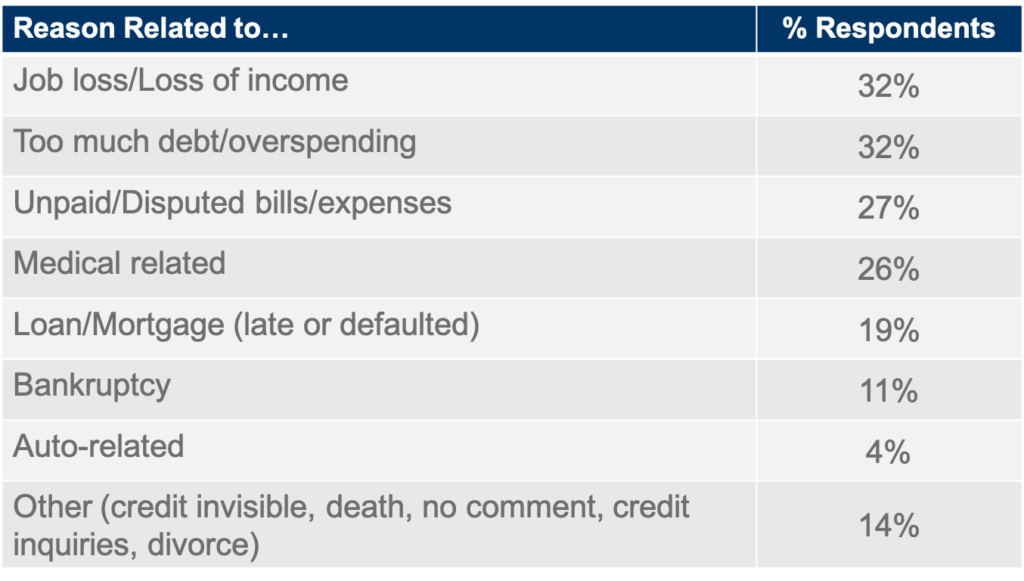

When nonprime respondents are asked to describe, in their own words, the events that led to their credit score drop, four overarching themes emerge:

•Job loss/Loss of income

•Too much debt/overspending

•Unpaid/Disputed bills/expenses

•Medical related costs

If given a list of possible reasons, or causes, for a credit score drop, almost 80% of nonprime consumers choose one or any combination of the following: Job Loss, Drop in Income, or Medical Costs.

The most common consequences of damaged credit include Using savings for bills, Bankruptcy, Divorce, or Eviction/Foreclosure.

For most nonprime consumers, a drop in their credit score is a confluence of tragic and disruptive forces that ruins their personal and financial livelihood:

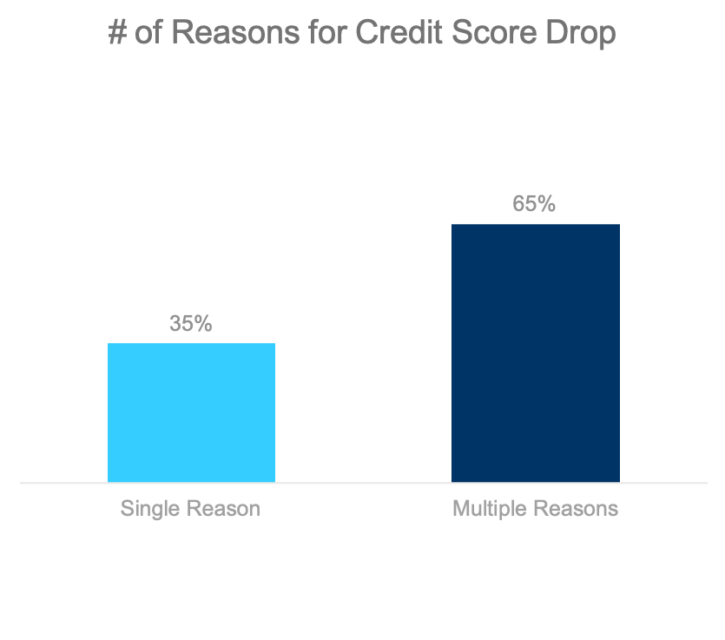

•Nonprime consumers are 86% more likely to experience multiple factors that negatively affect their credit score compared to just one.

•Of the 23% who mention a medical reason, about three-quarters (75%) also experienced an income drop, severely complicating their ability to manage and cover medical expenses.

Becoming Nonprime

Stories about Credit Score Drop

Most common 3 stories given for a credit score drop include: Job Loss/Loss of Income, Too Much Debt, or Medical Related Expenses.

Q1. In the space below, please tell the story that has led to your recent credit score drop. (n=285)

In Their Own Words: Loss of Income (32%)

About 10 years ago I had to bankrupt because I wasn’t working and got behind on my bills. Some creditors got paid and some didn’t, so I know I am left with some bad creditors who didn’t get paid and bankruptcy on my credit.

Had to file bankruptcy because an ex spent all my money, then lost jobs that paid well – now working again full time but making half what I made before which makes it difficult to pay the bills.

Hours were cut at work a while back & we had to depend on a credit card to meet some expenses. Plus I have a couple old debts that I am slowly taking care of

Was forced to resign my employment due to not being able to accept a long distance employment transfer. Also, I was over 60 and was being forced out of the office due to that as well.

I recently lost half of my income and fell behind on multiple bills such as 4 credit cards. I was receiving child support and it stopped. This caused me to miss several payments for 1 month and my credit score dropped dramatically.

Q1. In the space below, please tell the story that has led to your recent credit score drop. (n=285)

In Their Own Words: Too Much Debt (32%)

When I was younger I was very irresponsible and bad about spending and had a terrible habit of ordering things I would never be able to pay for which led to me being in debt with several different companies and phone carriers.

I had a lot of credit cards when I was younger and maxed them out. That caused my credit score to drop. I am still paying those cards off. Those cards are from Victoria’s Secret, Kohls, and Capital One.

Credit cards that are maxed out that I pay minimum balance on to many of them just to get by in-between check to check. I’m married with 2 kids and a wife, work full-time, and make $23 an hour and still barely get by.

I lived on credit cards after undergrad and through grad school. I also maxed out two credit cards/accounts, so now my debt to credit ratio is not good with a few credit accounts.

I am retired and need help around the home. I do a lot of shopping by credit card and have a large debt and some months overdraw my checking account and hold off on some payments until the next month and pay twice. Right now I am up to date but over limit on some cards.

Q1. In the space below, please tell the story that has led to your recent credit score drop. (n=285)

In Their Own Words: Medical Related (26%)

I had some medical bills and I thought I had insurance at the time. I had gotten very sick and my insurance was not in effect and did not cover the bills and so they went to a collector and on my credit score. That’s why it affected my credit score and I am still paying on it today and it is still affecting me somewhat today.

I got cancer a few years back and trying to rebuild my score now, also changed my job, wife also lost her job during this time. Now I am working with my bank to fix my score.

Had a back injury at work and got behind on bills and it affected my credit report. My monthly income was cut in half and had medical bills on top of the bills I already had.

Got sick and had a lot of medical bills that I couldn’t afford. They were longer than 5 years ago I figured it wouldn’t affect my credit but it did. Trying to get my credit back up but it’s hard when I can’t get anyone to give me a LOC.

My husband had his own business and started using all our credit cards to cover his business expenses. Then we started having major medical bills that we weren’t able to pay. Trying to pay what I can, but extremely difficult since both of us are disabled and living on SS and disability it’s extremely difficult.

Q1. In the space below, please tell the story that has led to your recent credit score drop. (n=285)

In Their Own Words: Unpaid Expenses (27%)

I had a great stable job and home. After leaving my hometown for my boyfriend and moving in he soon became dependent on me to support him making my personal financial situation suffer. He couldn’t sign for an apartment or car or even get a credit card. Child support ended up taking a majority of his paycheck weekly, and sooner or later before you knew it, he was unemployed leaving me responsible for all the finances for two of us. I could not keep up with the bills had an eviction repossession and every credit card I had was maxed out and I wasn’t able to pay it back. Just trying to make ends meet and it still affecting me to this day.

I was very young and dumb and naïve. I thought it was okay to not pay bills. I opened credit cards and maxed them out and didn’t want to pay………………

My husband is an alcoholic and drug addict and he doesn’t pay our bills and he steals money and money comes up missing and that’s why my credit is bad because a lot of our bills were in my name.

Q1. In the space below, please tell the story that has led to your recent credit score drop. (n=285)

In Their Own Words: Loan/Mortgage (19%)

Have tons of student loan debt due to mistakes I made when I was younger. This also includes credit card debt due to a lifestyle I tried to live that I couldn’t afford at the time.

Housing market crash. Major overpayment of a house that was way too expensive and still not worth the money that was paid for it. Unable to use harp program because not qualified (was really qualified) then home was auctioned for less than I was willing to pay.

I have assisted family members with their debt responsibilities which resulted in too many high interest consumer loans and credit card charges. I have no one who is willing or able to help me with my financial situation.

Helping my kids at a time when I shouldn’t have. Now those debts have been paid off and show zero balances, my credit score is moving forward. It’s moving forward at a slow pace because I have not applied for new credit and paid off many of my accounts.

It was simple, I co-signed a loan and they had trouble paying it, which reflected onto me. I also then had trouble paying off credit card debt that my father got me into. Then my mortgage ended up falling behind and I had to catch up on that.

Q1. In the space below, please tell the story that has led to your recent credit score drop. (n=285)

Reasons for Nonprime Status: Causes

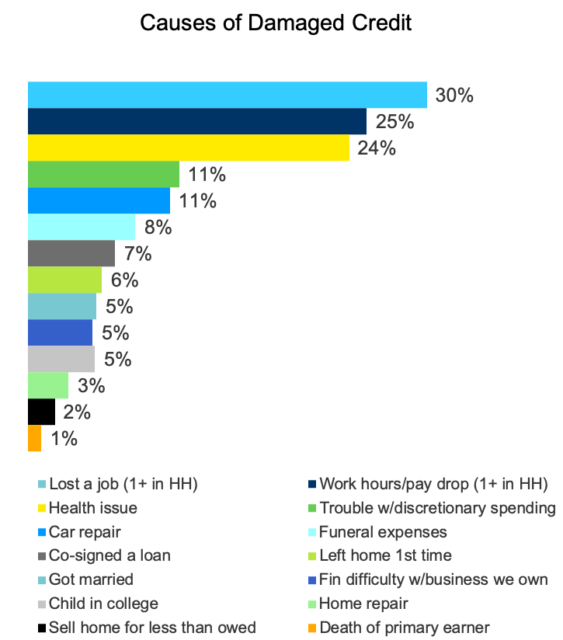

Reasons for becoming nonprime can be bucketed into two broad categories: Causes and Consequences. Most common Causes include Loss of job, Reduced work hours, or Medical-related costs.

Q2. Please look at the situations below and select those which took place at the same time as the credit disruption. (n=293)

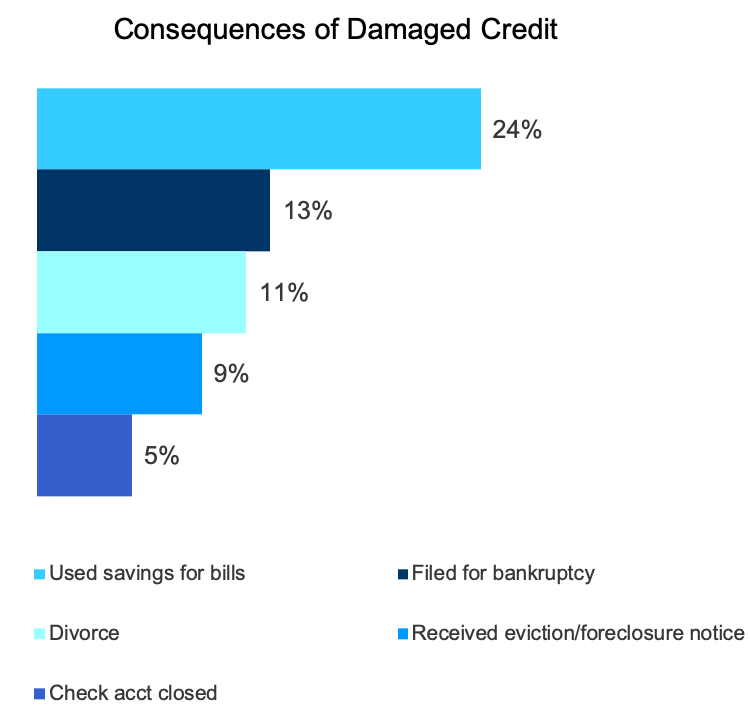

Reasons for Nonprime Status: Consequences

Most common Consequences of damaged credit include Using savings for bills, Bankruptcy, Divorce, or Eviction/Foreclosure.

Q2. Please look at the situations below and select those which took place at the same time as the credit disruption. (n=293)

Multiple Factors Drive Credit Erosion

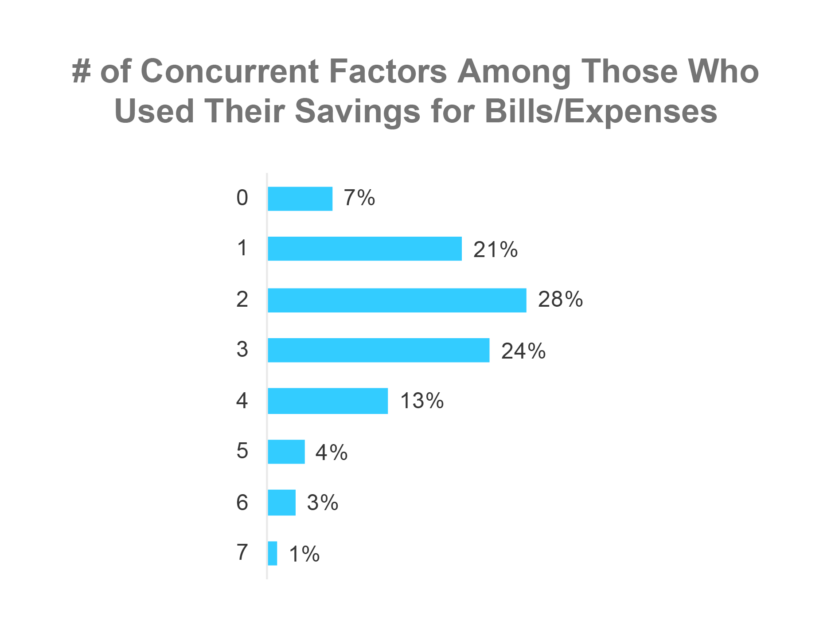

Almost two-thirds of nonprime consumers report that multiple concurrent factors led to the drop in their credit score.

Q2. Please look at the situations below and select those which took place at the same time as the credit disruption. (n=319)

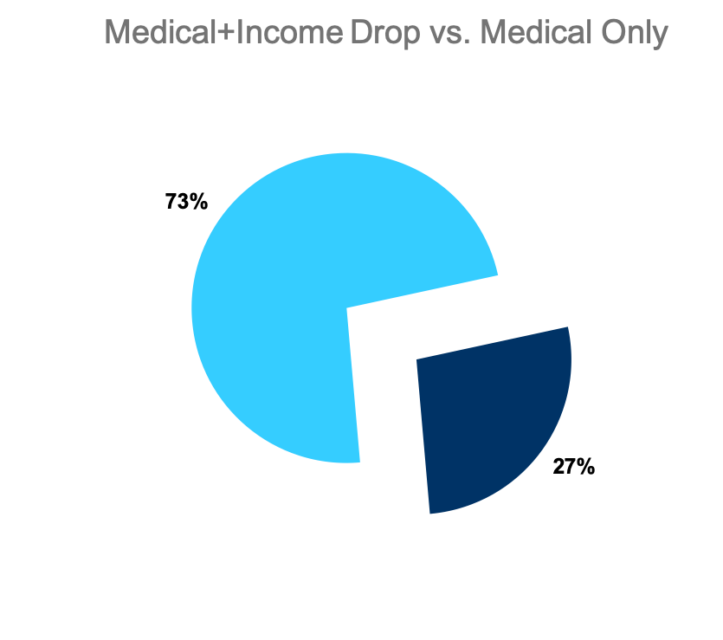

Drop in Income Accompanies Medical Problems

Almost three-quarters (73%) of nonprime consumers mention both a medical reason and an income drop (due to job loss, temp disability, or new job), which severely complicates their ability to manage and cover medical expenses.

Just over a quarter of consumers cite only a medical-related issue as a factor.

Q2. Please look at the situations below and select those which took place at the same time as the credit disruption. (n=293)

Likelihood to Use Savings Account

Among nonprime consumers who had to use their savings to cover bills/expenses, 93% experienced one or more factors that contributed to their credit score drop.

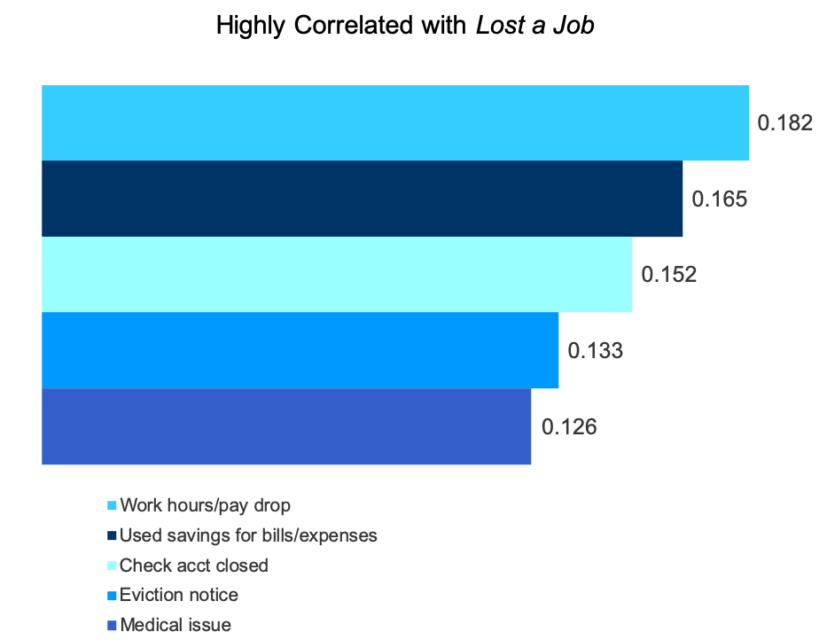

Reasons for Nonprime Status: Lost a Job

Losing a job can result in a cascade of other unfortunate situations that adversely impact credit: 1) Drop in pay; 2) Using savings to cover bills; 3) Had checking account closed; 4) Evicted from home; or 5) Needed to take care of a sick family member.

Q2. Please look at the situations below and select those which took place at the same time as the credit disruption. (n=293)

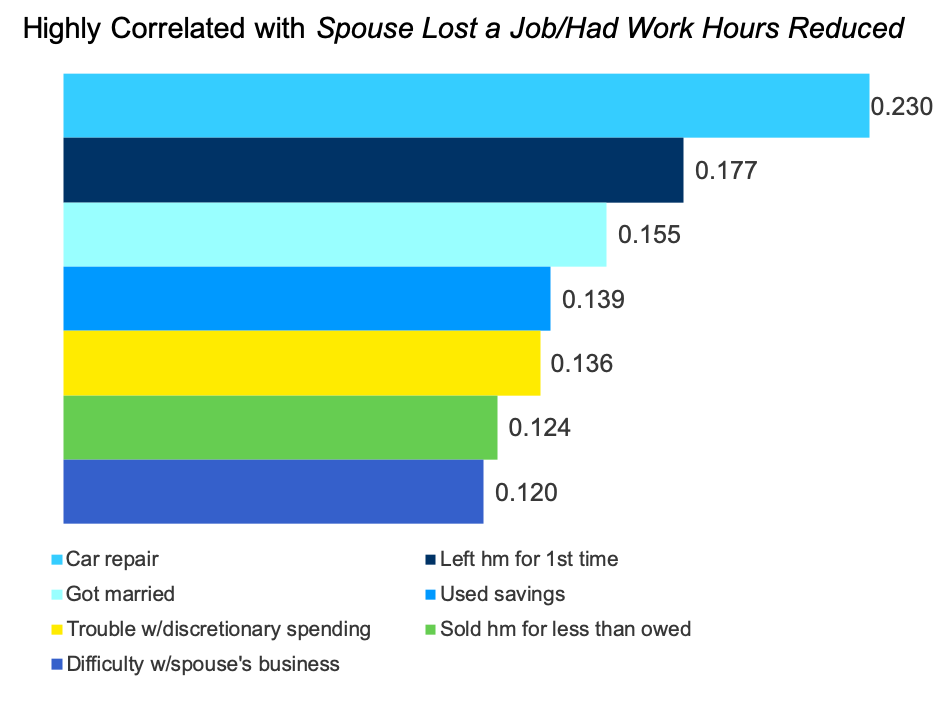

Reasons for Nonprime Status: Spousal Income Reduction

A spouse’s loss of income is closely tied to other situations that damage credit: 1) Car repair; 2) Left home for first time; 3) Getting married; 4) Using savings; 5) Overspending; 6) Sold home for less than what’s owed; or 7) Difficulty with spouse’s business.

Q2. Please look at the situations below and select those which took place at the same time as the credit disruption. (n=293)

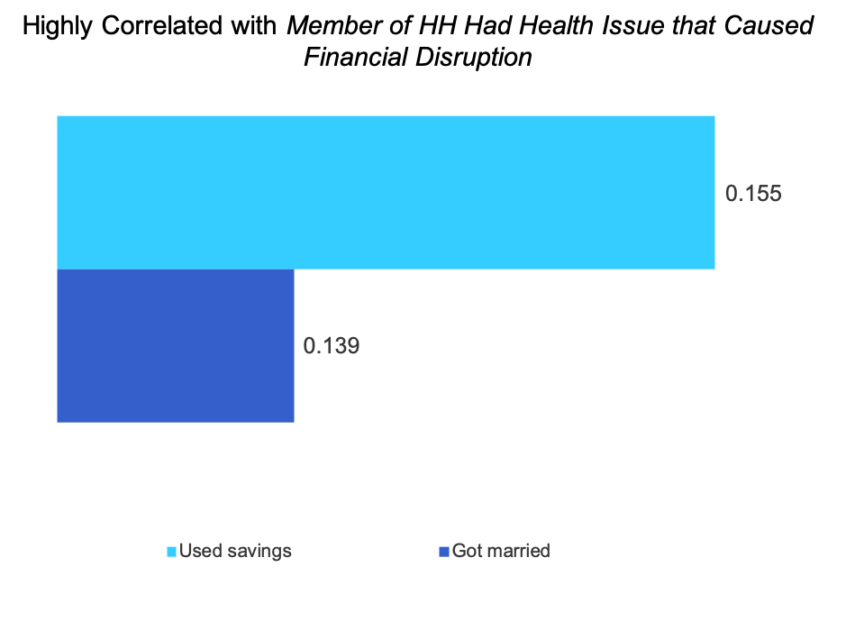

Reasons for Nonprime Status: Health Issues Deplete Savings

If a household member has a health issue that causes financial disruption, this can result in Using Savings to Cover Bills/Expenses. Getting Married is also highly associated which could be related to when spouses join health plans.

Q2. Please look at the situations below and select those which took place at the same time as the credit disruption. (n=293)

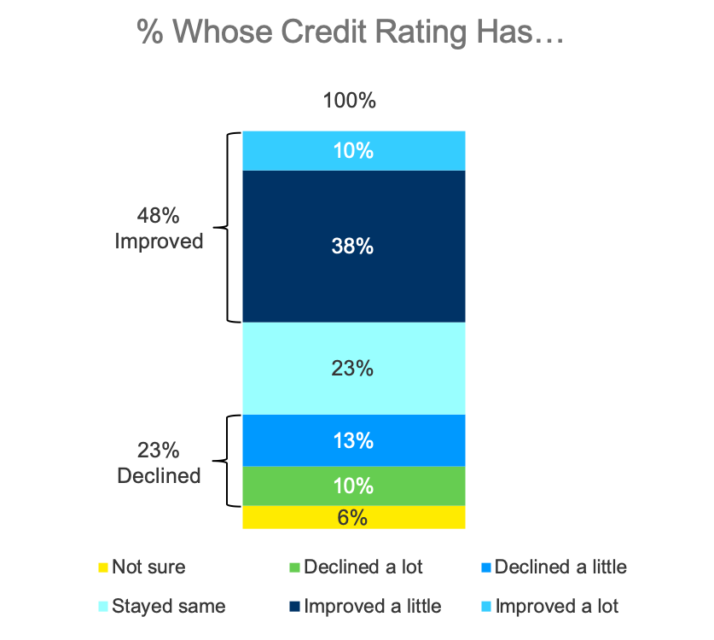

Credit Rating Change Over the Last 12 Months

Almost half of all nonprime consumers claim their credit rating has improved over the last 12 months.

Around a quarter indicate there’s been no change and another quarter suggest it’s actually declined.

Q9. How has your personal credit rating changed over the past 12 months? n=293

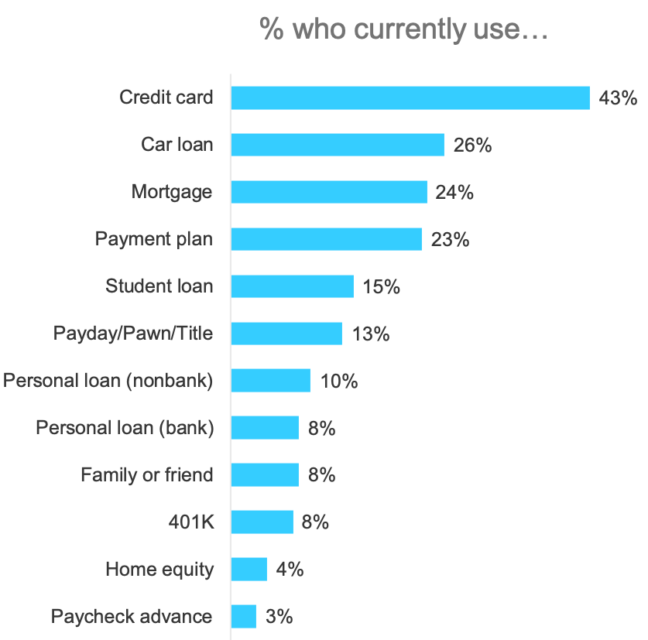

Credit/Lending Activity

Type of Debt Currently Used by Nonprime

The most frequently used debt instrument by nonprime consumers are credit cards. A little less than half (43%) currently use a credit card.

Around a quarter currently use a car loan, mortgage, or have a payment plan for a bill. Notably, 13% have used a payday, pawn or title loan, and 10% used a nonbank loan.

Q8. When, if ever, have you used the following forms of debt? n=293

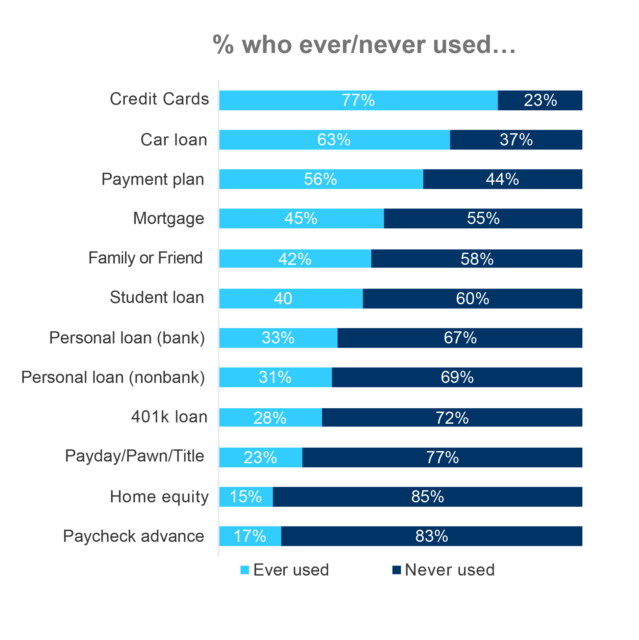

Types of Debt Ever/Never Used by Nonprime

Over three-quarters have ever used credit cards, and around a third have ever used a personal loan, either from a bank or nonbank institution.

Q8. When, if ever, have you used the following forms of debt? n=293

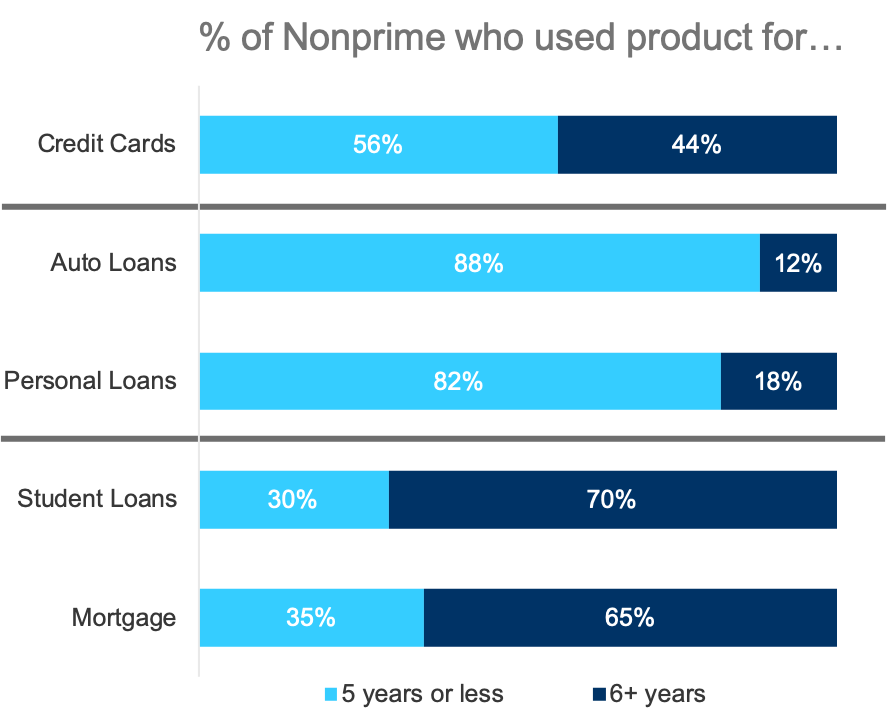

Length of Time Using Various Lending Products

In terms of how long a lending product has been held, credit cards differ from other lending products in that they’re held for both short and long periods of time.

Most auto and personal loans are held for 5 years or less, while student loans and mortgages are more long-term (e.g., 6 or more years).

Q4. For each lending product listed below, approximately how long have you used that product. n=293

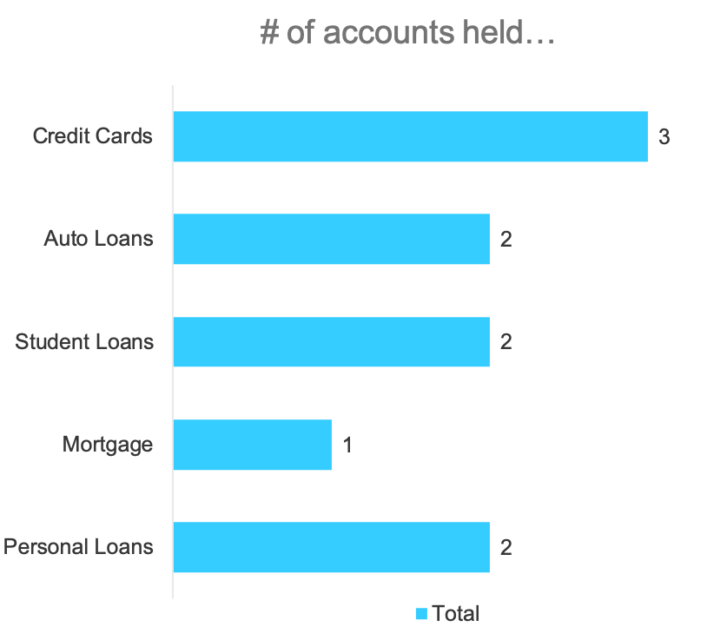

Number of Accounts Used in Last 7 Years

For nonprime consumers who’ve used each account type, on average they hold three credit card accounts, and two auto, student or personal loans. Not surprisingly, most who have a mortgage only have one.

Q5. For each product listed below, please indicate the number of accounts you have had in the last 7 years. n=293

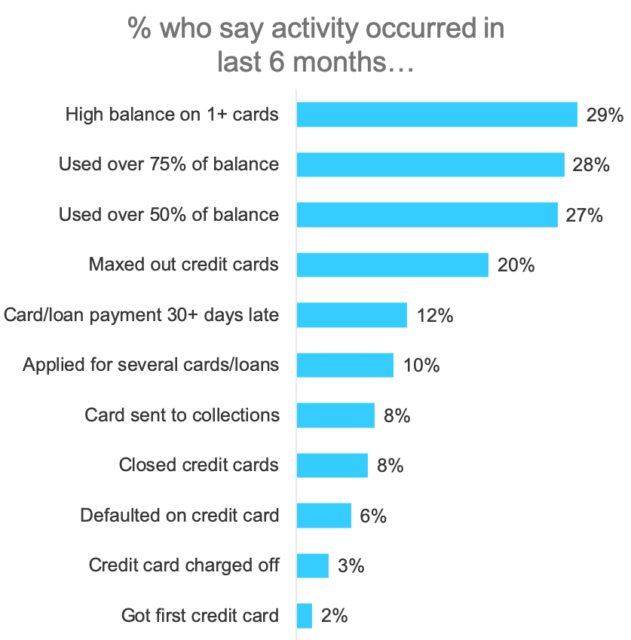

Activities Related to Credit Cards

Almost a third of consumers carry a high balance on one or more cards, while little over a quarter have used 50% to 75% of their existing balance, and 2 out of 10 max them out.

A smaller percentage had their card(s) sent to collections, account closed, defaulted or charged off.

Q6. Listed below are items that can affect your score. For each item please select how recently it occurred or never at all. n=293

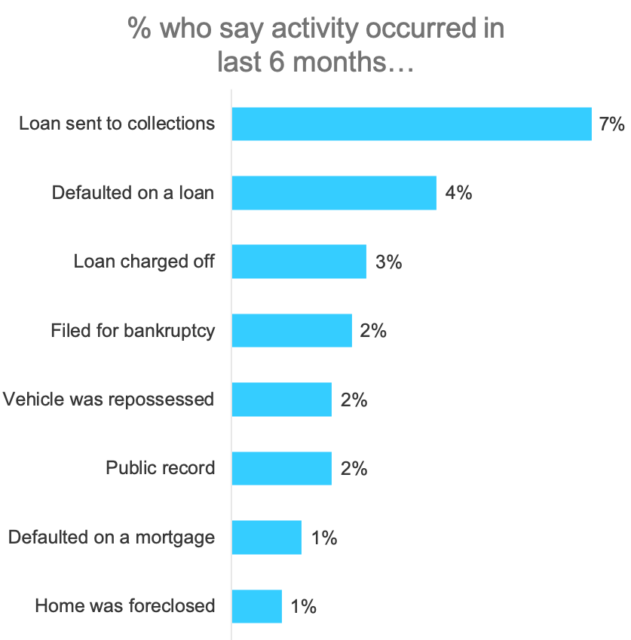

Activities Related to Loans

Under 10% of consumers have had a loan sent to collections, defaulted, charged off, or defaulted on a mortgage.

Q6. Listed below are items that can affect your score. For each item please select how recently it occurred or never at all. n=293

Methodology

The primary purpose of this study was to explore the causes of a credit score drop among nonprime consumers.

Sample Specs:

•Total Respondents = 319 nonprime consumers

•Sample Source: Variety of panels used by Qualtrics

Qualification Criteria:

•HH Income between $25K – $149K

•Employed (full, part-time, own business), homemaker, or retired

•At a minimum, equally shares management of household finances

•Self-reported credit score below 700

•Geography – U.S. Rep

Survey Instrument: 10-minute online survey.

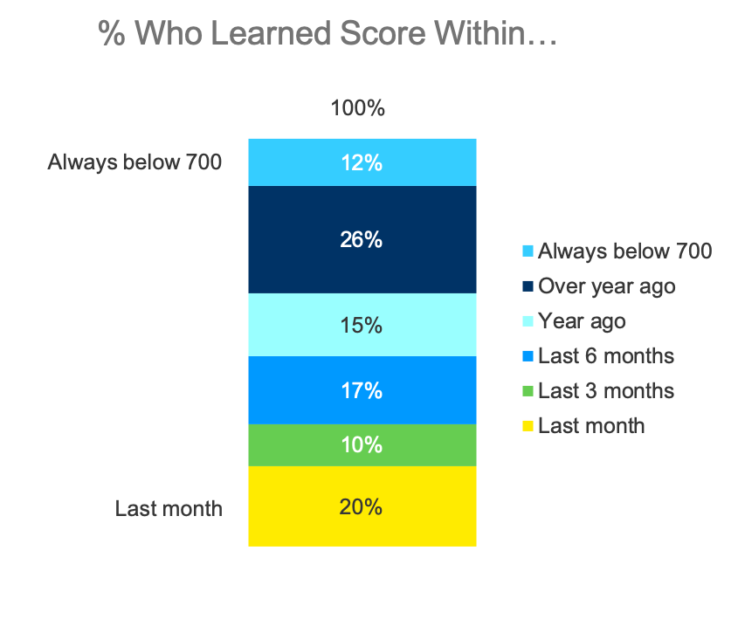

How Long Ago Did You Learn Score Below 700

Around half of nonprime consumers have been living with a credit score below 700 for a year or more.

About one-third have learned within the last 3 months that their score is below 700.

Q7. How long ago did you learn that your credit score was below 700? n=293

About

About Elevate’s Center for the New Middle Class

Elevate’s Center for the New Middle Class conducts research, engages in dialogue, and builds cooperation to generate understanding of the behaviors, attitudes, and experiences of America’s growing “New Middle Class.”

For more information, visit: www.elevate.com/NewMiddleClass