Summary

It has long been understood by economists that economic downturns can affect demographic groups differently. The COVID recession has certainly adversely affected women more significantly than men. Women with non-prime scores* have borne the brunt of the economic pain.

Women were more likely to experience a drop in income during the recession and 45% of non-prime women reported lower year-over-year income drops.

However, the impacts could be long term. Women are less likely to have exposure in the stock market meaning that they did not benefit from strong 2020 Wall Street performance. This is likely to impact their retirement outlooks as well as overall wealth creation.

Finally, absorbing the shocks of personal financial disruption is more difficult as women appear to have lower access to personal loans offered by banks and credit unions.

The country will have to deal with the inequity of impact that the COVID recession has had on the country or people will continue to fall further behind.

* The Center for the New Middle Class categorizes credit scores as non-prime if they fall below 700. That threshold often marks the separation between whether a person can reliably obtain mainstream credit approval or not.*

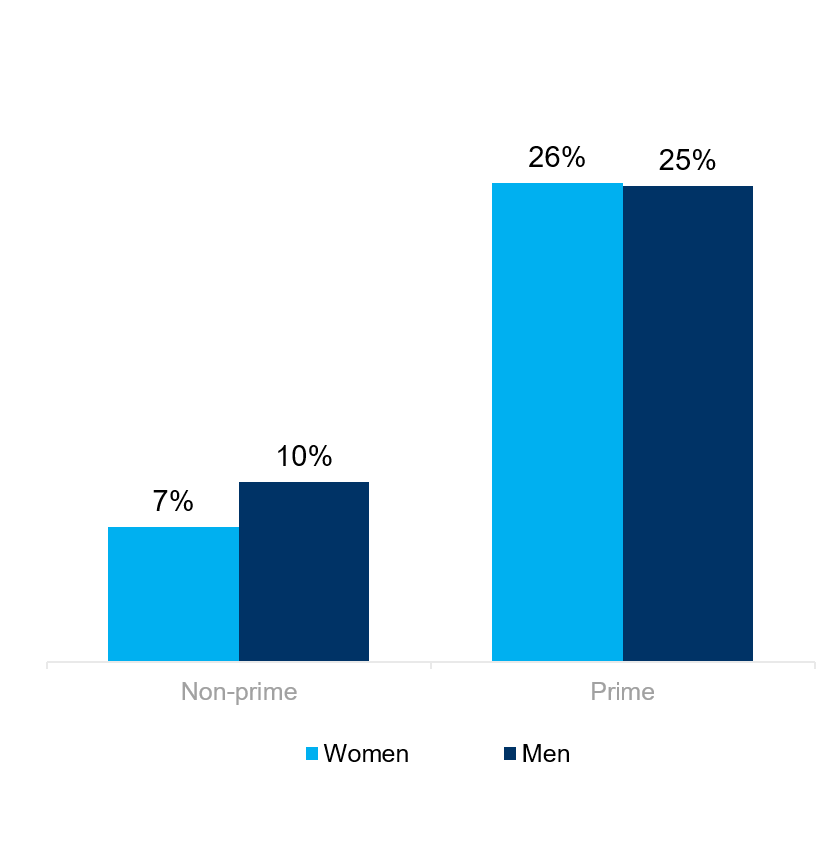

Investment account

Men are significantly more likely to report having an investment account. And non-prime men are 2.5 times as likely as non-prime women to have investment accounts.

By in large, women disproportionately missed out on the stock market gains in 2020.

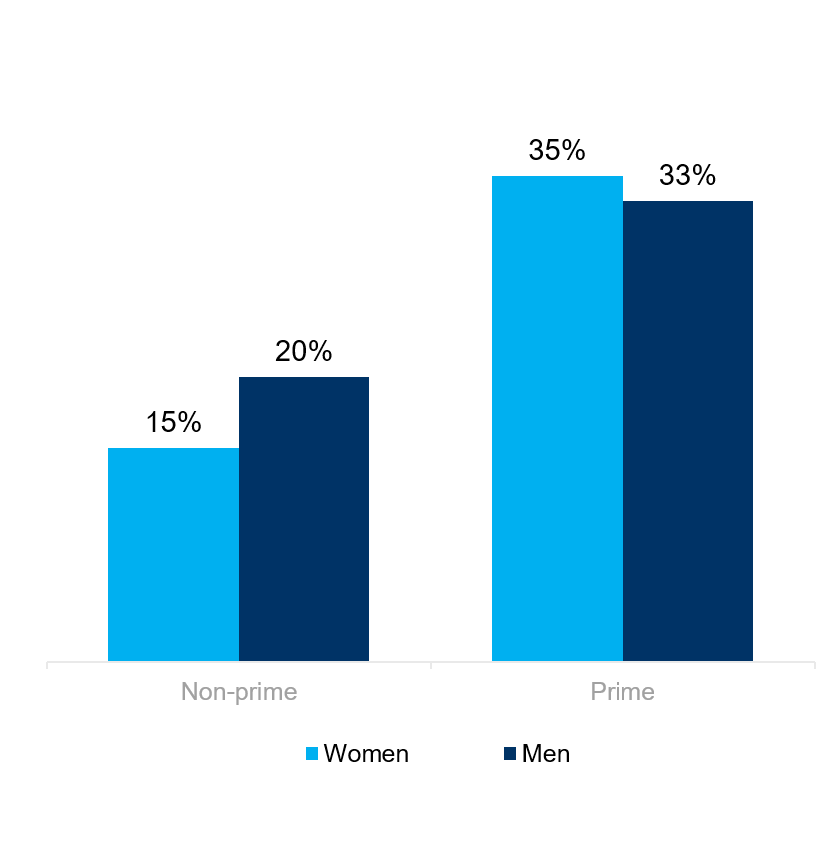

Personal retirement account

The gender difference in ownership of personal retirement accounts amongst prime respondents evaporates.

Non-prime respondents are much less likely to have these accounts and non-prime women are even less likely to have them. Just over one in fourteen non-prime women have one.

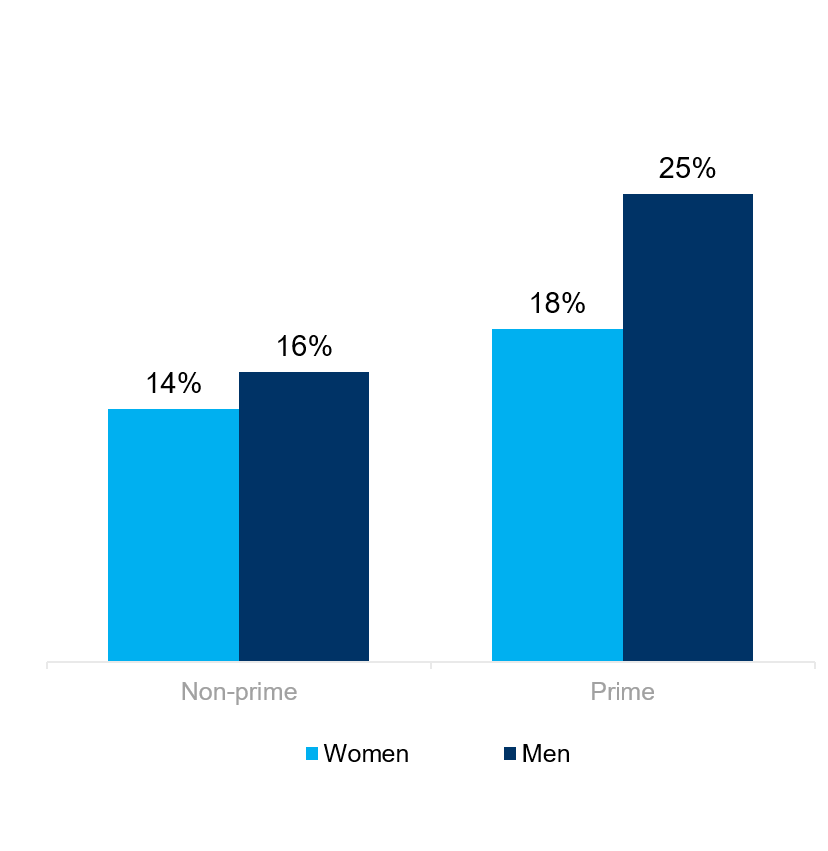

Retirement account with an employer

Only one in six non-prime women have access to employer-provided retirement funds.

The long-term implications of the gap in wealth-building activity for non-prime women will likely delay retirement and make it difficult for them to find a sense of security in their later years.

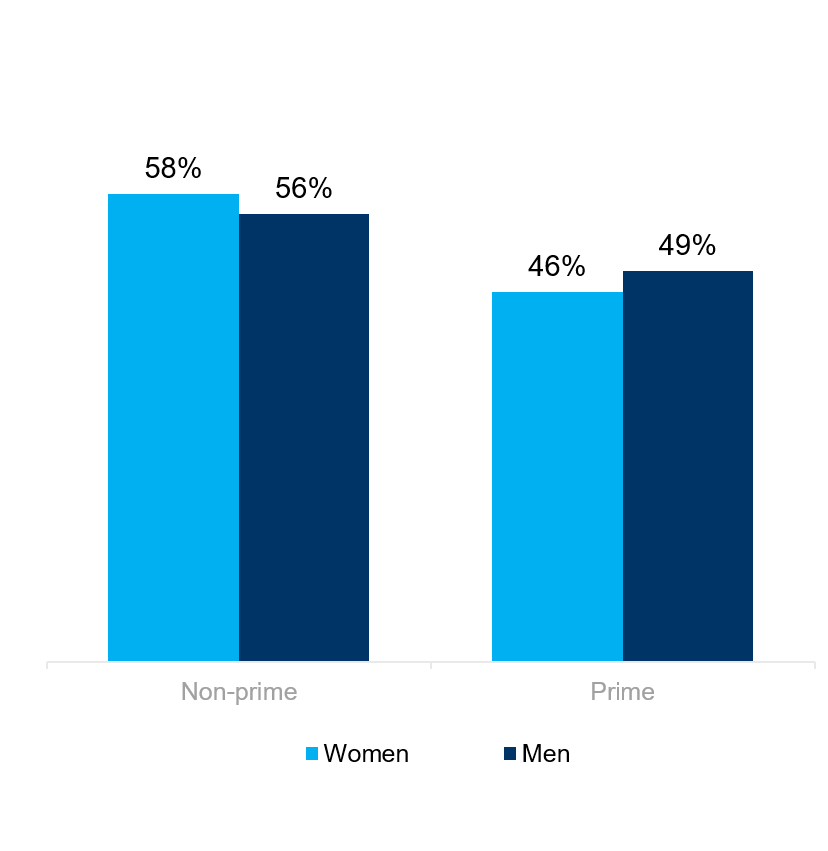

Uncertainty over retirement

About half of the total U. S. population expressed angst over retirement. Nearly three out of five non-prime respondents doubted that they would be able to retire comfortably.

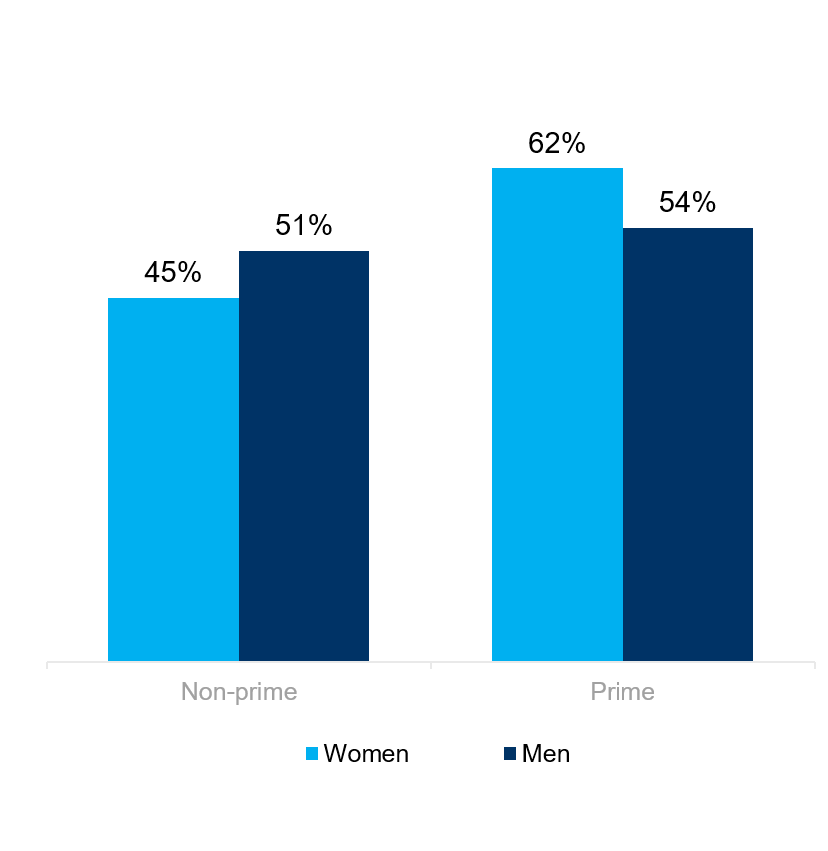

Experienced an extraordinary expense

Two-thirds of prime women have experienced an extraordinary expense that disrupted household finances during the pandemic.

There is no gender difference amongst non-prime respondents.

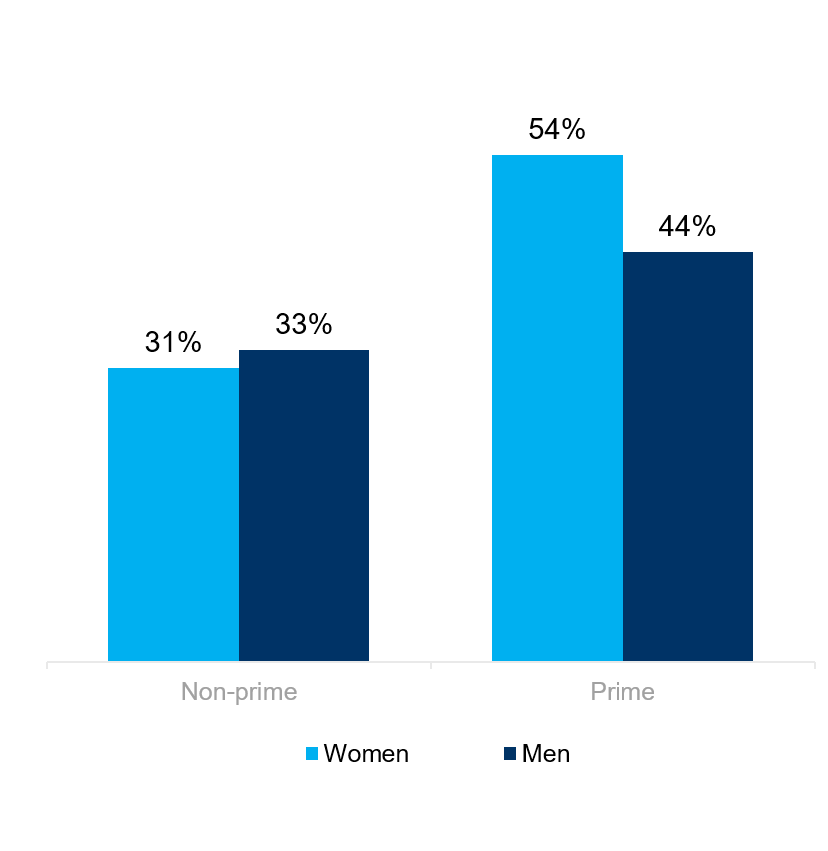

Experienced a drop in income

The pandemic has hit women’s income harder than men’s and nearly half of non-prime women have seen a drop in their income in the prior 12 months.

Personal loan from a bank or credit union

It would be nice to think that women’s lower propensity to carry a personal loan from a bank or credit union is an indication of fiscal responsibility, but lack of access amongst non-prime respondents suggest it might be a broader issue.

General purpose credit card

It appears that non-prime women gravitate to credit cards to meet their short-term borrowing needs.

Having a savings account

Prime women are more likely to use a savings account when managing their finances.

Within the context of the question, respondents are likely referring to having a bank account devoted to savings, not whether they hold a rainy-day fund.

Studies methodologies

Non-prime Tracker

The tracking study was meant to understand how prime and non-prime consumers fared over time in different economic conditions.

•Tracking two cohorts

•Non-prime consumers (self-declared credit score below 700)

•Prime consumers (self-declared credit score above 700)

•Qualifications •Balanced to US representative

•Recruited through third-party market research panels

•300 total interviews per wave (monthly or weekly) split evenly between prime and non-prime

•Questionnaire

•Quantitative

•Duration: 10 minutes to complete

•Captured broad economic conditions, attitudes, and effects

Our focus

Elevate’s Center for the New Middle Class set out to understand the differences in attitudes, experiences and behavior between consumers with prime credit and those with non-prime credit.

“Non-prime Americans” represent the New Middle Class. These are Americans with a credit score below 700, meaning that their access to credit is limited or curtailed.

It is the Center’s objective to better understand their experiences, attitudes, and behavior.

About Elevate’s Center for the New Middle Class

Elevate’s Center for the New Middle Class conducts research, engages in dialogue, and builds cooperation to generate understanding of the behaviors, attitudes, and challenges of America’s growing “New Middle Class.”

For more information, visit: www.elevate.com/NewMiddleClass

Contact

NewMiddleClass@elevate.com

@NewMidClass

Facebook.com/NewMiddleClass