Our Mission at the CNMC

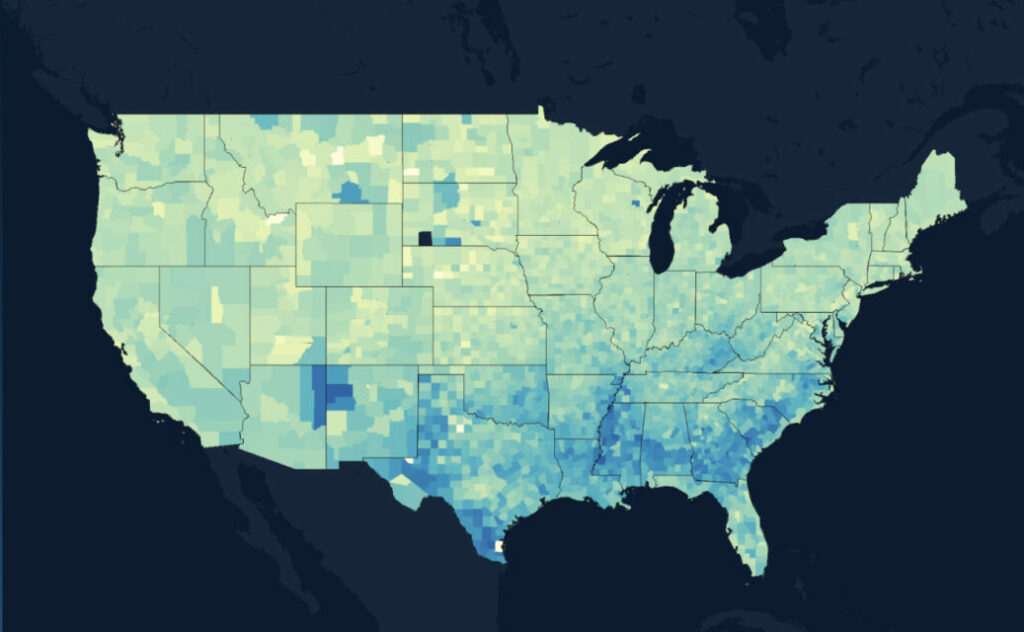

See how many people in the US don't have access to credit

Insights

2023 Summer Spending Blog

Summer is here! While that may mean having some extra time to relax, your credit card may be working overtime.

2023 Panel Discussion on Household Spending and the Impacts of the Fed’s Economic Policy.

On September 7th, the Center for the New Middle Class will be hosting a panel discussion on household spending and

THE SURVEY OF AMERICAN HOUSEHOLD FINANCES’ QUARTERLY REPORT: The Inflation Squeeze; Q3 2022

The unique inflationary pressures on household finances have not abated, especially for Americans with credit scores below 700. These consumers are less likely to have access to short-term lending options to help them weather temporary financial storms.

Events

/

July 23, 2020 | Virtual

Financial Service Industry Responds to Ease Consumer Hardships During COVID

Jonathan Walker will be joined by other industry professionals to discuss the COVID pandemic’s impact on consumers.

Advocacy

The Unintended Consequences of Interest Rate Caps: An Interview with Amir Fekrazad

Interest rate caps have a long history of capturing the imagination of politicians. Politicians rightly want to protect average citizens from abusive practices. The issue

The Unintended Consequences of Interest Rate Caps: An Interview with Amir Fekrazad

Interest rate caps have a long history of capturing the imagination of politicians. Politicians rightly want to protect average citizens from abusive practices. The issue

Commentary

2023 Summer Spending Blog

Summer is here! While that may mean having some extra time to relax, your credit card may be working overtime. As the temperatures get warmer,

2023 Summer Spending Blog

Summer is here! While that may mean having some extra time to relax, your credit card may be working overtime. As the temperatures get warmer,