Introduction

The broad discussion in many circles about the plight of the nonprime consumer often uses assumptions about how these consumers think, what matters to them, and even what would be good for them. However, there is limited data that really explains their circumstances.

Elevate’s Center for the New Middle Class set out to understand the differences in attitudes, experiences and behavior between consumers with prime credit and those with nonprime credit.

This study represents results from a survey of 502 nonprime Americans with 525 Americans with prime credit scores, using interviews conducted June 27- July 1, 2016.

Executive Summary

Nonprime Americans watch their finances closely

- Nonprime Americans check their bank account balances 50 percent more often than prime

- Nonprime check their credit scores 40 percent more often than prime

Nonprime Americans are careful with their spending

- 81 percent of nonprime Americans spend only what they earn, or less

- 67 percent consider themselves “careful spenders”

Nonprime Americans do attempt to plan ahead

- 68 percent of them plan for major expenses

- 72 percent say they know how to create a budget

Nonprime Americans watch their finances closely

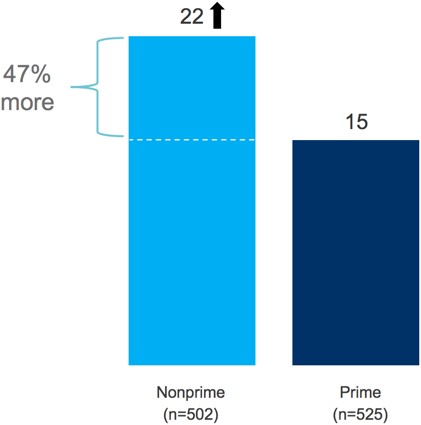

Nonprime Americans check their bank account balances almost 50 percent more frequently than prime Americans.

Frequency of Checking Account Balance

Mean # Times Per Month

Q.5a: How often do you check the balance of your checking/savings account?

Nonprimes watch their credit scores more closely than primes

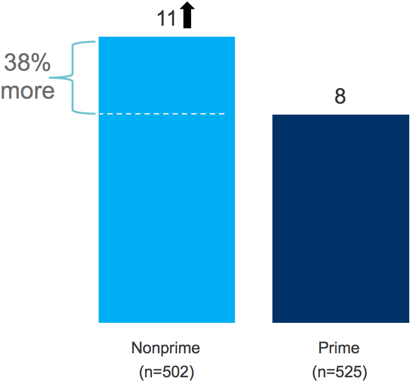

Prime Americans check their credit scores eight times a year. Nonprime Americans check it almost 40 percent more frequently, or 11 times a year.

Frequency of Checking Credit Score

Mean # Times Per Year

Q.5c: How frequently do you check your credit score?

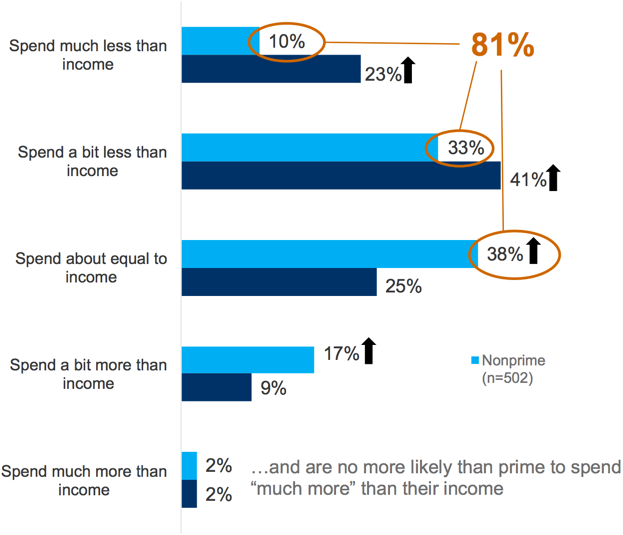

81% of nonprime Americans spend only what they earn, or less

Four out of five nonprime Americans keep their spending in line with their incomes and are no more likely than prime to spend “much more” than their income.

Spending Patterns

(past 12 months)

Q.3: On average, over the past 12 months, how would you describe your spending patterns?

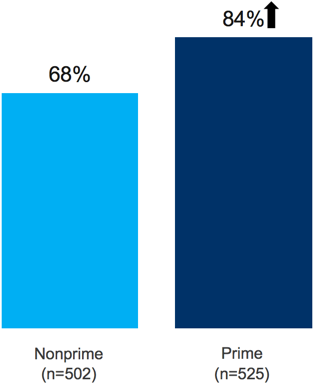

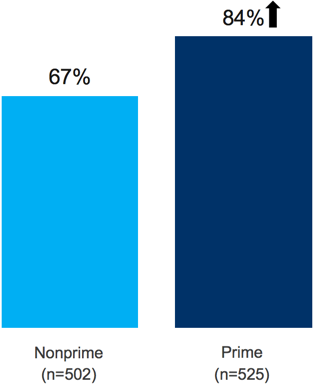

68% of nonprimes understand expense planning

Two out of three nonprimes know how to plan for major expenses compared to 84% of prime people.

I understand how to plan for major expenses

(% Top-2 Box: Strongly Agree/Agree)

Q.5: How much do you agree or disagree with the following statements?

67% of nonprime Americans consider themselves careful spenders

A vast majority of nonprime Americans declare themselves to be careful about how they spend money.

I am careful about how I spend my money

(% Top-2 Box: Strongly Agree/Agree)

Q.5: How much do you agree or disagree with the following statements?

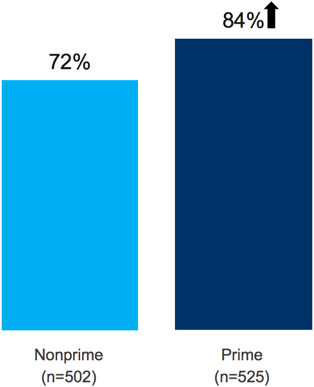

72% of nonprimes know how to create a budget

Nonprime Americans do not, generally, lack the understanding of how to create a budget.

I know how to create a budget

(% Top-2 Box: Strongly Agree/Agree)

Q.5: How much do you agree or disagree with the following statements?

Nonprime Americans

“Subprime” is often used to represent people with scores below 640. People with 641 to 700 are sometimes called “near prime.” We have elected to use the clearer designation of “nonprime” for all consumers with scores below 700.

“Nonprime Americans” represent the New Middle Class. These are Americans with a credit score below 700, meaning that their access to credit is limited or curtailed. It is the Center’s objective to better understand their experiences, attitudes, and behavior.

Methodology

The primary purpose of this study was to determine how nonprime consumers were similar or different from those with prime credit on a range of attitudes, behaviors and experiences.

Interview Dates: June 27 – July 1, 2016

Sample Specs:

- Total Consumers = 1,027 (Nonprime = 502; Prime = 525)

- Sample Source: Research Now Consumer Panel Qualification Criteria:

- Ages 18-64

- Personal income: Any

- Geography – U.S. Rep

- Has primary or shared responsibility managing HH finances

- Employment: No students or unemployed

- Has a checking or savings account

Survey Instrument: 10 minute online questionnaire

Arrows indicate statistical significance at 90%