Introduction

The broad discussion in many circles about the plight of the non-prime consumer often uses assumptions about how these consumers think, what matters to them, and even what would be good for them. However, there is limited data that really explains their circumstances.

Elevate’s Center for the New Middle Class set out to understand the differences in attitudes, experiences and behavior between consumers with prime credit and those with non-prime credit.

This study represents results from the survey of 1,117 Americans, using interviews conducted December 6-14, 2016. It focuses on the unique challenges of non-prime Baby Boomers before retirement (those born between 1945 and 1965).

“Subprime” is often used to represent people with scores below 640. People with 641 to 700 are sometimes called “near prime.” We have elected to use the clearer designation of “non-prime” for all consumers with scores below 700.)

Executive Summary

The Baby Boomer generation has led the nation’s trends for a half a century. As they move into retirement, it is clear that the Baby Boomer generation is far from a monolithic group. When compared to their prime counterparts, non-prime Boomers struggle to find the financial support they need and look for it in a variety of places.

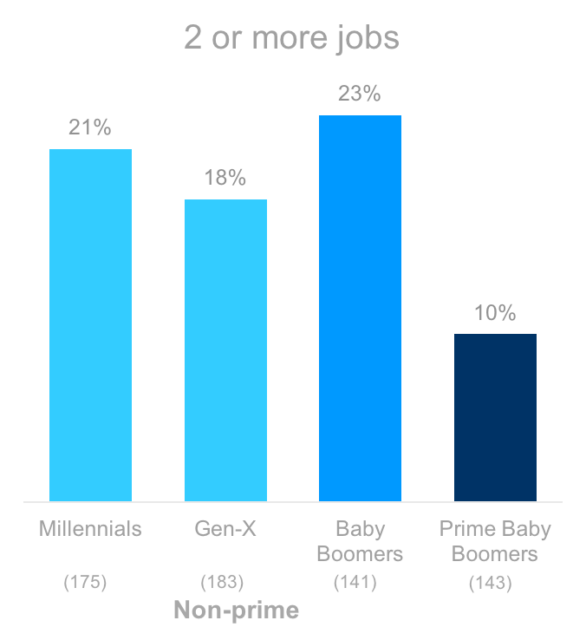

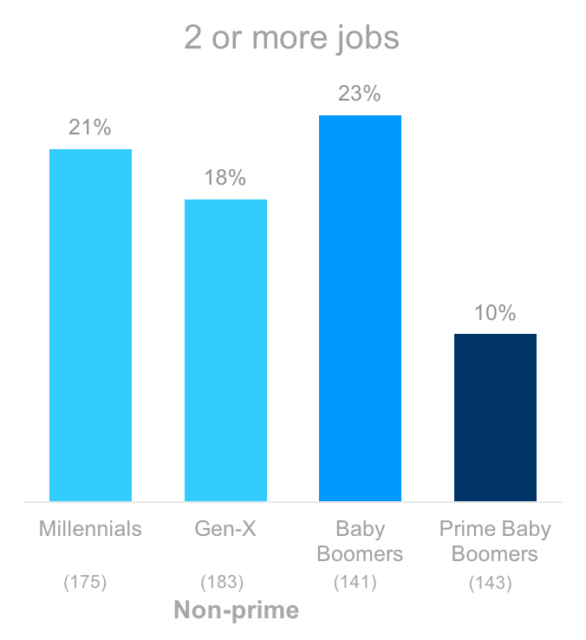

- Non-prime Boomers are the most likely generation to hold more than one job

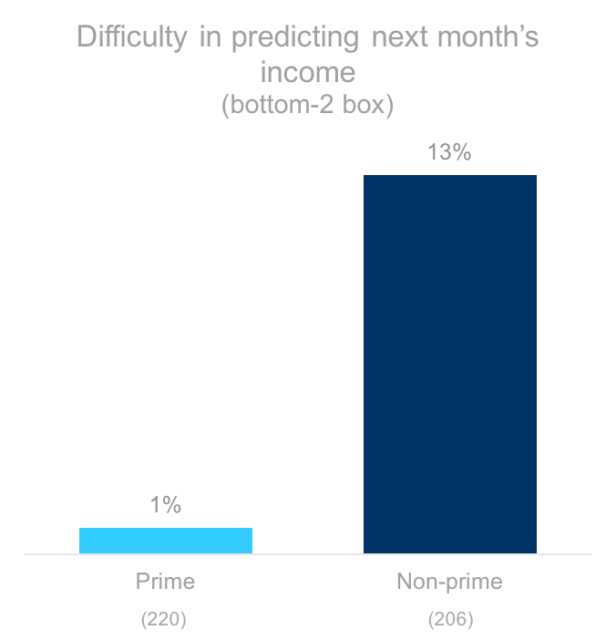

- Non-prime Boomers are 14x more likely than their prime counterparts to express difficulty in predicting monthly income

- Non-prime Boomers have difficulty planning their expenses and therefore are more likely than their prime counterparts to experience unexpected expenses

- When faced with an emergency need for $1,200, non-prime Boomers struggle to say where they might find the money and 1 in 8 can’t think of a means.

- Non-prime Boomers experience day-to-day financial stress and consequently do not express much confidence in their financial presents or futures.

- Non-prime Boomers search different credit options in order to make ends meet, both traditional (i.e., credit cards), non-traditional (i.e., payday lending), as well as creative (i.e., intentionally over-drafting a checking account).

Working Hard

Non-prime Baby Boomers are twice as likely as their prime counterparts to hold more than one job. They are also the most likely of any of the non-prime generations to do so.

Q7. How many jobs do you currently hold that contribute to your household income?

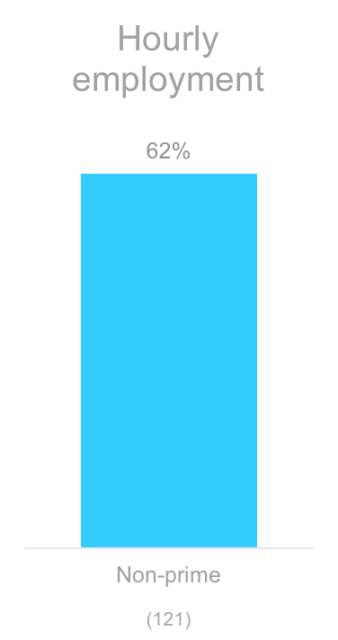

Working by the Hour

Almost two-thirds non-prime Baby Boomers work at jobs that pay by the hour.

Q8. Please indicate below how you are paid by your employer(s)?

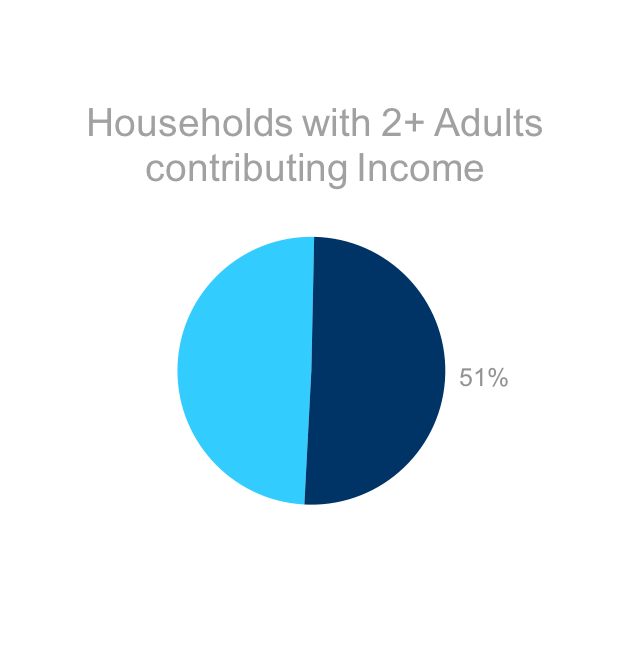

All Hands on Deck

Half of non-prime Baby Boomers live in a household with at least two adults contributing to the income.

n = (206)

Q9. Including yourself, how many adults in your household earn an income from outside employment, a business you/they own, or retirement/trust/investment disbursements?

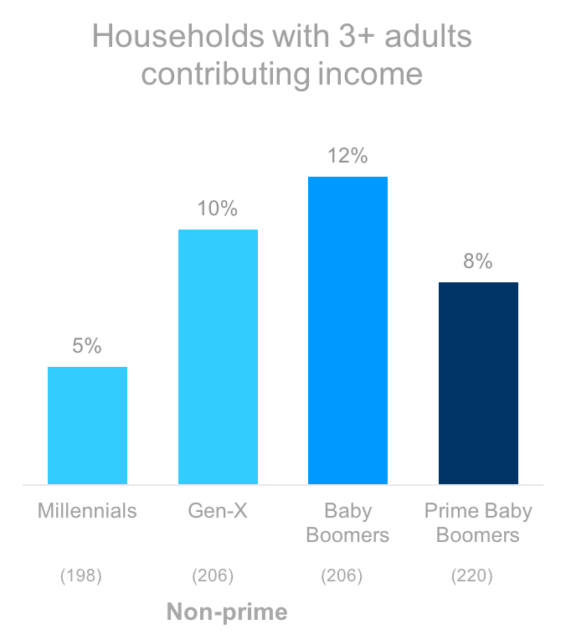

All Hands on Deck (cont.)

1 in 8 non-prime Baby Boomers live in households with 3 or more income-earning adults. They are 50% more likely than their prime counterparts to live in 3+ income households.

Q9. Including yourself, how many adults in your household earn an income from outside employment, a business you/they own, or retirement/trust/investment disbursements?

Employment Stability

Non-prime Baby Boomers are significantly more stable in their employment than non-prime Millennials, but are 17% less likely than their prime counterparts to be stable.

Q10. Which of the following employment events occurred to you or someone in your household in the previous 12 months? (answer represents people who selected “None of the above”)

Blind Corner

Non-prime Baby Boomers are 14x more likely to report difficulty in predicting next month’s income compared to their prime counterparts.

Q11. How easy or difficult is it for you to predict next month’s income for your household? Would you say it is…?

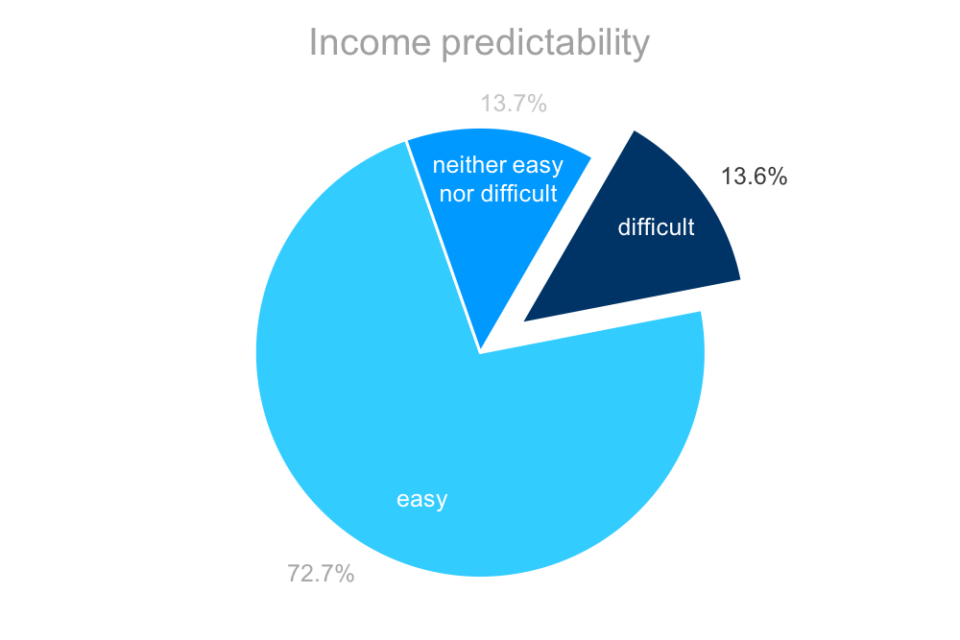

Predictability of Monthly Income

14% of non-prime Boomers express difficulty in predicting their month-to-month income.

n = 206; Q11. How easy or difficult is it for you to predict next month’s income for your household? Would you say it is…?

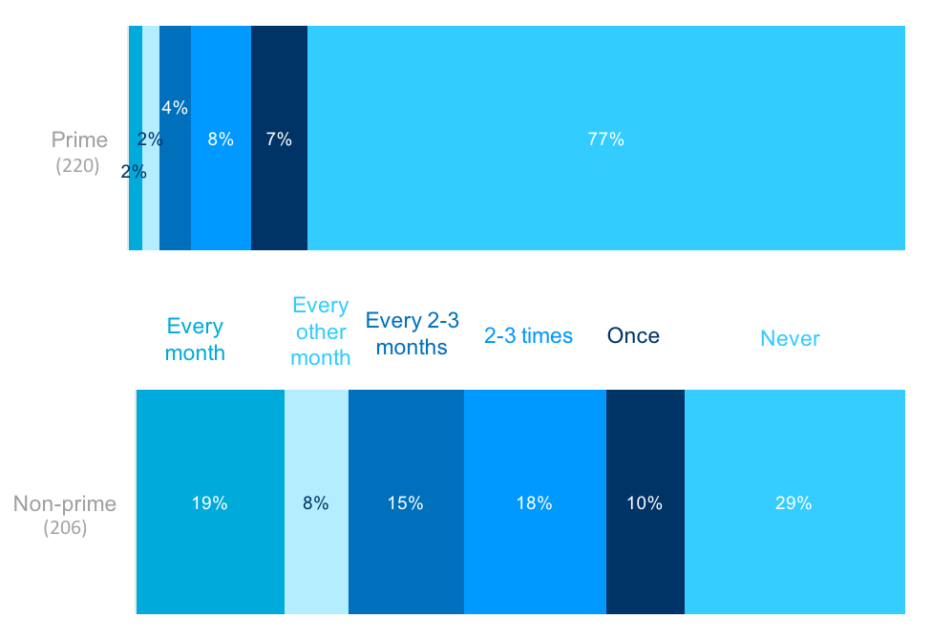

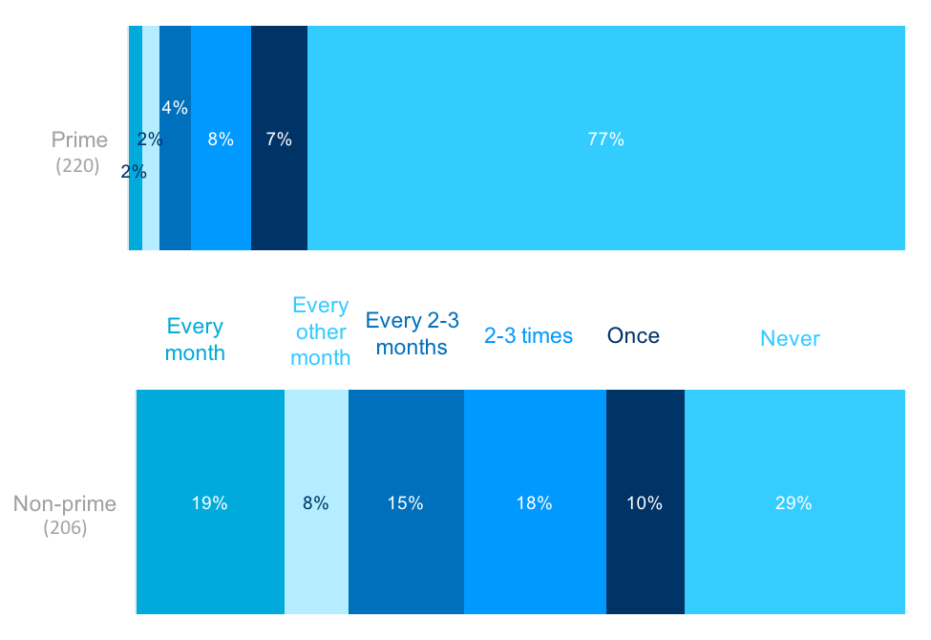

How Often Have Boomers Run Out of Money in the Prior 12 Months?

Boomers are the most stable generational group. Nevertheless, 7 in 10 non-prime Boomers run out of money at least once in a year. Non-prime Boomers are 10x more likely to say they run out of money every month than prime. They are twice as likely to run out of money at some point in the year.

Day-to-Day Financial Management

Less than half of non-prime Boomers feel comfortable with their ability to manage their day-to-day finances.

Q27. On a scale of 1 to 5, where 1 is ‘strongly disagree’ and 5 is ‘strongly agree’, how much do you agree or disagree with the following statements?

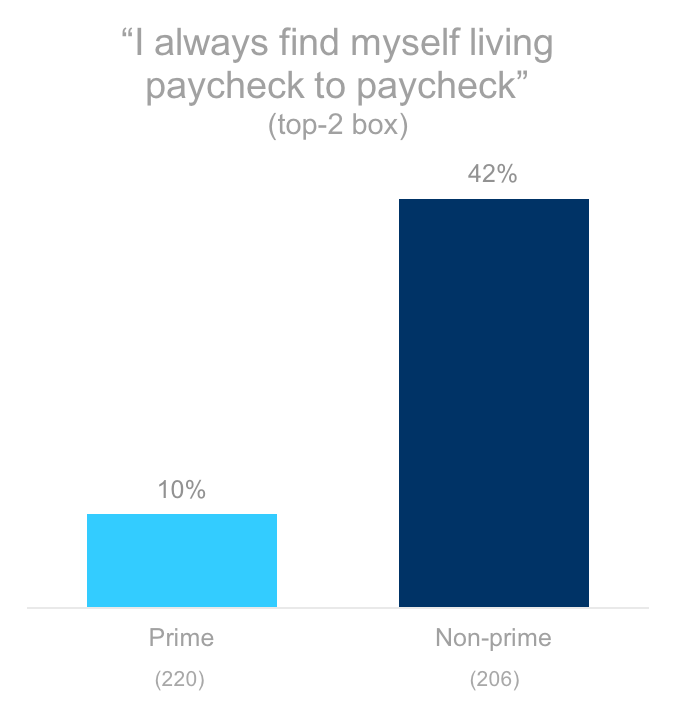

Paycheck to Paycheck

Non-prime Boomers are 4x as likely to be living paycheck to paycheck compared to their prime counterparts.

Q27. On a scale of 1 to 5, where 1 is ‘strongly disagree’ and 5 is ‘strongly agree’, how much do you agree or disagree with the following statements?

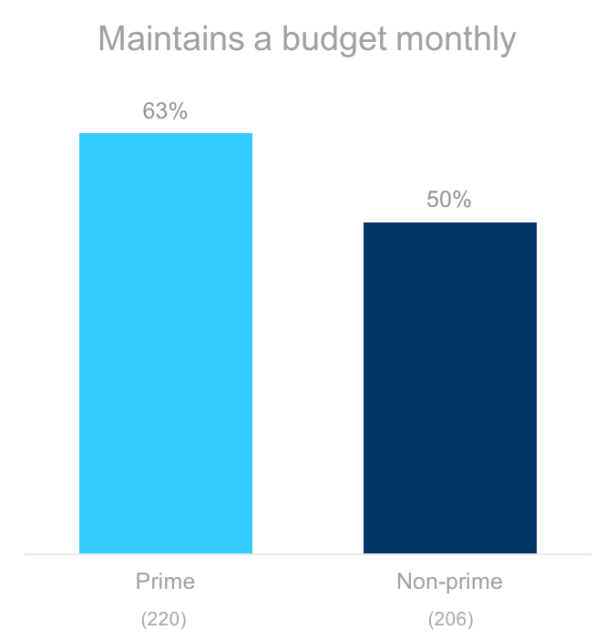

Balancing the Ledger

Non-prime Boomers are 21% less likely to maintain a budget monthly than their prime counterparts.

Q18_1. Maintained a monthly budget – Past 12 Month Financial Activities – Please indicate how often you engaged in the following financial activities (respondents selected “Regularly (monthly)”)

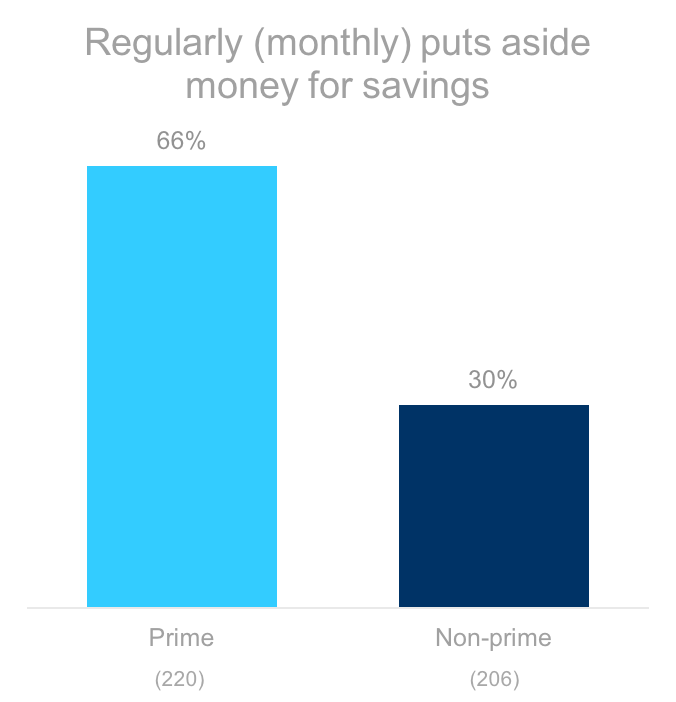

Rainy Day

Non-prime Boomers are half as likely as their prime counterparts to regularly save money. Less than 1 in 3 say they do it monthly. 18% say they never do it.

Q18_4. Put aside money for savings – Past 12 Month Financial Activities – Please indicate how often you engaged in the following financial activities (respondents selected “Never”)

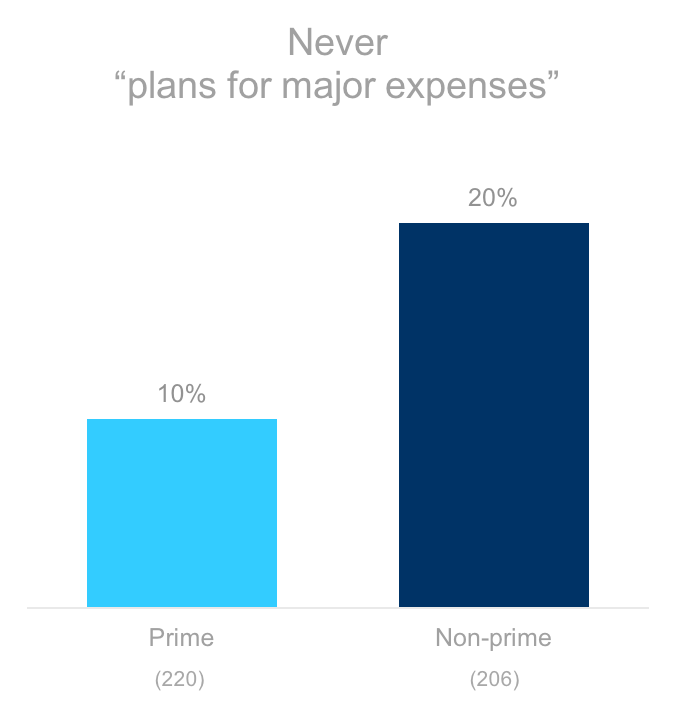

Planning for Big Expenses

Non-prime Boomers are twice as likely as their prime counterparts to say that they never plan for major expenses in the prior 12 months. Financial instability likely contributes to the feeling that future planning is futile.

Q18_2. Planned for major expenses – Past 12 Month Financial Activities – Please indicate how often you engaged in the following financial activities (respondents selected “Never”)

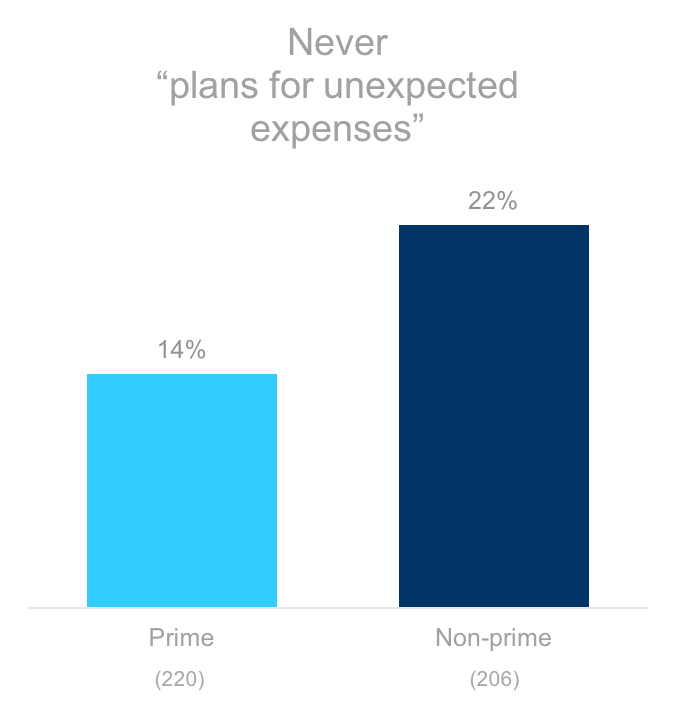

“What’s Next?”

Non-prime Boomers are 57% more likely than their prime counterparts to say that they never plan for unexpected expenses in the prior 12 months.

Q18_3. Planned for unexpected expenses – Past 12 Month Financial Activities – Please indicate how often you engaged in the following financial activities (respondents selected “Never”)

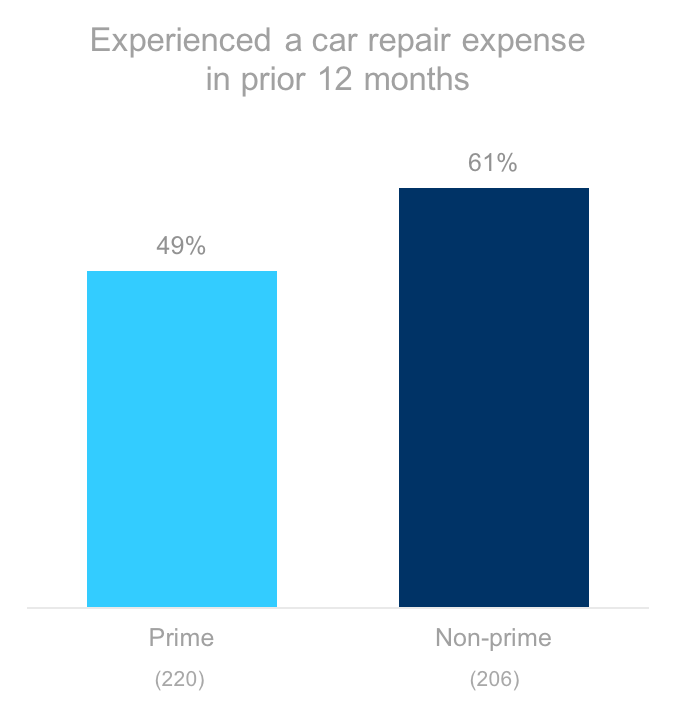

Broken Down

Non-prime Boomers are 24% more likely to have experienced a car repair in the prior 12 months.

Q13. In the previous 12 months, please indicate if you or anyone else in your household experienced any of the following events?

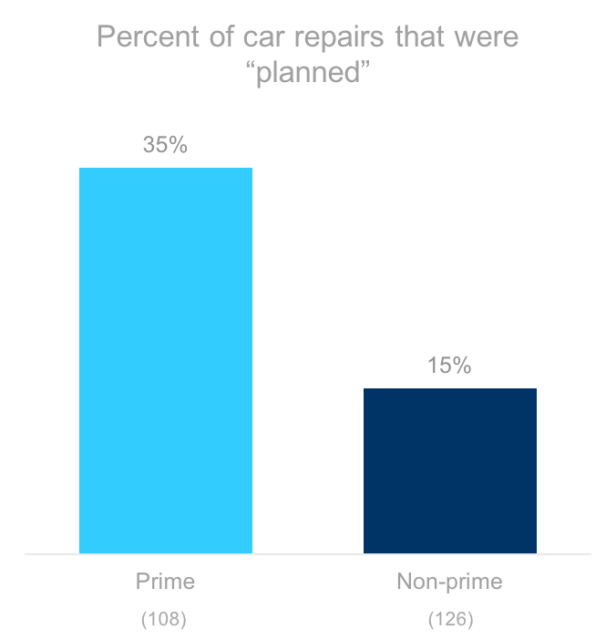

See it Coming

Prime Boomers are much more likely to be able to plan ahead on their car repairs.

Q13. In the previous 12 months, please indicate if you or anyone else in your household experienced any of the following events?

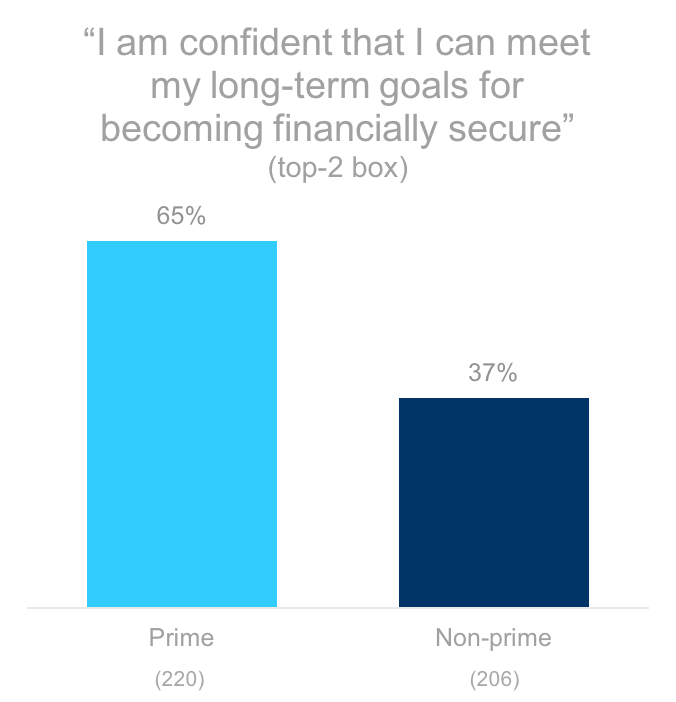

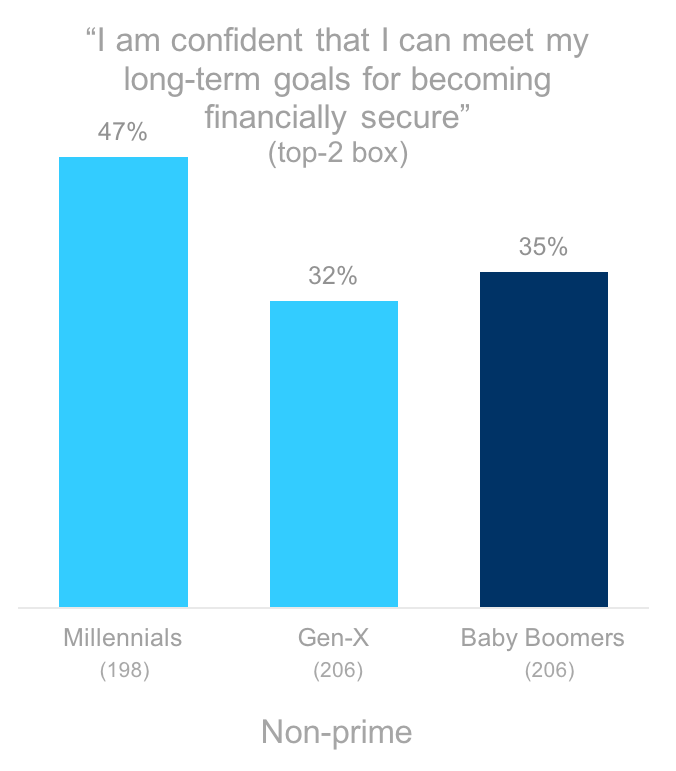

Long-Term Confidence

Only 1 in 3 Non-prime Boomers has confidence in their long-term goal of being financially secure.

Q27. On a scale of 1 to 5, where 1 is ‘strongly disagree’ and 5 is ‘strongly agree’, how much do you agree or disagree with the following statements?

Confidence in the Future

1 in 3 non-prime Boomers is confident that they can attain their goals for financial security.

Q27. On a scale of 1 to 5, where 1 is ‘strongly disagree’ and 5 is ‘strongly agree’, how much do you agree or disagree with the following statements?

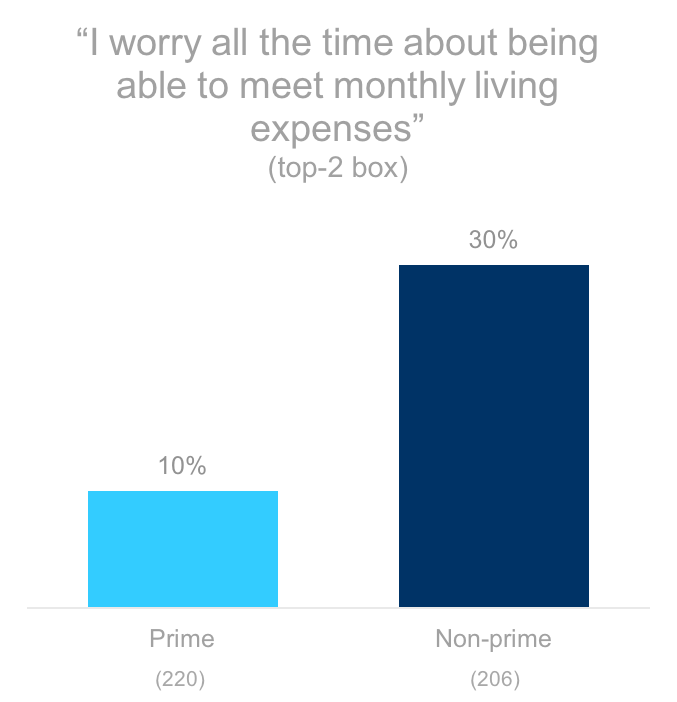

Something to Worry About

A third of non-prime Boomers are regularly worried about meeting their monthly expenses.

Q27. On a scale of 1 to 5, where 1 is ‘strongly disagree’ and 5 is ‘strongly agree’, how much do you agree or disagree with the following statements?

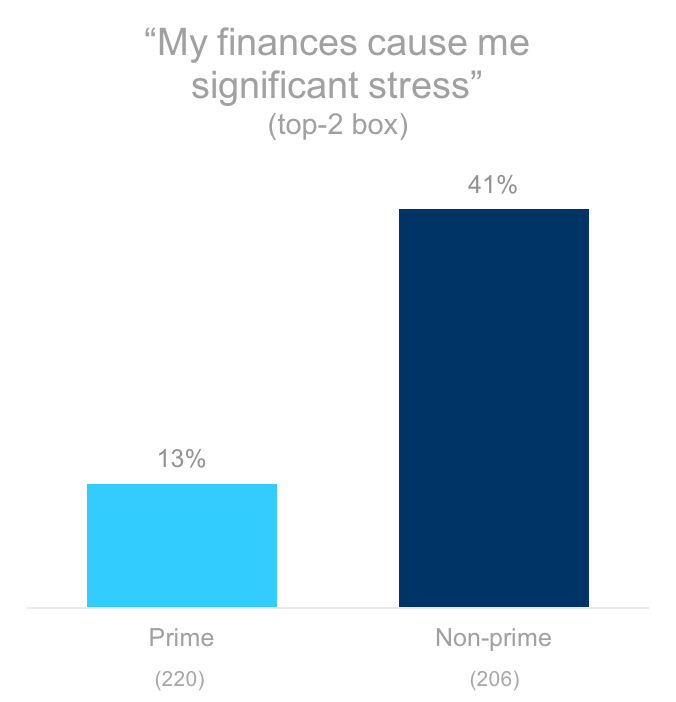

Finance-Induced Stress

Non-prime Boomers are 2.2x as likely as prime to say their finances cause them significant stress.

Q27. On a scale of 1 to 5, where 1 is ‘strongly disagree’ and 5 is ‘strongly agree’, how much do you agree or disagree with the following statements?

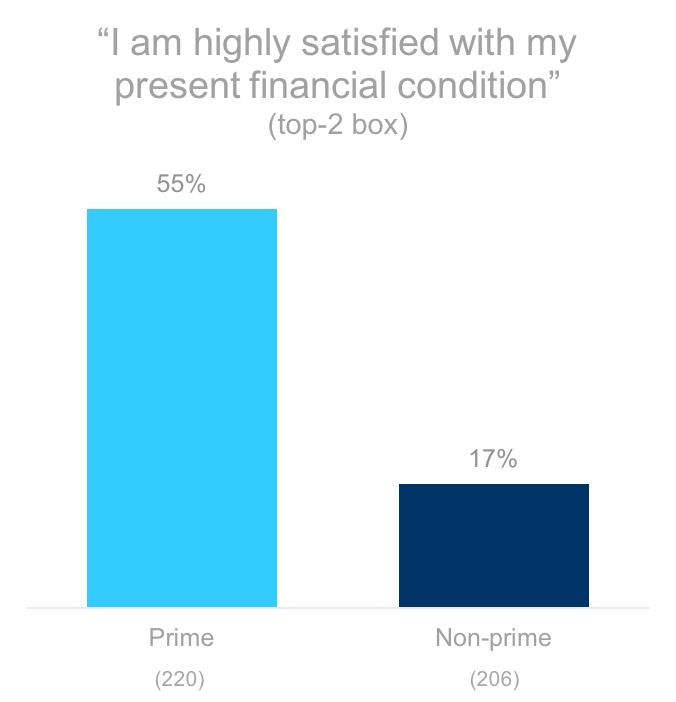

Satsifaction Not Guaranteed

Only 1 in 6 non-prime Boomers are satisfied with their present financial situation.

Q27. On a scale of 1 to 5, where 1 is ‘strongly disagree’ and 5 is ‘strongly agree’, how much do you agree or disagree with the following statements?

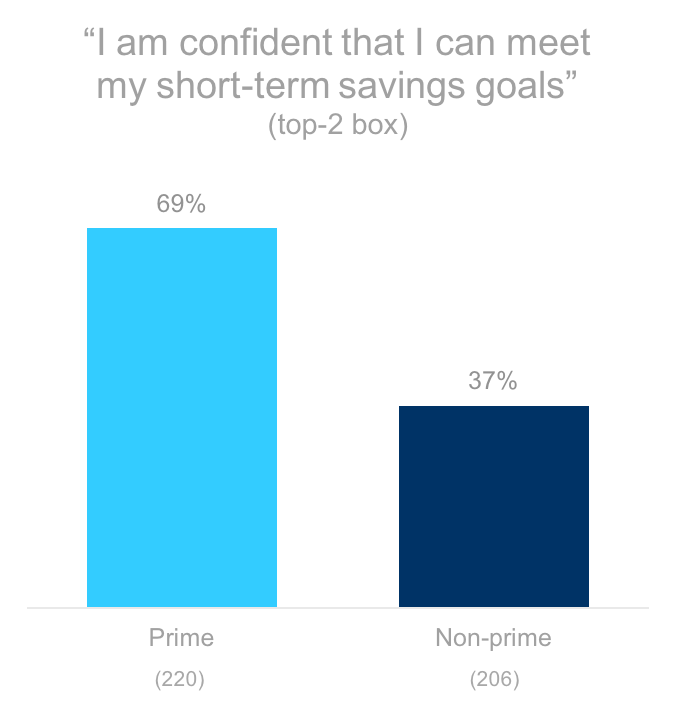

Short-Term Savings

Non-prime Boomers are 46% less likely than prime to express confidence that they can meet their short-term savings goals.

Q27. On a scale of 1 to 5, where 1 is ‘strongly disagree’ and 5 is ‘strongly agree’, how much do you agree or disagree with the following statements?

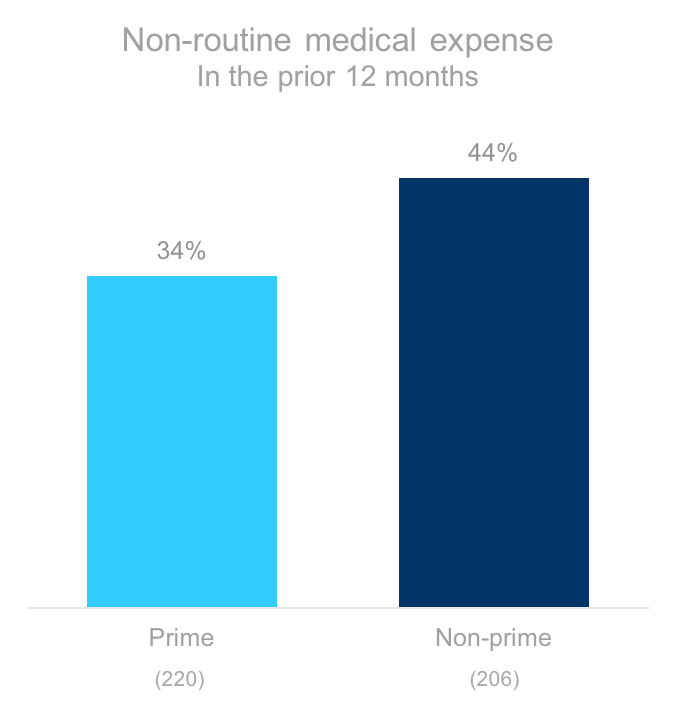

Broken Down, Part 2

Non-prime Boomers are 29% more likely to have experienced a non-routine medical expense in the prior 12 months. 85% of non-routine medical expenses came unexpectedly.

Q13. In the previous 12 months, please indicate if you or anyone else in your household experienced any of the following events?

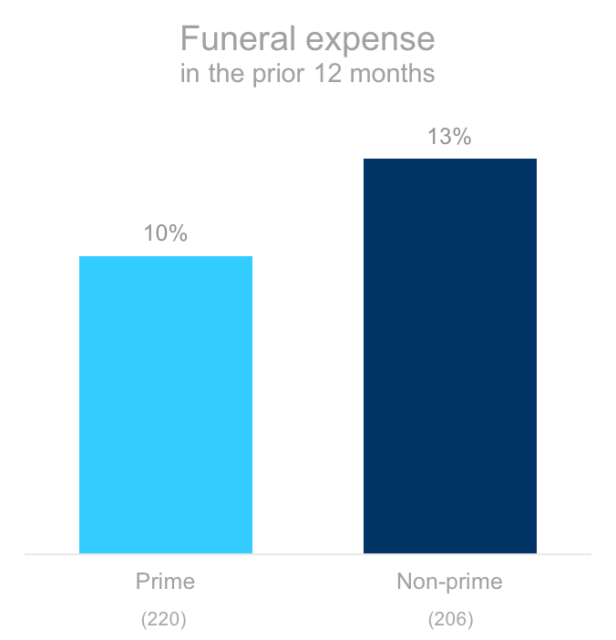

Funeral Expense

Non-prime Boomers are 30% more likely to face funeral expense.

Q13. In the previous 12 months, please indicate if you or anyone else in your household experienced any of the following events?

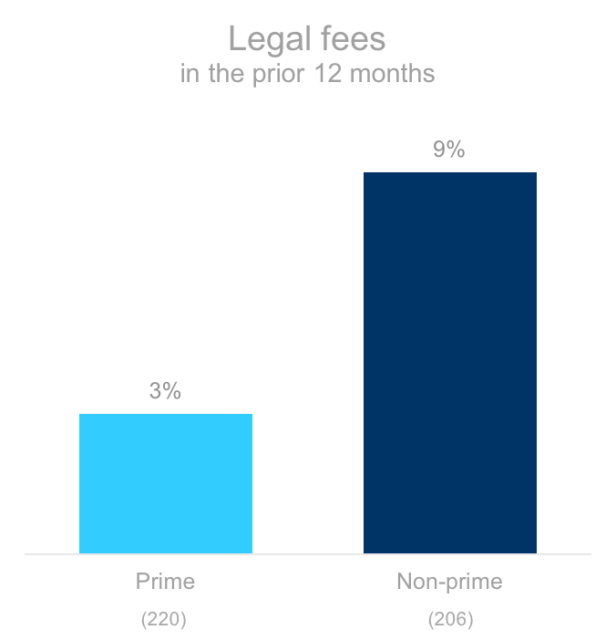

On Retainer

Non-prime Boomers are 3x more likely to have reported legal bills in the prior 12 months, compared to their prime counterparts.

Q13. In the previous 12 months, please indicate if you or anyone else in your household experienced any of the following events?

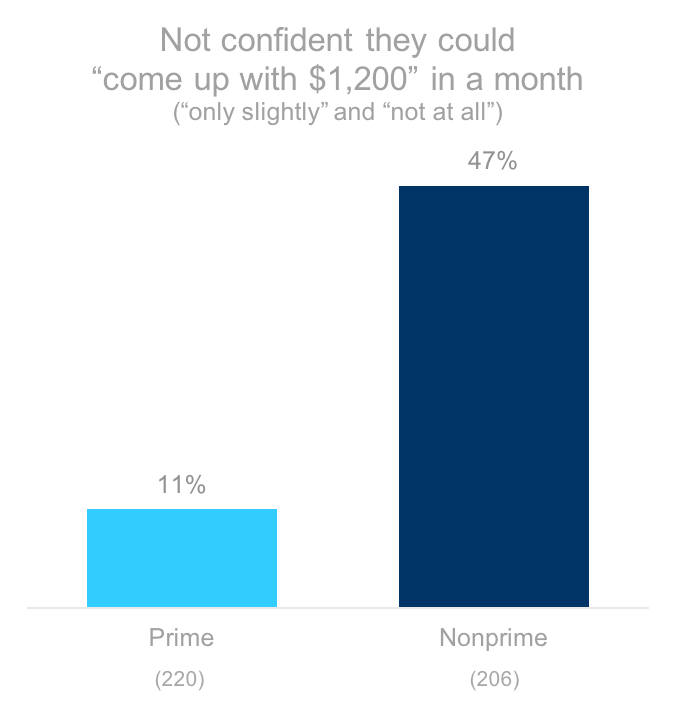

If the Need Arose

Non-prime Boomers are 4x more likely to express doubt about their ability to come up with $1,200 in a month if the need arose.

Q16. How confident are you that you could come up with $1,200 if an unexpected need arose within the next month?

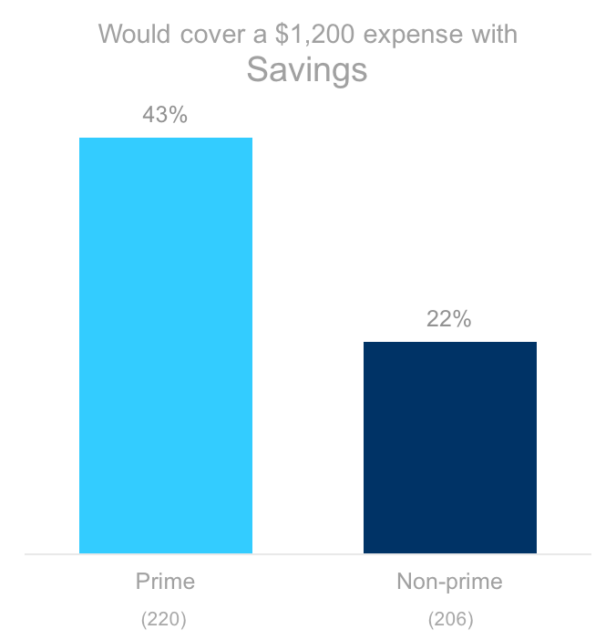

Where Would You Turn First?

Non-prime Boomers are half as likely to be able to cover an immediate $1,200 expense through savings.

Q17. If you had one week to pay $1,200 for an emergency expense, such as a car repair or medical bill, where would you turn first to get the money?

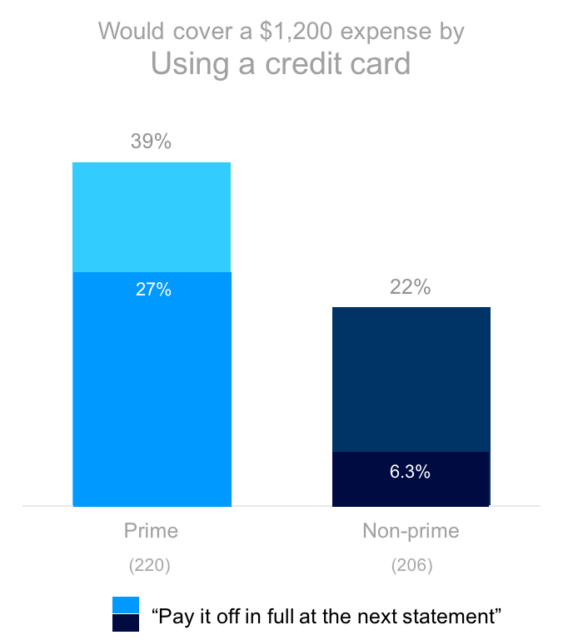

Where Would You Turn First?

Less than 1 in 4 non-prime Boomers would turn to a credit card to cover an unexpected $1,200 expense, but only 29% of those would be able to pay it off by the next statement, compared to 69% of prime Boomers.

Q17. If you had one week to pay $1,200 for an emergency expense, such as a car repair or medical bill, where would you turn first to get the money?

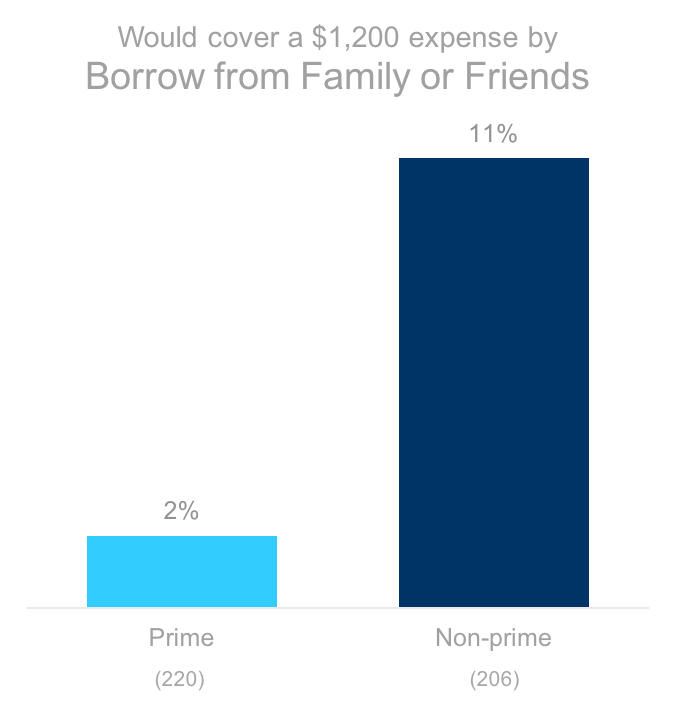

Where Would You Turn First?

More than 1 in every 10 Boomers would first turn to friends or family members to find the money for an immediate expense of $1,200.

Q17. If you had one week to pay $1,200 for an emergency expense, such as a car repair or medical bill, where would you turn first to get the money?

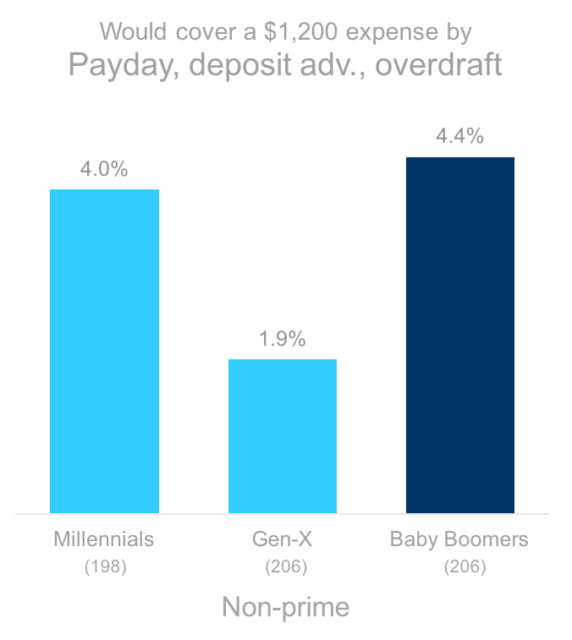

Where Would You Turn First?

Non-prime Boomers and Millennials are more likely to turn to alternative lending products than Gen-X.

Q17. If you had one week to pay $1,200 for an emergency expense, such as a car repair or medical bill, where would you turn first to get the money?

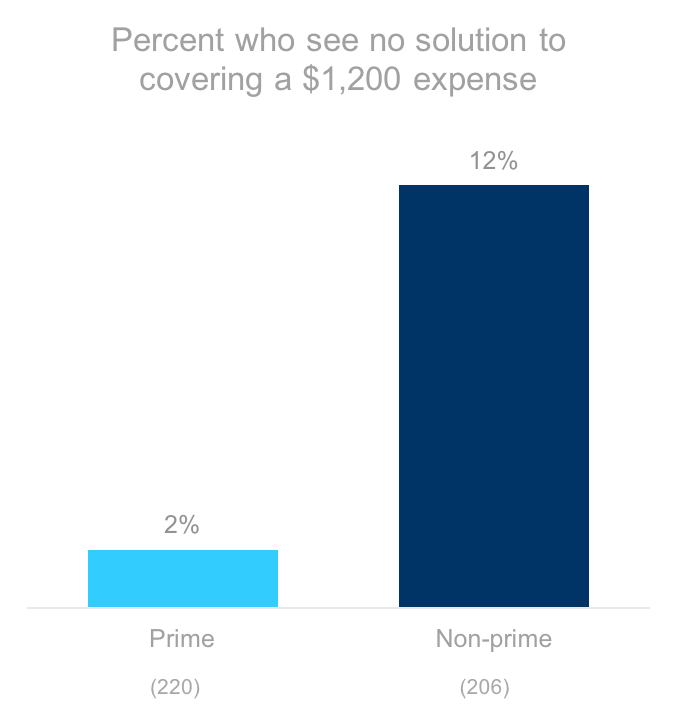

No Way Out

12% of non-prime Boomers don’t know how they would cover a $1,200 expense. They are 7 times as likely to say so compared to their prime counterparts.

Q17. If you had one week to pay $1,200 for an emergency expense, such as a car repair or medical bill, where would you turn first to get the money? (selected “I wouldn’t be able to pay for the expense” or “Don’t know”)

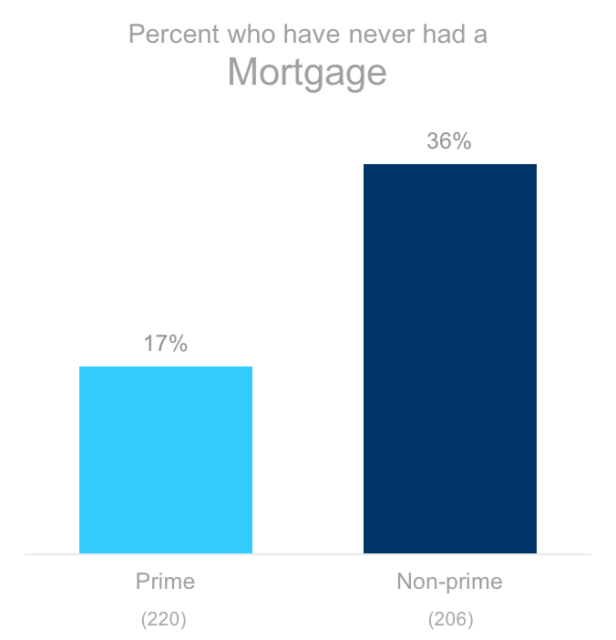

Home Sweet Home

A third of non-prime Boomers have never held a mortgage.

Q23_7. Mortgage – Frequency of Using Forms of Debt – Which of the following forms of debt have you used? (respondents who selected “Never used”)

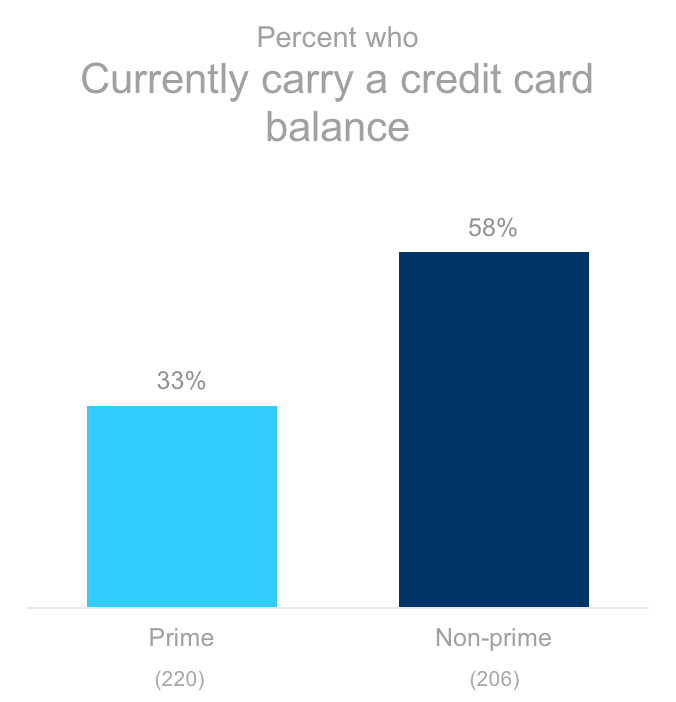

Plastic Debt

Non-prime Boomers are 76% more likely to be carrying a credit card balance compared to their prime counterparts.

Q23_8. Credit card (carrying a balance from last month) – Frequency of Using Forms of Debt – Which of the following forms of debt have you used? (respondents who selected “Currently use”)

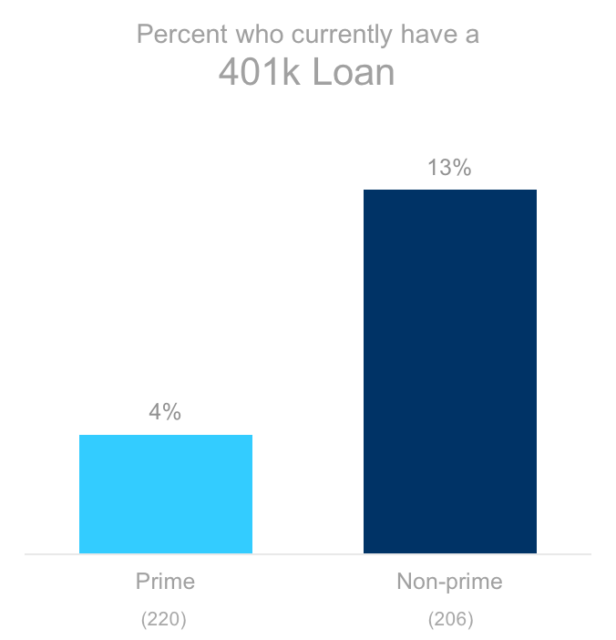

The Future Can Wait

Non-prime Boomers are 3x as likely as their prime counterparts to currently have a 401k loan.

Q23_11. 401k loan – Frequency of Using Forms of Debt – Which of the following forms of debt have you used? (respondents who selected “Currently use”)

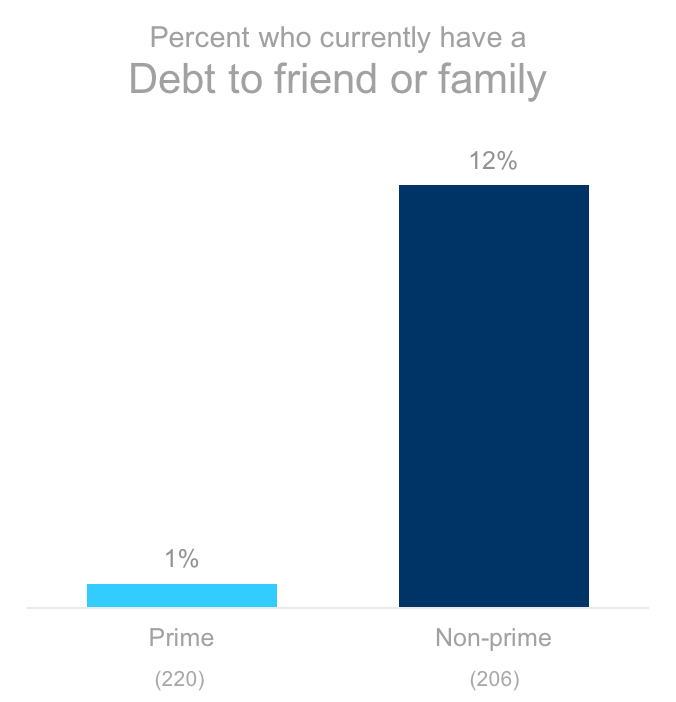

I Owe You One

1 in 8 non-prime Boomers currently owe a friend or family member money.

Q23_12. Debt to a friend or family member – Frequency of Using Forms of Debt – Which of the following forms of debt have you used? (respondents who selected “Currently use”)

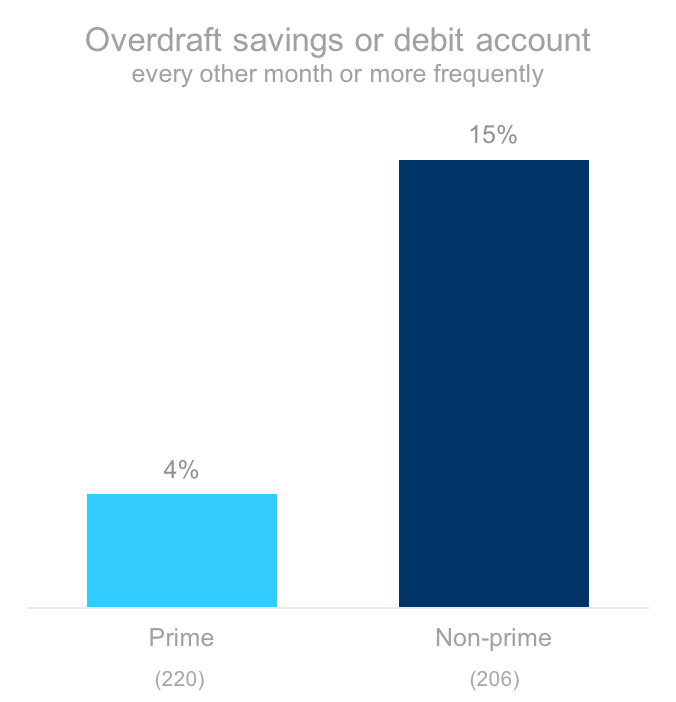

Oops

Non-prime Boomers are 2.5x as likely to overdraft a bank account regularly compared to their prime counterparts.

Q18_16. Overdrafted a savings or debit account – Past 12 Month Financial Activities – Please indicate how often you engaged in the following financial activities (respondents selected “Regularly (monthly)” or “Occasionally (every other month)”)

Agree to a Plan

Non-prime Boomers are 82% more likely to be currently on a payment plan for a bill compared to their prime counterparts. Even 1 in 6 prime Boomers use this option to manage an expense.

Q23_9. Payment plan on a bill – Frequency of Using Forms of Debt – Which of the following forms of debt have you used? (respondents who selected “Currently use”)

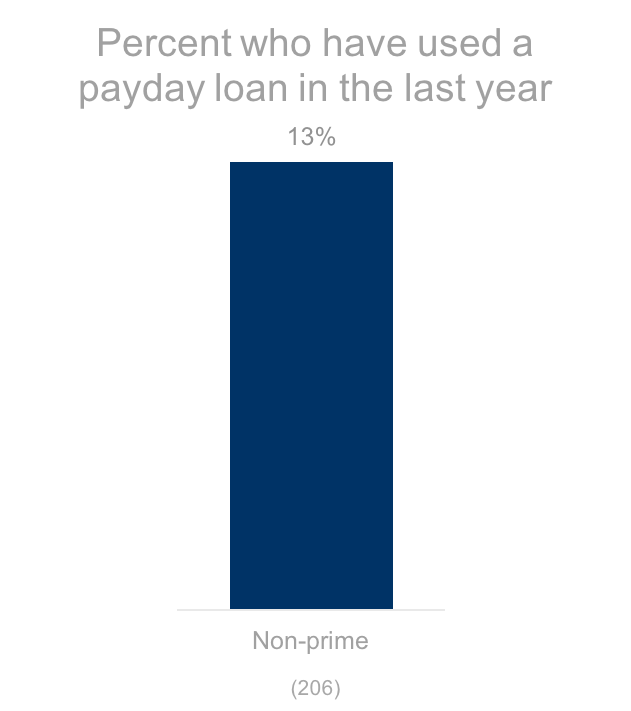

Payday Loans

Almost 1 in 6 non-prime Boomers used a Payday loan in the prior 12 months.

Q23_1. Payday loan – Frequency of Using Forms of Debt – Which of the following forms of debt have you used? (respondents who selected “Currently use” or “Used in previous 12 months”)

Methodology

The primary purpose of this study was to determine how non-prime Americans were similar or different from those with prime credit on a range of behaviors and attitudes.

Interview Dates: December 6-14, 2016

Sample Specs:

• Total Respondents = 1,217

• Sample Source: Research Now Consumer Panel

Qualification Criteria:

• Ages 18-64

• Personal income: Any

• Geography – U.S. Rep

• Has primary or shared responsibility managing HH finances

• Employment: No students or unemployed

• Has a checking or savings account

Survey Instrument: 15 minute online questionnaire